Remittances to India

Remittances to India are money transfers (called remittance) from non-resident Indians (NRIs) employed outside the country to family, friends or relatives residing in India. India is the world's top receiver of remittances, claiming more than 12% of the world's remittances in 2015.[1][2] Remittances to India stood at US$68.968 billion in 2017 and remittances from India to other countries totalled US$5.710 billion, for a net inflow of US$63.258 billion in 2017.[3][4][5]

As per the Ministry of Overseas Indian Affairs (MOIA), remittance is received from the approximately 35 million members of the Indian diaspora.[6]

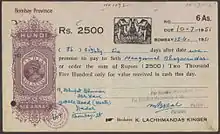

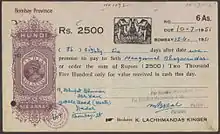

History

Overview

Under the Foreign Exchange Management Act (FEMA) of 1999, Non Resident Indians (NRIs) and Persons of Indian Origin (PIOs) can open and maintain three types of accounts namely, Non-Resident Ordinary Rupee Account (NRO Account), Non-Resident (External) Rupee Account (NRE Account) and Foreign Currency Non Resident (Bank) Account – FCNR (B) Account. NRO Accounts are not repatriable except for all current income. Balances in an NRO account of NRIs/ PIOs are remittable up to US$1 (one) million per financial year (April–March) along with their other eligible assets. NRE Accounts are repatriable. Credits permitted to NRE account are inward remittance from outside India, interest accruing on the account, interest on investment, transfer from other NRE/ FCNR(B) accounts, maturity proceeds of investments (if such investments were made from this account or through inward remittance). Inward remittances from outside India, legitimate dues in India and transfers from other NRO accounts are permissible credits to NRO account.[7] [8]

Since 1991, India has experienced sharp remittance growth. In 1991 Indian remittances were valued at 2.1 billion USD;[5][9] in 2006, they were estimated at between $22 billion[10] and $25.7 billion.[4] which grew to $67.6 billion in 2012-13, up from $66.1 billion the fiscal year, 2011-2012,[6] when the remittance exceed the foreign direct investment(FDI) inflow of $46.84 billion into India.[11]

Money is sent to India either electronically (for example, by SWIFT) or by demand draft. In recent years many banks are offering money transfers and this has grown into a huge business. Around 40% of the India's remittances flow to the states of Kerala, Andhra Pradesh, Tamil Nadu, Punjab and Uttar Pradesh which are among the top international remittance receiving states.[11][12] States like Andhra Pradesh and Tamil Nadu get most of their remittance from the USA, Kerala from UAE, Punjab from Canada as most of the people migrate from their states to these countries. Research work on remittances to India is listed in the India Migration Bibliography.[13]

In recent years many Indian Immigrants have used online money transfer services to send money from overseas to India. In recent years, many new Online and mobile companies have facilitated the transition to online remittances. Even some Indian banks have recently offered such services.[14]

A 2012 study, by Reserve Bank of India revealed 30.8% of total foreign remittances was from West Asia, compared to 29.4% from North America and 19.5% from Europe.[11]

However, owing to the onslaught of COVID-19, the World Bank has estimated a 9% decline in the remittances to India.[15]

Remittances to India by fiscal year

The following table illustrates the remittances to India as percent of GDP, 1990–1991 to 2005–2010.[16][17][18]

| Year | Remittances | Percent GDP |

|---|---|---|

| 1990–1991 | US$2.10 bn | 0.70% |

| 1995–1996 | US$8.50 bn | 3.22% |

| 1999–2000 | US$12.07 bn | 2.72% |

| 2000–2001 | US$12.85 bn | 2.84% |

| 2001–2002 | US$15.40 bn | 3.29% |

| 2002–2003 | US$16.39 bn | 3.39% |

| 2003–2004 | US$21.61 bn | 3.69% |

| 2004–2005 | US$20.25 bn | 3.03% |

| 2005–2006 | US$24.55 bn | 3.08% |

| 2006–2007 | US$29.10 bn | |

| 2007–2008 | US$37.20 bn | |

| 2008–2009 | US$51.60 bn | |

| 2009–2010 | US$55.06 bn | |

| 2011–2012 | US$66.10 bn | 4.00% [11] |

| 2012–2013 | US$67.60 bn | [6] |

| 2013-2014 | US$70.39 bn | [19][20] |

| 2014-2015 | US$66.30 bn | [18] |

| 2015–2016 | US$62.70 bn | |

| 2016–2017 | US$65.30 bn | |

| 2017–2018 | US$80.00 bn | |

Remittances to and from India by country

According to the Pew Research Center in 2017, the World Bank estimated that a total of US$68.968 billion was made in remittances to India from other countries, and a total of US$5.710 billion was made in remittances to other countries from India, for a net inflow of $63.258 billion. Figures for remittances between India and Pakistan are not available. The table on left lists the major source countries for remittances to India, and the table on the right lists the major destination countries for remittances from India in 2017.[3] Somewhat different figures have been estimated by the Reserve Bank of India.[21]

Remittances to IndiaFigures for remittances between India and Pakistan are not available.

|

Remittances from IndiaFigures for remittances between India and Pakistan are not available.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

See also

- Remittance related

- Indian economy related

- Economy of India

- Business process outsourcing to India

- Foreign trade of India

- List of exports of India

- Largest trading partners of India

- Factors influencing remittances to India

- Others

References

- "International Migration at All-Time High". The World Bank. 18 December 2015. Retrieved 27 May 2016.

- "Pakistan 4th largest source of remittances to India". The Business Standard. 24 December 2015. Retrieved 27 May 2016.

- "Remittance flows by country 2017". Pew Research Center. Retrieved 7 April 2019.

- "Remittances from Indians abroad push India to the top". www.nrirealtynews.com. 22 October 2007. Retrieved 14 March 2009.

- Gupta, Poonam (1 December 2005). Macroeconomic Determinants of Remittances: Evidence from India. International Monetary Fund. ISBN 9781451862430. Retrieved 14 March 2009.

- "Remittances from Indian diaspora on the rise". The Economic Times. 19 February 2014. Retrieved 23 February 2014.

- "Accounts in India by Non Resident Indians".

- "Facilities for Non Resident Indians (NRIs) and Persons of Indian Origin (PIOs)". Reserve Bank of India. Retrieved 23 February 2014.

- Chishti, Muzaffar (February 2007). "The Rise in Remittances to India: A Closer Look". Migration Policy Institute. Retrieved 14 March 2009.

- "Remittances to India touch $22 billion". The Financial Express. 26 October 2006. Retrieved 14 March 2009.

- "NRIs beat FDI, keep the money coming". Hindustan Times. 8 October 2012. Retrieved 23 February 2014.

- Tumbe, Chinmay (March 2011). "Remittances in India: Facts and Issues". IIMB Working Paper No. 331. SSRN 1780289. Missing or empty

|url=(help) - Tumbe, Chinmay (July 2012). "India Migration Bibliography". Indian Institute of Management Bangalore. SSRN 2117805. Missing or empty

|url=(help) - "Compare Money Transfer to India. Get Best USD to INR Exchange Rate". ExchangeRateIQ. Retrieved 22 July 2017.

- "Remittances to India to drop by 9% in 2020: World Bank report". Live Mint. 30 November 2020. Retrieved 30 November 2020.

- Chishti, Muzaffar (February 2007). "The Rise in Remittances to India: A Closer Look". Migration Information Source. Archived from the original on 4 December 2010. Retrieved 28 July 2011.

- "Figure 4. Remittances to India, 1970 to 2008". Migration Information Source. Archived from the original on 4 December 2010. Retrieved 28 July 2011.

- "India world's largest remittance recipient in 2015: World Bank". The Times of India. Retrieved 14 April 2016.

- "India Wins the Remittance Race Again". The Wall Street Journal. 15 April 2015. Retrieved 10 September 2015.

- "India tops global remittances list; received $70 billion in 2013: World Bank". The Economic Times. 11 April 2014. Retrieved 12 April 2014.

- "Reserve Bank of India - RBI Bulletin". m.rbi.org.in. Retrieved 18 December 2020.