Politics of Iran

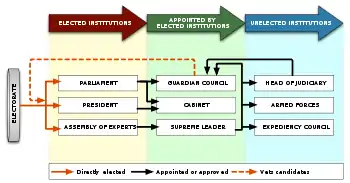

Iran is a Guardianship of the Islamic Jurist and Islamic republic in which the president, parliament (Majles) and judicial system share powers reserved to the national government, according to its Constitution. The politics of Iran take place in a framework that officially combines elements of theocracy and presidential democracy. The December 1979 constitution, and its 1989 amendment, define the political, economic, and social order of the Islamic Republic of Iran, declaring that Shia Islam is Iran's official religion where around 90–95% of Iranians associate themselves with the Shia branch of Islam.[1]

| |

| Constitution | Constitution of the Islamic Republic of Iran |

|---|---|

| Formation | 1 April 1979 |

| Legislative branch | |

| Name | Islamic Consultative Assembly |

| Type | Unicameral |

| Meeting place | Baharestan, Tehran |

| Presiding officer | Mohammad Bagher Ghalibaf, Speaker |

| Executive branch | |

| Head of Government | |

| Title | President |

| Currently | Hassan Rouhani |

| Appointer | Direct popular vote |

| Cabinet | |

| Name | Cabinet of Iran |

| Current cabinet | Cabinet of Hassan Rouhani |

| Leader | President |

| Deputy leader | Vice President |

| Appointer | President |

| Headquarters | Sa'dabad Complex |

| Ministries | 18 |

| Judicial branch | |

| Name | Judicial system of the Islamic Republic of Iran |

| Courts | Courts of Iran |

| Supreme Court | |

| Chief judge | Ebrahim Raisi |

| Seat | Courthouse of Tehran |

|

|---|

| This article is part of a series on the politics and government of Iran |

| Government of Islamic Republic of Iran |

|

Iran has a democratically elected president, a parliament (or Majlis), an Assembly of Experts which elects the Supreme Leader, and local councils. According to the constitution, all candidates running for these positions must be vetted by the Guardian Council before being elected.

In addition, there are representatives elected from appointed organizations (usually under the Supreme Leader's control) to "protect the state's Islamic character".[2]

Prior to 1979, Iran had its political system as a parliamentary democratic constitutional monarchy with parliamentary system. The Shah served as its head of state while the Prime Minister held the post of the head of government from the 1906 Persian Constitution. While the political system is secular in nature, it has been described as authoritarian in the later years of the Imperial State.

Current office holders

| Office | Name | Picture | Since |

|---|---|---|---|

| Supreme Leader | Ali Khamenei |  |

4 June 1989 |

| President | Hassan Rouhani |  |

3 August 2013 |

| Speaker of Parliament | Mohammad Bagher Ghalibaf |  |

28 May 2020 |

| Chief Justice | Ebrahim Raisi |  |

7 March 2019 |

Political conditions

The early days of the revolutionary government were characterized by political tumult. In November 1979 the US embassy was seized and its occupants taken hostage and kept captive for 444 days because of support of the US government for the King of Iran. The eight-year Iran–Iraq War killed hundreds of thousands and cost the country billions of dollars. By mid-1982, power struggles eliminated first the center of political spectrum and then the Republicans[3][4][5] leaving the revolutionary leader Ayatollah Khomeini and his supporters in power.

Iran's post-revolution challenges have included the imposition of economic sanctions and suspension of diplomatic relations with Iran by the United States because of the hostage crisis, political support to Iraq and other acts of terrorism that the U.S. government and some others have accused Iran of sponsoring. Emigration has lost Iran millions of entrepreneurs, professionals, technicians, and skilled craftspeople and their capital.[6][7] For this and other reasons Iran's economy has not prospered. Poverty rose in absolute terms by nearly 45% during the first 6 years since Iraqi invasion on Iran started[8] and per capita income has yet to reach pre-revolutionary levels when Iraqi invasion ended in 1988.[9][10]

The Islamic Republic Party was Iran's ruling political party and for years its only political party until its dissolution in 1987. After the war, new reformist/progressive parties had started to form. The country had no functioning political parties until the Executives of Construction Party formed in 1994 to run for the fifth parliamentary elections, mainly out of executive body of the government close to the then-president Akbar Hashemi-Rafsanjani. After the election of Mohammad Khatami in 1997, more parties started to work, mostly of the reformist movement and opposed by hard-liners. This led to incorporation and official activity of many other groups, including hard-liners. After the war ended in 1988, reformist and progressive candidates won four out of six presidential elections in Iran and the right-wing nationalist party of Mahmoud Ahmadinejad won twice.

The Iranian government is opposed by several militias, including the Mojahedin-e-Khalq, the People's Fedayeen, and the Kurdish Democratic Party. For other political parties see List of political parties in Iran.

Supreme Leader

The Supreme Leader of Iran[11] is the head of state and highest ranking political and religious authority (above the President). The armed forces, judicial system, state television, and other key governmental organizations are under the control of the Supreme Leader. There have been only two Supreme Leaders since the founding of the Islamic Republic, and the current leader (Ali Khamenei), has been in power since 1989. His powers extend to issuing decrees and making final decisions on the economy, environment, foreign policy, education, national planning of population growth,[12][13][14][15][16][17][18][19] the amount of transparency in elections in Iran,[20] and who is to be fired and reinstated in the Presidential cabinet.[21][22]

The Supreme Leader is appointed and supervised by the Assembly of Experts. However, all candidates to the Assembly of Experts, the President and the Majlis (Parliament), are selected by the Guardian Council, half of whose members are selected by the Supreme Leader of Iran.[23] Also, all directly-elected members after the vetting process by the Guardian Council still have to be approved by the Supreme Leader.[24][25]

Guardian Council

The Guardian Council is an appointed and constitutionally mandated 12-member council with considerable power. It approves or vetoes legislative bills from the Islamic Consultative Assembly (the Iranian Parliament), and approves or forbids candidates seeking office to the Assembly of Experts, the Presidency and the parliament,[26] Six of the twelve members are Islamic faqihs (expert in Islamic Law) selected by the Supreme Leader of Iran, and the other six are jurists nominated by the Head of the Judicial system (who is also appointed by the Supreme Leader),[27] and approved by the Iranian Parliament.[28]

Political parties and elections

These are the most recent elections that have taken place.

President

| Candidate | Party | Votes | % | ||

|---|---|---|---|---|---|

| Hassan Rouhani | Moderation and Development Party | 23,636,652 | 57.14 | ||

| Ebrahim Raisi | Combatant Clergy Association | 15,835,794 | 38.28 | ||

| Mostafa Mir-Salim | Islamic Coalition Party | 478,267 | 1.16 | ||

| Mostafa Hashemitaba | Executives of Construction Party | 214,441 | 0.52 | ||

| Invalid/blank registered votes | 1,200,931 | 2.90 | |||

| Total registered votes | 41,366,085 | 100 | |||

| Registered voters/turnout | 56,410,234 | 73.33 | |||

| Source: Ministry of Interior | |||||

Local Councils

Islamic Consultative Assembly

Assembly of Experts

Political pressure groups and leaders

Active student groups include the pro-reform "Office for Strengthening Unity" and "the Union of Islamic Student Societies';

- Groups that generally support the Islamic Republic include Ansar-e Hizballah, The Iranian Islamic Students Association, Muslim Students Following the Line of the Imam, Islam's Students, and the Islamic Coalition Association. The conservative power base has been said to be made up of a "web of Basiji militia members, families of war martyrs, some members of the Revolutionary Guard, some government employees, some members of the urban and rural poor, and conservative-linked foundations."[29]

- opposition groups include the Freedom Movement of Iran and the Nation of Iran party;

- armed political groups that have been almost completely repressed by the government include Mojahedin-e Khalq Organization (MEK), People's Fedayeen, Democratic Party of Iranian Kurdistan; the Society for the Defense of Freedom.

Military

Public finance and fiscal policy

| Public finance |

|---|

|

|

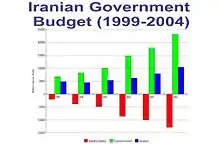

Budget

Iran's fiscal year (FY) goes from 21 to 20 March of the following year.

Iran has two types of budget:

- Public or "General" Government Budget

- Overall or "Total" Government Budget; which includes state-owned companies

Iran's budget is established by the Management and Planning Organization of Iran and then proposed by the government to the parliament/Majlis. Once approved by Majlis, the bill still needs to be ratified by the Guardian Council. The bill will be sent back to the parliament for amendments if it is voted down by the Guardian Council. The Expediency Council acts as final arbiter in any dispute.[31]

Following annual approval of the government's budget by Majlis, the central bank presents a detailed monetary and credit policy to the Money and Credit Council (MCC) for approval. Thereafter, major elements of these policies are incorporated into the five-year economic development plan.[32] The 5-year plan is part of "Vision 2025", a strategy for long-term sustainable growth.[33]

A unique feature of Iran's economy is the large size of the religious foundations (called Bonyads) whose combined budgets make up more than 30% that of the central government.[34][35][36]

Setad, another organization worth more than $95 billion, has been described as "secretive" and "little known".[37] It is not overseen by the Iranian Parliament, as that body voted in 2008 to "prohibit itself from monitoring organizations that the supreme leader controls, except with his permission". It is, however, an important factor in the Supreme Leader's power, giving him financial independence from parliament and the national budget.[37]

The National Development Fund of Iran (NDFI) does not depend on Iran's budget.[38] But according to the Santiago Principles, NDFI must coordinate its investment decisions and actions with the macro-economic and monetary policies of the government of Iran.

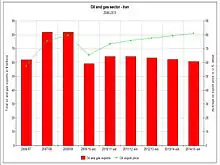

Revenues

Officials in Iran estimate that Iran's annual oil and gas revenues could reach $250 billion by 2015 once the current projects come on stream.[39]

In 2004, about 45 percent of the government's budget came from exports of oil and natural gas revenues, although this varies with the fluctuations in world petroleum markets and 31 percent came from taxes and fees.[30] Overall, an estimated 50 percent of Iran's GDP was exempt from taxes in FY 2004.[40]

As of 2010, oil income accounts for 80% of Iran's foreign currency revenues and 60% of the nation's overall budget.[41] Any surplus revenues from the sale of crude oil and gas are to be paid into the Oil Stabilization Fund (OSF). The approved "total budget", including state owned commercial companies, was $295 billion for the same period.[42]

The Government seeks to increase the share of tax revenue in the budget through the implementation of the economic reform plan through more effective tax collection from businesses.

As of 2016, the formula set by law is that, for sales of oil at or below the budget's price assumption, 14.5% remains with the National Iranian Oil Company (NIOC), 20% goes to the National Development Fund (NDF), 2% goes to deprived and oil-producing provinces, and 63.5% goes to the government treasury.[43]

Iran has not yet implemented the treasury single account system.[44]

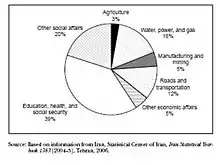

Expenditures

Because of changes in the classification of budgetary figures, comparison of categories among different years is not possible. However, since the Iranian Revolution, the government's general budget payments have averaged:[40]

- 59 percent for social affairs,

- 17 percent for economic affairs,

- 15 percent for national defense, and

- 13 percent for general affairs.

Iran spent 22.5% of its 2003 national budget on social welfare programs of which more than 50% covered pension costs.[45]

For a breakdown of expenditures for social and economic purposes, see the attached chart.

In FY 2004, central government expenditures were divided as follows:[40]

- current expenditures, 59 percent, and

- capital expenditures, 32 percent.

- Other items (earmarked expenditures, foreign-exchange losses, coverage of liabilities of letters of credit, and net lending) accounted for the remainder.

Among current expenditures, wages and salaries accounted for 36 percent; subsidies and transfers to households accounted for 22 percent (not including indirect subsidies). Earmarked expenditures totaled 13 percent of the central government total. Between FY 2000 and FY 2004, total expenditures and net lending accounted for about 26 percent of GDP.[40] According to the Vice President for Parliamentary Affairs, Iran's subsidy reforms would save 20 percent of the country's budget.[46]

According to the head of the Department of Statistics of Iran, if the rules of budgeting were observed in this structure, the government could save at least 30 to 35 percent on its expenses.[47]

Contrary to the main objective and because of a lack in the implementation of the subsidy reform plan, the volume of Iranian subsidies given to its citizens on fossil fuel, which increased 42.2% in 2019, equals 15.3% of Iran's GDP and 16% of total global energy subsidies.[48][49] As a direct consequence, Iranian taxpayers incur a loss of $3.3 billion annually because of fuel smuggling (& not including other smuggled oil derivatives), equivalent to the "development budget" of Iran.[50]

Public debt

In 2014, Iran's banks and financial institutions total claims on the public sector (government and governmental institutions) amounted to 929 trillion IRR ($34.8 billion), which must be reduced according to the IMF.[52][53][54] IMF estimates that public debt could be as high as 40% of GDP (or more) once government arrears to the private sector are recognized.[55] These arrears are owed to banks (45%), private contractors (37%), and social security (18%) (FY 2016).[51]

External debts

In 2013, Iran's external debts stood at $7.2 billion compared with $17.3 billion in 2012.[56] Iran's external debt was $9.3 billion in December 2020. This is one of the lowest numbers globally.[57]

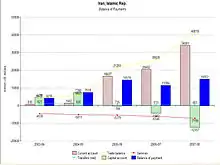

.png.webp) Money flow chart.

Money flow chart. Iran's balance of payment (2003-2007)

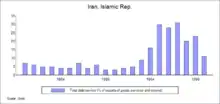

Iran's balance of payment (2003-2007) Iran's total debt service as percent of exports of goods services and income increased sixfold between 1990 and 1997

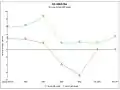

Iran's total debt service as percent of exports of goods services and income increased sixfold between 1990 and 1997 Iran's oil vs non-oil real GDP growth projections.

Iran's oil vs non-oil real GDP growth projections. Military expenditures (% GDP)

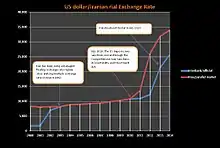

Military expenditures (% GDP) US dollar/Iranian rial exchange rate (2003-2014 est.)

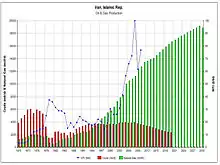

US dollar/Iranian rial exchange rate (2003-2014 est.) Oil and gas production (1970-2030 est.)

Oil and gas production (1970-2030 est.) Iranian budget process.

Iranian budget process.

Financial situation of the government

| Year 1386 (2007–08)

(realized) |

% of nominal GDP | Year 1387 (2008–09)

(approved budget) |

Year 1387 (2008–09)

(realized) |

Year 1391 (2012–13)

(realized) |

Revenues and payments |

|---|---|---|---|---|---|

| 191,815.3 | 11.4% | 217,155 | 239,741.4 | 395,166.7 | Tax revenues (i.e. Income tax, Corporate tax, VAT, Customs fees etc.) |

| 106,387.8 | 121,598.1 | 139,597.1 | 173,036.5 | (+) Other revenues (i.e. Public corporations' dividend, Government services & other fees) | |

| 298,203.1 | 338,753.1 | 379,338.5 | 568,203.2 | = Revenues | |

| (-) 421,334.1 | 16.1% | (-) 621,126 | (-) 564,290.0 | (-) 889,993.2 | (–) Expenditure payments/current (i.e. Government wages) (see also: Iranian targeted subsidy plan) |

| -123,131 | 4.7% | -282,372.9 | -184,951.5 | -321,790.0 | = (+/-) Operational balance* |

| 173,519.1 | 298,865.6 | 215,650.3 | 425,526.5 | Sale of oil and oil products (see also: Ministry of Petroleum of Iran & National Iranian Oil Company) | |

| 1,272.7 | 3,095 | 986.5 | 2,994.9 | (+) Others (Value of movable and immovable properties) | |

| 174,791.8 | 301,960.6 | 216,636.7 | 428,521.4 | = Transfer of capital assets | |

| - 147,715.8 (-157,215.8)(2) | 5.6% | (-) 251,573.8 | (-) 213,495.8 | (-) 152,277.4 | (–) Acquisition of capital assets/development expenditures (in Transport, Urban and Rural Development and Housing Provision Plans in the Framework of Welfare and Social Security System) |

| 27,076.1 (17,576.1)(2) | 50,386.8 | 3,140.9 | 276,244.0 | = Net transfer of capital assets | |

| -123,131 | 4.7% | -282,372.9 | -184,951.5 | -321,790.0 | + Operational balance (see above for details*) |

| -96,054.9 (-105,554.9)(2) | 3.7% | -231,986.1 | -181,810.6 | -45,546.0 | = Operational and capital balance (Operational balance + Net transfer of capital assets) |

| 156,614.1 (166,114.0)(2) | 267,771.6 | 218,260.0 | 67,696.1 | Transfer of financial assets (i.e. Privatization proceeds, World Bank facilities, Sale of participation papers & Oil Stabilization Fund utilization) | |

| (-) 60,559.2 | (-) 35,785.5 | (-) 36,449.4 | (-) 22,150.1 | (–) Acquisition of financial assets (i.e. Repayment of external debts and obligations) | |

| 96,054.9 (105,554.9)(2) | 3.7% | 231,986.1 | 181,810.6 | 45,546.0 | = Net transfer of financial assets (Transfer of financial assets – Acquisition of financial assets) |

Notes:

1) Since 2002, the latest International Monetary Fund Guidelines on government financial statistics have been used as a model to prepare annual budgetary acts. Accordingly, revenues are classified into “taxes and other revenues”, and “oil sales” which had earlier been classified as revenue are now referred to as "transfer of capital assets".

2) In 2007/08, it includes budget supplement at Rls. 9,500 billion.

3) The government budget does not include state revenues and expenses derived from state owned commercial enterprises.[63]

4) The government budget does not account for subsidies paid to state owned commercial enterprise. See also Subsidy reform plan.[63]

5) Excluding special revenues and expenditures and the figure for transparency in the price (subsidy) of energy bearers.[59]

6) For "Total Government Budget" (including state owned commercial companies), see Statistical Center of Iran.

7) Hidden spending and liability not included.

2009–10

In Iran's state budget for the Iranian calendar year 1388 (2009–2010), of the $102 billion earmarked for government spending,[42]

- 53% will be funded through revenues from the sale of crude oil and gas,

- 28% will come from taxes and the remaining

- 19% from other sources such as the privatization program.[42]

Oil revenues are calculated based on the average price of $37.50 per barrel at the US Dollar conversion rate of 9,500 Rials.[64] Iran balances its external accounts around $75 per barrel.[65]

2010–11

The budget for Iranian year 1389 (2010–2011), which starts on 21 March, amounts to $368.4bn, representing an increase of 31 per cent on the previous year and is based on a projected oil price of $60 a barrel compared with just $37.50 last year.[64]

2011–12

The public budget was $165 billion (1,770 trillion rials) in Iranian year 2011–2012. The Iranian Parliament also approved a total budget of $500 billion (5,170 trillion rials) that factors in $54 billion from price hikes and subsidy cuts and aside from the government (or public budget) also includes spending for state-owned companies.[66][67] The budget is based on an oil price of $80 per barrel. The value of the US dollar is estimated at IRR 10,500 for the same period. the 2011-total budget shows a 45-percent increase compared with that of 2011 which stood at $368 billion.[68]

2012–13

The proposed budget for 2011–2012 amounts to 5.1 quadrillion rials (approximately $416 billion).[69] The funding for running the government has been decreased by 5.6 percent and the government's tax revenues have been envisaged to rise by 20 percent.[69] The defense budget shows an increase of 127 percent. The government also is seeking higher sums for development, research, and health projects.[70] Approved budget of 5,660 trillion Rials $477 billion is based on an oil price of $85 per barrel and the average value of the U.S. dollar for the fiscal year has been projected to be 12,260 rials, allowing the government to gain $53.8 billion from subsidy cut.[71] The approved total state budget figure shows an 11% increase in Rial terms, in comparison to the previous year's budget. Of this amount, $134 billion relates to the government's general budget and the remaining $343 billion relates to state-owned companies and organizations. Of the $134 billion for the government's general budget, $117 billion relates to operating expenditure and $17 billion is for infrastructure developments. The government's general budget for 2012–13 shows a 3.5% decline in comparison to the previous year, while the budget for state-owned companies and organisations has risen by 18.5%. Revenues from crude oil make up 37% of the state's total revenues in the budget. Revenues from taxes have been projected at 458 trillion Rials ($37 billion), which shows a 10% increase year-on-year.[72] In the first half of 2012, Iran announced in Majlis that it has taken in only 25% of its budgeted annual revenue.[73] According to Apicorp, Iran needs oil to average $127 a barrel in 2012 for its fiscal budget to break even.[74]

2013–14

In May 2013, the Iranian parliament approved a 7.27-quadrillion-rial (about $593 billion) national budget bill for 2013–14. The new national budget has forecast a 40% drop in oil revenues compared to the previous year's projected figure. The bill has set the price of oil at $95 per barrel, based on the official exchange rate of 12,260 rials for a U.S. dollar, which has been fixed by the Central Bank of Iran.[75] The budget law also includes income of 500 trillion Rials from the subsidies reform plan. Out of this amount, 410 trillion Rials is allocated for direct cash handouts to those eligible who have registered and for social funds.[76]

2014–15

Iran's earmarked government spending for the year starting in March 2014 at $75 billion, calculated on an open-market exchange rate, with an overall/"total" budget ceiling estimated at about $265 billion. The draft budget estimates oil exports at about 1.1 million barrels per day (bpd). The 2014 budget assumes an average oil price of $100 per barrel, inflation at 21%, GDP growth at 3% and the official USD/IRR exchange rate at 26,000 Iranian rials.[77][78][79][80] The budget bill permits the government to use more than $35 billion in foreign finance.[81] Capital expenditure is set to rise by 9.7%.[82] The administration has set the goal of 519 trillion rials, (about $20.9 billion) government's income from implementation of the subsidy reform plan in budget bill and will be likely forced to double fuel prices.[83] In February 2014, Parliament approved a total budget bill worth 7,930 trillion rials ($319 billion at the official exchange rate).[84] The International Monetary Fund has estimated Iran needs an oil price above $130 a barrel to balance its 2015-state budget; Brent crude was below $80 a barrel in November 2014. The IMF estimated in October 2014 that Iran would run a general government deficit of $8.6 billion in 2015, at the official exchange rate, to be compensated by drawing on the National Development Fund.[85]

2015–16

Iran's 2015 proposed budget is nearly $300 billion. The overall/"total" budget shows a 4% growth compared with the 2014 budget. The budget assumes that the country exports 1 million barrels per day of crude oil and 0.3 million barrels per day of gas condensates at an average price of $72 per barrel of crude.[86] The official exchange rate is projected to be on average US$28,500/IRR.[87] Dependency on oil exports in this overall budget bill has dropped to 25% (down from over 30% of government revenues in 2014.)[31] The plan is to increase taxation on large organizations by reducing tax evasion/exemption. The Iranian state is the biggest player in the economy, and the annual budget strongly influences the outlook of local industries and the stock market. The 2015 budget is not expected to bring much growth for many of the domestic industries.[87][88] An average oil price of $50 for the coming year would result in a deficit of $7.5 billion. The government can lower this deficit by increasing the official exchange rate but this will trigger higher inflation.[89] The proposed expenses are $58 billion including $39 billion is salary and pension payments to government employees. Proposed development expenditure amounts to $17 billion.[89] R&D's share in the GNP is at 0.06% (where it should be 2.5% of GDP)[90][91] and industry-driven R&D is almost non‑existent.[87]

2016–17

Proposed government budget is 9.52-quadrillion Iranian rials (about 262 billion US dollars).[92] Assumptions made in the budget are $50 billion in foreign investment and foreign loans, 5-6% GDP growth and 11% inflation.[92] Sixty-five percent of the budget is to be financed through taxation and the remaining 35% from oil sales, based on 2.25 million barrels of oil sales per day, an average oil price of 40 dollars a barrel and US dollar-Iranian rial exchange rate at 29,970.[92]

According to the sixth five-year development plan (2016-2021), the subsidy reform plan is to continue until 2021.[92]

An amendment to the budget was passed in August 2016. This amendment allows the government to issue debt based instruments and the use of forex reserves in an attempt to clear its debt to the private sector, including contractors, banks and insurers.[93]

Complexity of the system

According to the constitution, the Guardian Council oversees and approves electoral candidates for most national elections in Iran. The Guardian Council has 12 members: 6 clerics, appointed by the Supreme Leader and 6 jurists, elected by the Majlis from among the Muslim jurists nominated by the Head of the Judicial System, who is appointed by the Supreme Leader. According to the current law, the Guardian Council approves the Assembly of Experts candidates, who in turn supervise and elect the Supreme Leader.

The reformists say this system creates a closed circle of power.[94] Iranian reformists, such as Mohammad-Ali Abtahi have considered this to be the core legal obstacle for the reform movement in Iran.[95][96][97][98][99]

See also

- Basij

- Censorship in Iran

- Constitution of Iran

- Corruption in Iran

- Cultural Heritage Organization of Iran

- Economy of Iran

- Foreign relations of Iran

- Human rights in Iran

- International Rankings of Iran in Politics

- Iran-Contra Affair

- Iranian reform movement

- List of current Iran governors

- List of Iranian officials

- Nuclear program of Iran

- Prime Minister of Iran

References

- "The World Factbook - Central Intelligence Agency". www.cia.gov. Archived from the original on 20 February 2011. Retrieved 18 December 2019.

- IRAN: POLITICS, THE MILITARY AND GULF SECURITY Archived 15 January 2010 at the Wayback Machine by Darius Bazargan, v.1, n.3, September 1997

- Moin, Khomeini (2001), p.21-234

- Arjomand, Said Amir, The Turban for the Crown : The Islamic Revolution in Iran, Oxford University Press, c1988, p.144

- Bakhash, Shaul, Reign of the Ayatollahs : Iran and the Islamic Revolution by Shaul, Bakhash, Basic Books, c1984 p.158-9

- "Iran's Economic Morass". www.washingtoninstitute.org. Archived from the original on 17 June 2009. Retrieved 29 July 2020.

- Harrison, Frances (8 January 2007). "Huge cost of Iranian brain drain By Frances Harrison". BBC News. Archived from the original on 29 March 2012. Retrieved 7 February 2012.

- Based on the government's own Planning and Budget Organization statistics, from: Jahangir Amuzegar, 'The Iranian Economy before and after the Revolution,` Middle East Journal 46, n.3 (summer 1992): 421)

- Low reached in 1995, from: Mackey, Iranians, 1996, p. 366.

- "According to World Bank figures, which take 1974 as 100, per capita GDP went from a high of 115 in 1976 to a low of 60 in 1988, the year war with Iraq ended ..." (Keddie, Modern Iran, 2003, p.274)

- Article 89-91, Iranian Constitution

- "Iran's Khamenei hits out at Rafsanjani in rare public rebuke". Middle East Eye. Archived from the original on 4 April 2016. Retrieved 15 August 2017.

- "Khamenei says Iran must go green - Al-Monitor: the Pulse of the Middle East". Al-Monitor. Archived from the original on 22 December 2015. Retrieved 15 August 2017.

- Louis Charbonneau and Parisa Hafezi (16 May 2014). "Exclusive: Iran pursues ballistic missile work, complicating nuclear talks". Reuters.com. Archived from the original on 31 July 2017. Retrieved 15 August 2017.

- "IranWire - Asking for a Miracle: Khamenei's Economic Plan". En.iranwire.com. Archived from the original on 7 March 2016. Retrieved 15 August 2017.

- "PressTV-'Economic issues, Iran's foremost problem'". Press.tv. Archived from the original on 1 August 2017. Retrieved 15 August 2018.

- "Archived copy". Archived from the original on 1 August 2017. Retrieved 15 August 2017.CS1 maint: archived copy as title (link)

- "Iran: Executive, legislative branch officials endorse privatization plan". Payvand.com. Archived from the original on 5 January 2017. Retrieved 15 August 2018.

- "Khamenei slams Rouhani as Iran's regime adopted UN education agenda". Thebaghdadpost.com. 8 May 2017. Archived from the original on 31 May 2017. Retrieved 15 August 2018.

- "Leader outlines elections guidelines, calls for transparency". Tehrantimes.com. 15 October 2016. Archived from the original on 1 August 2017. Retrieved 15 August 2018.

- "St. Albert Gazette". St. Albert Gazette. Archived from the original on 17 December 2013. Retrieved 15 August 2018.

- "BBC NEWS - Middle East - Iranian vice-president 'sacked'". News.bbc.co.uk. Archived from the original on 25 July 2009. Retrieved 15 August 2017.

- "Rafsanjani breaks taboo over selection of Iran's next supreme leader". Theguardian.com. 14 December 2015. Archived from the original on 18 December 2016. Retrieved 1 July 2016.

- (see Article 108 of the constitution)

- "ICL - Iran - Constitution". Servat.unibe.ch. Archived from the original on 21 August 2018. Retrieved 15 August 2018. "Everything you need to know about Iran's Assembly of Experts election". Brookings.edu. Retrieved 1 July 2016.

- Article 99 of the constitution

- "Archived copy". Archived from the original on 18 June 2009. Retrieved 15 August 2017.CS1 maint: archived copy as title (link)

- "Iranian Government Constitution, English Text". Iranonline.com. Archived from the original on 17 June 2011.

- Molavi, Afshin, The Soul of Iran, Norton, (2005), p.353

- Iran - MSN Encarta>. Archived from the original on 28 October 2009. Retrieved 25 May 2010.

- "PressTV-Iranian MPs approve budget bill outline". Presstv.com. Archived from the original on 5 June 2015. Retrieved 10 June 2015.

- Curtis, Glenn; Hooglund, Eric (April 2008). Iran, a country study. Washington, D.C., USA: Library of Congress. p. 195. ISBN 978-0-8444-1187-3. Archived from the original on 16 December 2019. Retrieved 18 December 2019.

- Ayse, Valentine; Nash, Jason John; Leland, Rice (January 2013). The Business Year 2013: Iran. London, U.K.: The Business Year. p. 41. ISBN 978-1-908180-11-7. Archived from the original on 27 December 2016. Retrieved 15 February 2015.

- Economist, 18 January 2003

- Pike, John. "Mostazafan and Janbazan (Oppressed and Disabled Veterans) Foundation (MJF)". www.globalsecurity.org. Archived from the original on 6 September 2017. Retrieved 15 August 2018.

- Abrahamian, History of Modern Iran, (2008), p. 178

- Steve Stecklow; Babak Dehghanpisheh; Yeganeh Torbati (11 November 2013). "Khamenei controls massive financial empire built on property seizures, (part 1)". Reuters. Archived from the original on 12 November 2013. Retrieved 13 November 2013.

- National Development Fund of Iran an overview of activities. YouTube. 11 July 2014. Archived from the original on 15 March 2016. Retrieved 10 June 2015.

- Mehr News Agency: Iran eyes $250 billion annual revenue in 5 years Archived 17 July 2018 at the Wayback Machine. Payvand.com, Retrieved 22 December 2010

- "About this Collection" (PDF). The Library of Congress. Archived (PDF) from the original on 22 June 2015. Retrieved 18 May 2016.

- "No Operation". Presstv.com. 16 June 2010. Archived from the original on 9 June 2012. Retrieved 7 February 2012.

- "Iran Investment monthly" (PDF). Turquoisepartners.com. May 2009. Archived (PDF) from the original on 18 January 2016. Retrieved 15 August 2018.

- "Iran's 'Frozen' Assets: Exaggeration on Both Sides of the Debate". Washingtoninstitute.org. Archived from the original on 27 June 2017. Retrieved 24 June 2017.

- "Archived copy". Archived from the original on 4 July 2019. Retrieved 4 July 2019.CS1 maint: archived copy as title (link)

- "Annual Review". Central Bank of Iran. December 2009. Archived from the original on 18 June 2011. Retrieved 10 May 2010.

- "No Operation". Presstv.com. 28 November 2010. Archived from the original on 23 January 2011. Retrieved 7 February 2012.

- "Ten Million Iranians Under 'Absolute Poverty Line'". Payvand.com. 20 March 2010. Archived from the original on 5 January 2012. Retrieved 7 February 2012.

- "Archived copy". Archived from the original on 22 July 2019. Retrieved 22 July 2019.CS1 maint: archived copy as title (link)

- "Archived copy". Archived from the original on 22 July 2019. Retrieved 22 July 2019.CS1 maint: archived copy as title (link)

- "Archived copy". Archived from the original on 18 July 2019. Retrieved 22 July 2019.CS1 maint: archived copy as title (link)

- IMF. "Selected Issues" Report, Islamic Republic of Iran, March 2018.

- Iran Investment Monthly. Turquoise Partners, November 2014. Retrieved 1 October 2015.

- Iran to test investor confidence with debt issue Archived 2 January 2016 at the Wayback Machine. Financial Times. Retrieved 1 October 2015.

- "IMF: Iran accord to lift Mideast economy". Archived from the original on 14 October 2015. Retrieved 18 May 2016.

- "Iran: Concluding Statement of an IMF Staff Visit". Imf.org. Archived from the original on 18 April 2018. Retrieved 24 June 2017.

- Iran's external debts cut by $10b, hit $7.2b: Central Bank Chief Archived 16 June 2018 at the Wayback Machine. Tehran Times, 27 May 2013. Retrieved 24 August 2013.

- https://www.presstv.com/Detail/2021/02/03/644483/Iran-foreign-debt-CBI-figures

- "The Memorandum of The Foreign Trade Regime of The Islamic Republic of Iran" (PDF). irantradelaw.com. Archived from the original (PDF) on 13 July 2011. Retrieved 10 June 2015.

- "Archived copy". Archived from the original on 1 May 2010. Retrieved 19 April 2010.CS1 maint: archived copy as title (link)

- "Islamic Republic of Iran: 2009 Article IV Consultation—Staff Report; Staff Supplement; Public Information Notice on the Executive Board Discussion; and Statement by the Executive Director for Iran" (PDF). Imf.org. Archived (PDF) from the original on 21 December 2011. Retrieved 15 August 2018.

- "Archived copy". Archived from the original on 8 August 2014. Retrieved 8 August 2014.CS1 maint: archived copy as title (link)

- "Annual Review" for 1387(2008/09)". Cbi.ir. 1 December 2009. Archived from the original on 24 February 2012. Retrieved 7 February 2012.

- "Statistical Centre of Iran". 13 November 2009. Archived from the original on 13 November 2009. Retrieved 15 August 2018.

- Bozorgmehr, Najmeh (24 January 2010). "Ahmadi-Nejad unveils expansionary Iran budget". Financial Times. Archived from the original on 8 June 2011. Retrieved 7 February 2012.

- PBS - Iran Primer: The Oil and Gas Industry Archived 26 July 2018 at the Wayback Machine. Pbs.org, Retrieved 27 October 2010

- Nasseri, Ladane (27 April 2011). "Iran Parliament Cut Budget 2.25% Before Approval, Donya Reports". Bloomberg. Archived from the original on 5 November 2012. Retrieved 7 February 2012.

- "More subsidy cuts in Iran budget". Archived from the original on 15 May 2011. Retrieved 10 June 2015.

- "Iran Majlis to discuss budget bill". Press TV. 23 April 2011. Archived from the original on 27 March 2012. Retrieved 7 February 2012.

- "Archived copy". Archived from the original on 19 April 2012. Retrieved 18 April 2012.CS1 maint: archived copy as title (link)

- "Global Legal Monitor: Iran: Criticism of Newly Proposed Budget - Global Legal Monitor - Law Library of Congress - Library of Congress". Archived from the original on 5 June 2015. Retrieved 10 June 2015.

- "Iran parliament approves reduced sanction-hit budget - Yahoo! News". Archived from the original on 12 July 2012. Retrieved 29 July 2020.

- "Iran Investment monthly" (PDF). Turquoisepartners.com. May 2012. Archived (PDF) from the original on 31 October 2013. Retrieved 15 August 2018.

- "Iranian Government Facing Budget Shortfall". Archived from the original on 11 June 2015. Retrieved 10 June 2015.

- Bloomberg. "Iran needs oil at $127 to balance budget". Archived from the original on 5 June 2015. Retrieved 10 June 2015.

- "Iranian Parliament passes $593 billion national budget bill". Archived from the original on 24 September 2015. Retrieved 10 June 2015.

- "Iran Investment monthly" (PDF). Turquoisepartners.com. June 2013. Archived (PDF) from the original on 3 March 2016. Retrieved 15 August 2018.

- "Irandaily - No. 4671 - Front page. p. 1". Archived from the original on 14 December 2013. Retrieved 18 May 2016.

- "Iran's president: Nuclear deal has helped economy". Yahoo News. 8 December 2013. Archived from the original on 29 November 2014. Retrieved 10 June 2015.

- "Iran's 2014 Budget Taking Shape". VOA. Archived from the original on 31 January 2014. Retrieved 10 June 2015.

- "Iran's next year budget bill sees economic growth at 3%, inflation at 21%". Trend. 29 January 2014. Archived from the original on 5 July 2014. Retrieved 10 June 2015.

- "Irandaily - No. 4680 - Front page. p. 1". Archived from the original on 23 December 2013. Retrieved 10 June 2015.

- "Iran Investment monthly" (PDF). Turquoisepartners.com. May 2014. Archived (PDF) from the original on 14 July 2014. Retrieved 15 August 2018.

- AzerNews. "Iranian government likely forced to double fuel prices". AzerNews. Archived from the original on 8 June 2015. Retrieved 10 June 2015.

- "Iranian Parliament Passes Budget in Win for Rouhani". VOA. Archived from the original on 29 November 2014. Retrieved 10 June 2015.

- "Iran to draw on sovereign fund to withstand oil price slide". Yahoo Finance. 15 November 2014. Archived from the original on 15 August 2018. Retrieved 10 June 2015.

- Iran Investment Monthly (January 2015) Archived 3 March 2016 at the Wayback Machine. Turquoise Partners. Retrieved 25 February 2015.

- "Iran's Neoliberal Austerity-Security Budget". Payvand.com. 16 February 2015. Archived from the original on 21 August 2016. Retrieved 21 February 2015.

- Iran Investment Monthly (December 2014) Archived 26 February 2015 at the Wayback Machine. Turquoise Partners. Retrieved 25 February 2015.

- Iran Investment Monthly (January 2015) Archived 3 March 2016 at the Wayback Machine. Turquoise Partners. Retrieved 26 February 2015.

- "Memorandum of the foreign trade regime of Iran" (PDF). Ministry of Commerce. November 2009. Archived from the original (PDF) on 13 July 2011. Cite journal requires

|journal=(help) - "Govt. favors weaning research from national budget". Tehrantimes.com. 29 July 2015. Archived from the original on 10 June 2016. Retrieved 15 August 2018.

- "Rouhani presents $262b budget bill to Majlis". Tehran Times. Tehran Times Social Desk. 18 January 2016. Archived from the original on 31 January 2016. Retrieved 24 January 2016.

- "Iran Investment monthly" (PDF). Turquoisepartners.com. October 2016. Archived (PDF) from the original on 5 September 2017. Retrieved 15 August 2018.

- "Archived copy". Archived from the original on 12 February 2009. Retrieved 12 February 2009.CS1 maint: archived copy as title (link)

- "Mohammad Ali Abtahi - Weblog". Webneveshteha.com. 8 October 2006. Archived from the original on 21 February 2012. Retrieved 7 February 2012.

- "Mohammad Ali Abtahi - Weblog". Webneveshteha.com. 13 November 2006. Archived from the original on 27 September 2007. Retrieved 7 February 2012.

- "Mohammad Ali Abtahi - Weblog". Webneveshteha.com. 7 September 2005. Archived from the original on 21 February 2012. Retrieved 7 February 2012.

- "Mohammad Ali Abtahi - Media - Articles". Webneveshteha.com. Archived from the original on 21 February 2012. Retrieved 7 February 2012.

- "Mohammad Ali Abtahi - Weblog". Webneveshteha.com. 11 January 2004. Archived from the original on 21 February 2012. Retrieved 7 February 2012.

Literature

- Ray Takeyh: Hidden Iran - Paradox and Power in the Islamic Republic, New York 2006, ISBN

External links

Media related to Politics of Iran at Wikimedia Commons

Media related to Politics of Iran at Wikimedia Commons- Memorandum of the foreign trade regime of Iran - 145-page official PDF document describing all Ministries and institutes affiliated to the Government of Iran

- Guide: How Iran is Ruled from BBC News, includes flowchart

- Iran Government at Curlie

- Iran who hold the power- BBC In depth

- Iranian Political History collection at the University of Maryland libraries