Australia and New Zealand Banking Group

The Australia and New Zealand Banking Group Limited, commonly called ANZ, is an Australian multinational banking and financial services company headquartered in Melbourne, Australia. It is the second largest bank by assets and third largest bank by market capitalisation in Australia.[2]

| |

| Type | Public |

|---|---|

| ASX: ANZ NZX: ANZ | |

| Industry | Banking Financial services |

| Predecessor | Bank of Australasia Union Bank of Australia |

| Founded | 1 October 1951 |

| Headquarters | 833 Collins Street Docklands, Melbourne, Australia |

Area served | Worldwide |

Key people |

|

| Products | Finance and insurance, consumer banking, corporate banking, private banking, Investment banking, investment management, global wealth management, private equity, mortgages, credit cards |

| Revenue | |

| Total assets | |

Number of employees | 37,588 (2019) [1] |

| Subsidiaries | |

| Website | www |

ANZ was established on 1 October 1951, when the Bank of Australasia merged with the Union Bank of Australia Limited.[3] It is one of the big four Australian banks, with the Commonwealth Bank, National Australia Bank (NAB) and Westpac.

Australian operations make up the largest part of ANZ's business, with commercial and retail banking dominating. ANZ is also the largest bank in New Zealand, where the legal entity became known as ANZ National Bank Limited in 2003 and changed to ANZ Bank New Zealand Limited in 2012. From 2003 to 2012, it operated two brands in New Zealand, ANZ and the National Bank of New Zealand. The National Bank brand was retired in 2012, with a number of branches closing and others converting to ANZ branches.[4] In addition to operations throughout Australia and New Zealand, ANZ also operates in 34 other countries.[5]

ANZ together with its subsidiaries has a workforce of 51,000 employees and serves around nine million customers worldwide. In Australia, the bank serves around six million customers at over 570 branches.[6]

History

19th century

The Bank of Australasia was founded in London in 1835. It combined with the Cornwall Bank, which was formed in Launceston, Van Diemens Land in 1828.[7] In 1837, Union Bank of Australia established in London by a group of people including George Fife Angas, a banker and slaveholder.[8][9][10] In 1852, The English, Scottish and Australian Bank (ES&A) established in London, and opened its first Australian branch in Sydney in 1853. The ES&A bank took over the Commercial Bank of Tasmania Limited and the London Bank of Australia Limited in 1921 and the Royal Bank of Australia Limited in 1927.

20th century

In 1951, the Bank of Australasia merged with Union Bank of Australia to form the Australia and New Zealand Bank Limited (ANZ Bank).[11] In 1963, the first computer systems established in new data processing centre in Melbourne, Australia. In 1966, ANZ began operations in Honiara, Solomon Islands. In 1968, ANZ opened an office in New York, USA. In 1969, ANZ established a representative office in Tokyo, Japan.

On 1 October 1970, ANZ merged with the English, Scottish and Australian Bank Limited to form the present organisation, Australia and New Zealand Banking Group Limited.[12] That same year, the bank began operating in Vanuatu. In 1976, ANZ (PNG) was established. In 1977, ANZ transferred its incorporation from the UK to Australia. In 1979, ANZ acquired the Bank of Adelaide.

In 1980, the Singapore and New York representative offices upgraded to branch status. In 1984, ANZ purchased Grindlays Bank.[13][14] In 1985, ANZ acquired Barclays’ operations in Fiji and Vanuatu. That same year, the bank received a full commercial banking licence and opened a branch in Frankfurt, Germany, and announced ANZ Singapore Limited. In 1988, ANZ opened branches in Rarotonga, Cook Islands and Paris, France. In 1989, ANZ purchased PostBank from New Zealand Government.[15]

During the 1990s, the Australia and New Zealand Banking Group acquired several banks. In 1990, this included National Mutual Royal Bank Limited in March[16] and the Town and Country Building Society in Western Australia in July.[17] That same year, ANZ purchased Lloyd Bank's operations in Papua New Guinea[18] and the Bank of New Zealand's operations in Fiji.[19]

In 1993, ANZ established new headquarters in Melbourne, Australia.[20] They also opened new branches in Hanoi, Vietnam,[21] and Shanghai, China,[22] and began a joint venture with PT Panin Bank in Indonesia.[23] That year they also began operating in Tonga[19] and sold their Canadian operations acquired via the purchase of Grindlays Bank in 1984 to HSBC Bank Canada.

Throughout the late 1990s, ANZ opened new branches in several locations, including Manila, Philippines,[24] and Ho Chi Minh City, Vietnam.[25] In 1997, John McFarlane was appointed Chief Executive Officer[26] and the bank opened its Beijing branch.[27] In 1999, ANZ formed a strategic alliance with E*Trade Australia for online share trading[28] and purchased Amerika Samoa Bank.[29]

21st century

In 2000, ANZ sold its Grindlays businesses in the Middle East and South Asia, and associated Grindlays Private Banking business to Standard Chartered.[30] In 2001, ANZ opened branches in Timor Leste[31] and began offering credit card services in Hong Kong.[32] In 2002, ANZ formed a joint venture with ING Group for wealth management and life insurance business in Australia and New Zealand.[33] The next year, ANZ acquired the National Bank of New Zealand.[34]

In 2005, ANZ established the ANZ Royal Bank in Cambodia, a joint venture with the Cambodian-based Royal Group company.[35][36] In 2006, ANZ announced a new world headquarters in the Melbourne Docklands[37] and invested in the Bank of Tianjin, China.[38] In 2007, ANZ acquired E*Trade Australia and Citizen Securities Bank in Guam.[39][40] Also in 2007, Mike Smith, formerly of HSBC, became CEO after the retirement of John McFarlane in October[41] and the company took over the naming rights sponsorship for Sydney's Stadium Australia.[42]

In August 2009, ANZ purchased the Royal Bank of Scotland's (RBS) operations in six Asian countries for $550 million.[43] In September the company announced it would buy out ING Group's 51% stake of the joint venture, giving ANZ 100% control of ING Australia.[43] In November, ANZ opened their new headquarters in Melbourne.

In 2010, ANZ acquired the RBS' interests in Hong Kong, Taiwan, Singapore and Indonesia.[44][45][46] That year ANZ also expanded its stake in the Bank of Tianjin.[38] In November, ING Australia was renamed OnePath.[47]

In 2012, ANZ announced the retirement of the National Bank brand in New Zealand.[4] In 2013, ANZ became the first bank to reopen in the Christchurch CBD following the 2011 earthquakes.[48]

In 2016, Shayne Elliott became CEO.[49] In April ANZ partnered with Apple Inc. to bring Apple Pay to its customers.[50][51] In 2017, ANZ acquired REALas property price predictor start-up.[52][53]

In 2018, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry heard that ANZ had failed to accurately verify the living expenses of home loan customers referred to the bank by mortgage brokers, believing that this was the responsibility of the brokers, in spite of a conflict of interest in doing so;[54]:465–469[55] and that, due to processing issues, it had charged nearly 500,000 home loan customers the incorrect interest rate for more than ten years, leading the bank to overcharge customers by approximately $90 million.[56][57][58]:662[59]:707

Organisational structure

- Australia

- Retail Products

- Retail Distribution

- Commercial Banking

- Wealth (including ETrade in Australia and OnePath)

- ANZ Bank New Zealand

- ANZ Bank

- UDC Finance

- Bonus Bonds

- Direct Broking – Share trading

- OnePath New Zealand

- Institutional Banking

- Institutional banking

- Corporate Finance

- Working Capital

- Corporate banking

- Economics@ANZ

- Asia and Pacific

- ANZ Amerika Samoa Bank

- ANZ Fiji

- ANZ Royal Bank

- International Partnerships

Asia-Pacific

ANZ is one of the leading Australian banks in the Asia-Pacific region. It has been aggressive in its expansion into the emerging markets of China, Vietnam and Indonesia. ANZ is also a leading bank in New Zealand as well as several Pacific Island Nations where it competes in many markets with fellow Australian bank Westpac. ANZ's arm in New Zealand is operated through a subsidiary company, ANZ National Bank, from 2003 to 2012, when it changed by ANZ Bank New Zealand upon merging the ANZ and National Bank brands.

In March 2005, it formed a strategic alliance with Vietnam's Sacombank involving an acquisition of 10% of Sacombank's share capital. As part of the strategic alliance, ANZ will provide technical assistance in the areas of risk management and retail and small business banking.

ANZ has followed a similar strategy in China, where it acquired a 20% share in Tianjin City Commercial Bank in July 2006. It also negotiated a similar deal with Shanghai Rural Commercial Bank.

In August 2009, ANZ purchased RBS's retail units in Taiwan, Singapore, Indonesia and Hong Kong, as well as RBS'si banking businesses in Taiwan, the Philippines and Vietnam. It was purchased for the price of A$687 million.

As of September 2012, the company had a total of 1,337 branches worldwide.[60]

In 2016, ANZ adopted less aggressive approach to expansion in the Asia-Pacific region after low returns.[61][62][63] At the end of October 2016 ANZ announced the sale of its Asian retail and wealth management operations to the Development Bank of Singapore; ANZ also signalled a withdrawal from its "Asian pivot".[64]

In 2020, as tensions between the US and China escalated, CEO Shayne Elliot acknowledged that the conflict had “raised the risk profile” of the bank's China investments, and said that the bank could further pull back from the country.[65]

Advertising and sponsorships

.jpg.webp)

In 2005, an advertisement included two famous robots: Lost in Space robot, and a Dalek from Doctor Who, although the Dalek was replaced in subsequent versions of the ad. In 2006, the company started a TV campaign with a series of ads featuring their new mascot – the Falcon, a bird trained to stop credit card thieves, illustrating the company's measures in prevention of credit card fraud. In 2010, ANZ ran an ad campaign parodying common banking scenarios with a fictional character known as 'Barbara who lives in Bank World', a middle-aged, rude, sarcastic and unhelpful bank manager. The adverts have received acclaim for wit and humour, but also criticism for stereotyping bank managers. Barbara is portrayed by Australian comedian Genevieve Morris.[66] In 2010, ANZ spent $195m in Australia on advertising.[67]

In 2011, a series of ads were fronted by Simon Baker, the star of the American television show The Mentalist. According to a 2014 top 20 list of advertising spends, ANZ was in the top 20.[68]

In 2015, ANZ held a campaign in sync with the Sydney Gay and Lesbian Mardi Gras.[69] In 2016, New Zealand ANZ had the highest spend of any bank.[67] One third of ANZ's spend on media is said to be digital.[70]

Global headquarters

In September 2006, plans were unveiled for ANZ's world headquarters to be located in Melbourne's Docklands precinct. The complex features a vast low rise office building, shops, car and bicycle parking facilities. The complex enables 6,500 ANZ staff to work in one integrated area. The building, located at 833 Collins Street, is the largest office complex in Australia at 84,500 square metres (910,000 sq ft) net lettable area, with 130,000 square metres (1,400,000 sq ft) gross floor area, and an accredited Six-Green Star Building. Construction commenced in late 2006 and the building opened in late 2009. Designed by HASSELL and Lend Lease Design, the building faces the Yarra River. In 2006, it was expected that it would cost A$478 million to build the new headquarters,[71] however costed A$750 million by the time it was complete in 2009.[72] The building was one of the winners at the 2010 World Architecture Festival in the category "Interiors and Fit Out of the Year".[73]

In 2016 ANZ announced that it would sell its former Melbourne global headquarters, located at the junction of 100 Queen Street, and 380 Collins Street, Melbourne, called Verdon Chambers and more commonly known as the Gothic Bank.[74] The former bank building was purpose built as the head office of the English, Scottish & Australian Bank (a predecessor of the current ANZ Banking Group).[74] The building was acquired in December 2016 by The GPT Group for A$275.4 million.[75]

Controversies

Manipulation of benchmark interest rates and other key metrics

In 2016, ANZ and 10 of its traders were named as being the subject of legal proceedings for manipulation of the benchmark inter-bank interest rates in Australia; specifically ASIC has made claims of unconscionable conduct and manipulation against ANZ.[76][77][78] ANZ has attempted to deny the claims and says it will defend the claim in court.[79] Formal filings of the originating process in this regards were made against ANZ on 4 March 2016.[80] Since that time ASIC has compounded their claim against the ANZ.[81] In a separate court appearance in November 2016 ANZ admitted to 10 instances of attempted cartel conduct regarding alleged manipulation of the Malaysian ringgit.[82] The wider market rigging case has been reported as likely lasting into 2018.[83]

Agriculture and child labour

ANZ has been the subject of claims that it has backed agriculture and timber companies that engage in so called 'land grabs'.[84][85] In 2014, ANZ faced allegations that it funded a Cambodian sugar plantation that has involved child labour, military-backed land grabs, forced evictions and food shortages.[86][87]

Litigious approach

ANZ has also been criticised in the Senate for its allegedly "hard boiled" approach to farmers exposed to the fallout from ANZ's purchase of the Landmark loan book.[88][89] One submission to the Senate inquiry into bank conduct mentioned one farmer self-immolating after alleged defaults occurring.[90] Another former customer in the Senate inquiry was mentioned as being subjected to victimisation by receivers and police, including use of SWAT teams and being held at gun-point.[90] In 2016 it was reported that ANZ was accused of racism in a high-profile court case involving the businessman Pankaj Oswal and his wife;[91] specifically it was reported that an email contained comments stating that, ""We are dealing with Indians with no moral compass and an Indian woman [the wife of Mr. Oswal], as every bit as devious as PO (Pankaj Oswal),” and "This has been a very Indian characteristic transaction."[91][92] The ANZ agreed to a settlement for an undisclosed amount in respect of the legal claim made by the Oswals.[93]

Culture

ANZ CEO Shayne Elliott admitted in 2016 that "culture" will be one of the biggest challenges for ANZ.[94] Media reports have included allegations of sexism, drug use and bravado culture.[95] In 2016, ANZ was pursued in court over its suggesting on social media that criticism of the bank's chief financial officer might have been sexist, which resulted in the broker at Bell Potter losing his job.[96][97] Former ANZ director John Dahlsen in 2016 admitted that there are issues with bank culture and competition.[98] In November 2016, there were further claims of sexist conduct and a separate lawsuit was filed against ANZ in the United States regarding staff at its New York office.[99][100]

Malaysian scandal

In early 2016, ANZ was also mentioned in a scandal in Malaysia involving one of ANZ's subsidiaries and the Malaysian leader.[101] The incident has raised questions for ANZ.[102] ANZ admitted in November 2016 that it had little ability to control its affiliate.[103]

Misleading file notes presented to Victorian Supreme Court

In 2016, there was an incident reported involving the Financial Ombudsman Service (Australia), where the Financial Ombudsman Service presented misleading file notes to the Supreme Court of Victoria, in the discovery phase of a case involving ANZ, to the benefit of ANZ's case.[104][105][106] The ANZ has not commented on the scandal as yet.

Out-sourcing of jobs

ANZ has continued to out-source jobs in countries other than Australia and this has caused some controversy with some outlets.[107] ANZ have been progressively increasing work output from offshore offices. ANZ's Bangalore office has been operational since 1989, making it one of the first organisations to employ IT staff based in India. ANZ employs around 4,800 staff in Bangalore, India.[108] 1500 IT positions, 2000 positions in Payments and Institutional Operations and International and High Value Services and 1300 positions in Operations Personal Banking have been shifted from Melbourne to India. In 2006, ANZ predicted that by 2010, over 2000 jobs would have been shifted from Australia to Bangalore.[109] In 2012, ANZ transferred 360 permanent staff from Melbourne and Bangalore to Capgemini. All these staff worked in the Technology Testing and Environment Space. As ANZ CIO Anne announced earlier that ANZ want a Hybrid model of technology in order to achieve the 2017 Technology roadmap.

Anti-competitive conduct

Despite the ANZ taking advantage of block-chain technology[110] the ANZ had blocked businesses making use of bitcoin. The ANZ was investigated by the Australian Competition and Consumer Commission and was cleared of colluding with other banks on the issue of bitcoin based business.[111] A number of prominent Senators have called the investigation into question and continue to criticise the conduct of ANZ and other large banks on this matter.

Panama Papers

ANZ was reported as appearing in 7,548 of the Mossack Fonseca documents in the Panama Papers, reflecting the bank's extensive work in New Zealand, the Cook Islands, Samoa and Jersey.[112]

Criminal cartel charges

On 1 June 2018, the Australian Competition and Consumer Commission (ACCC) announced that criminal cartel charges are expected to be laid by the Commonwealth Director of Public Prosecutions (CDPP) against ANZ Bank, its Group Treasurer Rick Moscati, along with Deutsche Bank, Citigroup and a number of individuals.[113][114] The charges concern a $2.5 billion ANZ capital raising that took place in August 2015.[115] In July 2020 committal proceedings were completed in the case,[116] which may last into 2022.[115]

Hayne Royal Commission

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, also known as the Hayne Royal Commission, was a Royal Commission established on 14 December 2017 by the Australian Government to inquire into and report on misconduct in the banking, superannuation, and financial services industry. The establishment of the commission followed revelations in the media of a culture of greed within several Australian financial institutions.[117] A subsequent parliamentary inquiry recommended a royal commission, noting the lack of regulatory intervention by the relevant government authorities,[118] and later revelations that financial institutions were involved in money laundering for drug syndicates, turned a blind eye to terrorism financing, and ignored statutory reporting responsibilities[119] and impropriety in foreign exchange trading.[120]

ANZ was also implicated in the bank bill swap rate scandal[121] and settled with ASIC prior to the commencement of legal proceedings.[122]

Defamation case

In July 2020 Bogac Ozdemir, a former employee of ANZ, filed a civil action against the bank at a New York court. Ozdemir claims that statements made by the bank about him were defamatory, and is seeking damages of US$20 million.[123]

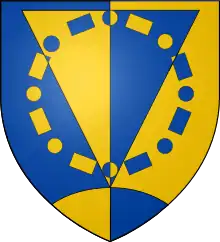

Coat of arms

|

|

See also

References

- "Annual Report 2019" (PDF). ANZ. 2019. Retrieved 30 August 2020.

- "ASX 200 List / Market Capitalisation Accurate on: 1 October 2017". ASX 200. Australian Securities Exchange. 26 October 2017. Retrieved 26 October 2017.

- "Faith in The Future". South Coast Times and Wollongong Argus. NSW: National Library of Australia. 8 February 1954. p. 23 Supplement: ROYAL VISIT SUPPLEMENT. Retrieved 12 July 2014.

- ANZ still finalising National Bank closures. 3 News NZ. 10 October 2013.

- "About ANZ". Australia and New Zealand Banking Group. Archived from the original on 1 February 2018. Retrieved 19 June 2017.

- "ANZ 180 Years". Australia and New Zealand Banking Group. Retrieved 3 November 2019.

- "Born Here". The Examiner (DAILY ed.). Launceston, Tas. 13 July 1935. p. 8. Retrieved 12 July 2014 – via National Library of Australia.

- Fernandes, C. Island Off the Coast of Asia: Instruments of statecraft in Australian foreign policy (Melbourne: Monash University Publishing, 2018), 13–14.

- "Prospectus of the Union Bank of Australia, About to be Established in Londone". The Sydney Monitor. 1 January 1838. p. 2. Retrieved 14 February 2016.

- "The New Bank". The True Colonist. 15 December 1837. p. 6. Retrieved 14 February 2016.

- "October first 1951 : Australia and New Zealand Bank Limited in which are merged the Bank of Australasia and the Union Bank of Australia Limited. – Version details – Trove". trove.nla.gov.au. Retrieved 14 February 2016.

- "1 October as merger date of ANZ and ES'A". The Canberra Times. 11 September 1970. p. 16. Retrieved 14 February 2016.

- "Shareholders approve takeover of Grindlays". The Canberra Times. 3 August 1984. p. 14. Retrieved 14 February 2016.

- "ANZ goes international". The Canberra Times. 20 June 1985. p. 20. Retrieved 14 February 2016.

- "Business and investment ANZ picks up NZ bank for $494m". The Canberra Times. 22 December 1988. p. 13. Retrieved 14 February 2016.

- "ANZ, NATIONAL MUTUAL CREATE $170BN GIANT". Australian Financial Review. 29 March 1990. Retrieved 11 May 2020.

- "ANZ UNIT'S HOME FOCUS". Australian Financial Review. 2 October 1991. Retrieved 11 May 2020.

- Oxford Business Group (17 September 2016). The Report: Papua New Guinea 2015. Oxford Business Group. p. 56. ISBN 978-1-910068-36-6.

- Mou, Freddy (17 December 2015). "ANZ celebrates 135 years in Fiji and the Pacific". Loop PNG. Retrieved 11 May 2020.

- "ANZ to sell its old Melbourne headquarters". Commercial Real Estate. 16 April 2019. Retrieved 11 May 2020.

- "ANZ Vietnam unifies operations". www.vneconomictimes.com. Retrieved 11 May 2020.

- Young, Victoria (22 November 2006). "ANZ buys into Chinese bank". Investor Daily.

- "UPDATE 1-Gunawan family to sell $1.4bln Bank Panin stake-sources". Reuters. 19 May 2010. Retrieved 11 May 2020.

- "ANZ opens Manila branch". Australian Financial Review. 3 October 1995. Retrieved 11 May 2020.

- Cornell, Andrew (18 March 1996). "ANZ plans a leading role in Vietnam". Australian Financial Review. Retrieved 11 May 2020.

- Ryan, Peter (23 January 2020). "Westpac picks John McFarlane as new chairman to deal with money laundering scandal". ABC News. Retrieved 21 February 2020.

- "CNN.com - ANZ quits bid for Thai bank stake - Jul. 25, 2003". CNN. Retrieved 11 May 2020.

- "ANZ makes takeover bid for E*Trade Australia". iTnews. Retrieved 11 May 2020.

- "FRB: Press Release – Approval of application of Australia & New Zealand Banking Group". Federal Reserve Board. 7 August 2000. Retrieved 17 November 2011.

- Treanor, Jill (28 April 2000). "Standard Chartered snaps up Grindlays". The Guardian. ISSN 0261-3077. Retrieved 11 May 2020.

- Mou, Freddy (17 December 2015). "ANZ celebrates 135 years in Fiji and the Pacific". Loop PNG. Retrieved 28 February 2020.

- "ANZ charges credit-card market with low entry at platinum level". South China Morning Post. 2 April 2001. Retrieved 11 May 2020.

- "ING To Sell Joint Venture To ANZ For Euro 1.1 Bln - Update". RTTNews. Retrieved 11 May 2020.

- "ANZ and ING expand joint venture to New Zealand". NZ Herald. 30 September 2005. ISSN 1170-0777. Retrieved 11 May 2020.

- Hunt, Luke. "ANZ Sees Further Restructuring of ASEAN Businesses". The Diplomat. Retrieved 11 May 2020.

- "ANZ to sell 55% stake in Cambodian bank to Japan's J Trust". S&P Global. Retrieved 11 May 2020.

- "ANZ to build Australia's biggest office building - ABC News". ABC News. 27 September 2006. Retrieved 11 May 2020.

- "ANZ invests A$126 million in Bank of Tianjin". Scoop. 15 November 2010. Retrieved 11 May 2020.

- "Archived copy" (PDF). Archived from the original (PDF) on 28 September 2007. Retrieved 30 August 2007.CS1 maint: archived copy as title (link)

- "ANZ acquires Guam bank for $A31.8m". The Sydney Morning Herald. 20 February 2007. Retrieved 11 May 2020.

- "ANZ Chairman announces successor to CEO". Australia and New Zealand Banking Group. 28 September 2011. Archived from the original on 28 September 2011. Retrieved 11 May 2020.

- Massoud, Josh (11 December 2007). "Telstra Stadium becomes ANZ". The Daily Telegraph. Retrieved 11 May 2020.

- Smith, Peter (25 September 2009). "ANZ to buy ING joint venture for $1.5bn". Financial Times. Retrieved 11 May 2020.

- "ANZ acquires RBS' Hong Kong businesses". 9News. 22 March 2010. Archived from the original on 5 June 2011. Retrieved 17 November 2011.

- "ANZ acquires RBS in Singapore". International Business Times. 17 May 2010. Archived from the original on 3 October 2011. Retrieved 17 November 2011.

- "ANZ completes RBS purchases in Indonesia". Financial Review. 14 June 2010.

- "ANZ rebrands ING as OnePath". The West Australian. 5 August 2010. Retrieved 11 May 2020.

- ANZ opens in Christchurch rebuild zone. 3 News NZ. 10 October 2013.

- "ANZ Management Board | ANZ Shareholder Centre". www.shareholder.anz.com. Archived from the original on 3 October 2014. Retrieved 21 January 2016.

- "Apple, ANZ Bank strike deal to bring Apple Pay to Australia". Reuters. 27 April 2016. Retrieved 28 April 2016.

- "Apple Pay – Apple (AU)". Apple (AU). Retrieved 28 April 2016.

- "ANZ makes push into real estate tech, buying property start-up REALas". Financial Review. 3 October 2017. Retrieved 10 November 2017.

- "REALas: could this be Australia's most accurate real estate price predictor? | Canstar". Canstar. 31 October 2017. Retrieved 10 November 2017.

- "Transcript of Proceedings: Day 8" (transcript). Auscript Australia Pty Limited. Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. 19 March 2018. Retrieved 23 April 2018.

- Hutchens, Gareth (19 March 2018). "ANZ admits not checking key details of loan applications made via brokers". Guardian Australia. Retrieved 23 April 2018.

- Frost, James (21 March 2018). "Hayne Royal Commission: Banking royal commission: ANZ is still charging the wrong interest rate". Financial Review. Retrieved 23 April 2018.

- Lannin, Sue (21 March 2018). "Banking royal commission: ANZ says 'processing errors' to blame for it overcharging customers by $90 million". ABC News. Australia. Retrieved 23 April 2018.

- "Transcript of Proceedings: Day 9" (transcript). Auscript Australia Pty Limited. Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. 20 March 2018. Retrieved 23 April 2018.

- "Transcript of Proceedings: Day 10" (transcript). Auscript Australia Pty Limited. Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. 21 March 2018. Retrieved 23 April 2018.

- "Company Profile for Australia and New Zealand Banking Group Ltd". reuters.com.

- "ANZ's Asian super regional strategy gets remake". Financial Review. Retrieved 15 February 2016.

- "ANZ pulling back from Asia expansion – The Rakyat Post". The Rakyat Post. Retrieved 15 February 2016.

- "ANZ's Shayne Elliott talks about shrinking the empire". Financial Review. Retrieved 15 February 2016.

- "ANZ sells Asian retail and wealth operations to DBS".

- "ANZ boss says the deteriorating Australia—China relationship is 'concerning'". 3AW. 25 May 2020. Retrieved 22 September 2020.

- "ANZ 'Barbara lives in Bank World' campaign launches this weekend via M&C Saatchi". Campaign Brief. 19 January 2010. Retrieved 17 November 2011.

- "ANZ leads bank advertising spending lower as only three banks spend more on ads in 2015 than in 2014". interest.co.nz. Retrieved 13 February 2016.

- "Ad spending tipped to remain steady". The Sydney Morning Herald. Retrieved 15 February 2016.

- "ANZ creates 'Only GAYTM in the Village' as it rekindles Sydney Mardi Gras sponsorship – mUmBRELLA". mUmBRELLA. Retrieved 13 February 2016.

- "The four pillars of marketing: How ANZ Bank goes big in digital". Econsultancy. Retrieved 13 February 2016.

- Draper, Michelle (17 July 2007). "Lend Lease tipped for $100m Myer Docklands HQ". Brisbane Times. Retrieved 17 November 2011.

- Engelen, John (8 March 2010). "ANZ Centre – Corporate HQ Docklands, Melbourne". Dedece Blog. Retrieved 17 November 2011.

- World Architecture Festival: ANZ Centre Archived 1 November 2013 at the Wayback Machine, retrieved 18 November 2010

- "ANZ to Sell its Old Melbourne Headquarters".

- "Sales analysis: ANZ Tower, 100 Queen Street/380 Collins Street, Melbourne" (PDF). Urbis. December 2016. Retrieved 1 January 2021.

- "ASIC ready to launch rate-rigging case against ANZ". Financial Review. Retrieved 13 February 2016.

- Commission, c=au;o=Australian Government;ou=Australian Government Australian Securities and Investments. "15-060MR ASIC commences civil penalty proceedings against ANZ for BBSW conduct". asic.gov.au. Retrieved 4 March 2016.

- "anz traders joked about rigging headline interest rate".

- "ASIC files civil rate rigging case against ANZ". The Sydney Morning Herald. Retrieved 4 March 2016.

- http://download.asic.gov.au/media/3563864/originating-process-asicvanz.pdf

- "ASIC Lobs New Rate Rigging Salvo at ANZ".

- "Bank rate rigging spreads as ANZ, Macquarie hauled into court over Malaysian ringgit cartel".

- "ANZ rate Rigging Case Could Drag into 2018".

- "Australian Banks and Land Grabs | Oxfam Australia". Oxfam Australia. Retrieved 15 February 2016.

- "ResourceSpace". resources.oxfam.org.au. Retrieved 15 February 2016.

- "ANZ ethics under scrutiny over Cambodian sugar plantation loan". The Sydney Morning Herald. Retrieved 15 February 2016.

- "ANZ faces accusations it financed business that forced villagers from land". Retrieved 15 February 2016.

- Gluyas, Richard (16 February 2016). "The Australian". Barrister Peter King calls for royal commission into provision of finance. Retrieved 16 February 2016.

- "Calls for Royal Commission into bank treatment of farmers". The Sydney Morning Herald. Retrieved 16 February 2016.

- "Parliamentary inquiry hears claims that farmers felt 'victimised' in loans affair". ABC Rural. Retrieved 16 February 2016.

- "Claims of Racism Surface in Oswals 15B ANZ Legal Battle".

- "ANZ Accused of Racial Bigotry Towards Indian Billionaires".

- "ANZ Settles High-profile Legal Dispute with Oswals".

- "ANZ boss Shayne Elliott draws up plan to fix toxic culture". Financial Review. 18 January 2016. Retrieved 21 June 2016.

- "ANZ women surely had little choice but to play along". The Sydney Morning Herald. Retrieved 21 June 2016.

- "ANZ set to apologise to broker Angus Aitken over sexism claims".

- "Bell Potter ANZ and Etrade Sale the Aitken Tale Gets Curiouser".

- "Ex-ANZ director John Dahlsen says bank culture, competition still need repair".

- "Sex Clubs, Racial Insults Inside ANZ's New York Office".

- "ANZ Hit with Sexually Aggressive Claims Against Managers".

- "ANZ grilled over Malay corruption scandal". The Sydney Morning Herald. Retrieved 4 April 2016.

- Media, WorkDay. "Malaysian corruption scandal deepens, raises more questions for ANZ". www.bankingday.com. Retrieved 4 June 2016.

- "ANZ Bank admits inability to control its Malaysian affiliate".

- "Calls for Financial Ombudsman Service to be disbanded over credibility issues". ABC News. Retrieved 17 March 2016.

- "The questions the Financial Ombudsman needs to answer". ABC News. Retrieved 2 April 2016.

- Media, WorkDay. "Australian Banking and Finance News from Banking Day". www.bankingday.com. Retrieved 7 April 2016.

- "ANZ Bank Slashes Hundreds of Jobs".

- "ANZ – KEEP OUR JOBS HERE!". Finance Sector Union. 28 November 2006. Archived from the original on 27 September 2011. Retrieved 17 November 2011.

- Financial Services Union of Australia, 2006. Bank Check, Spotlight on the ANZ Bank Archived 17 November 2007 at the Wayback Machine, retrieved 8 December 2009.

- "ANZ Bank Joins Tech Giants Creating Blockchain Hyperledger".

- "ACCC Clears Banks".

- "The Panama Papers: ANZ was the leading Australian bank in Mossack's universe".

- "Correction: Criminal cartel charges to be laid against ANZ". ACCC. 1 June 2018. Retrieved 5 August 2018.

- "Update: Criminal cartel charges to be laid against Citigroup". ACCC. 1 June 2018. Retrieved 4 August 2018.

- "Investment bankers back in the spotlight as cartel case resumes". Australian Financial Review. 1 July 2020. Retrieved 2 September 2020.

- "ACCC's 'criminal cartel six' to be split up before trial". Australian Financial Review. 24 July 2020. Retrieved 2 September 2020.

- Ferguson, Adele (5 May 2014). "Banking Bad" (transcript). Four Corners. Australian Broadcasting Corporation. Retrieved 1 March 2018.

- McGrath, Pat; Janda, Michael (27 June 2014). "Senate inquiry demands royal commission into Commonwealth Bank, ASIC". ABC News. Australia. Retrieved 1 March 2018.

- Verrender, Ian (7 August 2017). "How the Commonwealth Bank laid the groundwork for a royal commission". ABC News. Australia. Retrieved 1 March 2018.

- Frost, James; Eyers, James (21 December 2016). "CBA and NAB admit impropriety in foreign exchange trading". The Age. Melbourne. Retrieved 1 March 2018.

- Dankert, Sarah (30 October 2017). "Westpac to fight ASIC allegations after ANZ, NAB settle rate-rigging case". The Sydney Morning Herald. Retrieved 3 March 2018.

- Chau, David (23 October 2017). "ANZ settles interest rate rigging case just before trial begins". ABC News. Australia. Retrieved 1 March 2018.

- "ANZ Trader Sues for Defamation Over Social Media Rebuke, Seeking $20 Million". Bloomberg.com. 21 July 2020. Retrieved 9 September 2020.

- New Zealand Armorist, 76, 2000, p. 19

External links

| Wikimedia Commons has media related to Australia and New Zealand Banking Group. |