Banking in Switzerland

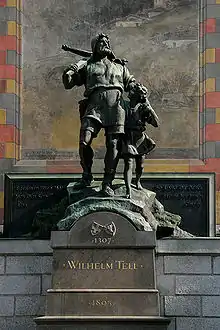

Banking in Switzerland dates to the early eighteenth century through Switzerland's merchant trade and has, over the centuries, grown into a complex, regulated, and international industry. Banking is seen as emblematic of Switzerland, along with the Swiss Alps, Swiss chocolate, watchmaking and mountaineering. Switzerland has a long, kindred history of banking secrecy and client confidentiality reaching back to the early 1700s. Starting as a way to protect wealthy European banking interests, Swiss banking secrecy was codified in 1934 with the passage of the landmark federal law, the Federal Act on Banks and Savings Banks. These laws, which were used to protect assets of persons being persecuted by Nazi authorities, have also been used by people and institutions seeking to illegally evade taxes, hide assets, or generally commit financial crime.

| Part of a series on the |

| Culture of Switzerland |

|---|

|

| History |

| People |

| Languages |

| Cuisine |

| Festivals |

| Literature |

| Sport |

|

Controversial protection of foreign accounts and assets during World War II sparked a series of proposed financial regulations seeking to temper bank secrecy to little success. Switzerland has been one of the largest offshore financial centers and tax havens in the world since the mid-20th century. Despite an international push to meaningfully roll back banking secrecy laws in the country, Swiss social and political forces have minimized and reverted much of proposed roll backs. Although disclosing criminal activities by banks, who do not enjoy a good reputation even in Switzerland, is generally well seen by the Swiss public, disclosing client information has been considered a criminal offence since the early 1900s. Employees working in Switzerland and abroad at Swiss banks "have long adhered to an unwritten code similar to that observed by doctors or priests".[1] Since 1934, banking secrecy laws have been violated by four people: Christoph Meili (1997), Bradley Birkenfeld (2007), Rudolf Elmer (2011), and Hervé Falciani (2014).

The Swiss Bankers Association (SBA) estimated in 2018 that Swiss banks held US$6.5 trillion in assets or 25% of all global cross-border assets. Switzerland's main lingual hubs, Geneva (for French), Lugano (for Italian), and Zürich (for German) service the different geographical markets. It consistently ranks in the top three states on the Financial Secrecy Index and was named first many times, most recently in 2018. The two large banks–UBS and Credit Suisse are regulated by the Swiss Financial Market Supervisory Authority (FINMA), and the Swiss National Bank (NSB) which derives its authority from a series of federal statutes. Banking in Switzerland has historically played, and still continues to play, a dominant role in the Swiss economy and society. According to the Organization for Economic Cooperation and Development (OECD), total banking assets amount to 467% of total gross domestic product.[2] Banking in Switzerland has been portrayed, to varying degrees of accuracy, in overall popular culture, books, movies, and television shows.

Banking secrecy

History

Bank secrecy in the Swiss region can be traced[2] to the Great Council of Geneva which outlawed the disclosure of information about the European upper class in 1713.[2] As a way of avoiding the Protestant banking system, Catholic French Kings deposited their holdings in Geneva accounts.[2] During the 1780s, Swiss bank accounts began insuring deposits which contributed to their reputation for financial security.[2] In 1815, the Congress of Vienna formally established Switzerland's international neutrality which led to a large capital influx.[2] The wealthy, landlocked Switzerland saw banking secrecy as a way to build an empire similar to that of France, Spain, and the United Kingdom.[2] Swiss historian Sébastian Guex notes in The Origins of Secret Swiss Bank Accounts:

This is what the Swiss bourgeoisie are thinking: 'That's our future. We will play on the contradictions between the European powers and, protected by the shield of our neutrality, our arm will be industry and finance.'[3]

After a small scale civil war in the 1840s between the Swiss cantons, the Swiss Federation was founded in 1848.[2] The formation of the state, through a direct democracy, contributed to the political stability needed for banking secrecy.[2] The mountainous terrain of Switzerland provided a natural environment to excavate underground vaults for storage of gold and diamonds.[2] During the 1910s, Swiss bankers traveled to France to advertise its banking secrecy during World War I.[2] The war's contribution to political and economic instability, sparked a rapid capital movement into Switzerland.[2] As European countries began to increase taxes to finance the war, wealthy clients moved their holdings into Swiss accounts to avoid taxation.[2] The French banked in Geneva, the Italians in Lugano, and the Germans in Zurich.[2] While disclosing client information was a civil offence in Switzerland for centuries, the Swiss Federal Assembly made it a federal criminal offence in 1934 with the passage of the landmark legislation, the Federal Act on Banks and Savings Banks.[2] Colloquially known as the Banking Law of 1934 or the Swiss Banking Law of 1934, it codified banking secrecy.[4] The Federal Assembly enacted the law to quell controversy over the alleged tax evasion of wealthy French businessmen, military generals, and Catholic bishops.[5] An additional provision, Article 47(b), was drafted before its ratification to protect Jewish assets from the Nazi party.[4][6]

Along with protecting German Jewish assets, Swiss banks collaborated with Nazi Germany and their allies by storing their gold and cash balances in underground vaults.[4] Adolf Hitler maintained an account at the Union Bank of Switzerland (UBS) estimated at 1.1 billion Reichsmarks.[4][7] After the United States formally asked the bank to transfer the money in the 1990s, UBS wired US$400 to 700 million worth of Reichsmarks to U.S. authorities.[4] Banking regulations in Switzerland limit the amount of orphaned assets allowed to leave a bank's custody.[4] UBS, with consent from the Swiss government, froze the account containing Hitler's assets indefinitely, and clipped the Reichsmarks, stripping the currency of value.[7] During World War II, UBS also maintained accounts for hundreds of German Jewish businesspeople and households.[6] After the Banking Law of 1934 was passed, the bank aggressively protected assets of the "enemies of Nazi Germany".[6] When Hitler announced an (aborted) invasion of Switzerland in 1940, UBS contracted the Swiss Armed Forces to blockade their retail banks and transport Jewish assets to underground military bunkers.[8] The Swiss Bank Corporation (SBC) and Credit Suisse, did likewise but along with UBS, they were later fined hundreds of millions of dollars in reparations for their dealings with Nazi Germany.[4] Throughout the 1980s and 1990s, numerous international proposals for bank secrecy rollbacks were made by foreign states with little success.[4]

After the 2008 financial crisis, Switzerland signed the European Union Savings Directive (EUSD) which obliges Swiss banks to report to 43 European countries non-identifying annual tax statistics.[9] On December 3, 2008, the Federal Assembly increased the prison sentence for violations of banking secrecy from a maximum of six months to five years.[10] In late 2008, after an international, multi-state investigation into Switzerland's role in U.S. tax evasion, UBS entered into a limited, deferred prosecution agreement (DPA) with the U.S. Department of Justice.[11] The agreement initiated the landmark Birkenfeld Disclosure of information on more than 4,000 clients.[11]

Steve Kroft, host of Banking: A Crack In the Swiss Vault[12]

In another step toward loosening banking secrecy, Switzerland signed the U.S. Foreign Account Tax Compliance Act (FATCA), after rejecting it twice in parliament.[11] The FATCA requires Swiss banks to disclose non-identifying U.S. client information annually to the Internal Revenue Service.[11] The agreement does not guarantee the semi-automatic information transfers, which remain at the discretion of Swiss government authorities.[13] If a client does not consent to having their information shared with the IRS, Swiss law prohibits the disclosure.[13] If a client does consent, Swiss banks send the IRS tax-related information about the account holder but are prohibited from disclosing identities pursuant to Article 47 of the Banking Law of 1934.[13] The 2018 Financial Secrecy Index stated: "this [does] not mean that Swiss banking secrecy was finished, as some excitable news reports suggest… the breach was a partial [dent]".[14]

In March 2015, the Swiss government entered into bilateral "Rubik Agreements" with Germany, Austria, and the United Kingdom allowing foreign holders of Swiss bank accounts to retain their anonymity in exchange for paying predetermined back taxes.[15] Switzerland adopted the International Convention on the Automatic Exchange of Banking Information (AEOI) in 2017, agreeing to automatically release limited financial information to certain countries for the sole purpose of tax auditing.[16] This agreement includes the Common Reporting Standard (CRS) which obliges Swiss banks to automatically send foreign tax authorities the client's name, address, domicile, tax number, date of birth, account number, account balance at years end, and the gross investment income.[17] The CRS does not, however, override the Swiss Banking Law of 1934, so the client's expenses (withdrawals) and investments are not disclosed.[14] Thus tax authorities cannot "go fishing" for tax evaders, they must directly link a financial crime to the client's account.[14] The disclosed information can only be used for tax auditing and Swiss authorities may prevent disclosure.[18]

In December 2017, the Swiss parliament launched a standing initiative and expressed an interest in formally embedding banking secrecy within the Swiss Constitution making it a federally-protected constitutional right.[19][20] In January, 2018, a U.S. district court ruled that Swiss bankers "[have] nothing to do with the choice that an American taxpayer makes to not declare offshore assets", later clarifying they should not be seen as facilitating tax evasion but rather provide a legal service that is made illegal by the client.[21] The Swiss Justice Ministry announced in March 2018 that disclosure of client information in a pending court case involving a Swiss bank is subject to federal espionage and extortion charges in addition to charges relating to banking secrecy laws.[22]

Modern secrecy

Ueli Maurer, former President of Switzerland in 2013[23]

Switzerland, considered the "grandfather of bank secrecy", has been one of the largest offshore financial centers and tax havens in the world since the mid-20th century.[24] Despite an international push to meaningfully roll back banking secrecy laws in the country, Swiss political forces have minimized and reverted much of the proposed roll backs.[24] Disclosing client information has been considered a serious social and criminal offense since the early 1900s.[24] Whistleblowers, despite legal protections, often face professional set backs in Switzerland.[24][25] Swiss bankers who maintain offices exclusively in Switzerland are shielded from a foreign state's lawsuits, extradition requests, and criminal charges, as long as they remain within the country's legal jurisdiction.[21] In spite of minor adjustments to bank secrecy, bankers working in Switzerland and abroad at Swiss banks "have long adhered to an unwritten code similar to that observed by doctors or priests".[1] Switzerland's main lingual hubs, Geneva (for French), Lugano (for Italian), and Zürich (for German) service the different geographical markets.[24] It consistently ranks in the top three states on the Financial Secrecy Index and was named first many times, most recently in 2018.[24] The Swiss Bankers Association estimated in 2018 that Swiss banks held US$6.5 trillion in assets or 25% of all global cross-border assets.[24] These secrecy laws have linked the Swiss banking system with individuals and institutions seeking to illegally evade taxes, hide assets, or generally commit financial crime.[26]

Secrecy laws have been violated by four people since 1934: Christoph Meili (1997), Bradley Birkenfeld (2007), Rudolf Elmer (2011), and Hervé Falciani (2014).[1] In all four cases, the whistleblowers were served with federal arrest warrants, fined, and sustained professional setbacks in Switzerland.[27]

Bank vaults and bunkers

A handful of larger Swiss banks operate undisclosed or otherwise secretive bank vaults, storage facilities or underground bunkers for gold bars, diamonds, or other valuable physical assets.[8][28] Most of these underground bunkers are located near or at the foothills of the mountainous regions of the Swiss Alps.[29] These facilities are not subject to the same banking regulations as banks in Switzerland and do not have to report holdings to regulatory agencies.[29][30] The Swiss defense department estimates that of the ten former military bunkers available for sale, six of them were sold to Swiss banks to house assets during the 1980s and 1990s.[8][31] Storage in these underground bunkers and bank vaults is typically reserved for clients that pass a multi-stage security clearance.[29] Some of these bunkers are not accessible by road or foot and require aircraft transportation.[8]

Numbered bank accounts

Many banks in Switzerland offer clients numbered bank accounts, accounts where the identity of the holder is replaced with a multi-digit number known only to the client and select private bankers.[32][33] Although these accounts do add another layer of banking secrecy, they are not completely anonymous as the name of the client is still recorded by the bank and subject to limited, warranted disclosure.[32] Some Swiss banks supplement the number with a code name such as "Cardinal",[21] "Octopussy"[34] or "Cello"[34] that identifies the client, alternatively.[35] However, to open this type of account in Switzerland, clients must pass a multi-stage clearance procedure and prove to the bank the lawful origins of their assets.[36]

Connection to illegal activities

Swiss banks have served as safe havens for the wealth of dictators, despots, mobsters, arms dealers, corrupt officials, and tax cheats of all kinds.[37][38][39][40]

In 2018, London-based Tax Justice Network ranks Switzerland's banking sector as the "most corrupt" in the world due to a large offshore banking industry and very strict secrecy laws. The ranking attempts to measure how much assistance the country's legal systems provide to money laundering, and to protecting corruptly obtained wealth.[41]

As of 2019, key criminal probes involving Swiss banks were the Petrobras bribery case, the Mozambique "tuna bonds", Credit Suisse "spygate" affair, Raiffeisen insider trading and UBS tax evasion in France.[42]

In 2021, the Swiss Broadcasting Corporation reported that the Zurich police are investigating CHF 9 billion from Venezuela that has been received by 30 Swiss banks. A Swiss bank account was used to bribe a Venezuelan minister.[43]

Starting in 2022, fines on Swiss banks abroad will be tax deductible.[44]

Swiss economy

Switzerland is a prosperous nation with a per capita gross domestic product higher than that of most Western European nations. The value of the Swiss franc (CHF) has been relatively stable compared with that of other currencies.[45] Swiss neutrality and national sovereignty, long recognized by foreign nations, have fostered a stable environment for the banking sector to develop and thrive. Switzerland maintained neutrality through both World Wars, is not a member of the European Union, and did not join the United Nations until 2002.[46][47] The Bank of International Settlements (BIS), an organization that facilitates cooperation among the world's central banks, is headquartered in Basel. Founded in 1930, the BIS chose to locate in Switzerland because of the country's neutrality, which was important to the organization founded by countries that had been enemies in World War I.[48]

Banking has played a dominant role in the Swiss economy for two centuries.[2] According to the Organization for Economic Co-operation and Development (OECD), total banking assets amount to 467% of total gross domestic product.[2]

Regulation

The Swiss Financial Market Supervisory Authority (FINMA) is a public law institution that supervises most banking-related activities as well as securities markets and investment funds.[49] Regulatory authority is derived from the Swiss Financial Market Supervision Act (FINMASA) and Article 98 of the Swiss Federal Constitution. The office of the Swiss Banking Ombudsman, founded in 1993, is sponsored by the Swiss Banking Ombudsman Foundation, which was established by the Swiss Bankers Association. The ombudsman's services, which are offered free of charge, include mediation and assistance to persons searching for dormant assets. The ombudsman handles about 1,500 complaints raised against banks yearly.[50]

Tax evasion

Many sovereign states do not legally require private bankers to confirm whether or not a client has or has not paid their taxes, in any capacity.[51] On top of this, Switzerland's banking secrecy laws prohibit the disclosure of client information under a variety of federal, cantonal, and civil policies.[24] Many foreign nationals open Swiss bank accounts to take advantage of these laws and tax distinctions.[52] While citizens of Switzerland retain the full force of banking secrecy protections, foreign clients are afforded some of the most stringent bank–client confidentiality protections in the world.[52] In exchange for banking services, the Swiss government charges "a low, lump-sum option on the money they bank", after which Swiss tax authorities consider client tax burdens "settled".[53] After the Banking Law of 1934 was passed, Swiss bankers traveled across Europe to advertise its banking secrecy during World War II.[2] As European countries began to increase taxes to finance the war, wealthy clients moved their holdings into Swiss accounts to avoid taxation.[2]

Starting in 2019, Switzerland began to share the details of 3.1 million bank accounts held by foreigners (to the country of origin or residence) as part of the automatic exchange of information agreement it has signed.[54][55] Swiss banks, insurance and trusts have a legal obligation to comply but charitable Swiss foundations are so far exempt. [54][56] As of 2019, Switzerland receives financial data from 75 countries and shares data with 63 (81 countries starting in 2021).[57]

According to the 2018 Financial Secrecy Index, Switzerland's banking secrecy laws have rendered it a premier tax haven since the 1900s.[11] It also noted that this status has been frequently abused by criminals to illegally evade paying taxes in their home country.[11] One of the most prominent attractions to the disclosure protection laws is the distinction between tax evasion (non-reporting of income) and tax fraud (active deception).[58] Akin to the distinction between legal tax avoidance and illegal tax evasion in the U.S., the non-reporting of income is only a civil offense in Switzerland while tax fraud is a financial crime.[58] When foreign clients deposit holdings into a Swiss bank account, the bank is legally prohibited from disclosing balances or client information to tax authorities.[58] This prohibition can only be waved if the client has produced a written statement of consent or a financial crime has been directly linked to the bank account.[58] More often than not,[2] clients don't consent to foreign tax authorities which leaves only the latter circumstance available.[52] Many client services available in Switzerland (e.g. numbered bank accounts) are used to shield client data from tax authorities.[52]

Breaches of banking secrecy laws in Switzerland are automatically processed pursuant to Article 47 of the Banking Law of 1934: those who disclose client information are subject to a maximum of five years imprisonment and 250,000 francs (€215,000 or US$250,000) in fines.[52] Whistleblowers and leakers of client information often face hostility from the public and sustain professional set backs.[25][24] Denounced as a criminal in Switzerland, a federal arrest warrant has been in place for Bradley Birkenfeld since 2008, after he disclosed UBS client information to the U.S. Internal Revenue Service in 2007.[59] After the 2008 financial crisis, the Swiss Parliament initiated a series of international tax treaties that rolled back banking secrecy protections for foreign clients in response to pressure from the European Union, United States, and United Kingdom.[2] Despite implementing nearly 50 information transfer agreements and numerous limitations to banking secrecy protections for foreign clients, Switzerland has been ranked among the top three tax havens in the world every single year since the financial crisis, most recently in 2018.[24] The majority of the overseas wealth in Switzerland originates in Germany, France and Saudi Arabia.[60] As of 2015, Swiss banking secrecy was considered dead because of FATCA.[61] According to the Financial Secrecy Index report, Switzerland will exchange information with rich countries if they have to, but will continue to hide the assets of citizens of poorer countries such as Brazil, Russia or India.[62]

Major banks

As of 2018, there are more than 400 securities dealers and banking institutions in Switzerland, ranging from the "Two Big Banks" down to small banks serving the needs of a single community or a few special clients.[63] The largest and second largest Swiss banks are UBS Group AG and Credit Suisse Group AG, respectively. They account for over 50% of all deposits in Switzerland; each has extensive branch networks throughout the country and most international centers. Due to their size and complexity, UBS and Credit Suisse are subject to an extra degree of supervision from the Federal Banking Commission.[64]

UBS

UBS Group AG came into existence in June 1998, when Union Bank of Switzerland, founded in 1862, and Swiss Bank Corporation, founded in 1872, merged.[66] Headquartered in Zurich and Basel, it is Switzerland's largest bank.[66] It maintains seven main offices around the world (four in the United States and one each in London, Tokyo, and Hong Kong) and branches on five continents.[66] UBS has been at the center of various tax evasion investigations since its founding.

Credit Suisse

Credit Suisse Group is the second-largest Swiss bank.[67] Based in Zurich and founded in 1856, Credit Suisse offers private banking, investment banking and asset management services.[67] It acquired the First Boston Corporation in 1988 and merged with the Winterthur insurance company in 1997; the latter was sold to AXA in 2006.[68] The asset management services were sold to Aberdeen Asset Management during the 2008 financial crisis.[67] Credit Suisse has been at the center of various tax evasion investigations or money laundering activities since its founding.[69]

Other banks

Central bank

The Swiss National Bank (SNB) serves as the country's central bank. Founded by the Federal Act on the Swiss National Bank (16 January 1906), it began conducting business on 20 June 1907. Its shares are publicly traded, and are held by the cantons, cantonal banks, and individual investors; the federal government does not hold any shares.[70] Although a central bank often has regulatory authority over the country's banking system, the SNB does not; regulation is solely the role of the Federal Banking Commission.[71]

Raiffeisen Banks "assumes the role of central bank" in providing treasury services, and is the third largest group consisting of 328 banks in 2011, 390 in 2012 with 1,155 branches.[72][73] During February 2012, P. Vincenz was chief executive.[74] During January, an announcement was made that the non-U.S. businesses of Wegelin & Co, the oldest Swiss bank, would be bought by the Raiffeisen group. The group has 3 million plus clients within Switzerland.[75][76]

Private banks

The term private bank refers to a bank that offers private banking services and in its legal form is a partnership.[77] The first private banks were created in St. Gallen in the mid-18th century and in Geneva in the late 18th century as partnerships, and some are still in the hands of the original families such as Hottinger and Mirabaud.[77] In Switzerland, such private banks are called private bankers (a protected term) to distinguish them from the other private banks which are typically shared corporations.[77] Historically in Switzerland a minimum of CHF1 million was required to open an account, however, over the last years many private banks have lowered their entry hurdles to CHF250,000 for private investors.[77]

Cantonal banks

There are, as of 2006, 24 cantonal banks; these banks are state-guaranteed semi-governmental organizations controlled by one of Switzerland's 26 cantons that engage in all banking businesses.[78] The largest cantonal bank, the Zurich Cantonal Bank, had a 2005 net income of CHF810 million.[79]

In popular culture

Banking in Switzerland, in particular Swiss banking secrecy practices, has been detailed in global popular culture to varying degrees of accuracy. According to official statements from the Swiss National Film Archives, inaccurate or exaggerated portrayals negatively impact Switzerland by reducing bankers to unflattering "caricatures" that are "ever disposed to accept funds from questionable sources".[80] In 2014, Sindy Schmiegel, a spokeswoman for the Swiss Bankers Association (SBA) stressed that financial regulation in Switzerland is dramatically more strict than portrayed fictionally.[80] The Economic Times noted that popular culture portrays Swiss bank accounts as "completely anonymous" later adding "this is simply not true."[81]

Swiss banking was prominently featured in the following films and television shows:

- The Great Spy Chase (1964): Francis Lagneau (Lino Ventura) engages with a Swiss banker to open a bank account containing patents to powerful weapons.[82] This film is considered the first motion picture to reference banking in Switzerland.[82]

- Swiss banking has been mentioned by James Bond in film and in literature dozens of times, it plays a central role in:

- Goldfinger (1964): James Bond (Sean Connery) thwarts Goldfinger's plans to rob a U.S. gold depository frequently citing Swiss underground gold bunkers and bank accounts numbers as motivation.[82] This film was written after Switzerland's role in World War II was at the forefront of international critique on bank secrecy.[82]

- On Her Majesty's Secret Service (1969): supervillain Ernst Stavro Blofeld (Telly Savalas) tells James Bond (George Lazenby) that unless a large sum of money is deposited into a Swiss bank account, a bomb will detonate and kill thousands of people.[83] Mentions of Swiss banking in the James Bond novels have been viewed as "reinforcing a stereotype".[80]

- The World Is Not Enough (1999): James Bond (Pierce Brosnan) visits a Swiss bank in Spain called La Banque Suisse de L'Industrie to meet an associate before jumping out of a five-story window.[85][82]

- Casino Royale (2006): After a high stakes poker game is completed, the winnings of James Bond (Daniel Craig) is transferred to a Swiss bank in Basel account for security.[82]

- The Godfather Part III (1990): Frederick Keinszig (Helmut Berger), a Swiss banker for the Vatican, gets into a shootout with the Corleone family over technicalities over bank–client confidentiality.[86] The movie was seen as establishing the "Swiss banker trope" within mainstream culture.[86]

- The Bourne Identity (2002): Jason Bourne (Matt Damon), a secret operative for the Central Intelligence Agency (CIA) suffering from retrograde amnesia, begins to recall life events after opening a bank deposit box containing a gun, large amounts of international currency and a variety of passports.[87] The scene was seen as unduly "[emphasizing] the issue of [bank] secrecy".[80]

- The Da Vinci Code (2006): Robert Langdon (Tom Hanks) opens a Swiss bank account at the Paris-based "Depository Bank of Zürich", a high-tech bank that allows clients to deposit and withdraw assets with complete anonymity.[89] The usage of this type of numbered bank account is illegal both in France and Switzerland.[33]

- The Wolf of Wall Street (2013): Jordon Belfort (Leonardo DiCaprio) travels to the Geneva-based Union Bancaire Privée (UBP) to meet with private banker Jean Jacques Saurel (Jean Dujardin) who advises Belfort to open an account in the name of a relative with a European passport to avoid U.S. taxation.[80] This is technically legal in Switzerland as Belfort was not charged with a financial crime (at the time of meeting) and extra banking secrecy is afforded to European citizens.[90] Belfort's bank–client confidentiality was waived because Saurel traveled outside of Switzerland and was arrested on U.S. soil for a crime (money laundering) illegal in both countries.[33] The fictional interaction was called "a bit ridiculous and exaggerated" and "not very Swiss" by the Swiss Bankers Association.[80]

See also

- List of Swiss financial market regulation

- List of banks in Switzerland

References

- Thomasson, Emma (April 18, 2013). "Special Report: The battle for the Swiss soul". Reuters. Retrieved May 19, 2018.

- Financial Secrecy Index: Narrative Report on Switzerland (2018), p. 2

- Guex, Sébastian (March 3, 2015). "The Origins of Secret Swiss Bank Accounts | JSTOR Daily". JSTOR Daily. Retrieved May 18, 2018.

- Financial Secrecy Index: Narrative Report on Switzerland (2018), p. 3

- Komisar, Lucy (Spring 2003). "Offshore banking, the secret threat to America". Dissent Magazine. Archived from the original on July 23, 2012.

- Mueller, Kurt (1969). "The Swiss Banking Secret: From a Legal View". The International and Comparative Law Quarterly. 18 (2): 361–362. doi:10.1093/iclqaj/18.2.360. JSTOR 757529.

- Boggan, Steve (September 5, 1996). "Discovered: Hitler's secret Swiss bank account". The Independent. Retrieved May 18, 2018.

Declassified intelligence documents at the US National Archives show that one of Hitler's closest confidantes opened the accounts at the Union Bank of Switzerland in Bern after the Fuhrer's book became required reading in German schools.

- Schütz, Dirk (2000). The Fall of UBS: The Forces that Brought Down Switzerland's Biggest Bank. Pyramid Media Group. ISBN 9780944188200.

- Financial Secrecy Index: Narrative Report on Switzerland (2018), p. 5

- Neghaiwi, Brenna Hughes (October 31, 2017). "Exclusive: Swiss prosecutors seek widening of secrecy law to..." Reuters. Retrieved May 18, 2018.

- Financial Secrecy Index: Narrative Report on Switzerland (2018), p. 4

- Kroft, Steve (August 15, 2010). "Banking: A Crack In the Swiss Vault". 1 (published May 13, 2018) – via CBS.

- Song, Jane (November 1, 2015). "The End of Secret Swiss Accounts?: The Impact of the U.S. Foreign Account Tax Compliance Act (FATCA) on Switzerland's Status as a Haven for Off Shore Accounts". Northwestern University. Retrieved March 18, 2018.

- Financial Secrecy Index: Narrative Report on Switzerland (2018), p. 4

- "Don't ask, won't tell". The Economist. February 12, 2016. Retrieved May 20, 2018.

- Naravane, Vaiju (October 10, 2016). "End of banking secrecy in Switzerland". The Hindu. ISSN 0971-751X. Retrieved May 18, 2018.

- "Swiss say goodbye to banking secrecy". SWI swissinfo.ch. January 1, 2017. Retrieved May 18, 2018.

- "Swiss Bank Secrecy: The Facts". www.moneyland.ch. Retrieved May 18, 2018.

- "Parliament: don't touch banking secrecy for Swiss clients". SWI swissinfo.ch. Retrieved May 19, 2018.

- M.V. (July 19, 2014). "Swiss bank secrecy: a whistleblower's woes". The Economist. Retrieved May 18, 2018.

The American-led attack on the Gnomes of Zurich has produced a backlash: a right-wing party has almost collected enough signatures to force a referendum on whether to strengthen constitutional support for financial secrecy. Swiss bankers who spill the beans continue to do so at their peril.

- Enrich, David (January 6, 2018). "A Swiss Banker Helped Americans Dodge Taxes. Was It a Crime?". The New York Times. Retrieved May 20, 2018.

Several hunkered down in Switzerland, which refused to extradite its citizens to the United States for actions that weren't illegal in Switzerland. None had actually gone on trial.

- Editorial, Reuters (March 21, 2018). "Swiss charge three Germans in bank secrecy clash". Reuters. Retrieved May 18, 2018.

- "Swiss president sees no need to change banking secrecy". Indian Express. 2013-04-14. Retrieved 2013-04-14.

- Financial Secrecy Index: Narrative Report on Switzerland (2018), p. 1

- Carvajal, Doreen (July 8, 2014). "Swiss Banks' Tradition of Secrecy Clashes With Quests Abroad for Disclosure". Retrieved May 20, 2018.

If you blow the whistle you are socially and financially dead.

- swissinfo.ch, S. W. I.; Corporation, a branch of the Swiss Broadcasting (June 26, 2018). "Swiss banks urged to step up fight against financial crime". SWI swissinfo.ch. Retrieved 2020-04-23.

- Pacaud, Julien (December 23, 2017). "One man's fight against the Swiss offshore banking system". The Economist. Retrieved June 1, 2018.

- Kroft, Steve (December 30, 2009). "Banking: A Crack In The Swiss Vault". CBC News: 60 Minutes. Retrieved May 16, 2018.

The subterranean vaults of Geneva and Zurich have served as sanctuaries for the wealth of dictators and despots, mobsters and arms dealers, corrupt officials and tax cheats of all kinds.

- Baker, Stephanie (September 30, 2016). "Secret Alpine Gold Vaults Are the New Swiss Bank Accounts". Bloomberg.com. Retrieved May 18, 2018.

- "The Sinister Face Of 'Neutrality' | Frontline | PBS". www.pbs.org. 1996. Retrieved May 17, 2018.

Before the Second World War, with the rise of Nazism, many Jews in Central and East Europe sought to protect a part of their assets by depositing money in Swiss accounts, and their valuables in Swiss safe deposit boxes. To encourage such transfers, in 1934 the Swiss even strengthened special banking secrecy laws which facilitated preservation of the anonymity of depositors.

- Bloomberg, News (August 17, 2013). "Got gold? Switzerland has an underground bunker just for you". The Mercury News. Retrieved May 14, 2018.

- "Fancy yourself a numbered Swiss Bank account? Here's how you can get one". The Economic Times. October 30, 2013. Retrieved May 18, 2018.

- Obringer, Lee Ann (June 8, 2011). "How Swiss Bank Accounts Work". HowStuffWorks. Retrieved May 18, 2018.

- Browning, Lynnley (August 19, 2009). "Under Agreement, UBS to Give Up 4,450 Names". The New York Times. Retrieved May 15, 2018.

- "Numbered Bank Accounts - Series 10 | Investopedia". Investopedia. November 12, 2014. Retrieved May 18, 2018.

A broker dealer, at the request of the customer, may open an account that is simply identified by a number or a symbol, as long as there is a statement signed by the customer attesting to the ownership of the account.

- Koba, Mark (August 20, 2008). "How To Open A Swiss Bank Account". CNBC. Retrieved May 12, 2018.

- https://m.youtube.com/watch?v=FequAfnkAbo

- "Banking: A Crack In The Swiss Vault". 60 Minutes. CBS. December 30, 2009. Archived from the original on May 21, 2014.

- "Subscribe to read | Financial Times". www.ft.com. Cite uses generic title (help)

- "Secret's out on the Swiss bank account".

- "Switzerland remains top of 'financial secrecy' ranking as US rises to second". 31 January 2018. Retrieved 18 July 2019.

- "The key criminal probes involving Swiss banks".

- "Banking secrecy remains a business model for Swiss banks". Swiss Broadcasting Corporation. 5 February 2021. Retrieved 5 February 2021.

- https://www.swissinfo.ch/eng/business/fines-on-swiss-firms-abroad-will-be-tax-deductible-from-2022/46156202

- "The World Factbook – Switzerland – Economy". Central Intelligence Agency. Archived from the original on 2006-07-05. Retrieved 2006-06-16.

- "The World Factbook – Switzerland – Introduction". Central Intelligence Agency. 2006-06-13. Retrieved 2010-06-02.

- "Country profile: Switzerland". BBC News. 2006-03-26. Archived from the original on 14 July 2006. Retrieved 2006-06-17.

- "Origins: Why Basel?". Bank of International Settlements. Archived from the original on 15 June 2006. Retrieved 2006-06-16.

- "About FINMA". Swiss Financial Market Supervisory Authority. Archived from the original on 2012-11-25. Retrieved 2009-09-04.

- "Swiss Banking Ombudsman". Swiss Banking Ombudsman. Archived from the original on 2006-07-20. Retrieved 2006-06-17.

- Enrich, David (January 6, 2018). "A Swiss Banker Helped Americans Dodge Taxes. Was It a Crime?". The New York Times. Retrieved May 20, 2018.

- Maurice, Aubert (1984). "The Limits of Swiss Banking Secrecy under Domestic and International Law". Berkeley Journal of International Law. 2 (2). doi:10.15779/Z38DW7X.

- Goetz, Lisa (June 7, 2016). "Why is Switzerland considered a tax haven?". Investopedia. Retrieved May 20, 2018.

- "Switzerland shares details of 3.1 million bank accounts held by foreigners".

- "Switzerland in the age of automatic exchange of banking information".

- "EFC-Swiss Federal Council refrains from making charitable foundations subject to the Automatic Exchange of Information (AEOI)".

- "Switzerland grants 18 more countries access to bank details".

- "Switzerland to adopt OECD standard on administrative assistance in fiscal matters". Federal Department of Finance. Archived from the original on 2009-03-16. Retrieved May 18, 2018.

- "UBS exec indicted in tax evasion scheme." The Recorder (2008). General Reference Center Gold. Web. 17 June 2010.

- "Switzerland remains biggest offshore wealth centre".

- https://www.swissinfo.ch/eng/perfect-storm_many-swiss-private-banks-facing--extinction-/45178358

- "View 2018 Results".

- "Figures on Switzerland as a location for financial services". Federal Department of Finance. 2009-12-31. Archived from the original on 2013-01-12. Retrieved 2010-05-20.

- "Supervision of large banking groups". Swiss Federal Banking Commission. Archived from the original on 2004-12-31. Retrieved 2006-06-17.

- "Les fonds américains rachètent la Suisse". Mary Varkadis (in French). 2015-12-09. Retrieved 2020-02-10.

- "History of UBS". Global topics. Retrieved May 18, 2018.

- "History of Credit Suisse". Credit Suisse. Retrieved May 18, 2018.

- "Company Profile" (PDF). Credit Suisse. Archived from the original (PDF) on 15 June 2006. Retrieved 2006-06-17.

- https://www.swissinfo.ch/eng/credit-suisse-told-to-tighten-money-laundering-compliance-by-us/46242718

- "The National Bank as a joint-stock company". Swiss National Bank. Archived from the original on August 8, 2002. Retrieved 2006-06-16.

- "Players". Swiss Bankers Association. Archived from the original on 2013-08-01. Retrieved 2006-06-17.

- "Archived copy". Archived from the original on 2012-07-24. Retrieved 2012-07-10.CS1 maint: archived copy as title (link)

- "unico.nl - unico Resources and Information". www.unico.nl. Retrieved 3 April 2018.

- "Raiffeisen bank breaks ranks over tax dispute". SWI Swissinfo.ch.

- "US tax scandal brings down Wegelin". SWI Swissinfo.ch.

- https://www.wsj.com/article/BT-CO-20120127-706462.html

- Noonan, Laura (December 10, 2017). "The decline of the Swiss private bank". Financial Times. Retrieved May 18, 2018.

- "Bank groups". Swiss Bankers Association. Archived from the original on 17 June 2006. Retrieved 2006-06-17.

- "ZKB Company Profile 2005" (PDF). Zürich Cantonal Bank. Archived from the original (PDF) on 2007-07-03. Retrieved 2006-06-17.

- Dupraz-Dobias, Paula (January 21, 2014). "Hollywood sticks with Swiss banker 'caricature'". SWI swissinfo.ch. Retrieved May 16, 2018.

- "Fancy yourself a numbered Swiss Bank account? Here's how you can get one". The Economic Times. October 30, 2014. Retrieved May 18, 2018.

- Haver, Gianni; Middleton, Robert (May 18, 2018). Swissness in a Nutshell. Schwabe AG. ISBN 9783905252644.

- Stephens, Thomas. "James Bond: half-Swiss, totally profitable". SWI swissinfo.ch. Retrieved May 18, 2018.

- Carvajal, Doreen (July 8, 2014). "Swiss Banks' Tradition of Secrecy Clashes With Quests Abroad for Disclosure". The New York Times. ISSN 0362-4331. Retrieved May 15, 2018.

- "Mr Lachaise's Swiss Bank | James Bond Locations". www.jamesbondmm.co.uk. Retrieved May 18, 2018.

- Emmenegger, Patrick (March 12, 2014). "The Politics of Financial Intransparency: The Case of Swiss Banking Secrecy". Swiss Political Science Review. 20 (1): 146–164. doi:10.1111/spsr.12092. ISSN 1424-7755.

- Broom, Giles (August 12, 2016). "Swiss Bank Secrets". Bloomberg.com. Retrieved May 16, 2018.

- Brown, Dan (November 18, 2003). The Da Vinci Code: Featuring Robert Langdon. Knopf Doubleday Publishing Group. pp. 181. ISBN 9780385504218.

- Kinsman, Robert. "Swiss Bank Account". Retrieved May 18, 2018.

In fact, mystery writers have utilized the Swiss Bank as the central focus of intrigue. Where else would one think to store the secrets of the holy grail but in a Swiss bank account, as was the case in the novel the "Da Vinci Code". But events in recent years have chipped away at this polished veneer to reveal some rather unseemly criminal behavior.

- Gumbel, Peter (2002-09-08). "Silence Is Golden". Time Magazine. Retrieved 2006-06-16.

Bibliography

- "Financial Secrecy Index: Narrative Report on Switzerland" (PDF). Financial Secrecy Index: 1–10. May 2018 – via Tax Justice Network.

- Guex, Sébastien (2000). "The Origins of the Swiss Banking Secrecy Law and Its Repercussions for Swiss Federal Policy" (PDF). Business History Review. 74 (2): 237–266. doi:10.2307/3116693. JSTOR 3116693.

- Mueller, Kurt (1969). "The Swiss Banking Secret: From a Legal View". International and Comparative Law Quarterly. 18 (2): 360–377. doi:10.1093/iclqaj/18.2.360. JSTOR 757529.

.svg.png.webp)