ABB Group

ABB, formerly ASEA Brown Boveri, is a Swedish-Swiss multinational corporation headquartered in Zürich, Switzerland,[6] operating mainly in robotics, power, heavy electrical equipment, and automation technology areas. It is ranked 341st in the Fortune Global 500 list of 2018 and has been a global Fortune 500 company for 24 years.[7] Until the sale of its electricity division in 2020, ABB was Switzerland's largest industrial employer.[8] ABB is traded on the SIX Swiss Exchange in Zürich, Nasdaq Stockholm and the New York Stock Exchange in the United States.[9]

| |

| Type | Public |

|---|---|

| SIX: ABBN NYSE: ABB Nasdaq Stockholm: ABB | |

| ISIN | CH0012221716 |

| Industry | Electrical equipment |

| Predecessor |

|

| Founded | 1988 |

| Headquarters | Zürich, Switzerland |

Area served | Worldwide |

Key people |

|

| Products | Power, Automation |

| Revenue | [1] |

| Total assets | |

| Total equity | |

| Owner | Alain Bashimbe (11.5%)

Blackrock Inc(3.4)%[3] Fisher Investments(2.4%) [5] Lazard(1.01%) |

Number of employees | 144,400 (2019)[1] |

| Website | www |

History

Predecessor companies

Allmänna Svenska Elektriska Aktiebolaget (General Swedish Electrical Limited Company, ASEA) was founded in 1883 by Ludvig Fredholm[10] in Västerås, Sweden as manufacturer of electrical light and generators.[11] Brown, Boveri & Cie (BBC) was formed in 1891 in Zurich, Switzerland by Charles Eugene Lancelot Brown and Walter Boveri[12] as a Swiss group of electrical engineering companies producing AC and DC motors, generators, steam turbines and transformers.

Formation and early years

On 10 August 1987, ASEA and BBC Brown Boveri announced they would merge to form ABB Asea Brown Boveri.[13] The new corporation was to be based in Zurich, Switzerland and Västerås, Sweden, with each parent company holding 50 percent. The merger created a global industrial group with revenue of approximately $15 billion and 160,000 employees.[13]

When ABB began operations on 5 January 1988, its core operations included power generation, transmission and distribution; electric transportation; and industrial automation and robotics.

In its first year, ABB made some 15 acquisitions, including the environmental control group Fläkt AB of Sweden, the contracting group Sadelmi/Cogepi of Italy, and the railway manufacturer Scandia-Randers A/S of Denmark.[14]

In 1989, ABB purchased an additional 40 companies, including Westinghouse Electric's transmission and distribution assets, and announced an agreement to purchase the Stamford, Connecticut-based Combustion Engineering (C-E).[15]

The following year, ABB bought the robotics business of Cincinnati Milacron in the US. The acquisition expanded ABB's presence in automated spot-welding and positioned the company to better serve the American automotive industry. ABB's 1991 introduction of the IRB 6000 robot, demonstrated its increased capacity in this field. The first modular robot, the IRB 6000, can be reconfigured to perform a variety of specific tasks. At the time of its launch, the IRB 6000 was the fastest and most accurate spot-welding robot on the market.

In the early 1990s, ABB started expanding in Central and Eastern Europe. By the end of 1991, the company employed 10,000 people in the region. The following year, that number doubled. A similar pattern played out in Asia, where economic reforms in China and the lifting of some Western sanctions, helped open the region to a new wave of outside investment and industrial growth. By 1994, ABB had 30,000 employees and 100 plants, engineering, service and marketing centers across Asia - numbers that would continue to grow. Through the 1990s, ABB continued its strategy of targeted expansion in Eastern Europe, the Asia-Pacific region and the Americas.

In 1995, ABB agreed to merge its rail engineering unit with that of Daimler-Benz AG of Germany. The goal was to create the world's largest maker of locomotives and railway cars. The new company, ABB Daimler-Benz Transportation (Adtranz), had an initial global market share of nearly 12 percent.[16][17] The merge took effect on 1 January 1996.[18]

A few months after the July 1997 Asian financial crisis, ABB announced plans to accelerate its expansion in Asia. The company also acted to improve the productivity and profitability of its Western operations, taking an $850 million restructuring charge as it shifted more resources to emerging markets and scaled back some facilities in higher-cost countries.

In 1998, ABB acquired Sweden-based Alfa Laval's automation unit, which at the time was one of Europe's top suppliers of process control systems and automation equipment.[19]

As a final step in the integration of the companies formerly known as ASEA and BBC, in 1999 the directors unanimously approved a plan to create a unified, single class of shares in the group.

That same year, ABB completed its purchase of Elsag Bailey Process Automation, a Netherlands-based maker of industrial control systems, for $2.1 billion.[20] The acquisition increased ABB's presence in the high-tech industrial robotics and factory control system sectors, which reducing its reliance on traditional heavy engineering sectors such as power generation and transmission.

Shift in business focus

In 1999, the company sold its stake in the Adtranz train-building business to DaimlerChrysler. Instead of building complete locomotives, ABB's transportation activities shifted increasingly toward traction motors and electric components.[21]

That same year, ABB and France-based Alstom, announced the merger of their power generation businesses in a 50-50 joint company, ABB Alstom Power. Separately, ABB agreed to sell its nuclear power business to British Nuclear Fuels of the United Kingdom.[22]

In 2000, ABB divested its interests in ABB Alstom Power and sold its boiler and fossil-fuel operations (including Gas turbines) to Alstom.[23] Thereafter, ABB's power business was focused on renewable energy and transmission and distribution.

In 2002, ABB announced its first-ever annual loss, a $691 million net loss for 2001.[24] The loss was caused by ABB's decision to nearly double its provisions for settlement costs in asbestos-related litigation against Combustion Engineering in the US from $470 million to $940 million. The claims were linked to asbestos products sold by Combustion Engineering prior to its acquisition by ABB.

At the same time, ABB's board announced it would seek the return of money "paid in excess of obligations to Goran Lindahl and to Percy Barnevik," two former chief executive officers of the group. Barnevik received some $89 million in pension benefits when he left ABB in 2001; Lindahl, who succeeded Barnevik as CEO, had received $50 million in pension benefits.[25]

In 2005, ABB delisted its shares from the London Stock Exchange and Frankfurt Stock Exchange.[26]

In 2006, ABB put an end to its financial uncertainties by finalizing a $1.43 billion plan to settle asbestos liabilities against its US subsidiaries, Combustion Engineering and ABB Lummus Global, Inc.[27] In August 2007, ABB Lummus Global, ABB's downstream oil and gas business, was sold to CB&I.[27] In 2004, ABB had sold its upstream oil and gas business, ABB Vetco Gray. ABB's plan going forward was to support the oil and gas industry with its core automation and power technology businesses.

In 2008, ABB agreed to acquire Kuhlman Electric Corporation, a US-based maker of transformers for the industrial and electric utility sectors. In December 2008, ABB acquired Ber-Mac Electrical and Instrumentation to expand its presence in Western Canada's oil and gas industries.

In 2010 K-TEK, a manufacturer of level measurement instruments, became part of ABB's Measurement Products business unit within ABB's Process Automation division.[28]

On 10 January 2011, ABB invested $10 million in ECOtality, a San Francisco-based developed of charging stations and power storage technologies, to enter North America's electric vehicle charging market.[29] On July 1, ABB announced the acquisition of Epyon B.V. of the Netherlands, an early leader in the European EV-charging infrastructure and maintenance markets.[30]

In 2011, ABB acquired Baldor Electric for $4.2 billion in an all-cash transaction. The move aligned with ABB's strategy to increase its market share in the North American industrial motors business.[31]

On 30 January 2012, ABB acquired Thomas & Betts, a North American leader in low voltage products for industrial, construction and utility applications, in a $3.9 billion cash transaction.[32] On June 15, 2012, it completed the acquisition of commercial and industrial wireless technology specialists Tropos.

In July 2013, ABB acquired Power-One in a $1 billion all-cash transaction, to become the leading global manufacturer of solar inverters.[33] Also in 2013, Fastned selected ABB to supply more than 200 Terra fast-charging stations along highways in the Netherlands. Ulrich Spiesshofer was named ABB's CEO, succeeding Joe Hogan.[34]

On 6 July 2017, ABB announced it had completed its acquisition of Bernecker + Rainer Industrie-Elektronik (B&R), the largest independent provider of product and software-based, open-architecture for machine and factory automation.[35]

In 2018, ABB became the title partner of the ABB FIA Formula E Championship, the world's first fully electric international FIA motorsport series.[36]

On 30 June 2018, ABB completed its acquisition of GE Industrial Solutions, General Electric's global electrification business.[37]

On 17 December 2018, ABB announced it had agreed to sell 80.1% of its Power Grids business to Hitachi. The transaction, which places a value of $11 billion on the business, is expected to close in the first half of 2020.[38]

In March 2020, ABB announced that it had agreed to sell its solar inverter business to Italian solar inverter manufacturer Fimer. The transaction includes all of ABB's manufacturing and R&D sites in Finland, Italy and India, along with 800 employees across 26 countries.[39][40]

Major product launches and innovations

In 1990, ABB launched Azipod, a family of electric propulsion systems that extends below the hulls of large ships, providing both thrust and steering functions. Developed in corporation with the Finnish shipbuilder Masa-Yards, Azipod has demonstrated the viability of hybrid-electric power in seagoing vessels, while also increasing maneuverability, fuel efficiency and space efficiency.

In 1998, ABB launched the FlexPicker, a robot using a three-armed delta design uniquely suited to the picking and packing industry.

In 2000, ABB brought to market the world's first commercial, high-voltage, shore-to-ship electric power, at the Swedish port of Gothenburg. Supplying electricity to berthed ships from the shore enables vessels to shut down their engines while in port, significantly reducing noise, vibrations and carbon emissions.

In 2004, ABB launched its Extended Automation System 800xA, an industrial system for the process industries. Today, the company is the global market leader in distributed control systems.

In 2014, ABB unveiled YuMi, a collaborative industrial robot. The innovative, dual-arm assembly robot permits people and machines to work side by side, unlocking new potential for automation in a range of industries.

In 2018, ABB unveiled the Terra High Power charger for electric vehicles, capable of delivering enough to charge in eight minutes to enable an electric car to travel 200 kilometers.

Electrification

ABB's Electrification business offers products and services from substation to socket. Customers include a wide range of industry and utility operations, plus commercial and residential buildings. The business has strong exposure to a range of rapidly growing segments, including renewables, e-mobility, data centers and smart buildings.

Its offerings include electric vehicle infrastructure, solar inverters, modular substations, distribution automation; products to protect people, installations and electronic equipment from electrical overload such as enclosures, cable systems and low-voltage circuit breakers; measuring and sensing devices, control products, switches and wiring accessories.

The business also offers KNX systems that integrate and automate a building's electrical installations, ventilation systems, and security and data communication networks. Electrification incorporates an "Electrification Solutions" unit manufacturing low voltage switchgear and motor control centers.

The acquisition of GE Industrial Solutions, which closed in June 2018, further strengthened ABB's #2 global position in electrification.[37]

Motion

ABB's Motion business provides a range of electrical motors, generators, drives and services, as well as integrated digital powertrain solutions. Motion is the #1 player in the market globally.[41]

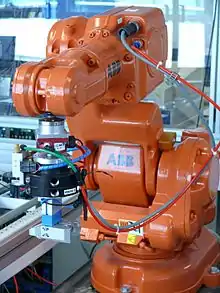

Robotics and discrete automation

ABB's Robotics & Discrete Automation business combines machine and factory automation systems, mainly from B&R, which ABB acquired in 2017, with a comprehensive robotics concepts and applications suite. ABB has installed over 300,000 robots globally. The Robotics & Discrete Automation business has been positioned to capture the opportunities associated with the “factory of the future” by providing services for flexible manufacturing and smart machinery. The business is #2 globally, with a #1 position in robotics in the high-growth Chinese market, where ABB is expanding its innovation and production capacity by investing in a new robotics factory in Shanghai.[41]

Industrial automation

The Industrial Automation business provides a range of services for process and hybrid industries, including its industry-specific integrated automation, electrification and digital services, control technologies, software and advanced services, as well as measurement & analytics, marine and turbocharging offerings.

Power grids

The Power Grids business offers components for the transmission and distribution of electricity, and incorporates ABB's manufacturing network for transformers, switchgear, circuit breakers, and associated high voltage equipment such as digital protective relays. It also offers maintenance services.

A key part of Power Grids' offering turnkey systems and service for power transmission and distribution grids and for power plants; this includes electrical substations and substation automation systems flexible AC transmission systems (FACTS), high-voltage direct current (HVDC) systems, and network management systems. The division is subdivided into the four business units High Voltage Products, Transformers, Grid Automation and Grid Integration.

In 2020, ABB's high voltage direct current systems segment in India has joined hands with Hitachi.

In December 2018, ABB and Hitachi Ltd. announced that Hitachi would take over ABB's power grid business for about $6.4 billion. The transaction would be the Japanese conglomerate's biggest-ever deal as it shifts focus from nuclear plants to the higher-growth market for electricity networks.[42]

Formula E Sponsorship

Prior to the 2016-17 Formula E season, it was announced that ABB would become the official title sponsor of Formula E.[43]

Transportation

Rail transport

ABB Group entered the heavy rail rolling stock manufacturing market in 1989 through a 40% shareholding in a consortium headed with Trafalgar House and some former British Rail employees purchased British Rail Engineering Limited (BREL), the state-owned manufacturing arm of British Rail. BREL was the first division of British Rail to be privatised as part of a phased plan initiated by the third Thatcher ministry. ABB took over two rolling stock manufacturing facilities from BREL; the Holgate Road carriage works in York and Derby Litchurch Lane Works.[44][45] Additionally ABB took over Crewe Works in a purely maintenance capacity. In September 1992, ABB Group purchased the stakes of the other members of the consortium to become the sole owner with the business rebranded ABB Transportation.[46]

The first trains to roll off the production line at either facility under ABB ownership were an order for 22 three-carriage Class 320 electric multiple units, built at ABB York for suburban railways in and around Glasgow in 1990. The same year, ABB York completed an order for five similar four-car Class 322 units, built for the new Stansted Express service. Between 1990 and 1991, ABB York manufactured 24 two-car Class 456 third rail trains for Network SouthEast services out of London Waterloo. A further order for 97 four-car Class 465 trains was completed at ABB York for Network SouthEast services in and around Kent between 1991 and 1994. A number of diesel multiple units were also built at ABB York: firstly the 76 Class 165 suburban units for Chiltern Main Line and Great Western Main Line commuter services between 1990 and 1992, followed by 21 Class 166 three-car express units for longer-distance services out of London Paddington.

After initially continuing to focus on rolling stock refurbishment, the first new trains to roll off the production line at ABB Derby were the ten two-car Class 482 trains, built for the Waterloo & City line while it was still under the control of Network SouthEast (since transferred to the London Underground). In 1995, ABB Derby built 16 four-car Class 325 electric freight multiple units for the Royal Mail to replace their ageing fleet of parcels carriages. During the mid-1990s, in a bid to expand their international portfolio, both the Derby and York plants completed a number of ABB Eurotram light rail vehicles for the Strasbourg tramway in France. Around the same time, in a further diversification, ABB partnered with Brush Traction to construct the fleet of 46 Class 92 electric locomotives for hauling freight trains through the Channel Tunnel; ABB were involved in the design and construction of many components including the traction motors, while final assembly took place at Brush Works in Loughborough.

The last trains to roll off the production line at ABB York were an order for 41 four-carriage Class 365 electric multiple units for Connex South Eastern and West Anglia Great Northern services between 1994 and 1995. Increased competition from other manufacturers following the privatisation of British Rail let to a decline in orders for trains manufactured by ABB, as they no longer held a monopoly on rolling stock manufacturing for the British market. As part of a rationalisation of the business, ABB York was closed in 1996, although it would later be reopened as a rail wagon manufacturing centre by the Thrall Car Manufacturing Company. Following the closure of the York plant, all manufacturing activity was relocated to ABB Derby, operation of which was transferred to the Adtranz joint venture between ABB and Daimler in 1996.

Adtranz unveiled the Class 168 train for Chiltern Railways in 1997. The Class 168 would subsequently evolve into the Turbostar and Electrostar families of related train designs, which went on to become the most successful rolling stock design on post-privatisation British railways by number of units sold. ABB sold its 50% stake in Adtranz to Daimler in 1999, ending their role in railway rolling stock manufacturing. Daimler subsequently sold the entire Adtranz operation to Bombardier Transportation in 2000.[47]

Trolleybuses

In May 2013, ABB Sécheron SA joined with several groups in Geneva TOSA (Trolleybus Optimisation Système Alimentation, or in English, Trolleybus Power System Optimization) in a one-year demonstration of a trolleybus route using a novel charging system. Rather than overhead wires, charging is accomplished by fixed overhead devices located at stops along the route and at the terminus.[48][49][50] Jean-Luc Favre, head of Rail ISI, discussed the promising role of improved electric transport technology in ABB.[51]

Management

In August 2019, ABB announced industrial veteran Björn Rosengren would take over as CEO starting March 2020. Rosengren was then serving as chief executive officer of Swedish mining-equipment giant Sandvik AB. In the meantime, ABB Chairman Peter Voser was appointed interim CEO on 17 April 2019, succeeding Ulrich Spiesshofer, who stepped down after five-and-a-half years.[52] Voser was elected Chairman of the Board of Directors in April 2015[53] and succeeded Hubertus von Grünberg, who had been Chairman since May 2007. Jürgen Dormann was chairman from 2002 to 2007, and Percy Barnevik from 1999 to 2002.

Primary investors

The largest single stake in the firm is held by the Swedish investment company Investor AB, controlled by the Wallenberg family, which holds 11.5%.[3] Activist investor Cevian also holds a large stake in the company. [54]

References

- "Annual Report 2019" (PDF). Retrieved 23 May 2020.

- "ABB Annual Report 2018". ABB.com. ABB. Retrieved 28 March 2019.

- "Major shareholders". ABB Group.

- https://money.cnn.com/quote/shareholder s/shareholders.html?symb=ABB&subView=institutional

- "ABB Group Headquarters". ABB Group. Retrieved 21 October 2020.

- "Fortune 500 - ABB". Fortune. Retrieved 8 August 2018.

- "Das sind künftig die grössten Arbeitgeber der Industrie". Bilanz (in German). Retrieved 13 November 2020.

- "Share - Listing information". Abb.

- "History of ABB". ABB Group.

- "ABB Group profits from Ulrich Spiesshofer's automation gamble". European CEO. 18 January 2018. Retrieved 6 February 2020.

- "Electrifying founders". new.abb.com.

- "BBC-Brown, Boveri and Asea Announce Merger". AP NEWS. Retrieved 9 October 2020.

- Crainer, Stuart. ""A.B.B., the Dancing Giant" by Kevin Barham and Claudia Heimer". strategy+business. Retrieved 9 October 2020.

- Cole, Robert J. (14 November 1989). "Combustion To Merge With ABB (Published 1989)". The New York Times. ISSN 0362-4331. Retrieved 9 October 2020.

- ABB joins forces with Daimler-Benz Rail issue 249 29 March 1995 page 6

- Rivals to merge Railway Gazette International April 1995 page 197

- Merger approved Railway Gazette International December 1995 page 818

- "ABB acquires Alfa Laval Automation". Abb.

- "Elsag Bailey was acquired by ABB Group". Bloomberg.

- "DaimlerChrysler buys ABB's share in Adtranz". Abb.

- "Press release: ABB to sell nuclear business to BNFL". Abb. 29 December 1999. Retrieved 13 September 2009.

- "ALSTOM acquires ABB's share in ABB ALSTOM POWER". Abb.

- "ABB posts US$ 691 million loss for 2001 after substantial charges, cuts net debt in Q4 by US$ 2.2 billion on record cash flow". Abb.

- Edith M. Lederer (1 March 2002). "UN: Swedish Businessman Loses Job". CorpWatch. Retrieved 12 December 2010.

- Restructuring announced by ABB Railway Gazette International October 2005 page 645

- Uncredited (1 September 2006). "ABB asbestos claims resolved". Reuters.

- Vinluan, Frank (9 July 2010). "ABB buys $50M Louisiana company K-TEK". Triangle Business Journal. Retrieved 11 September 2020.

- "ABB enters US market for electric vehicle infrastructure with ECOtality stake". Abb.

- "ABB acquires Epyon to expand offering in EV charging infrastructure". Abb.

- "ABB completes acquisition of Baldor Electric Company". Abb.

- "Thomas & Betts Corporation Reports Fourth Quarter 2011 Net Earnings" (PDF). TNB. 30 January 2012. Retrieved 1 February 2012.

- "ABB completes acquisition of Power-One". Abb.

- "Ulrich Spiesshofer takes over as ABB's new Chief Executive Officer". Abb.

- "ABB completes acquisition of B&R". Abb.

- "ABB and Formula E partner to write the future of e-mobility". Abb.

- "ABB completes acquisition of GE Industrial Solutions". Retrieved 30 July 2018.

- "ABB: Shaping a leader focused in digital industries". Abb.

- "ABB pays up to $470 m to ditch solar converter business". Reuters. 9 July 2019. Retrieved 3 March 2020.

- "FIMER SpA completes buy of ABB's solar inverter business". Power Engineering. 2 March 2020. Retrieved 3 March 2020.

- "ABB Strategy 2019 Update". Abb. Retrieved 28 February 2019.

- "ABB: Shaping a leader focused in digital industries". Abb. Retrieved 17 December 2018.

- Southwell, Hazel (9 January 2018). "FE takes on title sponsor, becomes ABB Formula E Championship". E-Racing. Retrieved 21 May 2020.

- In Brief Railway Gazette International May 1989 page 287

- BREL acquisition completed The Railway Magazine issue 1058 June 1989 page 369

- BREL becomes ABB Transportation Ltd The Railway Magazine issue 1099 November 1992 page 13

- Bombardier agrees to buy Adtranz Railway Gazette International September 2000 page 601

- Mike Millikin, ed. (31 May 2013). "ABB develops and demonstrates "flash charging" system for electric buses". Green Car Congress. Retrieved 1 June 2012.

- Zachary Shahan (31 May 2013). "ABB Unveils Ultrafast, 15-Second "Flash Charging" Electric Bus". CleanTechnica. Retrieved 1 June 2013.

- "New Charging Technology from ABB - Analyst Blog". Zachs Investment Research. 31 May 2013. Archived from the original on 9 February 2015. Retrieved 1 June 2013.

- "Geneva Unveils Electric Bus without Overhead Wires (see video of call)". The Local, Switzerland's News in English. 21 April 2013. Retrieved 1 June 2013.

- "ABB Interim CEO appointment". Abb. Retrieved 17 April 2019.

- "ABB Board of Directors". Abb. Retrieved 25 October 2015.

- https://www.reuters.com/article/us-abb-investor-cevian/activist-investor-cevian-reduces-stake-in-abb-to-under-5-idUKKCN2502HH

Further reading

- ABB (2005): The Dormann Letters, Jürgen Dormann/ABB Group, Zurich

- Bélanger, Jacques et al. (2001): Being local worldwide: ABB and the challenge of global management, Cornell University Press, New York. ISBN 0-8014-3650-8

- Kevin Barham, Claudia Heimer (1998): ABB: the dancing giant – creating the globally connected corporation. Financial Times, London. ISBN 0-273-62861-5

External links

Media related to ABB Group at Wikimedia Commons

Media related to ABB Group at Wikimedia Commons- Documents and clippings about ABB Group in the 20th Century Press Archives of the ZBW