Welfare

Welfare is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter.[1] Social security may either be synonymous with welfare,[lower-alpha 1] or refer specifically to social insurance programs, which provide support only to those who have previously contributed (e.g. most pension systems), as opposed to social assistance programs, which provide support on the basis of need alone (e.g. most disability benefits).[6][7] The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.[8][9]

More broadly, welfare may also encompass efforts to provide a basic level of well-being through free or subsidized social services such as healthcare, education, vocational training and public housing.[10][11] In a welfare state, the State assumes responsibility for the health, education, and welfare of society, providing a range of social services such as those described.[11]

The first welfare state was Imperial Germany (1871–1918), where the Bismarck government introduced social security in 1889.[12] In the early 20th century, the United Kingdom introduced social security around 1913, and adopted the welfare state with the National Insurance Act 1946, during the Attlee government (1945–51).[11] In the countries of western Europe, Scandinavia, and Australasia, social welfare is mainly provided by the government out of the national tax revenues, and to a lesser extent by non-government organizations (NGOs), and charities (social and religious).[11] A right to social security and an adequate standard of living is asserted in Articles 22 and 25 of the Universal Declaration of Human Rights.[6][lower-alpha 2]

History

In the Roman Empire, the first emperor Augustus provided the Cura Annonae or grain dole for citizens who could not afford to buy food every month. Social welfare was enlarged by the Emperor Trajan.[14] Trajan's program brought acclaim from many, including Pliny the Younger.[15] The Song dynasty government (960 CE) supported multiple programs which could be classified as social welfare, including the establishment of retirement homes, public clinics, and paupers' graveyards. According to economist Robert Henry Nelson, "The medieval Roman Catholic Church operated a far-reaching and comprehensive welfare system for the poor..."[16][17]

In the Islamic world, Zakat (charity), one of the Five Pillars of Islam, have been collected by the government since the time of the Rashidun caliph Umar in the 7th century, and used to provide income for the needy, including the poor, elderly, orphans, widows, and the disabled. According to the Islamic jurist Al-Ghazali (Algazel, 1058–111), the government was also expected to store up food supplies in every region in case a disaster or famine occurred.[18][19] (See Bayt al-mal for further information.)

Likewise, in Jewish tradition, charity (represented by tzedakah) is a matter of religious obligation rather than benevolence. Contemporary charity is regarded as a continuation of the Biblical Maaser Ani, or poor-tithe, as well as Biblical practices, such as permitting the poor to glean the corners of a field and harvest during the Shmita (Sabbatical year).

There is relatively little statistical data on transfer payments before the High Middle Ages. In the medieval period and until the Industrial Revolution, the function of welfare payments in Europe was achieved through private giving or charity, through numerous confraternities and activities of different religious orders. Early welfare programs in Europe included the English Poor Law of 1601, which gave parishes the responsibility for providing welfare payments to the poor.[20] This system was substantially modified by the 19th-century Poor Law Amendment Act, which introduced the system of workhouses.

It was predominantly in the late 19th and early 20th centuries that an organized system of state welfare provision was introduced in many countries. Otto von Bismarck, Chancellor of Germany, introduced one of the first welfare systems for the working classes.[21] In Great Britain the Liberal government of Henry Campbell-Bannerman and David Lloyd George introduced the National Insurance system in 1911,[22] a system later expanded by Clement Attlee.

Modern welfare states include Germany, France, the Netherlands,[23] as well as the Nordic countries, such as Iceland, Sweden, Norway, Denmark, and Finland[24] which employ a system known as the Nordic model. Esping-Andersen classified the most developed welfare state systems into three categories; Social Democratic, Conservative, and Liberal.[25]

A report published by the ILO in 2014 estimated that only 27% of the world's population has access to comprehensive social security.[26] The World Bank's 2019 World Development Report argues that the traditional payroll-based model of many kinds of social insurance are "increasingly challenged by working arrangements outside standard employment contracts."[21]

Forms

Welfare can take a variety of forms, such as monetary payments, subsidies and vouchers, or housing assistance. Welfare systems differ from country to country, but welfare is commonly provided to individuals who are unemployed, those with illness or disability, the elderly, those with dependent children, and veterans. Programs may have a variety of conditions for a person to receive welfare:

- Social insurance, discussed previously

- Means-tested benefits, financial assistance provided for those who are unable to cover basic needs, such as food, clothing and housing, due to poverty or lack of income because of unemployment, sickness, disability, or caring for children. While assistance is often in the form of financial payments, those eligible for social welfare can usually access health and educational services free of charge. The amount of support is enough to cover basic needs and eligibility is often subject to a comprehensive and complex assessment of an applicant's social and financial situation. See also Income Support.

- Non-contributory benefits. Several countries have special schemes, administered with no requirement for contributions and no means test, for people in certain categories of need: for example, veterans of armed forces, people with disabilities and very old people.

- Discretionary benefits. Some schemes are based on the decision of an official, such as a social worker.

- Universal or categorical benefits, also known as demogrants. These are non-contributory benefits given for whole sections of the population without a means test, such as family allowances or the public pension in New Zealand (known as New Zealand Superannuation). See also the Alaska Permanent Fund Dividend.

Social protection

In developing countries, formal social security arrangements are often absent for the vast majority of the working population, in part due to reliance on the informal economy. Additionally, the state's capacity to reach people may be limited because of its limited infrastructure and resources. In this context, social protection is often referred to instead of social security, encompassing a broader set of means, such as labour market intervention and local community-based programs, to alleviate poverty and provide security against things like unemployment.[27][28][29]

By country

Australia

Prior to 1900 in Australia, charitable assistance from benevolent societies, sometimes with financial contributions from the authorities, was the primary means of relief for people not able to support themselves.[30] The 1890s economic depression and the rise of the trade unions and the Labor parties during this period led to a movement for welfare reform.[31]

In 1900, the states of New South Wales and Victoria enacted legislation introducing non-contributory pensions for those aged 65 and over. Queensland legislated a similar system in 1907 before the Australian labor Commonwealth government led by Andrew Fisher introduced a national aged pension under the Invalid and Old-Aged Pensions Act 1908. A national invalid disability pension was started in 1910, and a national maternity allowance was introduced in 1912.[30][32]

During the Second World War, Australia under a labor government created a welfare state by enacting national schemes for: child endowment in 1941 (superseding the 1927 New South Wales scheme); a widows’ pension in 1942 (superseding the New South Wales 1926 scheme); a wife's allowance in 1943; additional allowances for the children of pensioners in 1943; and unemployment, sickness, and special benefits in 1945 (superseding the Queensland 1923 scheme).[30][32]

Canada

Canada has a welfare state in the European tradition; however, it is not referred to as "welfare", but rather as "social programs". In Canada, "welfare" usually refers specifically to direct payments to poor individuals (as in the American usage) and not to healthcare and education spending (as in the European usage).[33]

The Canadian social safety net covers a broad spectrum of programs, and because Canada is a federation, many are run by the provinces. Canada has a wide range of government transfer payments to individuals, which totaled $145 billion in 2006.[34] Only social programs that direct funds to individuals are included in that cost; programs such as medicare and public education are additional costs.

Generally speaking, before the Great Depression, most social services were provided by religious charities and other private groups. Changing government policy between the 1930s and 1960s saw the emergence of a welfare state, similar to many Western European countries. Most programs from that era are still in use, although many were scaled back during the 1990s as government priorities shifted towards reducing debt and deficits.

Denmark

Danish welfare is handled by the state through a series of policies (and the like) that seeks to provide welfare services to citizens, hence the term welfare state. This refers not only to social benefits, but also tax-funded education, public child care, medical care, etc. A number of these services are not provided by the state directly, but administered by municipalities, regions or private providers through outsourcing. This sometimes gives a source of tension between the state and municipalities, as there is not always consistency between the promises of welfare provided by the state (i.e. parliament) and local perception of what it would cost to fulfill these promises.

Finland

India

The Central Government of India's social programmes and welfare expenditures are a substantial portion of the official budget, and state and local governments play roles in developing and implementing social security policies. Additional welfare measure systems are also uniquely operated by various state governments. The government uses the unique identity number (Aadhar) that every Indian possesses to distribute welfare measures in India. As of 2020, the government's expenditure on social programme and welfare (direct cash transfers, financial inclusion, benefits, health and other insurances, subsidies, free school meals, rural employment guarantee), was approximately 14 lakh crore rupees ($192 billion), which was 7.3% of gross domestic product (GDP).

France

Solidarity is a strong value of the French Social Protection system. The first article of the French Code of Social Security describes the principle of solidarity. Solidarity is commonly comprehended in relations of similar work, shared responsibility and common risks. Existing solidarities in France caused the expansion of health and social security.[35][36][37]

Germany

The welfare state has a long tradition in Germany dating back to the industrial revolution. Due to the pressure of the workers' movement in the late 19th century, Reichskanzler Otto von Bismarck introduced the first rudimentary state social insurance scheme. Under Adolf Hitler, the National Socialist Program stated "We demand an expansion on a large scale of old age welfare". Today, the social protection of all its citizens is considered a central pillar of German national policy. 27.6 percent of Germany's GDP is channeled into an all-embracing system of health, pension, accident, longterm care and unemployment insurance, compared to 16.2 percent in the US. In addition, there are tax-financed services such as child benefits (Kindergeld, beginning at €192 per month for the first and second child, €198 for the third and €223 for each child thereafter, until they attain 25 years or receive their first professional qualification),[38] and basic provisions for those unable to work or anyone with an income below the poverty line.[39]

Since 2005, reception of full unemployment pay (60–67% of the previous net salary) has been restricted to 12 months in general and 18 months for those over 55. This is now followed by (usually much lower) Arbeitslosengeld II (ALG II) or Sozialhilfe, which is independent of previous employment (Hartz IV concept).

As of 2020, under ALG II, single adults receive up to €432 per month plus the cost of 'adequate' housing. ALG II can also be paid partially to employed persons to supplement a low work income.

Italy

The Italian welfare state's foundations were laid along the lines of the corporatist-conservative model, or of its Mediterranean variant. Later, in the 1960s and 1970s, increases in public spending and a major focus on universality brought it on the same path as social-democratic systems. In 1978, a universalistic welfare model was introduced in Italy, offering a number of universal and free services such as a National Health Fund.[40]

Japan

Social welfare, assistance for the ill or otherwise disabled and for the old, has long been provided in Japan by both the government and private companies. Beginning in the 1920s, the government enacted a series of welfare programs, based mainly on European models, to provide medical care and financial support. During the postwar period, a comprehensive system of social security was gradually established.[41][42]

History

The 1980s, marked a change in the structure of Latin American social protection programs. Social protection embraces three major areas: social insurance, financed by workers and employers; social assistance to the population's poorest, financed by the state; and labor market regulations to protect worker rights.[43] Although diverse, recent Latin American social policy has tended to concentrate on social assistance.

The 1980s, had a significant effect on social protection policies. Prior to the 1980s, most Latin American countries focused on social insurance policies involving formal sector workers, assuming that the informal sector would disappear with economic development. The economic crisis of the 1980s and the liberalization of the labor market led to a growing informal sector and a rapid increase in poverty and inequality. Latin American countries did not have the institutions and funds to properly handle such a crisis, both due to the structure of the social security system, and to the previously implemented structural adjustment policies (SAPs) that had decreased the size of the state.

New Welfare programs have integrated the multidimensional, social risk management, and capabilities approaches into poverty alleviation. They focus on income transfers and service provisions while aiming to alleviate both long- and short-term poverty through, among other things, education, health, security, and housing. Unlike previous programs that targeted the working class, new programs have successfully focused on locating and targeting the very poorest.

The impacts of social assistance programs vary between countries, and many programs have yet to be fully evaluated. According to Barrientos and Santibanez, the programs have been more successful in increasing investment in human capital than in bringing households above the poverty line. Challenges still exist, including the extreme inequality levels and the mass scale of poverty; locating a financial basis for programs; and deciding on exit strategies or on the long-term establishment of programs.[43]

1980s impacts

The economic crisis of the 1980s led to a shift in social policies, as understandings of poverty and social programs evolved (24). New, mostly short-term programs emerged. These include:[44]

- Argentina: Jefes y Jefas de Hogar, Asignación Universal por Hijo

- Bolivia: Bonosol

- Brazil: Bolsa Escola and Bolsa Familia

- Chile: Chile Solidario

- Colombia: Solidaridad por Colombia

- Ecuador: Bono de Desarrollo Humano

- Honduras: Red Solidaria

- Mexico: Prospera (earlier known as Oportunidades)

- Panama: Red de Oportunidades

- Peru: Juntos

Major aspects of current social assistance programs

- Conditional cash transfer (CCT) combined with service provisions. Transfer cash directly to households, most often through the women of the household, if certain conditions are met (e.g. children's school attendance or doctor visits) (10). Providing free schooling or healthcare is often not sufficient, because there is an opportunity cost for the parents in, for example, sending children to school (lost labor power), or in paying for the transportation costs of getting to a health clinic.

- Household. The household has been the focal point of social assistance programs.

- Target the poorest. Recent programs have been more successful than past ones in targeting the poorest. Previous programs often targeted the working class.

- Multidimensional. Programs have attempted to address many dimensions of poverty at once. Chile Solidario is the best example.

New Zealand

New Zealand is often regarded as having one of the first comprehensive welfare systems in the world. During the 1890s a Liberal government adopted many social programmes to help the poor who had suffered from a long economic depression in the 1880s. One of the most far reaching was the passing of tax legislation that made it difficult for wealthy sheep farmers to hold onto their large land holdings. This and the invention of refrigeration led to a farming revolution where many sheep farms were broken up and sold to become smaller dairy farms. This enabled thousands of new farmers to buy land and develop a new and vigorous industry that has become the backbone of New Zealand's economy to this day. This liberal tradition flourished with increased enfranchisement for indigenous Maori in the 1880s and women. Pensions for the elderly, the poor and war casualties followed, with State-run schools, hospitals and subsidized medical and dental care. By 1960, New Zealand was able to afford one of the best-developed and most comprehensive welfare systems in the world, supported by a well-developed and stable economy.

Philippines

Poland

South Africa

Spain

Sub-Saharan Africa

Sweden

Social welfare in Sweden is made up of several organizations and systems dealing with welfare. It is mostly funded by taxes, and executed by the public sector on all levels of government as well as private organizations. It can be separated into three parts falling under three different ministries; social welfare, falling under the responsibility of Ministry of Health and Social Affairs; education, under the responsibility of the Ministry of Education and Research and labor market, under the responsibility of Ministry of Employment.[45]

Government pension payments are financed through an 18.5% pension tax on all taxed incomes in the country, which comes partly from a tax category called a public pension fee (7% on gross income), and 30% of a tax category called employer fees on salaries (which is 33% on a netted income). Since January 2001, the 18.5% is divided in two parts: 16% goes to current payments, and 2.5% goes into individual retirement accounts, which were introduced in 2001. Money saved and invested in government funds, and IRAs for future pension costs, are roughly 5 times annual government pension expenses (725/150).

United Kingdom

- UK Government welfare expenditure 2011–12

- State pension (46.32%)

- Housing Benefit (10.55%)

- Disability Living Allowance (7.87%)

- Pension Credit (5.06%)

- Income Support (4.31%)

- Rent rebates (3.43%)

- Attendance Allowance (3.31%)

- Jobseeker's Allowance (3.06%)

- Incapacity Benefit (3.06%)

- Council Tax Benefit (3%)

- Other (10.03%)[46]

The United Kingdom has a long history of welfare, notably including the English Poor laws which date back to 1536. After various reforms to the program, which involved workhouses, it was eventually abolished and replaced with a modern system by laws such as National Assistance Act 1948.

In more recent times, comparing the Cameron–Clegg coalition's austerity measures with the Opposition's, the Financial Times commentator Martin Wolf commented that the "big shift from Labour ... is the cuts in welfare benefits."[47] The government's austerity programme, which involves reduction in government policy, has been linked to a rise in food banks. A study published in the British Medical Journal in 2015 found that each 1 percentage point increase in the rate of Jobseeker's Allowance claimants sanctioned was associated with a 0.09 percentage point rise in food bank use.[48] The austerity programme has faced opposition from disability rights groups for disproportionately affecting disabled people. The "bedroom tax" is an austerity measure that has attracted particular criticism, with activists arguing that two-thirds of council houses affected by the policy are occupied with a person with a disability.[49]

United States

In the United States, depending on the context, the term "welfare" can be used to refer to means-tested cash benefits, especially the Aid to Families with Dependent Children (AFDC) program and its successor, the Temporary Assistance for Needy Families Block Grant, or it can be used to refer to all means-tested programs that help individuals or families meet basic needs, including, for example, health care through Medicaid, Supplemental Security Income (SSI) benefits and food and nutrition programs (SNAP). It can also include Social Insurance programs such as Unemployment Insurance, Social Security, and Medicare.

AFDC (originally called Aid to Dependent Children) was created during the Great Depression to alleviate the burden of poverty for families with children and allow widowed mothers to maintain their households. The New Deal employment program such as the Works Progress Administration primarily served men. Prior to the New Deal, anti-poverty programs were primarily operated by private charities or state or local governments; however, these programs were overwhelmed by the depth of need during the Depression.[50] The United States has no national program of cash assistance for non-disabled poor individuals who are not raising children.

Until early in the year of 1965, the news media was conveying only whites as living in poverty however that perception had changed to blacks.[51] Some of the influences in this shift could have been the civil rights movement and urban riots from the mid 60s. Welfare had then shifted from being a White issue to a Black issue and during this time frame the war on poverty had already begun.[51] Subsequently, news media portrayed stereotypes of Blacks as lazy, undeserving and welfare queens. These shifts in media don't necessarily establish the population living in poverty decreasing.[51]

In 1996, the Personal Responsibility and Work Opportunity Reconciliation Act changed the structure of Welfare payments and added new criteria to states that received Welfare funding. After reforms, which President Clinton said would "end Welfare as we know it",[53] amounts from the federal government were given out in a flat rate per state based on population.[54] Each state must meet certain criteria to ensure recipients are being encouraged to work themselves out of Welfare. The new program is called Temporary Assistance for Needy Families (TANF).[55][56] It encourages states to require some sort of employment search in exchange for providing funds to individuals, and imposes a five-year lifetime limit on cash assistance.[53][55][57] In FY 2010, 31.8% of TANF families were white, 31.9% were African-American, and 30.0% were Hispanic.[56]

According to the U.S. Census Bureau data released September 13, 2011, the nation's poverty rate rose to 15.1% (46.2 million) in 2010,[58] up from 14.3% (approximately 43.6 million) in 2009 and to its highest level since 1993. In 2008, 13.2% (39.8 million) Americans lived in relative poverty.[59]

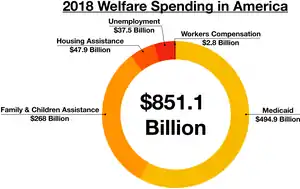

In a 2011 op-ed in Forbes, Peter Ferrara stated that, "The best estimate of the cost of the 185 federal means tested Welfare programs for 2010 for the federal government alone is nearly $700 billion, up a third since 2008, according to the Heritage Foundation. Counting state spending, total Welfare spending for 2010 reached nearly $900 billion, up nearly one-fourth since 2008 (24.3%)".[60] California, with 12% of the U.S. population, has one-third of the nation's welfare recipients.[61]

In FY 2011, federal spending on means-tested welfare, plus state contributions to federal programs, reached $927 billion per year. Roughly half of this welfare assistance – or $462 billion – went to families with children, most of which are headed by single parents.[62]

The United States has also typically relied on charitable giving through non-profit agencies and fundraising instead of direct monetary assistance from the government itself. According to Giving USA, Americans gave $358.38 billion to charity in 2014. This is rewarded by the United States government through tax incentives for individuals and companies that are not typically seen in other countries.

Effects

The welfare-to-work intervention programme is unlikely to have any impacts on the mental and physical health of lone parents and children. Even when the employment and income rates were higher in this group of people, the poverty rate was high which could lead to persistently high rates of depression whether they were in the programme or not.[63]

Income transfers can be either conditional or unconditional. Conditionalities are sometimes criticized as being paternalistic and unnecessary.

A 2008 study by welfare economist and Brown University Professor Allan M. Feldman[64] suggests that welfare can achieve both competitive equilibrium and Pareto efficiency in the market.[65]

Some opponents of welfare argue that it affects work incentives.

Perception

According to a 2012 review study, whether a welfare program generates public support depends on:[66]

- whether the program is universal or targeted towards certain groups

- the size of the social program benefits (larger benefits incentivize greater mobilization to defend a social program)

- the visibility and traceability of the benefits (whether recipients know where the benefits come from)

- the proximity and concentration of the beneficiaries (this affects the ease by which beneficiaries can organize to protect a social program)

- the duration of the benefits (longer benefits incentivize greater mobilization to defend a social program)

- the manner in which a program is administered (e.g. is the program inclusive, does it follow principles?)

See also

- Basic income

- Contingencies fund

- Economic, social and cultural rights

- Financing and benefit structure

- Human Poverty Index

- Human security

- List of countries by Social Progress Index

- List of countries by social welfare spending

- Poverty reduction

- Social democracy

- Social liberalism

- Social policy

- Social safety net

- The Four Pillars

- Welfare reform

- Welfare rights

- Welfare trap

- Workfare

Notes

- Except in the United States and Canada, where welfare refers only to direct financial assistance for poor or disabled people.[2][3] In the U.S. it often refers to the Temporary Assistance for Needy Families program, while "Social Security" is a specific social insurance program.[4][5]

-

Everyone, as a member of society, has the right to social security and is entitled to realization, through national effort and international co-operation and in accordance with the organization and resources of each State, of the economic, social and cultural rights indispensable for his dignity and the free development of his personality. [...]

Everyone has the right to a standard of living adequate for the health and well-being of himself and of his family, including food, clothing, housing and medical care and necessary social services, and the right to security in the event of unemployment, sickness, disability, widowhood, old age or other lack of livelihood in circumstances beyond his control.[13]

References

- "Social welfare program". Encyclopedia Britannica.

- Brown, Taylor Kate (26 August 2016). "How US welfare compares around the globe". BBC News.

- Gilles Séguin. "Welfare". Canadian Social Research. Archived from the original on 2012-05-04. Retrieved 2011-02-10.

- "Social Security Versus Welfare: Differences and Similarities". e-forms.us.

- "Social Security And Welfare - What Is The Difference?". www.get.com.

- David S. Weissbrodt; Connie de la Vega (2007). International Human Rights Law: An Introduction. University of Pennsylvania Press. p. 130. ISBN 978-0-8122-4032-0.

- Walker, Robert (1 November 2004). Social Security And Welfare: Concepts And Comparisons: Concepts and Comparisons. McGraw-Hill Education (UK). p. 4. ISBN 978-0-335-20934-7.

- "International Labour Standards on Social security". www.ilo.org.

- Frans Pennings (1 January 2006). Between Soft and Hard Law: The Impact of International Social Security Standards on National Social Security Law. Kluwer Law International B.V. pp. 32–41. ISBN 978-90-411-2491-3.

- J. C. Vrooman (2009). Rules of Relief: Institutions of Social Security, and Their Impact (PDF). Netherlands Institute for Social Research, SCP. pp. 111–126.

- The New Fontana Dictionary of Modern Thought Third Edition (1999), Allan Bullock and Stephen Trombley Eds., p. 919.

- "Social Security History". Social Security. 2019-09-28. Archived from the original on 2019-09-28. Retrieved 2019-09-28.

- United Nations, Universal Declaration of Human Rights

- "Trajan". Britannica.com. Retrieved 8 November 2017.

- "The Roman Empire: in the First Century. The Roman Empire. Emperors. Nerva & Trajan - PBS". Pbs.org. Retrieved 8 November 2017.

- Robert Henry Nelson (2001). "Economics as religión: from Samuelson to Chicago and beyond". Penn State Press. p. 103. ISBN 0-271-02095-4

- "Chapter1: Charity and Welfare", the American Academy of Research Historians of Medieval Spain.

- Crone, Patricia (2005). Medieval Islamic Political Thought. Edinburgh University Press. pp. 308–09. ISBN 978-0-7486-2194-1.

- Shadi Hamid (August 2003). "An Islamic Alternative? Equality, and Redistributive Justice, and the Welfare State in the Caliphate of Umar". Renaissance: Monthly Islamic Journal. 13 (8). Archived from the original on 2003-09-01. Retrieved 2003-09-01.)

- The Poor Laws of England Archived 2010-01-05 at the Wayback Machine at EH.Net

- World Bank World Development Report 2019: The Changing Nature of Work. Chapter 6

- Liberal Reforms at BBC Bitesize

- Shorto, Russell (April 29, 2009). Going Dutch. The New York Times (magazine). Retrieved: June 11, 2016.

- Paul K. Edwards and Tony Elger, The global economy, national states and the regulation of labour (1999) p. 111

- Ferragina, Emanuele; Seeleib-Kaiser, Martin (30 October 2011). "Thematic Review: Welfare regime debate: past, present, futures?" (PDF). Policy & Politics. 39 (4): 583–611. doi:10.1332/030557311X603592.

- "More than 70 per cent of the world population lacks proper social protection". ilo.org. 3 June 2014. Retrieved 24 March 2018.

- "Types of social protection". GSDRC.

- "Track 2: Social Security and Social Protection: Developing Discourses". www.ilera2015.com.

- Mendoza, Roger Lee (1990). The political economy of population control and retirement security in China, India and the Philippines. Philippine Economic Review, 31(2): 174–191.

- "History of Pensions and Other Benefits in Australia". Year Book Australia, 1988. Australian Bureau of Statistics. 1988. Archived from the original on 23 December 2014. Retrieved 23 December 2014.

- Garton, Stephen (2008). "Health and welfare". The Dictionary of Sydney. Archived from the original on 15 August 2012. Retrieved 23 December 2014.

- Yeend, Peter (September 2000). "Welfare Review". Parliament of Australia. Archived from the original on 23 December 2014. Retrieved 23 December 2014.

- "National Standards and Social Programs: What the Federal Government Can Do (BP379e)". 2.parl.gc.ca. Archived from the original on 2016-01-05. Retrieved 8 November 2017.

- "Government transfer payments to persons". Web.rchive.org. 4 November 2008. Archived from the original on 4 November 2008. Retrieved 8 November 2017.

- Samuel Lézé, "France", in: Andrew Scull (ed.), Cultural Sociology of Mental Illness : an A-to-Z Guide, Sage, 2014, pp. 316–17

- Allan Mitchell, A Divided Path: The German Influence on Social Reform in France After 1870 (1991)

- Paul V. Dutton, Origins of the French welfare state: The struggle for social reform in France, 1914–1947. (Cambridge UP, 2002). online

- "Federal Ministry of Family Affairs, Senior Citizens, Women and Youth". Bmfsfj.de. Retrieved 8 November 2017.

- "Society". Tatsachen-ueber-deutschland.de. 15 September 2015. Retrieved 8 November 2017.

- "European Welfare States - Information and Resources". Pitt.edu. Retrieved 8 November 2017.

- "The Evolution of Social Policy in Japan" (PDF). Siteresources.worldbank.org. Retrieved 8 November 2017.

- "ABCD" (PDF). Jcer.or.jp. Retrieved 8 November 2017.

- Barrientos, A. and Claudio Santibanez. (2009). "New Forms of Social, Assistance and the Evolution of Social Protection in Latin America". Journal of Latin American Studies. Cambridge University Press 41, 1–26

- "Home - Chronic Poverty Research Centre". Chronicpoverty.org. Retrieved 8 November 2017.

- "Regeringskansliet med departementen". Regeringen.se (in Swedish). Retrieved 2010-02-26.

- Rogers, Simon; Blight, Garry (4 December 2012). "Public spending by UK government department 2011–12: an interactive guide". The Guardian. Retrieved 2 April 2013.

- Martin Wolf (28 October 2011). "Britain has gone climbing without a rope". The Financial Times. Archived from the original on 2010-11-01.

- Loopstra, Rachel (2015). "Austerity, sanctions, and the rise of food banks in the UK" (PDF). BMJ. 350: 2. doi:10.1136/bmj.h1775. hdl:10044/1/57549. PMID 25854525. S2CID 45641347. Archived from the original (PDF) on 26 June 2015. Retrieved 25 June 2015.

- Ryan, Frances (16 July 2013). "'Bedroom tax' puts added burden on disabled people". Retrieved 25 June 2015.

- Katz, Michael B. (1988). In the Shadow Of the Poorhouse: A Social History Of Welfare In America. New York: Basic Books.

- Soss, Joe; Fording, Richard C. (2003). Schram, Sanford F. (ed.). Race and the politics of welfare reform ([Online-Ausg.]. ed.). Ann Arbor, Mich.: Univ. of Michigan Press. ISBN 978-0472068319.

- "Indicators of Welfare Dependence: Annual Report to Congress, 2008". Aspe.hhs.gov. 19 April 2015. Retrieved 8 November 2017.

- Deparle, Jason (2009-02-02). "Welfare Aid Isn't Growing as Economy Drops Off". The New York Times. Retrieved 2009-02-12.

- "Ending Welfare Reform as We Knew It". The National Review. 2009-02-12. Retrieved 2009-02-12.

- "Stimulus Bill Abolishes Welfare Reform and Adds New Welfare Spending". Heritage Foundation. 2009-02-11. Archived from the original on 2009-03-01. Retrieved 2009-02-12.

- "Characteristics and Financial Circumstances of TANF Recipients – Fiscal Year 2010". United States Department of Health and Human Services.

- Goodman, Peter S. (2008-04-11). "From Welfare Shift in '96, a Reminder for Clinton". The New York Times. Retrieved 2009-02-12.

- "Revised govt formula shows new poverty high: 49.1M". Yahoo! News. November 7, 2011

- "Poverty rate hits 15-year high". Reuters. September 17, 2010

- Ferrara, Peter (2011-04-22). "America's Ever Expanding Welfare Empire". Forbes. Retrieved 2012-04-10.

- "California lawmakers again waging political warfare over welfare". Los Angeles Times. June 24, 2012

- Dawn (January 9, 2014), Grants for Single Mother, Single Mother Guide, retrieved 2014-01-09

- Gibson M, Thomson H, Banas K, Lutje V, McKee MJ, Martin SP, Fenton C, Bambra C, Bond L (26 February 2018). "Welfare-to-work Interventions and Their Effects on the Mental and Physical Health of Lone Parents and Their Children". Cochrane Database of Systematic Reviews. 2 (2): CD009820. doi:10.1002/14651858.CD009820.pub3. PMC 5846185. PMID 29480555.

- "Allan M. Feldman". Brown University.

- Feldman, Allan M. (2017-03-31). Vernengo, Matias; Perez Caldentey, Esteban; Rosser Jr, Barkley J. (eds.). "Welfare Economics". The New Palgrave Dictionary of Economics (2nd ed.). doi:10.1057/978-1-349-95121-5_1417-2.

- Campbell, Andrea Louise (2012-05-11). "Policy Makes Mass Politics". Annual Review of Political Science. 15 (1): 333–351. doi:10.1146/annurev-polisci-012610-135202. ISSN 1094-2939.

Other sources

- Blank, R.M (2001), "Welfare Programs, Economics of", International Encyclopedia of the Social & Behavioral Sciences, pp. 16426–16432, ISBN 9780080430768

- Sheldon Danziger, Robert Haveman, and Robert Plotnick (1981). "How Income Transfer Programs Affect Work, Savings, and the Income Distribution: A Critical Review," Journal of Economic Literature 19(3), pp. 975–1028.

- Haveman, R.H (2001), "Poverty: Measurement and Analysis", International Encyclopedia of the Social & Behavioral Sciences, pp. 11917–11924, doi:10.1016/B0-08-043076-7/02276-2, ISBN 9780080430768

- Steven N. Durlauf et al., ed. (2008) The New Palgrave Dictionary of Economics, 2nd Edition:

- "social insurance" by Stefania Albanesi. Abstract.

- "social insurance and public policy" by Jonathan Gruber Abstract.

- "Welfare state" by Assar Lindbeck. Abstract.

- Nadasen, Premilla, Jennifer Mittelstadt, and Marisa Chappell, Welfare in the United States: A History with Documents, 1935–1996. (New York: Routledge, 2009). 241 pp. ISBN 978-0-415-98979-4

- Samuel Lézé, "Welfare", in : Andrew Scull, J. (ed.), Cultural Sociology of Mental Illness, Sage, 2014, pp. 958–60

- Alfred de Grazia, with Ted Gurr: American Welfare, New York University Press, New York (1962)

- Alfred de Grazia, ed. Grass roots private welfare: winning essays of the 1956 national competition of the Foundation for voluntary Welfare, New York University Press, New York 1957.

External links

| Wikimedia Commons has media related to Welfare. |

| Wikiquote has quotations related to: Welfare |

| Look up welfare in Wiktionary, the free dictionary. |