Economic policy of the Donald Trump administration

The economic policy of the Donald Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, immigration restriction, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.

| ||

|---|---|---|

|

President of the United States

Impeachments

Interactions involving Russia Business and personal  |

||

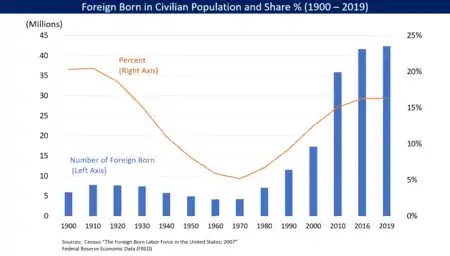

A key part of President Trump's economic strategy during his first three years (2017–2019) was to boost economic growth via tax cuts and additional spending, both of which significantly increased federal budget deficits.[1][2] The positive economic situation he inherited from the Obama administration[3][4][5] continued, with a labor market approaching full employment and measures of household income and wealth continuing to improve further into record territory.[6] President Trump also implemented trade protectionism via tariffs, primarily on imports from China,[1] as part of his "America First" strategy.[7][8] According to the Congressional Budget Office (CBO), the number of Americans without health insurance increased under Trump,[9] while his tax cuts were projected to worsen income inequality.[10]

However, the 128-month (10.7 year) record economic expansion that began in June 2009 abruptly ended at a peak in February 2020, with the U.S. entering a recession due to the COVID-19 pandemic.[11] In response, Trump signed the $2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES) on March 27, 2020 which helped maintain family incomes and savings during the crisis, but contributed to a $3.1 trillion budget deficit (14.9% GDP) for fiscal year 2020, the largest since 1945 relative to the size of the economy.[12][13] The recession was ongoing as of September 2020, with the number of jobs about 4 million below the level when Trump took office and the unemployment rate elevated at 7.9%.[14]

Overview

2017–2019

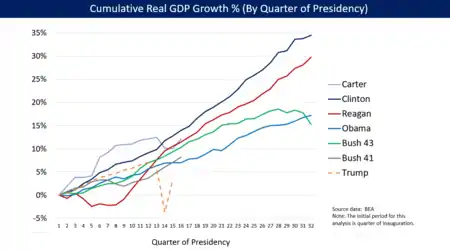

President Trump inherited an economy in January 2017 that was already at a record level on many key measures, such as the number of persons with jobs,[15] real median household income,[17] household net worth,[18] and stock market level. It also featured a low unemployment rate of 4.7%, very low inflation, and a moderate budget deficit.[19][3] While Trump referred to "American carnage" in his first inaugural address and announced an "America First" economic strategy,[8][20] overall the economy when he began was on solid ground in terms of major aggregate measures.[3][4] The Congressional Budget Office forecast in January 2017 that assuming the continuation of Obama policies (current law), real GDP growth would be 1.8% in 2017 and 2.3% in 2018, and unemployment would continue falling to 4.4% by 2018, as the economy reached full employment.[21]

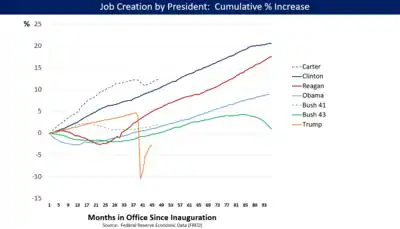

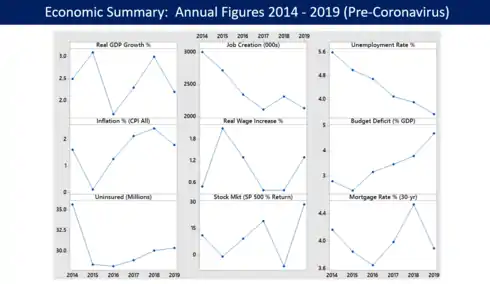

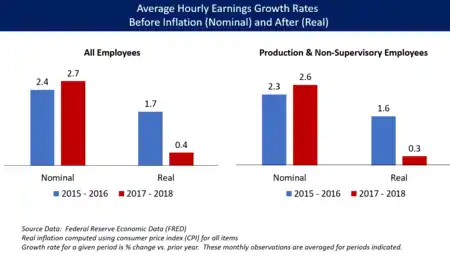

A key part of Trump's economic strategy has been to temporarily boost growth via tax cuts and additional spending,[2] with mixed success.[22] Comparing the 2014–2016 period (President Obama's last three years) with the 2017–2019 period (President Trump's first three years), actual results included several variables that continued their previous improvement trends, such as the unemployment rate, which had been falling since 2010 for all ethnic groups.[23] Some variables improved (e.g., real GDP growth and nominal wage growth) while others worsened (e.g., inflation and real wage growth).[6][22] Compared to the January 2017 Congressional Budget Office (CBO) ten-year forecast just prior to Trump's inauguration, the unemployment rate, job creation, and real GDP improved over the 2017–2019 period.[21]

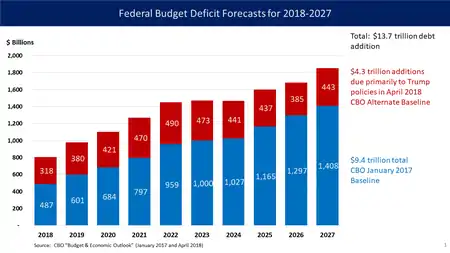

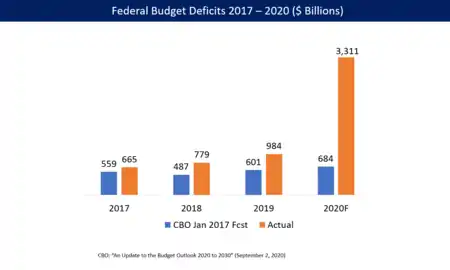

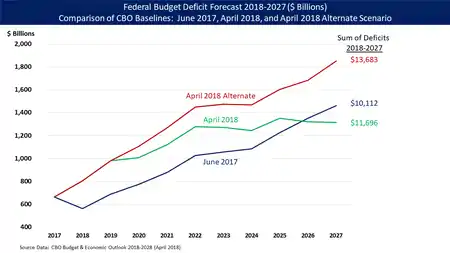

Contributing to this economic performance were large annual budget deficits of $779 billion in 2018 and $984 billion in 2019, about 60% above the CBO 10-year forecast.[21] Sustained economic expansions have historically brought down deficits, indicating the high degree to which economic stimulus has helped growth under Trump.[2] CBO explained in January 2020 that budget deficits averaged 1.5% of GDP over the past 50 years when the economy was "relatively strong (as it is now)." However, the budget deficit was 4.6% GDP in fiscal year 2019 and was expected to average 4.8% GDP over the 2021–2030 period.[1][24] The Committee for a Responsible Federal Budget estimated in January 2020 that President Trump had signed $4.2 trillion of additional debt into law for the 2017–2026 decade, and $4.7 trillion for 2017–2029. This was on top of the $17.2 trillion debt held by the public and the $9.2 trillion already expected to be added to the debt excluding these proposals.[25]

In the labor market, job creation in Trump's first three years was sufficient to continue lowering the unemployment rate to a 50-year record low of 3.5% in September 2019. Job creation 2017-2019 was considerably faster than the CBO forecast just prior to Trump's inauguration, which expected the U.S. to reach full employment by 2018, assuming the continuation of Obama policy.[21] However, job creation was 23% faster in the three years before Trump took office (8.1 million total) than the first 3 years of the Trump Administration (6.6 million total) through January 2020.[26][15]

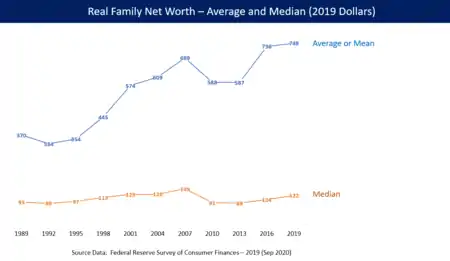

Household financial position also improved in aggregate, with the stock market (S&P500) up a cumulative 45% through Trump's first three years, versus 53% for Obama, -2.5% for Bush and 57% for Clinton for the same time frame.[27][28] Combined with rising home prices, real household net worth set new records in 2017 and 2019, despite a setback in 2018 due to a stock market decline of over 6% that year.[29] However, the bottom 50% of households only received 4% of the gain in net worth through Q3 2019.[30] Real median household income, a good measure of middle-class purchasing power, continued in record territory, rising from $62,898 in 2016 to $68,703 in 2019, a 3% average annual growth rate.[31]

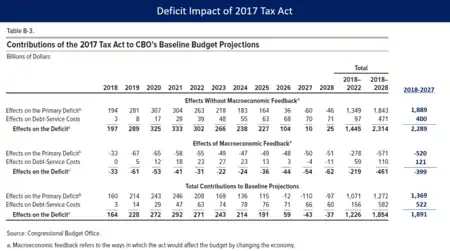

Trump's tax reform plan was signed into law in December 2017, which included substantial tax cuts for higher income taxpayers and corporations as well as repeal of a key Obamacare element, the individual mandate. The Joint Committee on Taxation (JCT) reported that the Tax Act would marginally increase the size of the economy and boost job creation.[32] Due primarily to the Tax Act, the Congressional Budget Office (CBO) increased the estimated national debt addition for the 2018–2027 period by $1.6 trillion, from $10.1 trillion to $11.7 trillion, assuming the individual tax cut elements expire as scheduled after 2025.[33] This was incremental to the existing $20 trillion national debt at the time. Debt held by the public as a percentage of GDP would rise from around 77% GDP in 2017 to as much as 105% GDP by 2028.[34]

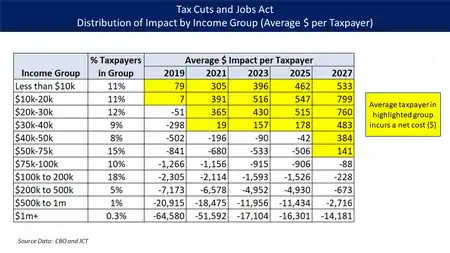

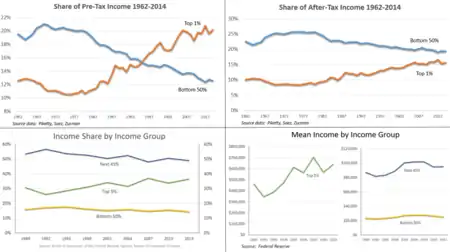

Under the Tax Act, households in all income groups were forecast to initially get a tax cut on average, with families earning $50,000 to $75,000 receiving around $900 in 2018. However, reduced rates for individuals were scheduled to expire after 2025, contributing (along with other factors) to a tax increase for households earning $75,000 or less by 2027 relative to the continuation of prior law.[35] Further, CBO reported that lower-income groups would incur net costs under the tax plan, either paying higher taxes or receiving fewer government benefits: those under $20,000 by 2019; those under $40,000 from 2021 to 2025; and those under $75,000 in 2027 and beyond.[36] As a result, critics argued the tax bill unfairly benefited higher-income taxpayers and corporations at the expense of lower-income taxpayers, and therefore would significantly increase income inequality.[37][38] The CBO reported in December 2019 that it expected inequality to increase from 2016 to 2021, due in part to the Trump tax cuts, with the share of income received by the top 1% rising and other groups falling, and larger tax cuts in percentage terms for higher income groups versus lower.[10] CBS News reported on a study indicating the effective Fortune 500 corporate tax rate in 2018 was the lowest rate in 40 years, at 11.3%, versus 21.2% on average for the 2008–2015 period.[39]

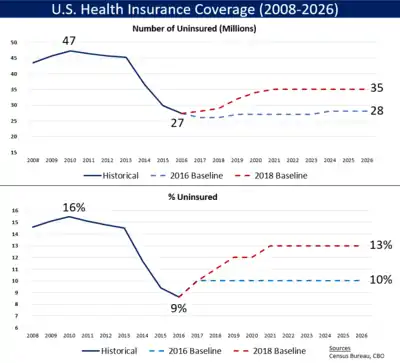

President Trump's healthcare policies have been criticized for their adverse impact.[40] Bills to repeal and replace the Affordable Care Act ("Obamacare") supported by President Trump did not pass Congress in mid-2017, due in part to estimates that over 20 million more persons would become uninsured.[41] The number without health insurance increased by 4.6 million or 16% from the end of 2016 through 2019; 2017 was the first year since 2010 with an increase.[42] CBO forecast in May 2019 that 6 million more would be without health insurance in 2021 under Trump's policies (33 million), relative to continuation of Obama policies (27 million).[9] The number of children under age 19 without health insurance increased by 425,000 from 2017 to 2018, mainly due to a decline in public coverage.[43]

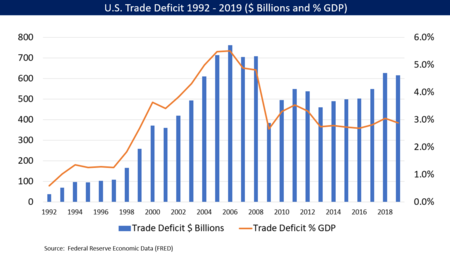

Trump's strategy of "America First" includes protectionism, which he implemented via tariffs in 2018–2019. Studies by the CBO and Federal Reserve estimated that Trump's implemented and threatened tariffs would be paid by Americans (not China or other countries, as Trump often falsely asserted[44]) costing the typical household an estimated $580–$1,280 per year, while marginally slowing GDP and income growth.[1][45] Trump withdrew the U.S. from the Trans-Pacific Partnership in January 2017, although the remaining countries implemented an alternative agreement in December 2018. Trump also signed the United States–Mexico–Canada Agreement to replace NAFTA in November, 2018.[46]

One July 2018 study indicated Trump's policies have had little impact on the U.S. economy in terms of GDP or employment.[47] Analysis conducted by Bloomberg News at the end of Trump's second year in office found that his economy ranked sixth among the last seven presidents, based on fourteen metrics of economic activity and financial performance.[48] Through his first three years in office, Trump falsely characterized the economy during his presidency as the best in American history over 250 times.[49][50]

2020–2021

The 128-month (10.7 year) record economic expansion that began in June 2009 abruptly ended at a peak in February 2020, with the U.S. entering a recession.[11] Pandemic concerns and mitigation measures resulted in over 40 million people filing for unemployment insurance the weeks of March 21 – May 28.[51] The number of unemployed persons jumped from 7.1 million in March 2020 to 23.1 million in April 2020, with the unemployment rate rising from 4.4% to 14.7%. The wider measure of unemployment (U-6) which includes those unemployed but not actively looking for work and those working part time for economic reasons, increased from 8.7% to 22.8%.[52]

Trump signed the $2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES) on March 27, which funded increased unemployment insurance amounts and duration, loans and grants to businesses, and funding for state governments.

The CBO forecast in April 2020 that the budget deficit in fiscal year 2020 would be $3.7 trillion (17.9% GDP), versus the January estimate of $1 trillion (4.6% GDP).[53] The CBO also reported in May 2020 that:

- The unemployment rate increased from 3.5% in February to 14.7% in April, representing a decline of more than 25 million people employed, plus another 8 million persons that exited the labor force.

- Job declines were focused on industries that rely on "in-person interactions" such as retail, education, health services, leisure and hospitality. For example, 8 of the 17 million leisure and hospitality jobs were lost in March and April.

- The economic impact was expected to hit smaller and newer businesses harder, as they typically have less financial cushion.

- Real (inflation-adjusted) consumer spending fell 17% from February to April, as social distancing reached its peak. In April, car and light truck sales were 49% below the late 2019 monthly average. Mortgage applications fell 30% in April 2020 versus April 2019.

- Real GDP was forecast to fall at a nearly 38% annual rate in the second quarter, or 11.2% versus the prior quarter, with a return to positive quarter-to-quarter growth of 5.0% in Q3 and 2.5% in Q4 2020. However, real GDP was not expected to regain its Q4 2019 level until 2022 or later.

- The unemployment rate was forecast to average 11.5% in 2020 and 9.3% in 2021.[54]

After peaking at $19.3 trillion in Q4 2019, real GDP fell to a trough of $17.3 trillion in Q2 2020, a drop of nearly $2 trillion or 10%.[55] The New York Times reported that the economy (real GDP) contracted by a record 9.5% in Q2 2020 (32.6% annualized, later revised to 31.4%), which reduced the overall size of the economy to early 2015 levels. This was twice as large a decline as the Great Recession. However, government efforts at financial support (the $2 trillion CARES Act) were largely successful in helping about 30 million people receiving unemployment benefits as of late July.[56] In Q3 2020, GDP partially recovered to $18.6 trillion, an increase of $1.3 trillion or 7% from the trough (33.1% annualized). Measured from Q4 2016 to Q3 2020, GDP increased by $0.7 trillion or 4%, which represented an annualized average growth rate of 1.0%, the slowest among post-WW2 Presidents.[55][57]

Economic strategy

The economic policy positions of United States President Donald Trump prior to his election had elements from across the political spectrum.[58] However, once in office his actions indicated a politically rightward shift towards more conservative economic policies.[59][60]

Prior to election, then-candidate Trump proposed sizable income tax cuts and deregulation consistent with conservative (Republican Party) policies, along with significant infrastructure investment and status-quo protection for entitlements for the elderly, typically considered liberal (Democratic Party) policies. His anti-globalization policies of trade protectionism and immigration reduction cross party lines.[58] This combination of policy positions from both parties could be considered "populist" and likely succeeded in converting some of the 2012 Obama voters who became Trump voters in 2016.[59]

President Trump announced an "America First" economic strategy in his January 2017 inaugural address: "Every decision on trade, on taxes, on immigration, on foreign affairs, will be made to benefit American workers and American families." The speech included references to infrastructure and military investment, securing the borders, reducing crime, reducing the trade deficit (e.g., "bringing back our wealth"), and protectionism (e.g., "bringing back our jobs"). A central theme of his speech, "American carnage" referred to "rusted-out factories scattered like tombstones" and those "millions upon millions of American workers left behind" by a political "establishment" that "protected itself, but not the citizens of our country."[20] Many of the assertions made in his address were described as false, misleading or exaggerated by fact-checkers.[8][7]

President Trump's 2018 United States federal budget was a statement of his administration's economic priorities for the following decade and indicated a rightward (i.e., more conservative) shift relative to the CBO January 2017 ten-year forecast:

- Republican agenda elements: Nearly $2 trillion in healthcare spending reductions (primarily from Medicaid, a program for lower-income persons), about $1.5 trillion in non-defense discretionary spending cuts, and about $1 trillion in corporate and income tax cuts, representing a net deficit reduction of $2.5 trillion.

- Democratic agenda elements: A net reduction in defense spending of $300 billion, and about $200 billion more for infrastructure, for a net deficit reduction of $100 billion.[61]

Journalist Matthew Yglesias wrote in December 2017 that while Trump campaigned as a populist, much of his post-election economic agenda has been consistent with far-right economic policy: "His decision to refashion himself in office as a down-the-line exponent of hard-right policies has been the key strategic decision of the Trump presidency." Yglesias hypothesized this was a bargain to reduce Congressional oversight of the executive branch.[59] Economist Paul Krugman expressed a similar view in February 2020, writing that Trump's initial promises of a more bi-partisan agenda (e.g., raising taxes on the rich, infrastructure investment and preserving safety net programs) ultimately gave way to pursuing more typical Republican policy priorities of tax cuts and reduced safety net spending, although without the previous concerns about the budget deficit that Republicans expressed during the Obama Administration.[62]

President Trump also sought to enlist the aid of the U.S. Federal Reserve in supporting his attempts to stimulate the economy. Initially, Fed officials hinted in December 2016 that fiscal policy stimulus (i.e., tax cuts and increased government spending) in an economy already near full employment and growing near its maximum sustainable pace of around 2%, might be counteracted by tightening monetary policy (e.g., raising interest rates) to offset the risk of inflation. To paraphrase a former Fed chairman, "The Fed's job is to take away the punch bowl just when the party gets going."[63] However, after raising rates through 2018, in 2019 the Fed reduced interest rates several times, citing the related issues of a global economic slowdown and Trump's trade policies.[64] President Trump often criticized the Fed for raising interest rates during his tenure, although he also criticized the Fed for keeping rates low during President Obama's administration.[65]

Overall evaluations

2017–2019

Economist Justin Wolfers wrote in February 2019: "I've reviewed surveys of about 50 leading economists—liberals and conservatives—run by the University of Chicago. What is startling is that the economists are nearly unanimous in concluding that Mr. Trump's policies are destructive." He assigned a letter grade of A- to the economy's performance overall, despite "failing grades" for Trump's policies, including an "F" grade for trade policy, "D-" for fiscal policy, and a "C" for monetary policy.[66] One July 2018 study indicated Trump's policies have had little impact on the U.S. economy in terms of GDP or employment.[47]

Writing in The New York Times, Steven Rattner explained in August 2018 that "Yes, the economy is continuing to expand nicely, which all Americans should celebrate. But no, there's nothing remarkable in the overall results since Mr. Trump took office. Most importantly, there is little evidence that the president's policies have meaningfully improved the fortunes of those 'forgotten' Americans who elected him."[67] Rattner explained that job creation and real wage growth had slowed comparing the end of the Obama administration with an equal period elapsed during the Trump administration; that the 4.1% real GDP growth in Q2 2018 was increased by non-recurring trade contributions and was exceeded during four quarters of the Obama Administration; that 84% of the benefits of the Trump tax cuts would go to businesses and individuals with incomes greater than $75,000 (thus increasing inequality); that the tax cuts and spending increases were forecast to increase the budget deficit in 2019 to nearly $1 trillion, double the previous forecast; and that half the benefit of the tax cuts for the typical middle-class worker in 2018 would be offset by higher gas prices.[67] Rattner expanded his analysis in December 2018, explaining further that the debt to GDP ratio was on a much higher trajectory compared to the forecast when Trump took office, with as much as $16 trillion more federal debt added over a decade.[68]

Writing in the Washington Post, Heather Long explained in August 2019 that: "[A] closer look at the data shows a mixed picture in terms of whether the economy is any better than it was in Obama's final years. The economy is growing at about the same pace as it did in Obama's last years, and unemployment, while lower under Trump, has continued a trend that began in 2011." Nominal wages, consumer and business confidence, and manufacturing job creation (initially) compared favorably, while government debt, trade deficits, and persons without health insurance did not.[22]

Writing in the Washington Post, Phillip Bump explained that for Trump's first term as of September 2019, performance on several key variables was comparable or below Obama's second term (January 2013 – September 2016), as follows: 1) Real GDP was up 7.5% cumulatively under Obama, versus 7.2% under Trump; 2) The total number of jobs was up 5.3% for Obama, versus 4.3% under Trump; 3) The S&P 500 was up moderately more under Obama at +39.9% versus Trump at +34.2%; 4) The unemployment rate fell 2.9 percentage points under Obama versus 1.2 points under Trump; and 5) the national debt was up 10.5% under Obama, versus 15.1% under Trump.[69]

Factcheck.org reported in November 2019 that: "There's no question the economy has been strong since Trump took office, but it was also strong before he took office, a fact he continues to distort as he falsely puffs up his own record." For example, Trump promised real GDP growth of 4–6% per year, but only achieved 2.9% growth in 2018, the same rate as 2015. Further, job creation was slower under President Trump than comparable periods at the end of the Obama Administration. Many of Trump's claims about unemployment, labor force participation, and median household income were also false or exaggerated.[70]

Writing in The New Yorker, John Cassidy described the opportunity costs of Trump's tax cuts: "Some of the debt that is being issued to pay for the tax cut could have been used to finance investments in infrastructure, renewable energy sources, universal day care, adult retraining, reducing the cost of higher education, or any other number of programs that yield long-term benefits to ordinary Americans. Instead, the biggest handouts went to corporations, who saw their tax rate [statutory] reduced from 35% to 21%."[24]

President Trump claimed in his third State of the Union Address in February 2020 that: "If we hadn't reversed the failed economic policies of the previous administration, the world would not now be witnessing this great economic success." The Trump administration provided statistics in support of this claim. However, Politifact rated this claim false, explaining: "The bottom line: For virtually each of these measurements, we found that the trend lines continued almost seamlessly from the second half of Obama's presidency into the first three years of Trump's tenure. Trump's claim that he turned around a failing economy is wrong."[71]

NBC explained in August 2020 that Trump inherited a solid economy: "If you compare key economic indicators from Barack Obama's second term in office to the first three years of Trump's time (that is, before the pandemic hit), the data show a continuation of trends, not a dramatic shift. It suggests Trump didn't build something new; rather he inherited a pretty good situation."[5]

Statistical summaries

Annual comparisons 2014–2019

The following table illustrates some of the key economic variables in the last three years of the Obama Administration (2014–2016) and the first three years of the Trump Administration(2017–2019). The arrows indicate whether the variable improved (green) or worsened (red) versus the prior year.

| Variable | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Real GDP growth[72] | 2.5% | |||||

| Job creation per month (000s)[73] | 250 | |||||

| Mfg. job creation per month (000s)[74] | 17 | |||||

| Unemployment rate (December)[75] | 5.6% | |||||

| Labor force participation Age 25–54 (Dec)[76] | 80.9% | |||||

| Inflation rate (CPI-All, Avg.)[77] | 1.6% | |||||

| Poverty rate %[78] | 14.8% | |||||

| Real median household income $[79] | $56,969 | |||||

| Real wage growth %[80] | 0.4% | |||||

| Productivity growth %[81] | 0.9% | |||||

| Mortgage rate 30-yr fixed (avg.)[82] | 4.2% | |||||

| Gas prices (avg.)[83] | $3.36 | |||||

| Stock market annual % increase (SP 500)[84] | +11.4% | |||||

| Number uninsured under 65 yrs. (millions)[85][86] | 35.7 | |||||

| Health insurance premium (family/employer mkt % chg)[87] | 3.0% | |||||

| Trade deficit % GDP[88] | 2.8% | |||||

| Budget deficit ($ Billions)[89] | $485 | |||||

| Budget deficit % GDP[89] | 2.8% | |||||

| Debt held by public % GDP[89] | 73.7% | |||||

| Growth in Real Federal Debt Held By Public[90] | 4.8% | |||||

| Inequality: Third Quintile Income Share[91] | 14.3% | |||||

| Border apprehensions-FY total (000s)[92] | 487 | |||||

| Carbon dioxide emissions (Metric tons in millions)[93] | 5,413 | Not avail. | ||||

Coronavirus impact 2020

The following table illustrates the impact of the pandemic on key economic measures. February 2020 represented the pre-crisis level for most monthly variables, with the S&P 500 stock market index (a leading daily indicator) falling from its February 19 peak.

| Variable | Feb | Mar | Apr | May | June | July | August | September |

|---|---|---|---|---|---|---|---|---|

| Jobs, level (000s)[73] | 152,463 | 151,090 | 130,303 | 133,028 | 137,809 | 139,570 | 141,059 | 141,720 |

| Jobs, monthly change (000s)[73] | 251 | −1,373 | −20,787 | 2,725 | 4,781 | 1,761 | 1,489 | 661 |

| Unemployment rate %[75] | 3.5% | 4.4% | 14.7% | 13.3% | 11.1% | 10.2% | 8.4% | 7.9% |

| Number unemployed (millions)[94] | 5.8 | 7.1 | 23.1 | 21.0 | 17.8 | 16.3 | 13.6 | 12.6 |

| Employment to population ratio %, age 25–54[95] | 80.5% | 79.6% | 69.7% | 71.4% | 73.5% | 73.8% | 75.3% | 75.0% |

| Inflation rate % (CPI-All)[77] | 2.3% | 1.5% | 0.4% | 0.2% | 0.7% | 1.0% | 1.3% | 1.4% |

| Stock market S&P 500 (avg. level)[84] | 3,277 | 2,652 | 2,762 | 2,920 | 3,105 | 3,208 | 3,392 | 3,432 |

| Debt held by public ($ trillion)[96] | 17.4 | 17.7 | 19.1 | 19.9 | 20.5 | 20.6 | 20.8 | 21.0 |

Current level vs. inauguration

The following table compares the latest economic data with levels at the time of Trump's inauguration in January 2017. For quarterly or annual variables, the figure closest to the date indicated is used. For the deficit, the CBO forecast for FY2020 is used.

| Variable | January 2017 | November 2020 | Change | % Change |

|---|---|---|---|---|

| Jobs, level (millions)[73] | 145.6 | 142.6 | -3.0 | −2.1% |

| Unemployment rate %[75] | 4.7% | 6.7% | 2.0 pp | n/a |

| Number unemployed (millions)[94] | 7.5 | 10.7 | 3.2 | 43% |

| Real GDP level ($ trillions)[97] | 17.9 | 18.6 | +0.7 | +3.7% |

| Budget deficit ($ billions)[53] | 665 | 3,131 | 2,466 | 371% |

| Stock market S&P 500[84] | 2,271 | 3,621 | 1,350 | 59% |

| Debt held by public ($ trillions)[96] | 14.4 | 21.3 | 6.9 | 48% |

Health care reform efforts

Health care coverage trends

On January 15, 2017, president-elect Trump said he was nearing completion of a new health insurance program to replace Obamacare, stating, "We're going to have insurance for everybody."[99] However, no such plan was proposed from 2017 to 2019, and both government and private analyses indicate gains in healthcare coverage under President Obama began to reverse under President Trump during that time:

- The Centers for Disease Control reported that the number of uninsured persons under age 65 rose from 28.2 million in 2016 to 32.8 million in 2019, an increase of 4.6 million or 16%; 2017 was the first year since 2010 with an increase. The rate of uninsured rose from 10.4% in 2016 to 12.1% in 2019.[42][100]

- The Census Bureau reported in September 2020 that the number of uninsured increased from 27.3 million in 2016 to 29.6 million in 2019, an increase of 2.3 million or 8%. The rate of uninsured rose from 8.6% in 2016 to 9.2% in 2019.[101] Further, the number of children under age 19 without health insurance increased from 3.9 million in 2017 to 4.3 million in 2018 (mainly due to declines in public coverage), then fell to 4.0 million in 2019.[101]

- CBO forecast in May 2019 that 6 million more would be without health insurance in 2021 under Trump's policies (33 million), relative to continuation of Obama policies (27 million).[9]

The Commonwealth Fund reported that the number of uninsured was increasing due to two factors: 1) Not addressing specific weaknesses in the ACA; and 2) Actions by the Trump administration that exacerbated those weaknesses. The impact was greater among lower-income adults, who had a higher uninsured rate than higher-income adults. Regionally, the South and West had higher uninsured rates than the North and East. Further, those 18 states that have not expanded Medicaid had a higher uninsured rate than those that did.[102] Gallup cited a "number of factors" for the increase, including: an increase in 2018 premiums; reduction in marketing and enrollment periods; reduced funding for enrollment support; elimination of the individual mandate; and elimination of cost-sharing reduction subsidies.[103][104] The Washington Post cited research indicating that mortality increases about one person per 800 without health insurance, so 2 million more uninsured represents 2,500 avoidable deaths per year.[105]

The 2020 Coronavirus pandemic was also expected to increase the number of uninsured significantly, as millions lost jobs and their employer-provided healthcare. One study placed the number over 5 million, versus nearly 4 million due to the Great Recession of 2007–2009.[106]

Legislation

President Trump advocated repealing and replacing the Affordable Care Act (ACA or "Obamacare"). The Republican-controlled House passed the American Health Care Act (AHCA) in May 2017, handing it to the Senate, which decided to write its own version of the bill rather than voting on the AHCA.[107] The Senate bill, called the "Better Care Reconciliation Act of 2017" (BCRA), failed on a vote of 45–55 in the Senate during July 2017. Other variations also failed to gather the required support, facing unanimous Democratic Party opposition and some Republican opposition.[108] The Congressional Budget Office estimated that the bills would increase the number of uninsured by over 20 million persons while reducing the budget deficit marginally.[41]

Actions to hinder implementation of ACA

President Trump continued Republican attacks on the ACA while in office, according to the New York Times,[109] including steps such as:

- Weakening the individual mandate through his first executive order, which resulted in limiting enforcement of mandate penalties by the IRS. For example, tax returns without indications of health insurance ("silent returns") will still be processed, overriding instructions from the Obama administration to the IRS to reject them.[110]

- Reducing funding for advertising for the 2017 and 2018 exchange enrollment periods by up to 90%, with other reductions to support resources used to answer questions and help people sign-up for coverage. This action could reduce ACA enrollment.[111]

- Cutting the enrollment period for 2018 by half, to 45 days. The NYT editorial board referred to this as part of a concerted "sabotage" effort.[112]

- Issuing public statements that the exchanges are unstable or in a death spiral.[113] CBO reported in May 2017 that the exchanges would remain stable under current law (ACA), but would be less stable if the AHCA were passed.[41]

Several insurers and actuary groups cited uncertainty created by President Trump, specifically non-enforcement of the individual mandate and not funding cost sharing reduction subsidies, as contributing 20–30 percentage points to premium increases for the 2018 plan year on the ACA exchanges. In other words, absent Trump's actions against the ACA, premium increases would have averaged 10% or less, rather than the estimated 28–40% under the uncertainty his actions created.[114] The Center on Budget and Policy Priorities (CBPP) maintains a timeline of many "sabotage" efforts by the Trump Administration.[115]

The New York Times reported in December 2017 that about 8.8 million persons signed up for ACA coverage via the marketplace exchanges for the 2018 policy period, roughly 96% of the 9.2 million who signed-up for the 2017 policy period. An estimated 2.4 million were new customers and 6.4 million returned. These figures represent the national Healthcare.gov exchanges in 39 states and not 11 states that operate their own exchanges and also reported strong enrollment. The enrollment numbers "essentially defied President Trump's assertion that 'Obamacare is imploding'".[116]

About 80% of persons who buy insurance through the marketplaces qualify for subsidies to help pay premiums. The Trump Administration reported in October 2017 that the average subsidy would rise to $555 per month in 2018, up 45% from 2017. This increase was due significantly to the actions it took to hinder ACA implementation.[116] Prior to Trump taking office, several insurance companies estimated there would be a 10% increase in premiums and related subsidies for 2017.[114]

Ending cost-sharing reduction (CSR) payments

President Trump announced in October 2017 he would end the smaller of the two types of subsidies under the ACA, the cost-sharing reduction (CSR) subsidies. This controversial decision significantly raised premiums on the ACA exchanges (as much as 20 percentage points) along with the premium tax credit subsidies that rise with them, with the CBO estimating a $200 billion increase in the budget deficit over a decade.[117] CBO also estimated that initially up to one million fewer would have health insurance coverage, although more might have it in the long run as the subsidies expand. CBO expected the exchanges to remain stable (e.g., no "death spiral") as the premiums would increase and prices would stabilize at the higher (non-CSR) level.[118]

President Trump's argument that the CSR payments were a "bailout" for insurance companies and therefore should be stopped, actually results in the government paying more to insurance companies ($200B over a decade) due to increases in the premium tax credit subsidies. Journalist Sarah Kliff therefore described Trump's argument as "completely incoherent."[117]

Repeal of the ACA individual mandate

President Trump signed the Tax Cuts and Jobs Act into law in December 2017, which included the repeal of the individual mandate of the Affordable Care Act (ACA). This removed the requirement that all persons purchase health insurance or pay a penalty. The Congressional Budget Office estimated that up to 13 million fewer persons would be covered by health insurance by 2027 relative to prior law and insurance premiums on the exchanges would increase by about 10 percentage points. This is because removing the mandate encourages younger and typically healthier persons to opt out of health insurance on the ACA exchanges, increasing premiums for the remainder. The non-group insurance market (which includes the ACA exchanges) would continue to be stable (i.e., no "death spiral"). CBO estimated this would reduce government spending for healthcare subsidies to lower income persons by up to $338 billion in total during the 2018–2027 period compared to the prior law baseline.[119][120] Trump stated in an interview with The New York Times in December 2017: "I believe we can do health care in a bipartisan way, because we've essentially gutted and ended Obamacare."[121]

The CBO released an analysis on May 23, 2018, indicating that repeal of the individual mandate will increase the number of uninsured by 3 million and increase individual healthcare insurance premiums by 10% through 2019. The CBO projected that another 3 million would become uninsured over the following two years due to repeal of the mandate.[122] CBO released an analysis in May 2019 that stated: "By 2021, in the current baseline, 7 million more people are uninsured than would have been if the individual mandate penalty had not been repealed; subsequently, that number remains roughly constant to the end of the projection period in 2029."[123]

Pre-existing conditions

The New York Times explained that the Affordable Care Act (ACA) was passed in 2010 and extended protections to those with pre-existing health conditions, requiring insurers to "offer coverage to anyone who wishes to buy it, with prices varying only by region and age of the customer." Prior to the ACA, insurers in most states (where not prohibited by state law) were able to discriminate against persons on the basis of their health history. President Trump advocated for the repeal of the ACA in 2017, which would have eliminated these protections.[124]

Further, on June 7, 2018, the Trump Justice Department notified a federal court that the ACA provisions that prohibit insurers from denying coverage or charging higher rates to people with pre-existing conditions were inextricably linked to the individual mandate and so must be struck down, hence the Department would no longer defend those provisions in court.[125] Polls have consistently shown that the pre-existing conditions provisions have been the most popular aspect of ACA.[126] Trump has falsely claimed he saved the coverage of pre-existing conditions provided in ACA.[127]

The Centers for Medicare and Medicaid Services website states that 50–129 million non-elderly Americans (19–50 percent) have pre-existing conditions that could place them at risk of losing insurance coverage without ACA protections.[128]

Healthcare costs

President Trump campaigned that he would support allowing the government to negotiate drug prices with drug companies, to push costs down. However, when House Democrats passed a bill (H.R.3) to do just that, Trump vowed to veto the bill.[129] CBO estimated that the price negotiation provisions of H.R.3 would reduce costs by $456 billion over a decade, while provisions to expand dental, vision, and hearing coverage under Medicare would raise spending by $358 billion.[130]

In his February 2020 State of the Union speech, President Trump stated that "...for the first time in 51 years, the cost of prescription drugs actually went down." However, Politifact rated this claim as "Mostly False", explaining that: "In 2019, 4,311 prescription drugs experienced a price hike, with the average increase hovering around 21%, according to data compiled by Rx Savings Solutions, a consulting group. Meanwhile, 619 drugs had price dips. And already in 2020, 2,519 drugs have increased prices. The average hike so far this year is 6.9%. Meanwhile, the prices of 70 drugs have dropped."[131]

The Kaiser Family Foundation surveyed the employer-sponsored health insurance market, reporting in September 2019 that:[87]

- Annual family premiums for employer-sponsored health insurance increased from $19,616 in 2018 to $20,576 in 2019, up $960 or 4.9%.

- Increases from 2014 to 2016 averaged 3.5%, while increases from 2017 to 2019 averaged 4.3%.

- Deductibles for single coverage averaged $1,655 in 2019, similar to 2018. However, this was 41% above the $989 for 2014.

- The percentage of workers with an annual deductible over $2,000 increased from 16% in 2016 to 22% in 2019.

- Premium growth exceeds inflation and wage growth, and the prices employer plans pay for care are rising faster than either Medicare or Medicaid.[87]

Consequences if ACA repealed

President Trump and Republicans in Congress tried repeatedly to repeal or replace the ACA, without success. In February 2018, 20 states, led by Texas Attorney General Ken Paxton and Wisconsin Attorney General Brad Schimel, filed a lawsuit against the federal government alleging the ACA is now unconstitutional because the individual mandate tax which NFIB v. Sebelius rested on was repealed by the Tax Cuts and Jobs Act of 2017.[132][133]

Writing in the Washington Post in September 2020, Catherine Rampell summarized some of the adverse consequences if the ACA is overturned by the U.S. Supreme Court:

- 50+ million non-elderly adults with pre-existing conditions could be declined health insurance, or be charged more by insurance companies

- 12+ million low-income persons would become ineligible for Medicaid, thereby losing insurance

- 9+ million persons receiving tax credits to reduce insurance premiums on the exchanges would either pay more or lose coverage

- Minimum essential coverage for prescription benefits and substance abuse treatment would no longer be required in insurance policies

- Children would no longer be able to stay on their parents’ plans until age 26

- Preventive care would again involve cost-sharing (co-pays)

- More Americans would have healthcare plans without comprehensive protection

- Insurance companies would again be able to impose lifetime limits.[134]

Taxation

2017 proposal

In late September 2017, the Trump administration proposed a tax overhaul. The proposal would reduce the corporate tax rate to 20% (from 35%) and eliminate the estate tax. On individual tax returns it would change the number of tax brackets from seven to three, with tax rates of 12%, 25%, and 35%; apply a 25% tax rate to business income reported on a personal tax return; eliminate the alternative minimum tax; eliminate personal exemptions; double the standard deduction; and eliminate many itemized deductions (specifically retaining the deductions for mortgage interest and charitable contributions).[137][138] It is unclear from the details offered whether a middle-class couple with children would see tax increase or tax decrease.[139]

In October 2017 the Republican-controlled Senate and House passed a resolution to provide for $1.5 trillion in deficits over ten years to enable enactment of the Trump tax cut. As Reuters reported:[140]

Republicans are traditionally opposed to letting the deficit grow. But in a stark reversal of that stance, the party's budget resolution, previously passed by the Senate, called for adding up to $1.5 trillion to federal deficits over the next decade to pay for the tax cuts.

In December 2017, the Trump Treasury Department released a one-page summary of the nearly 500-page Senate tax bill that suggested the tax cut would more than pay for itself, based on an assumption of higher economic growth than any independent analysis had forecast.[141] Every detailed, independent analysis found that the enacted tax cut would increase budget deficits.[142]

The House passed its version of the Trump tax plan on November 16, 2017, and the Senate passed its version on December 2, 2017. Important differences between the bills were reconciled by a conference committee on December 15, 2017.[143] The President signed the bill into law on December 22, 2017.[144]

Major elements of the new tax law include reducing tax rates for businesses and individuals; a personal tax simplification by increasing the standard deduction and family tax credits, but eliminating personal exemptions and making it less beneficial to itemize deductions; limiting deductions for state and local income taxes (SALT) and property taxes; further limiting the mortgage interest deduction; reducing the alternative minimum tax for individuals and eliminating it for corporations; reducing the number of estates impacted by the estate tax; and repealing the individual mandate of the Affordable Care Act (ACA).[145]

Just prior to signing the bill, Trump asserted the new tax law might generate GDP growth as high as 6%.[146]

On numerous occasions, Trump has falsely asserted the tax cut was the largest in history.[147][148][149][150][151]

Impact on the economy, deficit and debt

The non-partisan Joint Committee on Taxation of the U.S. Congress published its macroeconomic analysis of the Senate version of the Act, on November 30, 2017:

- Gross domestic product would be 0.7% higher on average each year during the 2018–2027 period relative to the CBO baseline forecast, a cumulative total of $1,895 billion, due to an increase in labor supply and business investment. This is the level of GDP, not annual growth rate, so the economic impact is relatively minor.

- Employment would be about 0.6% higher each year during the 2018–2027 period than otherwise. The lower marginal tax rate on labor would provide "strong incentives for an increase in labor supply."

- Personal consumption, the largest component of GDP, would increase by 0.6%.[32]

The CBO estimated in April 2018 that implementing the Act would add an estimated $2.289 trillion to the national debt over ten years,[33] or about $1.891 trillion ($15,000 per household) after taking into account macroeconomic feedback effects, in addition to the $9.8 trillion increase forecast under the current policy baseline and existing $20 trillion national debt.[34]

As Trump celebrated the six-month anniversary of the tax cut on June 29, 2018,[152] National Economic Council director Larry Kudlow asserted that the tax cut was generating such growth that "it's throwing off enormous amount[s] of new tax revenues" and "the deficit, which was one of the other criticisms, is coming down—and it's coming down rapidly." Both assertions were incorrect. Since the tax cut was enacted, federal tax receipts increased 1.9% on a year-on-year basis, while they increased 4.0% during the comparable period in 2017. By the same method, the federal budget deficit increased 37.8% while it increased 16.4% during the comparable period in 2017. Kevin Hassett, chairman of Trump's Council of Economic Advisers, noted days earlier that the deficit was "skyrocketing," which is consistent with the analysis of every reputable budget analyst.[153][154] Kudlow later asserted he was referring to future deficits, although every credible budget forecast indicates increasing deficits in coming years, made worse by the Trump tax cut if not offset by major spending cuts. Barring such spending cuts, the CBO projected the tax cut would add $1.27 trillion in deficits over the next decade, even after considering any economic growth the tax cut might generate.[155]

Providing a twelve-month summary of the impact on the economy of the tax cut, Minton Beddoes as editor of The Economist compared the short-term impact on the US economy to long-term expectations stating: "Mr. Trump's economic stewardship is less stellar than his supporters claim. Yes, the economy is booming. But that is largely because it is in the midst of a sugar high thanks to a fiscally irresponsible tax cut."[156]

The Trump administration predicted the tax cut would spur corporate capital investment and hiring. One year after enactment of the tax cut, a National Association for Business Economics survey of corporate economists found that 84% reported their firms had not changed their investment or hiring plans due to the tax cut.[157] The International Monetary Fund also found the tax cut had little impact on business investment decisions,[158] while the Penn Wharton Budget Model found that the increasing price of oil "explains the entire increase in the growth rate of investment in 2018."[159] Trump has on several occasions taken credit for business investments that began before he became president.[160][161][162]

Analysis released by the Congressional Research Service in May 2019 found that "On the whole, the growth effects tend to show a relatively small (if any) first-year effect on the economy."[163][164] Analysis conducted by The New York Times in November 2019 found that average business investment was lower after the tax cut than before, and that firms receiving larger tax relief increased investment less than firms receiving smaller tax relief. The analysis also found that since the tax cut firms increased dividends and stock buybacks by nearly three times as much as they increased capital investments.[165]

In a December 2019 opinion piece, former Trump economic advisors Kevin Hassett and Gary Cohn argued that the Trump tax cut had caused wages to rise faster for lower-wage workers than for higher-wage workers, thus delivering on a Trump campaign promise. Other analysts noted wages at the lower end of the income scale had increased at least in part due to numerous states raising their minimum wage in recent years.[166][167]

Distribution of benefits and costs

The distribution of impact from the final version of the Act by individual income group varies significantly based on the assumptions involved and point in time measured. In general, businesses and upper income groups will mostly benefit regardless, while lower income groups will see the initial benefits fade over time or be adversely impacted. CBO reported on December 21, 2017, that: "Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits (primarily stemming from reductions in spending) allocated to lower-income tax filing units and to increase deficits (primarily stemming from reductions in taxes) allocated to higher-income tax filing units."[36]

For example:

- During 2019, income groups earning under $20,000 (about 23% of taxpayers) would contribute to deficit reduction (i.e., incur a cost), mainly by receiving fewer subsidies due to the repeal of the individual mandate of the Affordable Care Act. Other groups would contribute to deficit increases (i.e., receive a benefit), mainly due to tax cuts.

- During 2021, 2023, and 2025, income groups earning under $40,000 (about 43% of taxpayers) would contribute to deficit reduction, while income groups above $40,000 would contribute to deficit increases.

- During 2027, income groups earning under $75,000 (about 76% of taxpayers) would contribute to deficit reduction, while income groups above $75,000 would contribute to deficit increases.[36]

The Joint Committee on Taxation reported in March 2019 that: "[G]enerally as income increases the average tax rate reduction increases." For example, in 2019 the average tax rate reduction for the group earning $50,000–$75,000 would be 1.3%, while the reduction for the group earning $1,000,000+ would be 2.3%.[168]

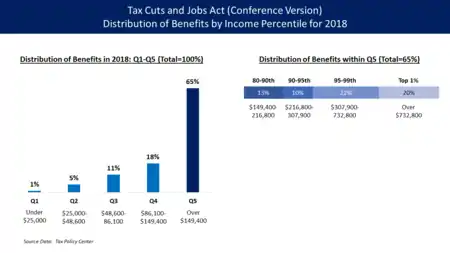

The Tax Policy Center (TPC) reported its distributional estimates for the Act on December 18, 2017. This analysis excludes the impact from repealing the ACA individual mandate, which would apply significant costs primarily to income groups below $40,000. It also assumes the Act is deficit financed and thus excludes the impact of any spending cuts used to finance the Act, which also would fall disproportionally on lower income families as a percentage of their income.[136]

- Compared to current law, 5% of taxpayers would pay more in 2018, 9% in 2025, and 53% in 2027.

- The top 1% of taxpayers (income over $732,800) would receive 8% of the benefit in 2018, 25% in 2025, and 83% in 2027.

- The top 5% (income over $307,900) would receive 43% of the benefit in 2018, 47% in 2025, and 99% in 2027.

- The top 20% (income over $149,400) would receive 65% of the benefit in 2018, 66% in 2025 and all of the benefit in 2027.

- The bottom 80% (income under $149,400) would receive 35% of the benefit in 2018, 34% in 2025 and none of the benefit in 2027, with some groups incurring costs.

- The third quintile (taxpayers in the 40th to 60th percentile with income between $48,600 and $86,100, a proxy for the "middle class") would receive 11% of the benefit in 2018 and 2025, but would incur a net cost in 2027.

The TPC also estimated the amount of the tax cut each group would receive, measured in 2017 dollars:

- Taxpayers in the second quintile (incomes between $25,000 and $48,600, the 20th to 40th percentile) would receive a tax cut averaging $380 in 2018 and $390 in 2025, but a tax increase averaging $40 in 2027.

- Taxpayers in the third quintile (incomes between $48,600 and $86,100, the 40th to 60th percentile) would receive a tax cut averaging $930 in 2018, $910 in 2025, but a tax increase of $20 in 2027.

- Taxpayers in the fourth quintile (incomes between $86,100 and $149,400, the 60th to 80th percentile) would receive a tax cut averaging $1,810 in 2018, $1,680 in 2025, and $30 in 2027.

- Taxpayers in the top 1% (income over $732,800) would receive a tax cut of $51,140 in 2018, $61,090 in 2025, and $20,660 in 2027.[136]

Bloomberg News reported in January 2020 that the top six American banks saved more than $32 billion in taxes during the two years after enactment of the tax cut, while they reduced lending, cut jobs and increased distributions to shareholders.[169]

Effects on corporate taxation and behavior

The Institute on Taxation and Economic Policy (ITEP) reported in December 2019 that:

- The Tax Act lowered the statutory corporate tax rate from 35% to 21% in 2018, although corporations continued to reduce their taxes below the statutory rate via loopholes. The Tax Act closed some old loopholes, but created new ones.

- The effective corporate tax rate (i.e., taxes paid as a percentage of taxable income) in 2018 was the lowest rate in 40 years, at 11.3%, versus 21.2% on average for the 2008–2015 period.

- Of 379 profitable Fortune 500 corporations in the ITEP study, 91 paid no corporate income taxes and another 56 paid an average effective tax rate of 2.2%.

- If the 379 businesses had instead paid the 21% tax rate, it would have generated an additional $74 billion in tax revenue.[170]

The Economic Policy Institute reported in December 2019 that:

- Working people saw no discernible wage increase due to the Tax Act. The tight labor market and higher state-level minimum wages can explain the wage growth in 2018.

- The Tax Act has not increased business investment, with the small increase in 2018 a "natural bounceback" from a weak 2015–2016, and a sizable decline in 2019.

- Companies used much of the tax benefit for stock buybacks, to the tune of $580 billion in 2018, an increase of 50% from 2017.[171][39]

Taxation through tariffs

President Trump increased tariffs significantly as part of his trade policies. CBO reported that "Customs Duties" (which includes tariff revenues) increased from $34.6 billion in 2017, to $41.3 billion in 2018 and $70.8 billion in 2019, reducing deficits accordingly.[1] Reuters reported that: "Tariffs are a tax on imports. They are paid by U.S.-registered firms to U.S. customs for the goods they import into the United States. Importers often pass the costs of tariffs on to customers – manufacturers and consumers in the United States – by raising their prices."[172] President Trump falsely claimed in August 2018 that "because of tariffs we will be able to start paying down large amounts of the $21 trillion in debt that has been accumulated...while at the same time reducing taxes for our people." The tariff revenue is very small relative to the debt, and tariffs are taxes on Americans.[173]

Criticism

A FiveThirtyEight average of November 2017 surveys showed that 32% of voters approved of the legislation while 46% opposed it.[174] This made the 2017 tax plan less popular than any tax proposal since 1981, including the tax increases of 1990 and 1993.[174] Trump has claimed the tax cuts on the wealthy and corporations would be "paid for by growth", although 37 economists polled by the University of Chicago unanimously rejected the claim.[175] The Washington Posts fact-checker has found that Trump's claims that his economic proposal and tax plan would not benefit wealthy persons like himself are provably false.[176] The elimination of the estate tax (which only applies to inherited wealth greater than $11 million for a married couple) benefits only the heirs of the very rich (such as Trump's children), and there is a reduced tax rate for people who report business income on their individual returns (as Trump does).[177][139][178] If Trump's tax plan had been in place in 2005 (the one recent year in which his tax returns were leaked), he would have saved $31 million in taxes from the alternative minimum tax cut alone.[139] If the most recent estimate of the value of Trump's assets is correct, the repeal of the estate tax could save his family about $1.1 billion.[179]

Treasury Secretary Steven Mnuchin argued that the corporate income tax cut will benefit workers the most; however, the nonpartisan Joint Committee on Taxation and Congressional Budget Office estimate that owners of capital benefit vastly more than workers.[180]

Economist Paul Krugman summarized what he called ten lies modern Republicans and conservatives tell about their tax plans, many of which have been deployed in this case: "But the selling of tax cuts under Trump has taken things to a whole new level, both in terms of the brazenness of the lies and their sheer number." These range from "America is the most highly taxed country in the world" (the OECD reported the U.S. is in fact one of the lowest-taxed in the OECD) to "Cutting [corporate] profits taxes really benefits workers" (corporate tax cuts mainly benefit wealthy stockholders) to "Tax cuts won't increase the deficit" (they significantly increase the deficit). Krugman referred to a Tax Policy Center estimate that by 2027, the majority of the tax cut would go to the top 1%; but only 12% to the middle class.[181]

Economist and former Treasury Secretary Larry Summers referred to the analysis provided by the Trump administration of its tax proposal as "... some combination of dishonest, incompetent, and absurd." Summers continued that "... there is no peer-reviewed support for [the Administration's] central claim that cutting the corporate tax rate from 35 percent to 20 percent would raise wages by $4,000 per worker. The claim is absurd on its face."[182][183]

On the day Trump signed the tax bill, polls showed that 30% of Americans approved of the new law. While its popularity has increased somewhat since, through August 2018 a plurality of Americans still dislike the law.[184]

Despite every independent economic analysis concluding that the tax cut would increase deficits, a June 2018 survey found that 22% of Republicans agreed with that conclusion, while nearly 70% of Democrats agreed.[185]

Federal budget deficit and debt 2017–2019

Summary

President Trump's policies have significantly increased the budget deficits and U.S. debt trajectory over the 2017–2027 time periods.

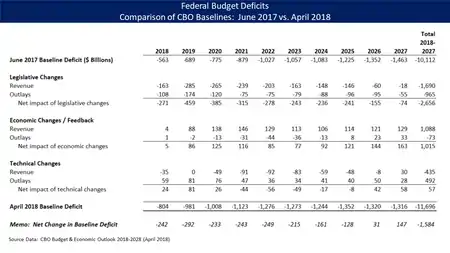

- Fiscal year 2018 (FY 2018) ran from October 1, 2017, through September 30, 2018. It was the first fiscal year budgeted by President Trump. The Treasury department reported on October 15, 2018, that the budget deficit rose from $666 billion in FY2017 to $779 billion in FY2018, an increase of $113 billion or 17.0%. Corporate tax receipts fell by 31%, accounting for most of the deficit increase. Compared with 2017, tax receipts fell by 0.8% GDP, while outlays fell by 0.4% GDP. The 2018 deficit was an estimated 3.9% of GDP, up from 3.5% GDP in 2017.[186]

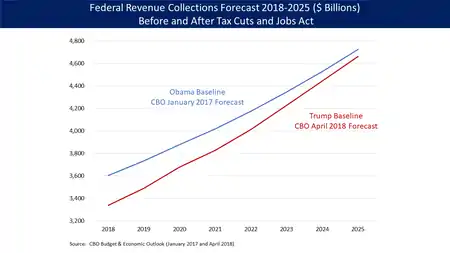

- The FY2018 deficit increased about 60% from the $487 billion level forecast by CBO in January 2017, just prior to Trump's inauguration. The deficit increase relative to this forecast was due to Trump's tax cuts and additional spending.[21][16] CBO forecast in January 2017 that tax revenues in fiscal year 2018 would be $3.60 trillion if laws in place as of January 2017 continued.[187] However, actual 2018 revenues were $3.33 trillion, a shortfall of $270 billion (7.5%) relative to the forecast. This difference is primarily due to the Tax Act.[188] In other words, revenues would have been considerably higher in the absence of the tax cuts.

- The debt additions projected by CBO for the 2017–2027 period have increased from the $10.0 trillion that Trump inherited from Obama (January 2017 CBO baseline[21]) to $13.7 trillion (CBO January 2019 current policy baseline[189]), a $3.7 trillion or 37% increase.

As a presidential candidate, Trump pledged to eliminate $19 trillion in federal debt in eight years.[190] Trump and his economic advisers initially pledged to radically decrease federal spending in order to reduce the country's budget deficit. A first estimate of $10.5 trillion in spending cuts over 10 years was reported on January 19, 2017,[191] although cuts of this size did not appear in Trump's 2018 budget. However, the CBO forecast in the April 2018 baseline for the 2018–2027 period includes much larger annual deficits than the January 2017 baseline he inherited from President Obama, due to the Tax Cuts and Jobs Act and other spending bills.[16]

Wells Fargo Economics reported in May 2018 that: "Despite stronger predicted economic growth in the short term, a combination of tax cuts and surging spending have led the budget deficit to widen as a share of GDP, with more deterioration expected over the next year or two. This pattern is historically unusual, as budget deficits typically expand during recession, gradually close during the recoveries and then begin widening again at the next onset of economic weakness."[192]

The New York Times reported in August 2019 that: "The increasing levels of red ink stem from a steep falloff in federal revenue after Mr. Trump's 2017 tax cuts, which lowered individual and corporate tax rates, resulting in far fewer tax dollars flowing to the Treasury Department. Tax revenues for 2018 and 2019 have fallen more than $430 billion short of what the budget office predicted they would be in June 2017, before the tax law was approved that December."[193]

The Committee for a Responsible Federal Budget estimated in January 2020 that President Trump had signed $4.2 trillion of additional debt into law for the 2017–2026 decade, and $4.7 trillion for 2017–2029. This is on top of the $17.2 trillion debt held by the public and the $9.2 trillion already expected to be added to the debt excluding these proposals. About half was the Tax Act, and the other half was spending increases. This analysis assumed the individual tax cuts expire as scheduled after 2025; if extended, up to another $1 trillion could be added through 2029. The Bipartisan Budget Act of 2018 and Bipartisan Budget Act of 2019 added $2.2 trillion to the projected debt, mainly by increasing defense and non-defense discretionary spending caps through 2017–2021. There are no such caps after 2021. A December 2019 spending deal added another $500 billion of debt through additional tax cuts, repealing 3 taxes meant to fund the Affordable Care Act, including the so-called "Cadillac tax" on unusually generous health plans.[25]

CBO baseline projections

The CBO publishes a 10-year economic and budgetary forecast ("baseline") annually as part of their "Budget and Economic Outlook" report. Comparing baselines provides insight into the impact of policies on the deficit. The January 2017 "current law" baseline assumed the implementation of laws already on the books from the Obama Administration (i.e., laws in place just prior to Trump's inauguration would continue or expire as scheduled). All of the figures in the January 2017 baseline shown in the table below were forecasts at the time.[21] The January 2019 "current policy" or "alternative" baseline reflected Trump's policies along with various assumptions, including the extension of individual tax cuts scheduled to expire after 2025. The 2018 and 2019 actual budget deficits were about 60% above the January 2017 baseline, while the sum of the 2017–2027 deficits in the January 2019 alternative baseline are 37% higher.[189]

| Budget Deficit ($ Billions) | 2017 | 2018 | 2019 | 2020F | 2021-2027F | Total 2017-2027F |

|---|---|---|---|---|---|---|

| January 2017 Baseline[21] | 559 | 487 | 601 | 684 | 7,654 | 9,984 |

| January 2019 Alt Baseline[189] | 665 | 779 | 984 | 1,021 | 10,263 | 13,712 |

| Increase | 106 | 292 | 383 | 337 | 2,610 | 3,728 |

| % Increase | 19% | 60% | 64% | 49% | 34% | 37% |

The January 2017 baseline projected that "debt held by the public" would increase from $14.2 trillion in 2016 to $24.9 trillion by 2027, an increase of $10.7 trillion. Debt held by the public would reach 88.9% GDP in 2027.[21] Three years later, the 2027 estimate was 92.6% of GDP.[194]

CBO also estimated that if policies in place as of the end of the Obama administration continued over the following decade (i.e., the January 2017 10-year forecast or baseline), real GDP would grow at approximately 2% per year, the unemployment rate would remain around 5%, inflation would remain around 2%, and interest rates would rise moderately. This forecast assumed the U.S. was very close to full employment by the time President Trump took office and that deficits would fall through 2018.[21] With the notable exception of deficits, actual results for 2017–2019 for the these key variables compare favorably against the baseline, as the Tax Cuts and Jobs Act provided a stimulus and the economy was further from full employment than CBO anticipated:

- Real GDP growth averaged 2.5%, versus the 1.9% forecast.

- Job creation averaged 193,000 per month, versus the 92,000 forecast, a three-year total of 7.0 million versus 3.3 million forecast.

- The unemployment rate averaged 4.0%, versus the 4.5% forecast.

- Inflation averaged 2.1%, versus the 2.3% forecast.

- Budget deficits totaled $780 billion more than forecast, with the 2018 and 2019 deficits up 60% versus forecast.[195]

CBO scoring of the 2018 budget

A budget document is a statement of goals and priorities, but requires separate legislation to achieve them. As of January 2018, the Tax Cuts and Jobs Act was the primary legislation passed that moved the budget closer to the priorities set by Trump.

Trump released his first budget, for FY2018, on May 23, 2017. It proposed unprecedented spending reductions across most of the federal government, totaling $4.5 trillion over ten years,[196] including a 33% cut for the State Department, 31% for the EPA, 21% each for the Agriculture Department and Labor Department, and 18% for the Department of Health and Human Services, with single-digit increases for the Department of Veterans Affairs, Department of Homeland Security and the Defense Department.[197] The Republican-controlled Congress promptly rejected the proposal.[198] Instead, Congress pursued an alternative FY2018 budget[199] linked to their tax reform agenda; this budget was adopted in late 2017, after the 2018 fiscal year had begun.[200] The budget agreement included a resolution specifically providing for $1.5 trillion in new budget deficits over ten years to accommodate the Tax Cuts and Jobs Act that would be enacted weeks later.[201]

The Congressional Budget Office reported its evaluation of President Trump's FY2018 budget on July 13, 2017, including its effects over the 2018–2027 period.

- Mandatory spending: The budget cuts mandatory spending by a net $2,033 billion (B) over the 2018–2027 period. This includes reduced spending of $1,891B for healthcare, mainly due to the proposed repeal and replacement of the Affordable Care Act (ACA/Obamacare); $238B in income security ("welfare"); and $100B in reduced subsidies for student loans. This savings would be partially offset by $200B in additional infrastructure investment.

- Discretionary spending: The budget cuts discretionary spending by a net $1,851 billion over the 2018–2027 period. This includes reduced spending of $752 billion for overseas contingency operations (defense spending in Afghanistan and other foreign countries), which is partially offset by other increases in defense spending of $448B, for a net defense cut of $304B. Other discretionary spending (cabinet departments) would be reduced by $1,548B.

- Revenues would be reduced by $1,000B, mainly by repealing the ACA, which had applied higher tax rates to the top 5% of income earners. Trump's budget proposal was not sufficiently specific to score other tax proposals; these were simply described as "deficit neutral" by the Administration.

- Deficits: CBO estimated that based on the policies in place as of the start of the Trump administration, the debt increase over the 2018–2027 period would be $10,112B. If all of President Trump's proposals were implemented, CBO estimated that the sum of the deficits (debt increases) for the 2018–2027 period would be reduced by $3,276B, resulting in $6,836B in total debt added over the period.

- CBO estimated that the debt held by the public, the major subset of the national debt, would rise from $14,168B (77.0% GDP) in 2016 to $22,337B (79.8% GDP) in 2027 under the President's budget, versus 91.2% GDP under the pre-Trump policy baseline.[61]

Actual results FY2017

Fiscal year 2017 (FY2017) ran from October 1, 2016, to September 30, 2017; President Trump was inaugurated in January 2017, so he began office in the fourth month of the fiscal year, which was budgeted by President Obama. In FY2017, the actual budget deficit was $666 billion, $80 billion more than FY2016. FY2017 revenues were up $48 billion (1%) vs. FY2016, while spending was up $128 billion (3%). The deficit was $107 billion more than the CBO January 2017 baseline forecast of $559 billion. The deficit increased to 3.5% GDP, up from 3.2% GDP in 2016 and 2.4% GDP in 2015.[202]

FY2018 results

Fiscal year 2018 (FY 2018) ran from October 1, 2017, through September 30, 2018. It was the first fiscal year budgeted by President Trump. The Treasury department reported on October 15, 2018, that the budget deficit rose from $666 billion in FY2017 to $779 billion in FY2018, an increase of $113 billion or 17.0%. In dollar terms, tax receipts increased 0.4%, while outlays increased 3.2%. Revenue fell from 17.2% GDP in 2017 to 16.4% GDP in 2018, below the 50-year average of 17.4%. Outlays fell from 20.7% GDP in 2017 to 20.3% GDP in 2018, equal to the 50-year average.[203] The 2018 deficit was an estimated 3.9% of GDP, up from 3.5% GDP in 2017.[186]

CBO reported that corporate income tax receipts fell by $92 billion or 31% in 2018, falling from 1.5% GDP to 1.0% GDP, approximately half the 50-year average. This was due to the Tax Cuts and Jobs Act. This accounted for much of the $113 billion deficit increase in 2018.[203]

During January 2017, just prior to President Trump's inauguration, CBO forecast that the FY 2018 budget deficit would be $487 billion if laws in place at that time remained in place. The $779 billion actual result represents a $292 billion or 60% increase versus that forecast.[16] This difference was mainly due to the Tax Cuts and Jobs Act, which took effect in 2018, and other spending legislation.[204]

FY2019 budget

Trump released his second budget, for FY2019, on February 23, 2018; it also proposed major spending reductions, totaling $3 trillion over ten years, across most of the federal government.[205] This budget was also largely ignored by the Republican-controlled Congress.[196] One month later, Trump signed a $1.3 trillion bipartisan, omnibus spending bill to fund the government through the end of FY2018, hours after he had threatened to veto it. The bill increased both defense and domestic expenditures, and Trump was sharply criticized by his conservative supporters for signing it.[206][207] Trump then vowed, "I will never sign another bill like this again."[208]

FY 2019 results

Fiscal year 2019 (FY 2019) ran from October 1, 2018, through September 30, 2019. It was the first fiscal year where Trump's tax cuts were in effect for the entire period. The Treasury Department reported on October 17, 2019, that the budget deficit rose from $778 billion in FY2018 to $984 billion in FY2018, an increase of $205 billion or 26%. In dollar terms, tax receipts increased 4%, while outlays increased 8%.[209] The 2019 deficit was an estimated 4.7% of GDP, up from 3.9% GDP in 2018. This was the highest as a % GDP since 2012 and the fourth consecutive year with an increase.[210]

During January 2017, just prior to President Trump's inauguration, CBO forecast that the FY 2019 budget deficit would be $601 billion if laws in place at that time remained in place. The $984 billion actual result represents a $383 billion or 64% increase versus that forecast.[210][16] This difference was mainly due to the Tax Cuts and Jobs Act, which took effect in 2018, and other spending legislation.

The New York Times reported in October 2019 that: "In fact, tax revenue for the last two years has fallen more than $400 billion short of what the Congressional Budget Office projected in June 2017, six months before the tax law was passed." The Treasury Department expects the deficit to exceed $1 trillion in FY2020. The budget deficit has increased nearly 50% since Trump took office and has increased for the past four years. This is contrary to Trump's promises to eliminate deficits within 8 years.[211] The 2019 calendar year deficit exceeded $1 trillion.[212]

Ten year forecasts 2018–2028

The CBO estimated the impact of Trump's tax cuts and separate spending legislation over the 2018–2028 period in their annual "Budget & Economic Outlook", released in April 2018:

- CBO forecasts a stronger economy over the 2018–2019 periods than do many outside economists, blunting some of the deficit impact of the tax cuts and spending increases.

- Real (inflation-adjusted) GDP, a key measure of economic growth, is expected to increase 3.3% in 2018 and 2.4% in 2019, versus 2.6% in 2017. It is projected to average 1.7% from 2020 to 2026 and 1.8% in 2027–2028. Over 2017–2027, real GDP is expected to grow 2.0% on average under the April 2018 baseline, versus 1.9% under the June 2017 baseline.

- The non-farm employment level would be about 1.1 million higher on average over the 2018–2028 period, about 0.7% level higher than the June 2017 baseline.

- The budget deficit in fiscal 2018 (which runs from October 1, 2017, to September 30, 2018, the first year budgeted by President Trump) is forecast to be $804 billion, an increase of $139 billion (21%) from the $665 billion in 2017 and up $242 billion (39%) over the previous baseline forecast (June 2017) of $580 billion for 2018. The June 2017 forecast was essentially the budget trajectory inherited from President Obama; it was prepared prior to the Tax Act and other spending increases under President Trump.

- For the 2018–2027 period, CBO projects the sum of the annual deficits (i.e., debt increase) to be $11.7 trillion, an increase of $1.6 trillion (16%) over the previous baseline (June 2017) forecast of $10.1 trillion.

- The $1.6 trillion debt increase includes three main elements: 1) $1.7 trillion less in revenues due to the tax cuts; 2) $1.0 trillion more in spending; and 3) Partially offsetting incremental revenue of $1.1 trillion due to higher economic growth than previously forecast. The $1.6 trillion figure is approximately $12,700 per family or $4,900 per person total.

- Debt held by the public is expected to rise from 78% of GDP ($16 trillion) at the end of 2018 to 96% GDP ($29 trillion) by 2028. That would be the highest level since the end of World War Two.

- CBO estimated under an alternative scenario (in which policies in place as of April 2018 are maintained beyond scheduled initiation or expiration) that deficits would be considerably higher, rising by $13.7 trillion over the 2018–2027 period, an increase of $3.6 trillion (36%) over the June 2017 baseline forecast. Maintaining current policies for example would include extending the individual Trump tax cuts past their scheduled expiration in 2025, among other changes. The $3.6 trillion figure is approximately $28,500 per household or $11,000 per person total.[16]

Federal corporate income tax receipts

During the six months following enactment of the Trump tax cut, year-on-year corporate profits increased 6.4%, while corporate income tax receipts declined 45.2%. This was the sharpest semiannual decline since records began in 1948, with the sole exception of a 57.0% decline during the Great Recession when corporate profits fell 47.3%.[213]

Federal corporate income tax receipts fell from about $297 billion in fiscal year 2017 (prior to the Trump tax cuts) to $205 billion in fiscal year 2018, nearly one-third. This revenue decline occurred despite a growing economy and corporate profits, which ordinarily would cause tax receipts to increase. Corporate tax receipts fell from 1.5% GDP in 2017 to 1.0% GDP in 2018. The pre-Great Recession historical average (1980–2007) was 1.8% GDP.[214]

Federal budget shutdown of 2018–2019

On December 22, 2018, the federal government went into a partial shutdown caused by the expiration of funding for nine Executive departments, although only one such budget – Homeland Security – was actually in contention. Approximately 800,000 federal employees were either furloughed or made to work without pay, and some public services were shut down.[215] The shutdown ended on January 25, 2019, with the total shutdown period extending over a month, the longest in American history.[216][217] By mid-January 2019, the White House Council of Economic Advisors estimated that each week of the shutdown reduced GDP growth by 0.1 percentage points, the equivalent of 1.2 points per quarter. CEA chairman Kevin Hassett later acknowledged that GDP growth could decline to zero in the first quarter of 2019 if the shutdown lasted the entire quarter.[218][219][220]

Federal budget deficit 2020–

Coronavirus and CARES ACT impact on deficit

The CBO forecast in April 2020 that the budget deficit in fiscal year 2020 would be $3.7 trillion (17.9% GDP), versus the January estimate of $1 trillion (4.6% GDP).[53] The COVID-19 pandemic in the United States impacted the economy significantly beginning in March 2020, as businesses were shut-down and furloughed or fired personnel. About 20 million persons filed for unemployment insurance in the four weeks ending April 11. It caused the number of unemployed persons to increase significantly, which is expected to reduce tax revenues while increasing automatic stabilizer spending for unemployment insurance and nutritional support. As a result of the adverse economic impact, both state and federal budget deficits will dramatically increase, even before considering any new legislation.[221]