Gwadar Port

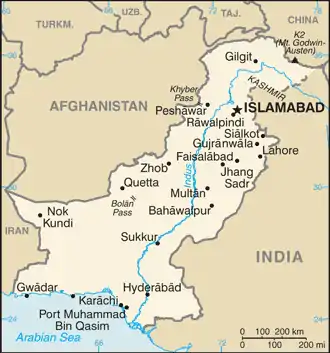

The Gwadar Port (Urdu: گوادر بندرگاہ ); IPA: gʷɑːd̪əɾ bənd̪əɾgɑː) or Gwadar Port Authority (Urdu: مقتدرہ گوادر بندرگاہ ) is the deepest sea port in the world, situated on the Arabian Sea at Gwadar in Balochistan province of Pakistan and is under the administrative control of the Maritime Secretary of Pakistan and operational control of the China Overseas Port Holding Company.[2] The port features prominently in the China–Pakistan Economic Corridor (CPEC) plan, and is considered to be a link between the Belt and Road Initiative and the Maritime Silk Road projects.[3] It is about 120 kilometres (75 mi) southwest of Turbat, and 170 kilometres (110 mi) to the east of Chabahar Port in Iran's Sistan and Balochistan Province.[4]

| Gwadar Port | |

|---|---|

| |

| Location | |

| Location | Gwadar, Balochistan, |

| Coordinates | 25.1105°N 62.3396°E |

| UN/LOCODE | PK GWD[1] |

| Details | |

| Built | Phase I: (2002-2006) 12.5 meters (41 feet) max draft (hull) of channels Phase II: (2007–2029) 20.5 m (67 ft) max draft of channels Phase III: (2030–2045) 24.5 m (80 ft) max draft of channels |

| Operated by | |

| Size | 2,292 Acre Free Trade Area |

| Available berths | Current: 3 in 2018 Phase I: 3 by 2006 Phase II: 75 by 2029 Phase III: 150 by 2045 |

| Type of ships | Phase I (Current): Bulk carriers of 30,000 Deadweight tonnage (DWT), and container Panamax vessels of 52,000 (DWT) Phase II (Proposed): 200,000 (DWT) Neopanamax vessels Phase III (Proposed): 400,000+ (DWT) Chinamax (Valemax) vessels, and TI-class supertanker |

| Rail lines | Khunjerab Railway (Proposed) |

| Rail gauge | 5 ft 6 in gauge railway (1676 mm) (Proposed) |

| Truck types | Tank truck Karakoram Highway (OBOR) (CPEC) |

| Statistics | |

| Annual TEU | Current (2018): Total capacity of 30 million (tonnes) of cargo per year Phase I: 11 million (tonnes) of cargo per year Phase II: 200 million (tonnes) of cargo per year Phase III: 400 million (tonnes) of cargo per year |

| Website cophcgwadar | |

Gwadar's potential to be a deep water sea port was first noted in 1954, while the city was still under Omani sovereignty.[5] Plans for construction of the port were not realised until 2007, when the port was inaugurated by Parvez Musharraf after four years of construction, at a cost of $248 million.[6]

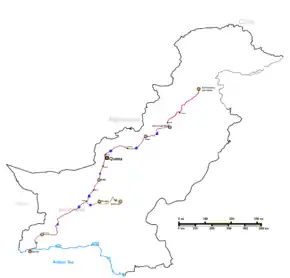

In 2015, it was announced that the city and port would be further developed under CPEC at a cost of $1.62 billion,[7] with the aim of linking northern Pakistan and western China to the deep water seaport.[8] The port will also be the site of a floating liquefied natural gas facility that will be built as part of the larger $2.5 billion Gwadar-Nawabshah segment of the Iran–Pakistan gas pipeline project.[9] Construction began in June 2016 on the Gwadar Special Economic Zone, which is being built on 2,292-acre site adjacent to Gwadar's port.[10] In late 2015, the port was officially leased to China for 43 years, until 2059.[11]

Gwadar Port became formally operational on 14 November 2016, when it was inaugurated by Pakistan's Prime Minister Muhammad Nawaz Sharif; the first convoy was seen off by the then Pakistan's Chief of Army Staff, General Raheel Sharif.[12] On 14 January 2020, Pakistan operationalized Gwadar Port for Afghan transit trade.[13]

Location

.PNG.webp)

Gwadar Port is situated on the shores of the Arabian Sea in the city of Gwadar, located in the Pakistani province of Balochistan. The port is located 533 km from Pakistan's largest city, Karachi, and is approximately 120 km from the Iranian border. It is located 380 km (240 mi) away from Oman, and near key oil shipping lanes from the Persian Gulf. The greater surrounding region is home to around two-thirds of the world's proven oil reserves. It is also the nearest warm-water seaport to the landlocked, but hydrocarbon rich, Central Asian Republics, as well as Afghanistan.[14]

The port is situated on a rocky outcropping in the Arabian sea that forms part of a natural hammerhead-shaped peninsula protruding out from the Pakistani coastline.[15] The peninsula, known as the Gwadar Promentory, consists of rocky outcropping reaching an altitude of 560 feet with a width of 2.5 miles that are connected to the Pakistani shore by a narrow and sandy 12 kilometre long isthmus.[16] The isthmus separates the shallow Padi Zirr bay to the west, from the deep water Demi Zirr harbour in the east.

Background

Pakistan identified Gwadar as a port site as far back as 1954 when Gwadar was still under Omani rule.[17] Pakistan's interest in Gwadar started when, in 1954, it engaged the United States Geological Survey (USGS) to conduct a survey of its coastline. The USGS deputed the surveyor, Worth Condrick, for the survey, who identified Gwadar as a suitable site for a seaport.[17] After four years of negotiations, Pakistan purchased the Gwadar enclave from Oman for US$3 million on 8 September 1958 and Gwadar officially became part of Pakistan on 8 December 1958, after 200 years of Omani rule.[17]

A small wharf at Gwadar was completed in 1992, and formal proposals for a deep sea port at Gwadar were unveiled a year later in 1993.[18] The federal government approved the construction of the port in December 1995 but the project could not get started because of shortage of funds. In 1997, a government-appointed task force identified Gwadar as one of the focus area of development, but the project did not launch due to economic sanctions imposed against Pakistan following its nuclear tests in May 1998.[17] Construction on Phase 1 of the project began in 2002 after the agreement for its construction was signed during the state visit of Chinese Premier Zhu Rongji in 2001.[19] After completion of Phase 1 in 2007, the first commercial cargo vessel to dock at the port was the "Pos Glory," with 70,000 Metric Tonnes of Wheat on 15 March 2008.[20]

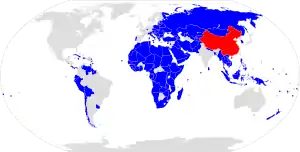

The port is part of the 21st Century Maritime Silk Road that runs from the Chinese coast through the Strait of Malacca, to Mombasa, from there via the Suez Canal to the Mediterranean, there to the Upper Adriatic region with its rail connections to Central Europe and the North Sea.[21][22][23][24]

Construction

Gwadar Port is being developed in two phases: Phase I covered building of three multipurpose berths and related port infrastructure and port handling equipment, and was completed in December 2006, but inaugurated on 20 March 2007.[25]

Phase I (2002–2006)

The first phase of construction at Gwadar Port began in 2002, and was completed in 2006, before inauguration in 2007.[26]

- Berths: 3 Multipurpose Berths

- Length of Berths: 602 m in total

- Approach Channel: 4.5 km long dredged to 12.5 m depth and max draft (hull) of channel.(capacity: bulk carriers of 30,000 deadweight tonnage [DWT] and container vessels of 25,000 DWT)[27]

- Turning basin: 450 m diameter

- Service Berth: One 100 m Service Berth

- Related port infrastructure and handling equipment, pilot boats, tugs, survey vessels, etc.

- Built at a cost of $248 million.[6]

Phase II

The second phase of construction is currently underway as part of planned improvements under CPEC and other ancillary projects. The total project is expected to cost $1.02 billion.[28] In Sep 2018, the Pakistan Senate expressed concern at slow rate of progress of most projects of Phase II at Gwadar as construction had not started for most projects.[29]

Ongoing:

- Approach Channel: To be dredged to 14.5 m depth and max draft (hull) of channel

- 6 lane East Bay Expressway to connect the port to the Makran Coastal Highway

- New international airport to be built in vicinity of the port

- Desalination plant

- 300 megawatt coal-fired power plant

Planned:

- 4 Container Berths along 3.2 kilometres of shoreline

- 1 Bulk Cargo Terminal (capacity: 100,000 DWT ships)

- 1 Grain Terminal

- 1 Ro-Ro Terminal

- 2 oil terminals (capacity: 200,000 DWT ships each)

- Floating liquefied natural gas terminal with capacity of 500 million cubic feet of gas per day

- 2,292-acre special economic zone to be developed adjacent to port

Longer term plans

- Dredging of approach channel to depth of 20 meters

- 100 berths to be built by 2045[27]

- Capacity to handle 400 million tons of cargo per year

Expansion under CPEC

Under the China-Pakistan Economic Corridor plan, the state-owned China Overseas Port Holding Company (COPHC) will expand Gwadar Port with construction of nine new multipurpose berths on 3.2 kilometres of seafront to the east of the existing multipurpose berths.[30] COPHC will also build cargo terminals in the 12 kilometres of land to the north and northwest of the site along the shoreline of the Demi Zirr bay.[30]

In total, COPHC has awarded $1.02 billion worth of contracts for expansion of the port.[28] In addition to construction of nine berths and cargo terminals, plans for expanded port infrastructure also include several projects that will be financed by loans extended by Chinese state owned banks. The Gwadar Port dredging project will deepen approach channels to a depth of 14 meters from the current 11.5-meter depth, at a cost of $27 million.[31] Dredging will enable docking of larger ships with a deadweight tonnage of up to 70,000 at Gwadar Port,[8] while current capacity permits a maximum 20,000 DWT.[32] Future plans call for dredging of the harbour to a depth of 20 meters to allow for docking of larger vessels.[33] Also included as part of the CPEC infrastructure development package for port infrastructure is a $130 million breakwater around the port.[34]

Ancillary infrastructure projects for the port will also be built as part of CPEC. A $114 million desalination plant will be developed to provide potable water to the city, while the Government of Pakistan will also contribute $35 million towards infrastructure projects in the Gwadar Special Economic Zone.[35][36] A 19 kilometre-long dual carriageway known as the Gwadar East Bay Expressway will also be built at a cost of $140 million to connect Gwadar Port to the existing Makran Coastal Highway and the planned $230 million Gwadar International Airport.[37]

A floating liquefied natural gas facility that will have a capacity of 500 million cubic feet of liquified natural gas per day will also be built at the port as part of the $2.5 billion Gwadar-Nawabshah segment of the Iran–Pakistan gas pipeline,[9] which is being built as a joint venture between Pakistan's Inter State Gas System, and the China National Petroleum Corporation.[38] The Pakistani government also intends to establish a training institute named Pak-China Technical and Vocational Institute at Gwadar which is to be completed at the cost of 943 million rupees to impart skills to local residents to train them to operate machinery at the port.[39]

It was expected that by 2017, the port will handle over one million tons of cargo,[40] most of which will consist of construction materials for other CPEC projects.[41] However, the project has faced multiple challenges. The Pakistan government has curbed expansion of mega project due to mounting debt on country's exchequer. The Covid19 pandemic has further impacted the work on the project.[42] COPHC plans to eventually expand the port's capacity to 400 million tons of cargo per year.[43] Long terms plans for Gwadar Port call for a total of 100 berths to be built by 2045.[44]

In Sep 2018 the Ministry of Maritime of Pakistan submitted a report in Senate that during the last five years, 99 ships loaded with cargo from seven different countries anchored at Gwadar Port. The weight of shipments was 1.439 million tons.[45]

Financing

The government of China in August 2015 announced that the previously announced concessionary loans for several projects in Gwadar totalling $757 million would be converted 0% interest loans for which Pakistan will only be required to repay the principal value.[34] The projects which are now to financed by the 0% interest loans include: the construction of the $140 million East Bay Expressway project, installation of breakwaters in Gwadar which will cost $130 million, a $360 million coal power plant in Gwadar, a $27 million project to dredge berths in Gwadar harbour, and a $100 million 300-bed hospital in Gwadar.[34]

In September 2015, the government of China also announced that the $230 million Gwadar International Airport project would no longer be financed by loans, but would instead be constructed by grants which the government of Pakistan will not be required to repay.[46]

Gwadar Special Economic Zone

The expanded port will be located near a 2,282-acre free trade area in Gwadar which is being modelled on the lines of the Special Economic Zones of China.[47] The swathe of land was handed to the China Overseas Port Holding Company in November 2015 as part of a 43-year lease,[48] while construction of the project began on 20 June 2016.[49] The special economic zone is expected to employ approximately 40,000 people,[50] with possibility for future expansion.[51]

The special economic zone will include manufacturing zones, logistics hubs, warehouses, and display centres.[52] Business established in the special economic zone will be exempt from Pakistani income, sales, and federal excise taxes for 23 years.[53] Contractors and subcontractors associated with China Overseas Port Holding Company will be exempt from such taxes for 20 years,[54] while a 40-year tax holiday will be granted for imports of equipment, materials, plants, machinery, appliances and accessories that are to be for construction of Gwadar Port and special economic zone.[55]

The special economic zone will be completed in three phases. By 2025, it is envisaged that manufacturing and processing industries will be developed, while further expansion of the zone is intended to be complete by 2030.[39] On 10 April 2016, talking to The Washington Post, Zhang Baozhong, chairman of China Overseas Port Holding Company said that his company could spend a total of $4.5 billion on roads, power, hotels and other infrastructure for the industrial zone, which he said would be open to non-Chinese companies. The company also plans to build an international airport and power plant for Gwadar.[56]

Saudi Arabia has promised to build US$10 billion oil refinery at Gwadar Port in 2019.[57][58]

Operations

Gwadar Port is owned by the government-owned Gwadar Port Authority[59] and operated by China Overseas Port Holding Company (COPHC), a state-run Chinese firm.[60] Prior to COPHC, the port was operated by the Port of Singapore Authority.

Port of Singapore Authority (2007–2013)

Following the completion of Phase I, the Government of Pakistan in February 2007 signed a 40-year agreement with PSA International for development and operation of the port, and an adjacent 584-acre special economic zone.[61] PSA International was the highest bidder for the Gwadar Port, after its competitor DP World withdrew from the bidding process.[62] PSA was granted a wide range of tax concessions, including exemption from corporate tax for 20 years, land for a special economic zone, duty-free imports of materials and equipment for construction and operations of the port, and duty-free shipping and bunker oil for 40 years. In addition to these incentives, the provincial government of Balochistan was also asked to exempt PSA International from the levy of provincial and district taxes. According to the agreement with PSA, the Government of Pakistan was to get a fixed 9% share of the revenue from cargo and maritime services, in addition to 15% of revenues earned from the adjacent special economic zone.

In September 2011, The Wall Street Journal reported that Gwadar was being underused as commercial port, and that Pakistan had asked the Chinese government to assume operations of the port.[63] PSA also reportedly sought to withdraw from its contract with the Pakistani Government, and expressed willingness to sell its share in the project to a Chinese firm after the Pakistani Navy failed to transfer land required for development of the planned 584-acre free trade zone.[61] PSA also did not invest the agreed $550 million into the port, on account of the poor security situation in Balochistan in the period between 2007 and 2013.[61] The government of Pakistan also failed to invest in requisite infrastructure works.[64] The Supreme Court of Pakistan further issued a stay order against the allotment of land to PSA on account of a public petition.[61]

China Overseas Port Holding Company (2013–present)

On 18 February 2013, Pakistan awarded a contract for construction and operation of Gwadar Port to a Chinese state-owned enterprise. As per details of the contract, the port would remain as property of Pakistan, but would be operated by the state-run Chinese firm – China Overseas Port Holding Company (COPHC).[65] The contract signing ceremony was held on 18 February 2013 in Islamabad, and was attended by Pakistani President Asif Ali Zardari, Chinese Ambassador Liu Jian, as well as various federal ministers and members of parliament, as well as senior government officials.[65] The ceremony was also marked the transfer of the concession agreement from the PSA to the COPHC.[65]

As per this agreement, 91% of the revenue generated by Gwadar Port will go to COPHC and 9% to Gwadar Port Authority.[66] In March 2019, the Pakistani Senate was informed that during last three years, total gross revenue of Rs 358.151 million had been generated from Gwadar Port, out of which the share going to Gwadar Port Authority was Rs 32.324 million.[67]

Geopolitical impact

Gwadar Port as a means to circumvent the Straits of Malacca

The Straits of Malacca provide China with its shortest maritime access to Europe, Africa, and the Middle East.[68] Approximately 80% of its Middle Eastern and African energy imports also pass through the Straits of Malacca.[69] As the world's biggest oil importer,[70] energy security is a key concern for China while current sea routes used to import Middle Eastern and African oil are frequently patrolled by the United States Navy.[71] The sea-route via the Straits of Malacca is roughly 12,000 kilometres (7,500 mi), while the distance from Gwadar Port to Xinjiang province is approximately 3,000 kilometres (1,900 mi), and another 3,500 kilometres (2,200 mi) from Xinjiang to China's eastern coast.[69] However, the cost of moving oil overland is far greater. An oil pipeline from Gwadar to China's population centers (not yet built), will cost up to $8/barrel, while the cost of shipping oil from the Persian Gulf to China is $2–3/barrel.[72]

In the event that China were to face hostile actions from a state or non-state actor, energy imports through the Straits of Malacca could be halted, which in turn would paralyse the Chinese economy in a scenario that is frequently referred to as the "Malacca Dilemma".[69] In addition to vulnerabilities it faces in the Straits of Malacca region, China is heavily dependent upon sea-routes that pass through the South China Sea, near the disputed Spratly Islands and Paracel Islands, which are currently a source of tension between China, Taiwan, Vietnam, the Philippines, and the United States.[73][note 1] The CPEC project will allow Chinese energy imports to circumvent these contentious areas.[74] The Sino-Myanmar pipelines have also been constructed by China to address this so-called "Malacca Dilemma".[75]

In addition to China's potential weaknesses against the U.S. Navy, potential vulnerabilities could stem from a decline in China–India relations. The Indian Navy has recently increased maritime surveillance of the Straits of Malacca region from its base on Great Nicobar Island.[76] India has expressed fears of a Chinese "String of Pearls" encircling it.[77][78] Were conflict to erupt, India could potentially impede Chinese imports through the straits.[79] Indian maritime surveillance in the Andaman Sea could possibly enhance Chinese interest in Pakistan's Gwadar Port. The Kyaukpyu Port, which is currently being developed in Myanmar by the Chinese government as another alternate route around the Straits of Malacca, will likely be vulnerable to similar advances by the Indian Navy. The proposed Bangladesh-China-India-Myanmar Corridor (BCIM) would also be vulnerable to Indian advances against China in the event of conflict, thereby potentially limiting the BCIM Corridor's usefulness to China's energy security, and thereby increasing Chinese interest in CPEC.

Improved access to western China

Planned investments in Gwadar Port as part of CPEC will improve connectivity to the restive Xinjiang Uyghur Autonomous Region, thereby increasing the region's potential to attract public and private investment.[68] The CPEC is considered central to China–Pakistan relations; its central importance is reflected by China's inclusion of the project as part of its 13th five-year development plan.[81][82] The Gwadar Port project will also complement China's Western Development plan, which includes not only Xinjiang, but also the neighbouring regions of Tibet and Qinghai.[83]

In addition to its significance to reduce Chinese dependence on the Sea of Malacca and South China Sea routes, the port of Gwadar will provide China an alternative and shorter route for energy imports from the Middle East, thereby reducing shipping costs and transit times. The currently available sea-route to China is roughly 12,000 kilometres (7,500 mi), while the distance from Gwadar Port to Xinjiang province is approximately 3,000 kilometres (1,900 mi), and another 3,500 kilometres (2,200 mi) from Xinjiang to China's eastern coast.[69] As a result of the CPEC, Chinese imports and exports to the Middle East, Africa, and Europe would require much shorter shipment times and distances.

A new transit hub for the Central Asian Republics

Upon completion of CPEC-related infrastructure projects, transit times between Kashgar, China and Pakistan's Gwadar Port will be greatly reduced. This will in turn will also reduce transit times to the Kyrgyzstan and hydrocarbon-rich Kazakhstan through already existing overland routes. The Chinese government has already upgraded the road linking Kashgar to Osh, Kyrgyzstan via the Kyrgyz town of Erkeshtam while a railway between Ürümqi, China and Almaty, Kazakhstan has also been completed as part of China's One Belt One Road initiative.[84] Numerous land crossings already exist between Kazakhstan and China as well. Additionally, the Chinese government has announced plans to lay railway track from Tashkent, Uzbekistan towards Kyrgyzstan with onwards connections to China and Pakistan's coast.[85]

The heads of various Central Asian republics have expressed their desire to connect their infrastructure networks to the CPEC project and Gwadar Port via China. During the August 2015 visit of Pakistani Prime Minister Nawaz Sharif to Kazakhstan, the Kazakh Prime Minister Karim Massimov, conveyed Kazakhstan's desire to link its road network to the CPEC project, which will also provide Kazakhstan with access to the port.[86]

During the November 2015 visit of Tajikistan's President Emomali Rahmon to Pakistan, the Tajik premier also expressed his government's desire to join the Quadrilateral Agreement on Traffic in Transit to use CPEC and Gwadar Port as a conduit for imports and exports to Tajikistan by circumventing Afghanistan.[87] The request received political backing by the Pakistani Prime Minister.[87] The Pamir Highway in Central Asia already provides Tajikistan access to Kashgar via the Kulma Pass. These crossings complement the CPEC project to provide Central Asian states access to Pakistan's seaports in Gwadar and Karachi by completely bypassing Afghanistan – a country which has been ravaged by civil war and political instability since the late 1970s.

Comparison to Chabahar Port projects

In May 2016, Indian Prime Minister Narendra Modi and his Iranian counterpart President Hassan Rouhani signed a series of twelve agreements in Tehran in a boon to India–Iran relations. By these agreements, India Ports Global Pvt. Limited will refurbish a 640-meter long container handling facility, and reconstruct a 600-meter long berth at the Port of Chabahar,[88] as well as modernise ancillary infrastructure at the berths.[89] Improvements at the port are intended to allow Indian goods to be exported to Iran, with the possibility of onward connections to Afghanistan and Central Asia.[90] A section of the Indian media described it as "a counter to the China-Pakistan Economic Corridor,"[91] although the total monetary value of projects has been noted to be significantly less than that of US$46 billion CPEC project, evaluated at worth about $500 million.[92]

Indian financial commitments in Chabahar

As part of the twelve memoranda of understanding signed by Indian and Iranian delegations as per text released by India's Ministry of External Affairs, India Ports Global signed a contract with Iran's Arya Banader to refurbish and reconstruct two existing berths at the port,[93] at a cost of $85 million[94] over the course of 18 months.[95] The berth project represents the only direct investment in port infrastructure mentioned in the May 2016 agreements.[96][97] Chabahar was developed in 1972 as the oceanic port in Iran, and already features ten berths as of 2016,[98] with a capacity to dock vessels of 80,000 deadweight tonnage.[98]

As part of the agreements, India will also offer a $150 million line of credit extended by the Exim Bank of India for future port development,[99] India further agreed to extend a $400 million line of credit to be used for the import of steel for the construction of a rail link between Chabahar and Zahedan,[100] while India's IRCON and Iran's CDTIC signed a memorandum of understanding for the possible construction and financing of the Chabahar to Zahedan rail line at a cost of $1.6 billion.[101]

Chinese financial commitments in Gwadar

China has not offered Pakistan any line of credit for CPEC infrastructure development in the same manner as India has for Iran.[102][103] As part of CPEC, China has instead has committed $1.153 billion to finance construction projects and development of the port and adjacent sites.[104] Chinese commitments in Gwadar as part of the CPEC project include: the construction of the $140 million East Bay Expressway project to connect the port with the Makran Coastal Highway,[34] installation of breakwaters at Gwadar port which will cost $130 million,[31] a $360 million coal power plant adjacent to Gwadar Port,[105] a $27 million project to dredge berths in Gwadar harbour,[31] and a $100 million 300-bed hospital in Gwadar.[34] A $114 million desalination plant will also be developed to provide potable water, while $35 million worth of infrastructure projects around the special economic zone will also be built.[36] China will also grant Pakistan $230 million to construct a new international airport in Gwadar which is to be operational by December 2017.[106] A floating liquefied natural gas facility will also be built at Gwadar Port as part of the $2.5 billion Gwadar-Nawabshah segment of the Iran–Pakistan gas pipeline.[9]

In addition to investments directly under the aegis of CPEC, the China Overseas Port Holdings Company also initiated $2 billion worth of additional infrastructure projects at the adjacent Gwadar Special Economic Zone on 20 June 2016.[10] COPHC will also expand Gwadar Port with construction of multipurpose berths on 3.2 kilometres (2.0 mi) of seafront to the east of the existing multipurpose berths.[30] COPHC will additionally build cargo terminals in the 12 kilometres (7.5 mi) of land to the north and northwest of the site along the shoreline of the Demi Zirr bay.[30]

Iranian and Pakistani responses to Chabahar development plans

After signing the Chabahar agreement, Iran's ambassador to Pakistan, Mehdi Honerdoost, stated that the agreement was "not finished," and that Iran would welcome the inclusion of both Pakistan and China in the project.[107] While clarifying that Chabahar Port would not be a rival or enemy to Pakistan's Gwadar Port,[108] he further stated that Pakistan and China had both been invited to contribute to the project before India, but neither China nor Pakistan had expressed interest in joining.[109][110]

Pakistani analysts have endorsed the view that Chabahar is not a competitor, stating that Gwadar has an advantage by being a deep sea port and the expansion of Chabahar would in fact expand trade through Gwadar. Larger vessels that cannot dock at Chabahar could dock at Gwadar and the cargo transshipped to Chabahar.[111] However, Pakistan's military commentators have characterised the alliance between India, Iran, and Afghanistan as a "security threat to Pakistan", and it had "ominous and far-reaching implications" to the region. Pakistan's foreign policy advisor Sartaj Aziz has further signalled that Pakistan may link the Gwadar port to Chabahar via rail.[112]

Future environmental impact

Some have expressed concerns on the future of the environment of the region in light of the Gwadar port's expansion. A report of the LEAD Fellows' Study Group on the Oil Spill (SGOS) alleges that a port expansion would lead to future damage on the maritime environment such as oil spills and other human industrial waste pouring into the sea, also alleging that Pakistan's laws on maritime pollution have weak penalties and lack of institutional responsibility.[113]

This sentiment was shared by Syed Fazl-E-Haider. In his publication in Pakistan and the Gulf Economist, Haider put forth the argument that the sea water on the Baloch coast was pollution free due to the lack of human presence and activity. But ever since the commence of commercial operations in the port, all this will result in environmental consequences.[114]

In the jointly written book with Barbara E. Curry, Humpback Dolphins (Sousa spp.): Current Status and Conservation, Part 1 of Advances in Marine Biology, PhD marine biologist, Thomas A. Jefferson outlines some of the environmental consequences suffered by the Balochistan coast. He discusses the problem of sewage waste and solid waste affecting the coast including that of Gwadar. He argues that a thorough natural habitat assessment and regulation of fisheries is a solution to this growing environmental problem.[115]

Numismatics

Gwadar Port was featured on the back of the five Pakistani Rupee currency note, which is no longer in circulation.

See also

Notes

- See South China Sea dispute for more context.

References

- "UNLOCODE (PK) - PAKISTAN". unece.org. UNECE. Retrieved 17 December 2020.

- "Archived copy". Archived from the original on 30 August 2019. Retrieved 12 April 2020.CS1 maint: archived copy as title (link)

- Saran, Shyam (10 September 2015). "What China's One Belt and One Road Strategy Means for India, Asia and the World". The Wire (India). Archived from the original on 18 November 2015. Retrieved 6 December 2015.

- "Gwadar is most feasible option to stimulate regional integration". 1 February 2020.

- "Gwadar port: 'history-making milestones'". Dawn. 14 April 2008. Archived from the original on 23 May 2016. Retrieved 21 June 2016.

- Walsh, Declan (31 January 2013). "Chinese Company Will Run Strategic Pakistani Port". New York Times. Archived from the original on 17 January 2017. Retrieved 22 June 2016.

China paid for 75 percent of the $248 million construction costs,

- "Chinese firm to develop SEZ in Gwadar". China Daily. 11 December 2015. Archived from the original on 18 August 2016. Retrieved 1 July 2016.

China is expected to invest $1.62 billion in the Gwadar project, including construction of an expressway linking the harbor and coastline, a rail link, breakwater and other nine projects expected to be completed in three to five years.

- "Industrial potential: Deep sea port in Gwadar would turn things around". The Express Tribune. 17 March 2016. Archived from the original on 20 April 2016. Retrieved 9 April 2016.

- "China to build $2.5 billion worth LNG terminal, gas pipeline in Pakistan". Deccan Chronicle. 10 January 2016. Archived from the original on 1 October 2016. Retrieved 22 June 2016.

- "Construction of industrial free zone in Gwadar begins". Express Tribune. Archived from the original on 20 June 2016. Retrieved 21 June 2016.

- "Pakistan hands over 2000 acres to China in Gwadar port city". indianexpress.com. 12 November 2015. Archived from the original on 11 July 2018. Retrieved 25 March 2018.

- Dawn.com (13 November 2016). "'Today marks dawn of new era': CPEC dreams come true as Gwadar port goes operational". dawn.com. Archived from the original on 3 December 2017. Retrieved 25 March 2018.

- "Archived copy". Archived from the original on 16 January 2020. Retrieved 22 April 2020.CS1 maint: archived copy as title (link)

- "Pakistan launches strategic port". BBC News. 20 March 2007. Archived from the original on 26 January 2013. Retrieved 3 February 2012.

- "Gwadar Port: Gwadar Port Authority". Archived from the original on 23 May 2014.

- Persian Gulf Pilot: Comprising the Persian Gulf, the Gulf of Omán and the Makrán Coast. Pilot Guides. 1920.

- "Gwadar port: 'history-making milestones'". dawn.com. 14 April 2008. Archived from the original on 1 January 2013. Retrieved 25 March 2018.

- Willasey-Wilsey, Tim (28 January 2016). "Gwadar and "the String of Pearls"". Indian Council on Global Relations. Gateway House. Archived from the original on 4 August 2016. Retrieved 1 July 2016.

- Mathias, Hartpence (15 July 2011). "The Economic Dimension of Sino-Pakistan Relations: An Overview". pp. 581–589.

- China’s Maritime Silk Road

- Beijing’s Grand Plan to Rejuvenate Gwadar

- Can the New Silk Road Compete with the Maritime Silk Road?

- How the Belt and Road Initiative will affect the Containerised Shipping Trade Lanes?

- Shahid, Saleem (21 March 2007). "Gwadar Port inaugurated: Plan for second port in Balochistan at Sonmiani". dawn.com. Archived from the original on 27 September 2013. Retrieved 25 March 2018.

- "PORT PROFILE CURRENT PORT INFRASTRUCTURE". Gwadar Port Authority. Archived from the original on 23 June 2016. Retrieved 22 June 2016.

- "Gwadar Port to have 100 berths by 2045: minister". The News. 15 June 2015. Archived from the original on 21 June 2016. Retrieved 22 June 2016.

The three currently functional multipurpose berths of the deep-sea-port have a capacity to handle carriers of 30,000 deadweight tonnage (DWT) and to handle container vessels of 25,000 DWT.

- "Zhuhai Port scores big with deal in Pakistan". China Daily. 30 October 2015. Archived from the original on 18 August 2016. Retrieved 1 July 2016.

- "Archived copy". Archived from the original on 16 September 2018. Retrieved 16 September 2018.CS1 maint: archived copy as title (link)

- "China to construct 3.2 km additional berths at Gwadar Port". Customs Today. 9 March 2016. Archived from the original on 10 August 2016. Retrieved 22 June 2016.

- "China converts $230m loan for Gwadar airport into grant". Geo News. 23 September 2015. Archived from the original on 12 August 2016. Retrieved 21 June 2016.

- "Gwadar Port to have 100 berths by 2045: minister". The News. 15 June 2015. Archived from the original on 21 June 2016. Retrieved 22 June 2016.

The three currently functional multipurpose berths of the deep-sea-port have a capacity to handle carriers of 30,000 deadweight tonnage (DWT)

- "Why Gwadar". COPHC. Archived from the original on 11 May 2016. Retrieved 21 June 2016.

- Butt, Naveed (3 September 2015). "ECONOMIC CORRIDOR: CHINA TO EXTEND ASSISTANCE AT 1.6 PERCENT INTEREST RATE". Business Recorder. Archived from the original on 17 November 2015. Retrieved 16 December 2015.

- "$1,036 million to be invested in Gwadar projects by 2018: Ahsan". Geo TV. 11 November 2015. Archived from the original on 12 August 2016. Retrieved 23 June 2016.

Talking to The News, Minister for Planning and Development Ahsan Iqbal said the projects to be completed in Gwadar included Gwadar Coal Power Project (360 million dollars), new Gwadar Airport (260 million dollars), construction of breakwaters (130 million dollars), water treatment plant (114 million dollars), state-of-the-art hospital (100 million dollars), Free Economic Zones (35 million dollars), dredging of channels (27 million dollars) and technical and vocational institute (10 million dollars). He said all the projects in Gwadar would be completed on the basis of loans that have been converted into grants and interest-free loans so the cost of the overall basket can be reduced to a considerable level.

- "CPEC- Gwadar Port Related Projects". Ministry of Planning, Development, and Reform. Archived from the original on 15 June 2016. Retrieved 23 June 2016.

- "Gwadar Port to create over 40,000 job opportunities". Hellenic Shipping News. Archived from the original on 14 August 2016. Retrieved 21 June 2016.

He further said that a 19-kilometres long East Bay Expressway would connect Gwadar International Airport to Gwadar Deep seaport adding that the project would be completed by 2018.

- "At Gwadar port: Additional multipurpose berths in offing". Express Tribune. 10 March 2016. Archived from the original on 10 August 2016. Retrieved 22 June 2016.

Outside the concession area, he added, an LNG terminal is being constructed at Gwadar port by Inter State Gas Systems and China Petroleum. The work is planned to start during the first quarter of 2016

- Abrar, Mian (4 December 2015). "Between the devil and deep Gwadar waters". Pakistan Today. Archived from the original on 22 December 2015. Retrieved 6 December 2015.

- "China's Gwadar Port Nears Completion". Maritime Executive. 14 April 2016. Archived from the original on 20 June 2016. Retrieved 21 June 2016.

- "Expanded Chinese-operated Pakistani port on $46 billion economic corridor "almost ready"". Reuters. 13 April 2016. Archived from the original on 20 June 2016. Retrieved 21 June 2016.

- "Security fence at Gwadar port creates new tensions for China, Pakistan". South China Morning Post. 2 January 2021. Retrieved 7 January 2021.

- "The $46 Billion Tie That Binds China and Pakistan". STRATFOR. 6 May 2016. Archived from the original on 7 May 2016. Retrieved 21 June 2016.

- "Gwadar Port to have 100 berths by 2045: minister". The News. 15 June 2015. Archived from the original on 21 June 2016. Retrieved 22 June 2016.

- "Archived copy". Archived from the original on 4 May 2019. Retrieved 4 May 2019.CS1 maint: archived copy as title (link)

- Haider, Mehtab (23 September 2015). "China converts $230m loan for Gwadar airport into grant". Geo TV News. Archived from the original on 17 November 2015. Retrieved 16 December 2015.

- Li, Yan. "Groundwork laid for China-Pakistan FTZ". ECNS. Archived from the original on 18 November 2015. Retrieved 6 December 2015.

- "ECONOMIC ZONE: GOVERNMENT HANDS GWADAR LAND OVER TO CHINA". Business Recorder. 12 November 2015. Archived from the original on 4 March 2016. Retrieved 24 May 2016.

- "Construction of industrial free zone in Gwadar begins". Express Tribune. Archived from the original on 20 June 2016. Retrieved 21 June 2016.

It is expected that the port city will be able to create about 40,000 jobs. Gwadar Port Authority (GPA), Chairman Dostain Khan Jamaldini said that the construction of Gwadar Free Zone is underway at a cost of US$2 billion.

- "Gwadar Port to create over 40,000 job opportunities". Daily Times. 20 June 2016. Archived from the original on 21 June 2016. Retrieved 21 June 2016.

the port city alone will be able to create over 40,000 jobs"

- "Gwadar Port to create over 40,000 job opportunities". Daily Times. 20 June 2016. Archived from the original on 21 June 2016. Retrieved 21 June 2016.

port city alone will be able to create over 40,000 jobs having more capacity of job opportunities in future."

- "Gwadar Port to become distribution centre for ME market: Zhang". Business Recorder. 17 March 2016. Archived from the original on 11 June 2016. Retrieved 9 April 2016.

include bonded warehouses, manufacturing, international purchasing, transit and distribution transshipment, commodity display and supporting services and where the federal, provincial and local taxes

- "Pakistan approves massive tax exemptions for Gwadar port operators". Express Tribune. 24 May 2016. Archived from the original on 25 May 2016. Retrieved 25 May 2016.

In a major move, the ECC approved a complete income tax holiday for 23 years to businesses that will be established in the Gwadar Free Zone... / A 23-year exemption from sales tax and federal excise duty has also been granted to businesses that will be established inside the Gwadar Free Zone. However, if these businesses make supplies and sales outside the free zone, they will be subject to taxation.

- "Pakistan approves massive tax exemptions for Gwadar port operators". Express Tribune. 24 May 2016. Archived from the original on 25 May 2016. Retrieved 25 May 2016.

Under the move, the concession will extend to contractors and subcontractors and COPHCL companies for 20 years.

- "Pakistan approves massive tax exemptions for Gwadar port operators". Express Tribune. 24 May 2016. Archived from the original on 25 May 2016. Retrieved 25 May 2016.

Pakistan approved customs duty exemption for the COPHCL, its operating companies, contractors and subcontractors for a period of 40 years on import of equipment, materials, plants, machinery, appliances and accessories for construction of Gwadar Port and the associated Free Zone.

- Shah, Saeed. "Big Chinese-Pakistani Project Tries to Overcome Jihadists, Droughts and Doubts". The Wall Street Journal. ISSN 0099-9660. Archived from the original on 12 March 2017. Retrieved 10 April 2016.

- "Saudi Crown Prince Courts China as Counterweight to Critical West". The Wall Street Journal. Archived from the original on 24 February 2019. Retrieved 23 February 2019.

- "Saudi Crown Prince Signs $20B in Investment Deals in Pakistan". Voice of America. Archived from the original on 18 February 2019. Retrieved 23 February 2019.

- "Welcome to Gwadar Port". Archived from the original on 16 May 2014. Retrieved 23 May 2014.

- Ahmed, Haseeb. "Pakistan hands over Gwadar Port operation to China". The Nation. Archived from the original on 25 February 2013. Retrieved 2 March 2013.

- "China set to run Gwadar port as Singapore quits". Asia Times. 5 September 2012. Archived from the original on 6 August 2016. Retrieved 23 June 2016.

- Walsh, Declan. "Chinese Company Will Run Strategic Pakistani Port". New York Times. Archived from the original on 17 January 2017. Retrieved 22 June 2016.

- Tom Wright, Jeremy Page (30 September 2011). "China Pullout Deals Blow to Pakistan". The Wall Street Journal. Archived from the original on 13 January 2017. Retrieved 3 August 2017.

- Walsh, Declan. "Chinese Company Will Run Strategic Pakistani Port". New York Times. Archived from the original on 17 January 2017. Retrieved 22 June 2016.

But Pakistan has failed to build the port or transportation infrastructure needed to develop the port, the property bubble has burst and, according to the port management Web site, the last ship to dock there arrived in November. "The government never built the infrastructure that the port needed – roads, rail or storage depots," said Khurram Husain, a freelance business journalist. "Why would any shipping company come to the port if it has no service to offer?

- Raza, Syed Irfan (18 February 2013). "China given contract to operate Gwadar port". dawn.com. Archived from the original on 4 June 2013. Retrieved 25 March 2018.

- "China to get 91pc Gwadar income, minister tells Senate". 25 November 2017. Archived from the original on 16 July 2019. Retrieved 28 July 2019.

- "Archived copy". Archived from the original on 28 July 2019. Retrieved 28 July 2019.CS1 maint: archived copy as title (link)

- "Is China-Pakistan 'silk road' a game-changer?". BBC (22 April 2015). Archived from the original on 30 January 2016. Retrieved 17 February 2016.

- Ramachandran, Sudha (31 July 2015). "China-Pakistan Economic Corridor: Road to Riches?". China Brief (The Jamestown Foundation). 15 (15). Archived from the original on 25 February 2016. Retrieved 17 February 2016.

- "Pakistan lands $46 billion investment from China". CNN. 20 April 2015. Archived from the original on 24 September 2016. Retrieved 21 June 2016.

- Chowdhary, Mawish (25 August 2015). "China's Billion-Dollar Gateway to the Subcontinent: Pakistan May Be Opening A Door It Cannot Close". Forbes. Archived from the original on 24 February 2016. Retrieved 17 February 2016.

- Archived 10 December 2019 at the Wayback Machine

- "Exclusive: China sends surface-to-air missiles to contested island in provocative move". Fox News Channel. 16 February 2016. Archived from the original on 16 February 2016. Retrieved 17 February 2016.

- Alam, Omar (21 December 2015). "China-Pakistan Economic Corridor: Towards a New 'Heartland'?". International Relations and Security Network. Archived from the original on 24 February 2016. Retrieved 17 February 2016.

- Lintner, Bertil (15 April 2019). The Costliest Pearl: China's Struggle for India's Ocean. Oxford University Press. ISBN 978-1-78738-239-8.

- "India Boosts Strait of Malacca Maritime Surveillance". The Maritime Executive. 27 January 2016. Archived from the original on 2 March 2016. Retrieved 17 February 2016.

- Shrivastava, Sanskar (1 June 2013). "Indian String of Pearls "Unstringing" Chinese String of Pearls Theory". The World Reporter. Archived from the original on 19 December 2017. Retrieved 4 June 2013.

- Blasko, Dennis J. and M. Taylor Fravel. "'Much Ado About The Sansha Garrison." Archived 29 October 2012 at the Wayback Machine, "The Diplomat", 23 August 2012. Retrieved 4 May 2013

- "Know your own strength". The Economist. 30 May 2013. Archived from the original on 5 February 2016. Retrieved 17 February 2016.

- Fazl-e-Haider, Syed (5 March 2015). "A Strategic Seaport – Is Pakistan Key to China's Energy Supremacy?". Foreign Affairs. Archived from the original on 18 April 2015. Retrieved 23 April 2015.

- "CPEC made part of China's 13th 5-year development plan: Weidong". Pakistan Today. 23 November 2015. Archived from the original on 22 February 2016. Retrieved 6 March 2016.

- "China's landmark investments in Pakistan". The Express Tribune. 21 April 2015. Archived from the original on 22 April 2015. Retrieved 21 April 2015.

- Malhotra, Aditi (8 June 2015). "CPEC and China's Western Development Strategy". South Asian Voices. Archived from the original on 2 March 2016. Retrieved 17 February 2016.

- "Belt and road initiative". The Daily Star. 9 May 2015. Archived from the original on 28 January 2016. Retrieved 23 January 2016.

- Pantucci, Raffaello (12 February 2016). "The tangled threads in China's Silk Road strategy". Business Spectator. Archived from the original on 16 February 2016. Retrieved 17 February 2016.

Similarly, in Uzbekistan, the plan to develop train lines from Tashkent through Ferghana to Kyrgyzstan points to a project that will help develop faster train links across Central Asia to China.

- "Kazakhstan shows willingness to join CPEC project". The News. 26 August 2015. Archived from the original on 27 January 2016. Retrieved 23 January 2016.

- Bhutta, Zafar. "Pakistan could turn into a transit trade hub". The Tribune (Pakistan). Archived from the original on 24 January 2016. Retrieved 23 January 2016.

During a visit to Pakistan in the middle of this month, Tajikistan President Emomali Rahmon praised the China-Pakistan Economic Corridor (CPEC), insisting the project would facilitate economic and trade links between Pakistan and Tajikistan as well as other Central Asian states. Prime Minister Nawaz Sharif, on his part, made an offer to Tajikistan to use Pakistan's seaports for imports and exports as these provide the shortest route for movement of goods. The premier backed Tajikistan's request for being part of the Quadrilateral Agreement on Traffic in Transit among China, Kazakhstan, Kyrgyzstan and Pakistan – an arrangement that will further improve regional connectivity.

- "India, Iran moving forward on redeveloping Chabahar port". The Journal of Commerce. 9 May 2016. Archived from the original on 14 July 2016. Retrieved 30 June 2016.

According to the provisional deal, IPGPL will refurbish a 640-meter (2,100-foot) container handling facility through deployment of new equipment, including four rail-mounted gantry cranes, 16 rubber-tire gantry cranes, two reach stackers and two empty handlers. For the rebuilding of a 600-meter (1,969-foot) multi-purpose berth at Chabahar, Indian authorities will invest in six mobile harbor cranes, 10 forklifts and 10 trailers.

- "Easing sanctions allows Iran to develop key port project". The Journal of Commerce. 23 May 2016. Archived from the original on 28 May 2016. Retrieved 30 June 2016.

- "India to invest $500 million on Chabahar port in Iran for easy access to Afghanistan, Europe". India Today. 24 May 2016. Archived from the original on 25 May 2016. Retrieved 24 May 2016.

- Gupta, Shishir (23 May 2016). "Why the Chabahar Port agreement kills two birds with one stone". Hindustan Times. Archived from the original on 24 May 2016. Retrieved 24 May 2016.

- "How significant is India's $500 million deal with Iran?". Christian Science Monitor. 24 May 2016. Archived from the original on 27 May 2016. Retrieved 28 May 2016.

But India's additional investment pales in comparison to China's pledge of $46 billion to develop the Pakistani port of Gwadar, not even 125 miles from Chabahar, along with an accompanying network of railways, pipelines, and roads to connect with western China.

- "List of Agreements/MOUs signed during the visit of Prime Minister to Iran (May 23. 2016)". Ministry of External Affairs (India). Archived from the original on 26 May 2016. Retrieved 26 May 2016.

6. Bilateral contract on Chabahar Port for port development and operations between IPGPL [India Ports Global Private Limited] and Arya Banader of Iran. The contract envisages development and operation for 10 years of two terminals and 5 berths with cargo handling [multipurpose and general] capacities.

- "India, Iran and Afghanistan sign Chabahar port agreement". Hindustan Time. 24 May 2016. Archived from the original on 23 May 2016. Retrieved 24 May 2016.

- "Five things about Chabahar Port and how India gains from it". Economic Times. 23 May 2016. Archived from the original on 23 May 2016. Retrieved 24 May 2016.

- "List of Agreements/MOUs signed during the visit of Prime Minister to Iran (May 23. 2016)". Ministry of External Affairs (India). Archived from the original on 26 May 2016. Retrieved 26 May 2016.

- Refer to list of MoUs – no other project directly related to Chabahar Port is mentioned

- "Chabahar Port" (PDF). Port and Marine Authority – Director Governate of Sistan Balochistan. Archived (PDF) from the original on 17 May 2017.

- "List of Agreements/MOUs signed during the visit of Prime Minister to Iran (May 23. 2016)". Ministry of External Affairs (India). Archived from the original on 26 May 2016. Retrieved 26 May 2016.

MoU between EXIM Bank and Iran's Ports and Maritime Organization [PMO] oncurrent specific terms for the Chabahar Port project This MoU is intended for the purpose of credit of USD 150 million for Chabahar port. Mr. Yaduvendra Mathur, Chairman, EXIM Bank H. E. Mr Saeednejad, Chairman of Ports and Maritime Organization of Iran.

- "List of Agreements/MOUs signed during the visit of Prime Minister to Iran (May 23. 2016)". Ministry of External Affairs (India). Archived from the original on 26 May 2016. Retrieved 26 May 2016.

Confirmation Statement between EXIM Bank and Central Bank of Iran This confirms the availability of credit up to INR 3000 crore for the import of steel rails and implementation of Chabahar port.

- "List of Agreements/MOUs signed during the visit of Prime Minister to Iran (May 23. 2016)". Ministry of External Affairs (India). Archived from the original on 26 May 2016. Retrieved 26 May 2016.

MoU between IRCON and Construction, Development of Transport and Infrastructure Company (CDTIC) of Iran. MoU will enable IRCON to provide requisite services for the construction of Chabahar-Zahedan railway line which forms part of transit and transportation corridor in trilateral agreement between India, Iran and Afghanistan. Services to be provided by IRCON include all superstructure work and financing the project (around USD 1.6 billion).

- "Details of agreements signed during Xi's visit to Pakistan". Dawn. 20 April 2015. Archived from the original on 13 June 2016. Retrieved 21 June 2016.

- No reference to credit lines is to be found in list of MoUs

- See below: List of projects $230million for Gwadar Airport, $114m desalination plant, $35m for SEZ infrastructure, $360m for coal plant, $140m for East Bay Expressway, $100m for hospital, $130m for breakwaters, $27m for dredging. Sum of figures = $987million

- "2,000 acres leased to China for Gwadar Economic Zone". The News. 27 August 2015. Archived from the original on 1 April 2016. Retrieved 21 June 2016.

- Sial, Amer (27 August 2015). "China converts Rs 23b Gwadar Airport loan into grant". Pakistan Today. Archived from the original on 17 November 2015. Retrieved 6 December 2015.

- "Chabahar deal 'not finished'; Pakistan, China welcome, says Iran". Indian Express. 27 May 2016. Archived from the original on 28 May 2016. Retrieved 27 May 2016.

- "Gwadar and Chabahar not enemy ports: Iranian ambassador". Pakistan Today. 27 May 2016. Archived from the original on 28 May 2016. Retrieved 27 May 2016.

Ahmed Safee, a research fellow at the ISSI, quoted the Iranian envoy as saying that the deal is still on the table for both Pakistan and China, assuring that 'Chabahar is not a rival to Gwadar'. The ambassador added that both are sister ports, and Chabahar port authorities would extend cooperation to Gwadar. "The deal is not finished. We are waiting for new members. Pakistan, our brotherly neighbours and China, a great partner of the Iranians and a good friend of Pakistan, are both welcome," said the envoy.

- Yousaf, Kamran (27 May 2016). "Iran offers Pakistan to join Chabahar port deal". Express Tribune. Archived from the original on 28 May 2016. Retrieved 27 May 2016.

Honardost went on to say that Pakistan and China were offered to join the Chahbahar port development deal before India. However, both Pakistan and China did not show any interest, he added.

- "Chabahar deal 'not finished'; Pakistan, China welcome, says Iran". Indian Express. 27 May 2016. Archived from the original on 28 May 2016. Retrieved 27 May 2016.

The offer to cooperate had first been extended to Pakistan and then China, implying neither had expressed interest, he said while speaking on Pakistan-Iran relations at the Institute of Strategic Studies in Islamabad (ISSI)

- Aamir Latif, Iran's Chabahar won't vie with Pakistan's Gwadar: Experts Archived 29 November 2018 at the Wayback Machine, Andalou Agency, 1 June 2016.

- "Pakistan may link Gwadar to India-funded Chabahar in Iran, says Sartaj Aziz" Archived 14 June 2016 at the Wayback Machine, Daily Pakistan, 27 May 2016.

- The Tasman Spirit Oil Spill in Retrospect: Salvaging Lessons from the Disaster : a Report of the LEAD Fellows' Study Group on the Oil Spill (SGOS). Lead, Pakistan. 1 January 2005. ISBN 978-969-8529-26-0.

- Pakistan and Gulf Economist. Economist Publications. 2008.

- Humpback Dolphins (Sousa spp.): Current Status and Conservation. Elsevier Science. 21 November 2015. pp. 202–. ISBN 978-0-12-803259-6.

External links

Media related to Gwadar Port at Wikimedia Commons

Media related to Gwadar Port at Wikimedia Commons- Gwadar Port Authority

- HamaraGwadar.com

- Government of Pakistan, Board of Investment, Gwadar

- Latest Updates Gwadar Pakistan

- Gwadar Deep Sea Port’s Emergence as Regional Trade and Transportation Hub: Prospects and Problems