Economics of nuclear power plants

New nuclear power plants typically have high capital expenditure for building the plant. Fuel, operational, and maintenance costs are relatively small components of the total cost. The long service life and high capacity factor of nuclear power plants allow sufficient funds for ultimate plant decommissioning and waste storage and management to be accumulated, with little impact on the price per unit of electricity generated.[3] Other groups disagree with these statements.[4] Additionally, measures to mitigate climate change such as a carbon tax or carbon emissions trading, would favor the economics of nuclear power over fossil fuel power.[3] Other groups argue that nuclear power is not the answer to climate change.[5]

Nuclear power construction costs have varied significantly across the world and in time. Large and rapid increases in cost occurred during the 1970s, especially in the United States. There were no construction starts of nuclear power reactors between 1979 and 2012 in the United States, and since then more new reactor projects have gone into bankruptcy than have been completed. Recent cost trends in countries such as Japan and Korea have been very different, including periods of stability and decline in costs.

In more economically developed countries, a slowdown in electricity demand growth in recent years has made large-scale power infrastructure investments difficult. Very large upfront costs and long project cycles carry large risks, including political decision making and intervention such as regulatory ratcheting.[6] In Eastern Europe, a number of long-established projects are struggling to find financing, notably Belene in Bulgaria and the additional reactors at Cernavoda in Romania, and some potential backers have pulled out.[6] Where cheap gas is available and its future supply relatively secure, this also poses a major problem for clean energy projects.[6] Former Exelon CEO John Rowe said in 2012 that new nuclear plants in the United States "don't make any sense right now" and would not be economic as long as gas prices remain low.[7]

Current bids for new nuclear power plants in China were estimated at between $2800/kW and $3500/kW,[8] as China planned to accelerate its new build program after a pause following the Fukushima disaster. However, more recent reports indicated that China will fall short of its targets. While nuclear power in China has been cheaper than solar and wind power, these are getting cheaper while nuclear power costs are growing. Moreover, the costs of third generation plants are expected to be considerably more expensive than earlier plants.[9] Therefore, comparison with other power generation methods is strongly dependent on assumptions about construction timescales and capital financing for nuclear plants. Analysis of the economics of nuclear power must take into account who bears the risks of future uncertainties. To date all operating nuclear power plants were developed by state-owned or regulated utility monopolies[10][11] where many of the risks associated with political change and regulatory ratcheting were borne by consumers rather than suppliers. Many countries have now liberalized the electricity market where these risks, and the risk of cheap competition from subsidised energy sources emerging before capital costs are recovered, are borne by plant suppliers and operators rather than consumers, which leads to a significantly different evaluation of the risk of investing in new nuclear power plants.[12]

Two of the four EPRs under construction (the Olkiluoto Nuclear Power Plant in Finland and Flamanville in France), which are the latest new builds in Europe, are significantly behind schedule and substantially over cost.[13] Following the 2011 Fukushima Daiichi nuclear disaster, costs are likely to go up for some types of currently operating and new nuclear power plants, due to new requirements for on-site spent fuel management and elevated design basis threats.[14]

Overview

Although the price of new plants in China is lower than in the Western world[19] John Quiggin, an economics professor, maintains that the main problem with the nuclear option is that it is not economically viable.[20] Professor of science and technology Ian Lowe has also challenged the economics of nuclear power.[21][22] However, nuclear supporters continue to point to the historical success of nuclear power across the world, and they call for new reactors in their own countries, including proposed new but largely uncommercialised designs, as a source of new power.[23][24][25][26][27][28][29] Nuclear supporters point out that the IPCC climate panel endorses nuclear technology as a low carbon, mature energy source which should be nearly quadrupled to help address soaring greenhouse gas emissions.[30]

Some independent reviews keep repeating that nuclear power plants are necessarily very expensive,[31][32] and anti-nuclear groups frequently produce reports that say the costs of nuclear energy are prohibitively high.[33][34][35][36]

In 2012 in Ontario, Canada, costs for nuclear generation stood at 5.9¢/kWh while hydroelectricity, at 4.3¢/kWh, cost 1.6¢ less than nuclear.[37][38] By September 2015, the cost of solar in the United States dropped below nuclear generation costs, averaging 5¢/kWh.[39] Solar costs continued to fall, and by February 2016, the City of Palo Alto, California, approved a power-purchase agreement (PPA) to purchase solar electricity for under 3.68¢/kWh,[40] lower than even hydroelectricity. Utility-scale solar electricity generation newly contracted by Palo Alto in 2016 costs 2.22¢/kWh less than electricity from the already-completed Canadian nuclear plants, and the costs of solar energy generation continue to drop.[41] However, solar power has very low capacity factors compared to nuclear, and solar power can only achieve so much market penetration before (expensive) energy storage and transmission become necessary.

Countries including Russia, India, and China, have continued to pursue new builds. Globally, around 50 nuclear power plants were under construction in 20 countries as of April 2020, according to the IAEA.[42] China has 10 reactors under construction. According to the World Nuclear Association, the global trend is for new nuclear power stations coming online to be balanced by the number of old plants being retired.[43]

In the United States, nuclear power faces competition from the low natural gas prices in North America. Former Exelon CEO John Rowe said in 2012 that new nuclear plants in the United States "don’t make any sense right now" and won't be economic as long as the natural gas glut persists.[7] In 2016, Governor of New York Andrew Cuomo directed the New York Public Service Commission to consider ratepayer-financed subsidies similar to those for renewable sources to keep nuclear power stations profitable in the competition against natural gas.[44][45]

A 2019 study by the economic think tank DIW found that nuclear power has not been profitable anywhere in the World.[46] The study of the economics of nuclear power has found it has never been financially viable, that most plants have been built while heavily subsidised by governments, often motivated by military purposes, and that nuclear power is not a good approach to tackling climate change. It found, after reviewing trends in nuclear power plant construction since 1951, that the average 1,000MW nuclear power plant would incur an average economic loss of 4.8 billion euros ($7.7 billion AUD). This has been refuted by another study.[47]

Capital costs

"The usual rule of thumb for nuclear power is that about two thirds of the generation cost is accounted for by fixed costs, the main ones being the cost of paying interest on the loans and repaying the capital..." [48]

Capital cost, the building and financing of nuclear power plants, represents a large percentage of the cost of nuclear electricity. In 2014, the US Energy Information Administration estimated that for new nuclear plants going online in 2019, capital costs will make up 74% of the levelized cost of electricity; higher than the capital percentages for fossil-fuel power plants (63% for coal, 22% for natural gas), and lower than the capital percentages for some other nonfossil-fuel sources (80% for wind, 88% for solar PV).[49]

Areva, the French nuclear plant operator, offers that 70% of the cost of a kWh of nuclear electricity is accounted for by the fixed costs from the construction process.[48] Some analysts argue (for example Steve Thomas, Professor of Energy Studies at the University of Greenwich in the UK, quoted in the book The Doomsday Machine by Martin Cohen and Andrew McKillop) that what is often not appreciated in debates about the economics of nuclear power is that the cost of equity, that is companies using their own money to pay for new plants, is generally higher than the cost of debt.[50] Another advantage of borrowing may be that "once large loans have been arranged at low interest rates – perhaps with government support – the money can then be lent out at higher rates of return".[50]

"One of the big problems with nuclear power is the enormous upfront cost. These reactors are extremely expensive to build. While the returns may be very great, they're also very slow. It can sometimes take decades to recoup initial costs. Since many investors have a short attention span, they don't like to wait that long for their investment to pay off."[51]

Because of the large capital costs for the initial nuclear power plants built as part of a sustained build program, and the relatively long construction period before revenue is returned, servicing the capital costs of first few nuclear power plants can be the most important factor determining the economic competitiveness of nuclear energy.[52] The investment can contribute about 70%[53] to 80%[54] of the costs of electricity. Timothy Stone, businessman and nuclear expert, stated in 2017 "It has long been recognised that the only two numbers which matter in [new] nuclear power are the capital cost and the cost of capital."[55] The discount rate chosen to cost a nuclear power plant's capital over its lifetime is arguably the most sensitive parameter to overall costs.[56] Because of the long life of new nuclear power plants, most of the value of a new nuclear power plant is created for the benefit of future generations.

The recent liberalization of the electricity market in many countries has made the economics of nuclear power generation less attractive,[57][58] and no new nuclear power plants have been built in a liberalized electricity market.[57] Previously a monopolistic provider could guarantee output requirements decades into the future. Private generating companies now have to accept shorter output contracts and the risks of future lower-cost competition, so they desire a shorter return on investment period. This favours generation plant types with lower capital costs or high subsidies, even if associated fuel costs are higher.[59] A further difficulty is that due to the large sunk costs but unpredictable future income from the liberalized electricity market, private capital is unlikely to be available on favourable terms, which is particularly significant for nuclear as it is capital-intensive.[60] Industry consensus is that a 5% discount rate is appropriate for plants operating in a regulated utility environment where revenues are guaranteed by captive markets, and 10% discount rate is appropriate for a competitive deregulated or merchant plant environment;[61] however the independent MIT study (2003) which used a more sophisticated finance model distinguishing equity and debt capital had a higher 11.5% average discount rate.[12]

As states are declining to finance nuclear power plants, the sector is now much more reliant on the commercial banking sector. According to research done by Dutch banking research group Profundo, commissioned by BankTrack, in 2008 private banks invested almost €176 billion in the nuclear sector. Champions were BNP Paribas, with more than €13,5 billion in nuclear investments and Citigroup and Barclays on par with both over €11,4 billion in investments. Profundo added up investments in eighty companies in over 800 financial relationships with 124 banks in the following sectors: construction, electricity, mining, the nuclear fuel cycle and "other".[62]

A 2016 study argued that while costs did increase in the past for reactors built in the past, this does not necessarily mean there is an inherent trend of cost escalation with nuclear power, as prior studies tended to examine a relatively small share of reactors built and that a full analysis shows that cost trends for reactors varied substantially by country and era.[63]

Cost overruns

Construction delays can add significantly to the cost of a plant. Because a power plant does not earn income and currencies can inflate during construction, longer construction times translate directly into higher finance charges. Modern nuclear power plants are planned for construction in five years or less (42 months for CANDU ACR-1000, 60 months from order to operation for an AP1000, 48 months from first concrete to operation for an EPR and 45 months for an ESBWR)[64] as opposed to over a decade for some previous plants. However, despite Japanese success with ABWRs, two of the four EPRs under construction (in Finland and France) are significantly behind schedule.[13]

In the United States many new regulations were put in place in the years before and again immediately after the Three Mile Island accident's partial meltdown, resulting in plant startup delays of many years. The NRC has new regulations in place now (see Combined Construction and Operating License), and the next plants will have NRC Final Design Approval before the customer buys them, and a Combined Construction and Operating License will be issued before construction starts, guaranteeing that if the plant is built as designed then it will be allowed to operate—thus avoiding lengthy hearings after completion.

In Japan and France, construction costs and delays are significantly diminished because of streamlined government licensing and certification procedures. In France, one model of reactor was type-certified, using a safety engineering process similar to the process used to certify aircraft models for safety. That is, rather than licensing individual reactors, the regulatory agency certified a particular design and its construction process to produce safe reactors. U.S. law permits type-licensing of reactors, a process which is being used on the AP1000 and the ESBWR.[65]

In Canada, cost overruns for the Darlington Nuclear Generating Station, largely due to delays and policy changes, are often cited by opponents of new reactors. Construction started in 1981 at an estimated cost of $7.4 Billion 1993-adjusted CAD, and finished in 1993 at a cost of $14.5 billion. 70% of the price increase was due to interest charges incurred due to delays imposed to postpone units 3 and 4, 46% inflation over a 4-year period and other changes in financial policy.[66] No new nuclear reactor has since been built in Canada, although a few have been and are undergoing refurbishment and environment assessment is complete for 4 new generation stations at Darlington with the Ontario government committed in keeping a nuclear base load of 50% or around 10GW.

In the United Kingdom and the United States cost overruns on nuclear plants contributed to the bankruptcies of several utility companies. In the United States these losses helped usher in energy deregulation in the mid-1990s that saw rising electricity rates and power blackouts in California. When the UK began privatizing utilities, its nuclear reactors "were so unprofitable they could not be sold." Eventually in 1996, the government gave them away. But the company that took them over, British Energy, had to be bailed out in 2004 to the extent of 3.4 billion pounds.[67]

Operating costs

In general, coal and nuclear plants have the same types of operating costs (operations and maintenance plus fuel costs). However, nuclear has lower fuel costs but higher operating and maintenance costs.[68]

Fuel costs

Nuclear plants require fissile fuel. Generally, the fuel used is uranium, although other materials may be used (See MOX fuel). In 2005, prices on the world market for uranium averaged US$20/lb (US$44.09/kg). On 2007-04-19, prices reached US$113/lb (US$249.12/kg).[69] On 2008-07-02, the price had dropped to $59/lb.[70]

Fuel costs account for about 28% of a nuclear plant's operating expenses.[69] As of 2013, half the cost of reactor fuel was taken up by enrichment and fabrication, so that the cost of the uranium concentrate raw material was 14 percent of operating costs.[71] Doubling the price of uranium would add about 10% to the cost of electricity produced in existing nuclear plants, and about half that much to the cost of electricity in future power plants.[72] The cost of raw uranium contributes about $0.0015/kWh to the cost of nuclear electricity, while in breeder reactors the uranium cost falls to $0.000015/kWh.[73]

As of 2008, mining activity was growing rapidly, especially from smaller companies, but putting a uranium deposit into production takes 10 years or more.[69] The world's present measured resources of uranium, economically recoverable at a price of US$130/kg according to the industry groups Organisation for Economic Co-operation and Development (OECD), Nuclear Energy Agency (NEA) and International Atomic Energy Agency (IAEA), are enough to last for "at least a century" at current consumption rates.[74]

According to the World Nuclear Association, "the world's present measured resources of uranium (5.7 Mt) in the cost category less than three times present spot prices and used only in conventional reactors, are enough to last for about 90 years. This represents a higher level of assured resources than is normal for most minerals. Further exploration and higher prices will certainly, on the basis of present geological knowledge, yield further resources as present ones are used up." The amount of uranium present in all currently known conventional reserves alone (excluding the huge quantities of currently-uneconomical uranium present in "unconventional" reserves such as phosphate/phosphorite deposits, seawater, and other sources) is enough to last over 200 years at current consumption rates. Fuel efficiency in conventional reactors has increased over time. Additionally, since 2000, 12–15% of world uranium requirements have been met by the dilution of highly enriched weapons-grade uranium from the decommissioning of nuclear weapons and related military stockpiles with depleted uranium, natural uranium, or partially-enriched uranium sources to produce low-enriched uranium for use in commercial power reactors. Similar efforts have been utilizing weapons-grade plutonium to produce mixed oxide (MOX) fuel, which is also produced from reprocessing used fuel. Other components of used fuel are currently less commonly utilized, but have a substantial capacity for reuse, especially so in next-generation fast neutron reactors. Over 35 European reactors are licensed to use MOX fuel, as well as Russian and American nuclear plants. Reprocessing of used fuel increases utilization by approximately 30%, while the widespread use of fast breeder reactors would allow for an increase of "50-fold or more" in utilization.[75][76][77]

Waste disposal costs

All nuclear plants produce radioactive waste. To pay for the cost of storing, transporting and disposing these wastes in a permanent location, in the United States a surcharge of a tenth of a cent per kilowatt-hour is added to electricity bills.[78] Roughly one percent of electrical utility bills in provinces using nuclear power are diverted to fund nuclear waste disposal in Canada.[79]

In 2009, the Obama administration announced that the Yucca Mountain nuclear waste repository would no longer be considered the answer for U.S. civilian nuclear waste. Currently, there is no plan for disposing of the waste and plants will be required to keep the waste on the plant premises indefinitely.

The disposal of low level waste reportedly costs around £2,000/m³ in the UK. High level waste costs somewhere between £67,000/m³ and £201,000/m³.[80] General division is 80%/20% of low level/high level waste,[81] and one reactor produces roughly 12 m³ of high level waste annually.[82]

In Canada, the NWMO was created in 2002 to oversee long term disposal of nuclear waste, and in 2007 adopted the Adapted Phased Management procedure. Long term management is subject to change based on technology and public opinion, but currently largely follows the recommendations for a centralized repository as first extensively outlined by AECL in 1988. It was determined after extensive review that following these recommendations would safely isolate the waste from the biosphere. The location has not yet been determined, and the project is expected to cost between $9 and $13 billion CAD for construction and operation for 60–90 years, employing roughly a thousand people for the duration. Funding is available and has been collected since 1978 under the Canadian Nuclear Fuel Waste Management Program. Very long term monitoring requires less staff since high-level waste is less toxic than naturally occurring uranium ore deposits within a few centuries.[79]

The primary argument for pursuing IFR-style technology today is that it provides the best solution to the existing nuclear waste problem because fast reactors can be fueled from the waste products of existing reactors as well as from the plutonium used in weapons, as is the case of the discontinued EBR-II in Arco, Idaho, and in the operating, as of 2014, BN-800 reactor. Depleted uranium (DU) waste can also be used as fuel in fast reactors. Waste produced by a fast-neutron reactor and a pyroelectric refiner would consist only of fission products, which are produced at a rate of about one tonne per GWe-year. This is 5% as much as present reactors produce, and needs special custody for only 300 years instead of 300,000. Only 9.2% of fission products (strontium and caesium) contribute 99% of radiotoxicity; at some additional cost, these could be separated, reducing the disposal problem by a further factor of ten.

Decommissioning

At the end of a nuclear plant's lifetime, the plant must be decommissioned. This entails either dismantling, safe storage or entombment. In the United States, the Nuclear Regulatory Commission (NRC) requires plants to finish the process within 60 years of closing. Since it may cost $500 million or more to shut down and decommission a plant, the NRC requires plant owners to set aside money when the plant is still operating to pay for the future shutdown costs.[83]

Decommissioning a reactor that has undergone a meltdown is inevitably more difficult and expensive. Three Mile Island was decommissioned 14 years after its incident for $837 million.[84] The cost of the Fukushima disaster cleanup is not yet known, but has been estimated to cost around $100 billion.[85] Chernobyl is not yet decommissioned, different estimates put the end date between 2013[86] and 2020.[87]

Proliferation and terrorism

A 2011 report for the Union of Concerned Scientists stated that "the costs of preventing nuclear proliferation and terrorism should be recognized as negative externalities of civilian nuclear power, thoroughly evaluated, and integrated into economic assessments—just as global warming emissions are increasingly identified as a cost in the economics of coal-fired electricity".[88]

"Construction of the ELWR was completed in 2013 and is optimized for civilian electricity production, but it has "dual-use" potential and can be modified to produce material for nuclear weapons."[89]

Safety, security and accidents

Nuclear safety and security is a chief goal of the nuclear industry. Great care is taken so that accidents are avoided, and if unpreventable, have limited consequences. Accidents could stem from system failures related to faulty construction or pressure vessel embrittlement due to prolonged radiation exposure.[90] As with any aging technology, risks of failure increase over time, and since many currently operating nuclear reactors were built in the mid 20th century, care must be taken to ensure proper operation. Many more recent reactor designs have been proposed, most of which include passive safety systems. These design considerations serve to significantly mitigate or totally prevent major accidents from occurring, even in the event of a system failure. Still, reactors must be designed, built, and operated properly to minimize accident risks.[91] The Fukushima disaster represents one instance where these systems were not comprehensive enough, where the tsunami following the Tōhoku earthquake disabled the backup generators that were stabilizing the reactor.[92][93] According to UBS AG, the Fukushima I nuclear accidents have cast doubt on whether even an advanced economy like Japan can master nuclear safety.[94] Catastrophic scenarios involving terrorist attacks are also conceivable.[91]

An interdisciplinary team from MIT estimated that given the expected growth of nuclear power from 2005 to 2055, at least four core damage incidents would be expected in that period (assuming only current designs were used – the number of incidents expected in that same time period with the use of advanced designs is only one).[95] To date, there have been five core damage incidents in the world since 1970 (one at Three Mile Island in 1979; one at Chernobyl in 1986; and three at Fukushima-Daiichi in 2011), corresponding to the beginning of the operation of generation II reactors.[93]

According to the Paul Scherrer Institute, the Chernobyl incident is the only incident ever to have caused any fatalities. The report that UNSCEAR presented to the UN General Assembly in 2011 states that 29 plant workers and emergency responders died from effects of radiation exposure, two died from causes related to the incident but unrelated to radiation, and one died from coronary thrombosis. It attributed fifteen cases of fatal thyroid cancer to the incident. It said there is no evidence the incident caused an ongoing increase in incidence of solid tumors or blood cancers in Eastern Europe.

In terms of nuclear accidents, the Union of Concerned Scientists have claimed that "reactor owners ... have never been economically responsible for the full costs and risks of their operations. Instead, the public faces the prospect of severe losses in the event of any number of potential adverse scenarios, while private investors reap the rewards if nuclear plants are economically successful. For all practical purposes, nuclear power's economic gains are privatized, while its risks are socialized".[96]

However, the problem of insurance costs for worst-case scenarios is not unique to nuclear power: hydroelectric power plants are similarly not fully insured against a catastrophic event such as the Banqiao Dam disaster, where 11 million people lost their homes and from 30,000 to 200,000 people died, or large dam failures in general.[97] Private insurers base dam insurance premiums on worst-case scenarios, so insurance for major disasters in this sector is likewise provided by the state.[97] In the US, insurance coverage for nuclear reactors is provided by the combination of operator-purchased private insurance and the primarily operator-funded Price Anderson Act.

Any effort to construct a new nuclear facility around the world, whether an existing design or an experimental future design, must deal with NIMBY or NIABY objections. Because of the high profiles of the Three Mile Island accident and Chernobyl disaster, relatively few municipalities welcome a new nuclear reactor, processing plant, transportation route, or deep geological repository within their borders, and some have issued local ordinances prohibiting the locating of such facilities there.

Nancy Folbre, an economics professor at the University of Massachusetts, has questioned the economic viability of nuclear power following the 2011 Japanese nuclear accidents:

The proven dangers of nuclear power amplify the economic risks of expanding reliance on it. Indeed, the stronger regulation and improved safety features for nuclear reactors called for in the wake of the Japanese disaster will almost certainly require costly provisions that may price it out of the market.[98]

The cascade of problems at Fukushima, from one reactor to another, and from reactors to fuel storage pools, will affect the design, layout and ultimately the cost of future nuclear plants.[99]

In 1986, Pete Planchon conducted a demonstration of the inherent safety of the Integral Fast Reactor. Safety interlocks were turned off. Coolant circulation was turned off. Core temperature rose from the usual 1000 degrees Fahrenheit to 1430 degrees within 20 seconds. The boiling temperature of the sodium coolant is 1621 degrees. Within seven minutes the reactor had shut itself down without action from the operators, without valves, pumps, computers, auxiliary power, or any moving parts. The temperature was below the operating temperature. The reactor was not damaged. The operators were not injured. There was no release of radioactive material. The reactor was restarted with coolant circulation but the steam generator disconnected. The same scenario recurred. Three weeks later, the operators at Chernobyl repeated the latter experiment, ironically in a rush to complete a safety test, using a very different reactor, with tragic consequences. Safety of the Integral Fast Reactor depends on the composition and geometry of the core, not efforts by operators or computer algorithms.[100]

Insurance

Insurance available to the operators of nuclear power plants varies by nation. The worst case nuclear accident costs are so large that it would be difficult for the private insurance industry to carry the size of the risk, and the premium cost of full insurance would make nuclear energy uneconomic.[101]

Nuclear power has largely worked under an insurance framework that limits or structures accident liabilities in accordance with the Paris convention on nuclear third-party liability, the Brussels supplementary convention, the Vienna convention on civil liability for nuclear damage,[102] and in the United States the Price-Anderson Act. It is often argued that this potential shortfall in liability represents an external cost not included in the cost of nuclear electricity.

However, the problem of insurance costs for worst-case scenarios is not unique to nuclear power: hydroelectric power plants are similarly not fully insured against a catastrophic event such as the Banqiao Dam disaster, where 11 million people lost their homes and from 30,000 to 200,000 people died, or large dam failures in general.[97] Private insurers base dam insurance premiums on worst-case scenarios, so insurance for major disasters in this sector is likewise provided by the state.[97]

In Canada, the Canadian Nuclear Liability Act requires nuclear power plant operators to obtain $650 million (CAD) of liability insurance coverage per installation (regardless of the number of individual reactors present) starting in 2017 (up from the prior $75 million requirement established in 1976), increasing to $750 million in 2018, to $850 million in 2019, and finally to $1 billion in 2020.[103][104] Claims beyond the insured amount would be assessed by a government appointed but independent tribunal, and paid by the federal government.[105]

In the UK, the Nuclear Installations Act 1965 governs liability for nuclear damage for which a UK nuclear licensee is responsible. The limit for the operator is £140 million.[106]

In the United States, the Price-Anderson Act has governed the insurance of the nuclear power industry since 1957. Owners of nuclear power plants are required to pay a premium each year for the maximum obtainable amount of private insurance ($450 million) for each licensed reactor unit.[107] This primary or "first tier" insurance is supplemented by a second tier. In the event a nuclear accident incurs damages in excess of $450 million, each licensee would be assessed a prorated share of the excess up to $121,255,000. With 104 reactors currently licensed to operate, this secondary tier of funds contains about $12.61 billion. This results in a maximum combined primary+secondary coverage amount of up to $13.06 billion for a hypothetical single-reactor incident. If 15 percent of these funds are expended, prioritization of the remaining amount would be left to a federal district court. If the second tier is depleted, Congress is committed to determine whether additional disaster relief is required.[108] In July 2005, Congress extended the Price-Anderson Act to newer facilities.

The Vienna Convention on Civil Liability for Nuclear Damage and the Paris Convention on Third Party Liability in the Field of Nuclear Energy put in place two similar international frameworks for nuclear liability.[109] The limits for the conventions vary. The Vienna convention was adapted in 2004 to increase the operator liability to €700 million per incident, but this modification is not yet ratified.[110]

Cost per kWh

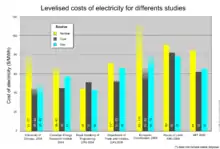

The cost per unit of electricity produced (kWh) will vary according to country, depending on costs in the area, the regulatory regime and consequent financial and other risks, and the availability and cost of finance. Costs will also depend on geographic factors such as availability of cooling water, earthquake likelihood, and availability of suitable power grid connections. So it is not possible to accurately estimate costs on a global basis.

Commodity prices rose in 2008, and so all types of plants became more expensive than previously calculated.[111] In June 2008 Moody's estimated that the cost of installing new nuclear capacity in the United States might possibly exceed $7,000/KWe in final cost.[112] In comparison, the reactor units already under construction in China have been reported with substantially lower costs due to significantly lower labour rates.

In 2009, MIT updated its 2003 study, concluding that inflation and rising construction costs had increased the overnight cost of nuclear power plants to about $4,000/kWe, and thus increased the power cost to $0.084/kWh.[54][113] The 2003 study had estimated the cost as $0.067/kWh.[12]

A 2013 study indicates that the cost competitiveness of nuclear power is "questionable" and that public support will be required if new power stations are to be built within liberalized electricity markets.[114]

In 2014, the US Energy Information Administration estimated the levelized cost of electricity from new nuclear power plants going online in 2019 to be $0.096/kWh before government subsidies, comparable to the cost of electricity from a new coal-fired power plant without carbon capture, but higher than the cost from natural gas-fired plants.[115]

In 2019 the US EIA revised the levelized cost of electricity from new advanced nuclear power plants going online in 2023 to be $0.0775/kWh before government subsidies, using a regulated industry 4.3% cost of capital (WACC - pre-tax 6.6%) over a 30-year cost recovery period.[116] Financial firm Lazard also updated its levelized cost of electricity report costing new nuclear at between $0.118/kWh and $0.192/kWh using a commercial 7.7% cost of capital (WACC - pre-tax 12% cost for the higher-risk 40% equity finance and 8% cost for the 60% loan finance) over a 40 year lifetime.[117]

Comparisons with other power sources

Generally, a nuclear power plant is significantly more expensive to build than an equivalent coal-fueled or gas-fueled plant. If natural gas is plentiful and cheap operating costs of conventional power plants is less.[118] Most forms of electricity generation produce some form of negative externality — costs imposed on third parties that are not directly paid by the producer — such as pollution which negatively affects the health of those near and downwind of the power plant, and generation costs often do not reflect these external costs.

A comparison of the "real" cost of various energy sources is complicated by a number of uncertainties:

- The cost of climate change through emissions of greenhouse gases is hard to estimate. Carbon taxes may be enacted, or carbon capture and storage may become mandatory.

- The cost of environmental damage caused by any energy source through land use (whether for mining fuels or for power generation), air and water pollution, solid waste production, manufacturing-related damages (such as from mining and processing ores or rare earth elements), etc.

- The cost and political feasibility of disposal of the waste from reprocessed spent nuclear fuel is still not fully resolved. In the United States, the ultimate disposal costs of spent nuclear fuel are assumed by the U.S. government after producers pay a fixed surcharge.

- Operating reserve requirements are different for different generation methods. When nuclear units shut down unexpectedly they tend to do so independently, so the "hot spinning reserve" must be at least the size of the largest unit. On the other hand, some renewable energy sources (such as solar/wind power) are intermittent power sources with uncontrollably varying outputs, so the grid will require a combination of demand response, extra long-range transmission infrastructure, and large-scale energy storage.[119] (Some firm renewables such as hydroelectricity have a storage reservoir and can be used as reliable back-up power for other power sources.)

- Potential governmental instabilities in the plant's lifetime. Modern nuclear reactors are designed for a minimum operational lifetime of 60 years (extendible to 100+ years), compared to the 40 years (extendible to 60+ years) that older reactors were designed for.[120]

- Actual plant lifetime (to date, no nuclear plant has been shut down solely due to reaching its licensed lifetime. Over 87 reactors in the United States have been granted extended operating licenses to 60 years of operation by the NRC as of December 2016, and subsequent license renewals could extend that to 80 years.[121][122] Modern nuclear reactors are also designed to last longer than older reactors as outlined above, allowing for even further increased plant lifetimes.)

- Due to the dominant role of initial construction costs and the multi-year construction time, the interest rate for the capital required (as well as the timeline that the plant is completed in) has a major impact on the total cost of building a new nuclear plant.

Lazard's report on the estimated levelized cost of energy by source (10th edition) estimated unsubsidized prices of $97–$136/MWh for nuclear, $50–$60/MWh for solar PV, $32–$62/MWh for onshore wind, and $82–$155/MWh for offshore wind.[123]

However, the most important subsidies to the nuclear industry do not involve cash payments. Rather, they shift construction costs and operating risks from investors to taxpayers and ratepayers, burdening them with an array of risks including cost overruns, defaults to accidents, and nuclear waste management. This approach has remained remarkably consistent throughout the nuclear industry's history, and distorts market choices that would otherwise favor less risky energy investments.[124]

In 2011, Benjamin K. Sovacool said that: "When the full nuclear fuel cycle is considered — not only reactors but also uranium mines and mills, enrichment facilities, spent fuel repositories, and decommissioning sites — nuclear power proves to be one of the costliest sources of energy".[125]

In 2014, Brookings Institution published The Net Benefits of Low and No-Carbon Electricity Technologies which states, after performing an energy and emissions cost analysis, that "The net benefits of new nuclear, hydro, and natural gas combined cycle plants far outweigh the net benefits of new wind or solar plants", with the most cost effective low carbon power technology being determined to be nuclear power.[126][127] Moreover, Paul Joskow of MIT maintains that the "Levelized cost of electricity" (LCOE) metric is a poor means of comparing electricity sources as it hides the extra costs, such as the need to frequently operate back up power stations, incurred due to the use of intermittent power sources such as wind energy, while the value of baseload power sources are underpresented.[128]

A 2017 focused response to these claims, particularly "baseload" or "back up", by Amory Lovins in 2017, countered with statistics from operating grids.[129]

Other economic issues

Kristin Shrader-Frechette analysed 30 papers on the economics of nuclear power for possible conflicts of interest. She found of the 30, 18 had been funded either by the nuclear industry or pro-nuclear governments and were pro-nuclear, 11 were funded by universities or non-profit non-government organisations and were anti-nuclear, the remaining 1 had unknown sponsors and took the pro-nuclear stance. The pro-nuclear studies were accused of using cost-trimming methods such as ignoring government subsidies and using industry projections above empirical evidence where ever possible. The situation was compared to medical research where 98% of industry sponsored studies return positive results.[130]

Nuclear Power plants tend to be very competitive in areas where other fuel resources are not readily available — France, most notably, has almost no native supplies of fossil fuels.[131] France's nuclear power experience has also been one of paradoxically increasing rather than decreasing costs over time.[132][133]

Making a massive investment of capital in a project with long-term recovery might affect a company's credit rating.[134][135]

A Council on Foreign Relations report on nuclear energy argues that a rapid expansion of nuclear power may create shortages in building materials such as reactor-quality concrete and steel, skilled workers and engineers, and safety controls by skilled inspectors. This would drive up current prices.[136] It may be easier to rapidly expand, for example, the number of coal power plants, without this having a large effect on current prices.

Existing nuclear plants generally have a somewhat limited ability to significantly vary their output in order to match changing demand (a practice called load following).[137] However, many BWRs, some PWRs (mainly in France), and certain CANDU reactors (primarily those at Bruce Nuclear Generating Station) have various levels of load-following capabilities (sometimes substantial), which allow them to fill more than just baseline generation needs. Several newer reactor designs also offer some form of enhanced load-following capability.[138] For example, the Areva EPR can slew its electrical output power between 990 and 1,650 MW at 82.5 MW per minute.[139]

The number of companies that manufacture certain parts for nuclear reactors is limited, particularly the large forgings used for reactor vessels and steam systems. Only four companies (Japan Steel Works, China First Heavy Industries, Russia's OMZ Izhora and Korea's Doosan Heavy Industries) currently manufacture pressure vessels for reactors of 1100 MWe or larger.[140][141] Some have suggested that this poses a bottleneck that could hamper expansion of nuclear power internationally,[142] however, some Western reactor designs require no steel pressure vessel such as CANDU derived reactors which rely on individual pressurized fuel channels. The large forgings for steam generators — although still very heavy — can be produced by a far larger number of suppliers.

For a country with both a nuclear power industry and a nuclear arms industry synergies between the two can favor a nuclear power plant with an otherwise uncertain economy. For example, in the United Kingdom researchers have informed MPs that the government was using the Hinkley Point C project to cross-subsidise the UK military's nuclear-related activity by maintaining nuclear skills. In support of that, the researchers from the University of Sussex, Prof. Andy Stirling and Dr. Phil Johnstone, stated that the costs of the Trident nuclear submarine programme would be prohibitive without “an effective subsidy from electricity consumers to military nuclear infrastructure”.[143]

Recent trends

The nuclear power industry in Western nations has a history of construction delays, cost overruns, plant cancellations, and nuclear safety issues despite significant government subsidies and support.[145][146][147] In December 2013, Forbes magazine reported that, in developed countries, "reactors are not a viable source of new power".[148] Even in developed nations where they make economic sense, they are not feasible because nuclear's “enormous costs, political and popular opposition, and regulatory uncertainty”.[148] This view echoes the statement of former Exelon CEO John Rowe, who said in 2012 that new nuclear plants “don’t make any sense right now” and won't be economically viable in the foreseeable future.[148] John Quiggin, economics professor, also says the main problem with the nuclear option is that it is not economically-viable. Quiggin says that we need more efficient energy use and more renewable energy commercialization.[20] Former NRC member Peter A. Bradford and Professor Ian Lowe have recently made similar statements.[149][150] However, some "nuclear cheerleaders" and lobbyists in the West continue to champion reactors, often with proposed new but largely untested designs, as a source of new power.[148][150][151][152][153][154][155]

Significant new build activity is occurring in developing countries like South Korea, India and China. China has 25 reactors under construction,[156][157] However, according to a government research unit, China must not build "too many nuclear power reactors too quickly", in order to avoid a shortfall of fuel, equipment and qualified plant workers.[158]

The 1.6 GWe EPR reactor is being built in Olkiluoto Nuclear Power Plant, Finland. A joint effort of French AREVA and German Siemens AG, it will be the largest pressurized water reactor (PWR) in the world. The Olkiluoto project has been claimed to have benefited from various forms of government support and subsidies, including liability limitations, preferential financing rates, and export credit agency subsidies, but the European Commission's investigation didn't find anything illegal in the proceedings.[159][160] However, as of August 2009, the project is "more than three years behind schedule and at least 55% over budget, reaching a total cost estimate of €5 billion ($7 billion) or close to €3,100 ($4,400) per kilowatt".[161] Finnish electricity consumers interest group ElFi OY evaluated in 2007 the effect of Olkiluoto-3 to be slightly over 6%, or €3/MWh, to the average market price of electricity within Nord Pool Spot. The delay is therefore costing the Nordic countries over 1.3 billion euros per year as the reactor would replace more expensive methods of production and lower the price of electricity.[162]

Russia has launched the world's first floating nuclear power plant. The £100 million vessel, the Akademik Lomonosov, is the first of seven plants (70 MWe per ship) that Moscow says will bring vital energy resources to remote Russian regions.[163] Startup of the first of the ships two reactors was announced in December 2018.[164]

Following the Fukushima nuclear disaster in 2011, costs are likely to go up for currently operating and new nuclear power plants, due to increased requirements for on-site spent fuel management and elevated design basis threats.[14] After Fukushima, the International Energy Agency halved its estimate of additional nuclear generating capacity built by 2035.[165]

Many license applications filed with the U.S. Nuclear Regulatory Commission for proposed new reactors have been suspended or cancelled.[166][167] As of October 2011, plans for about 30 new reactors in the United States have been reduced to 14.[168] There are currently five new nuclear plants under construction in the United States (Watts Bar 2, Summer 2, Summer 3, Vogtle 3, Vogtle 4).[169] Matthew Wald from The New York Times has reported that "the nuclear renaissance is looking small and slow".[170]

In 2013, four aging, uncompetitive reactors were permanently closed in the US: San Onofre 2 and 3 in California, Crystal River 3 in Florida, and Kewaunee in Wisconsin.[171][172] The Vermont Yankee plant closed in 2014. New York State is seeking to close Indian Point Nuclear Power Plant, in Buchanan, 30 miles from New York City.[172] The additional cancellation of five large reactor uprates (Prairie Island, 1 reactor, LaSalle, 2 reactors, and Limerick, 2 reactors), four by the largest nuclear company in the United States, suggest that the nuclear industry faces "a broad range of operational and economic problems".[173]

As of July 2013, economist Mark Cooper has identified some US nuclear power plants that face particularly significant challenges to their continued operation due to regulatory policies.[173] These are Palisades, Fort Calhoun (meanwhile closed for economical reasons), Nine Mile Point, Fitzpatrick, Ginna, Oyster Creek (same as Ft. Calhoun), Vermont Yankee (same as Ft. Calhoun), Millstone, Clinton, Indian Point. Cooper said the lesson here for policy makers and economists is clear: "nuclear reactors are simply not competitive".[173] In 2017 analysis by Bloomberg showed that over half of U.S. nuclear plants were running at a loss, first of all those at a single unit site.[174]

See also

- Cost of electricity by source

- Generation IV reactor

- Light Water Reactor Sustainability Program

- List of books about nuclear issues

- List of nuclear reactors

- Lists of nuclear disasters and radioactive incidents

- Nuclear decommissioning

- Nuclear power debate

- Renewable energy commercialization

- World Nuclear Industry Status Report

References

- EDF raises French EPR reactor cost to over $11 billion, Reuters, Dec 3, 2012.

- Mancini, Mauro and Locatelli, Giorgio and Sainati, Tristano (2015). The divergence between actual and estimated costs in large industrial and infrastructure projects: is nuclear special? In: Nuclear new build: insights into financing and project management. Nuclear Energy Agency, pp. 177–188.

- "Nuclear Power Economics | Nuclear Energy Costs - World Nuclear Association". www.world-nuclear.org. Retrieved 27 September 2019.

- "The Case Against Nuclear Power: Facts and Arguments from A-Z:A Beyond Nuclear handbook - Beyond Nuclear International". www.beyondnuclearinternational.org. Retrieved 24 September 2020.

- "The Case Against Nuclear Power: Climate change and why nuclear power can't fix it - Beyond Nuclear International" (PDF). www.beyondnuclearinternational.files.wordpress.com/2019/01/climate-change-chapter.pdf. Retrieved 24 September 2020.

- Kidd, Steve (January 21, 2011). "New reactors—more or less?". Nuclear Engineering International. Archived from the original on 2011-12-12.

- Jeff McMahon, "Exelon's nuclear guy: no new nukes", Forbes 29 Mar. 2012

- Ed Crooks (12 September 2010). "Nuclear: New dawn now seems limited to the east". Financial Times. Retrieved 12 September 2010.

- Edward Kee (16 March 2012). "Future of Nuclear Energy" (PDF). NERA Economic Consulting. Archived from the original (PDF) on 5 October 2013. Retrieved 2 October 2013.

- The Future of Nuclear Power. Massachusetts Institute of Technology. 2003. ISBN 978-0-615-12420-9. Retrieved 2006-11-10.

- Patel, Tara; Francois de Beaupuy (24 November 2010). "China Builds Nuclear Reactor for 40% Less Than Cost in France, Areva Says". Bloomberg. Retrieved 2011-03-08.

- Massachusetts Institute of Technology (2011). "The Future of the Nuclear Fuel Cycle" (PDF). p. xv.

- "Olkiluoto pipe welding 'deficient', says regulator". World Nuclear News. 16 October 2009. Retrieved 8 June 2010.

- Kinnunen, Terhi (2010-07-01). "Finnish parliament agrees plans for two reactors". Reuters. Retrieved 2010-07-02.

- "Olkiluoto 3 delayed beyond 2014". World Nuclear News. 17 July 2012. Retrieved 24 July 2012.

- "Finland's Olkiluoto 3 nuclear plant delayed again". BBC. 16 July 2012. Retrieved 10 August 2012.

- "China Nuclear Power – Chinese Nuclear Energy – World Nuclear Association". www.world-nuclear.org.

- John Quiggin (8 November 2013). "Reviving nuclear power debates is a distraction. We need to use less energy". The Guardian.

- "Ian Lowe". Griffith.edu.au. August 8, 2014. Archived from the original on February 5, 2015. Retrieved January 30, 2015.

- Ian Lowe (March 20, 2011). "No nukes now, or ever". The Age. Melbourne.

- Jeff McMahon (10 November 2013). "New-Build Nuclear Is Dead: Morningstar". Forbes.

- Hannah Northey (18 March 2011). "Former NRC Member Says Renaissance is Dead, for Now". The New York Times.

- Leo Hickman (28 November 2012). "Nuclear lobbyists wined and dined senior civil servants, documents show". The Guardian. London.

- Diane Farseta (September 1, 2008). "The Campaign to Sell Nuclear". Bulletin of the Atomic Scientists. pp. 38–56.

- Jonathan Leake. The Nuclear Charm Offensive" New Statesman, 23 May 2005.

- Union of Concerned Scientists. Nuclear Industry Spent Hundreds of Millions of Dollars Over the Last Decade to Sell Public, Congress on New Reactors, New Investigation Finds Archived November 27, 2013, at the Wayback Machine News Center, February 1, 2010.

- Nuclear group spent $460,000 lobbying in 4Q Archived October 23, 2012, at the Wayback Machine Business Week, March 19, 2010.

- https://www.ipcc.ch/pdf/assessment-report/ar5/wg3/ipcc_wg3_ar5_summary-for-policymakers.pdf

- "Russian Federation" (PDF). Organisation for Economic Co-operation and Development (OECD). Retrieved 24 February 2008.

- "Bilateral Relations: Korea". Brussels: European Commission. Archived from the original on 2013-03-25. Retrieved 2015-01-30.

- Greenpeace (12 June 2012). "Toxic Assets – Nuclear Reactors in the 21st Century. Financing reactors and the Fukushima nuclear disaster". Greenpeace. Archived from the original on 2 January 2015. Retrieved 2 January 2015.

- Gordon Evans (13 February 2014). "The Costs and Risks of Nuclear Power".

- Chesapeake unsafe energy coalition (13 February 2014). "At What Cost: Why Maryland Can't Afford A New Reactor" (PDF).

- Institute for Energy and Environmental Ideology (13 January 2008). "Nuclear Costs: High and Higher" (PDF).

- dustin.pringle (2014-02-19). "Affordable, Stable Prices". Ontario Nuclear. Archived from the original on 2016-01-20. Retrieved 2015-11-01.

- "Ontario Hydro Rate Increase Set For Tuesday". Huffingtonpost.ca. 2012-04-30. Retrieved 2015-11-01.

- Weiner, Jon (2015-09-30). "Price of Solar Energy in the United States Has Fallen to 5¢/kWh on Average | Berkeley Lab". News Center. Retrieved 2016-09-27.

- "Palo Alto, California, Approves Solar PPA With Hecate Energy At $36.76/MWh! (Record Low) – CleanTechnica". cleantechnica.com.

- Fares, Robert. "The Price of Solar Is Declining to Unprecedented Lows".

- "PRIS – Home". www.iaea.org. Missing or empty

|url=(help) - World Nuclear Association, "Plans for New Reactors Worldwide", October 2015.

- Yee, Vivian (July 20, 2016). "Nuclear Subsidies Are Key Part of New York's Clean-Energy Plan". The New York Times.

- "NYSDPS-DMM: Matter Master".

- DIW Weekly Report 30 / 2019, S. 235-243 Research: not one single nuclear power plant in the world was ever profitable

- Das DIW-Papier über die „teure und gefährliche“ Kernenergie auf dem Prüfstand, Wendland, Peters; 2019

- The Doomsday Machine, Cohen and McKillop (Palgrave 2012) page 89

- "U.S. Energy Information Administration (EIA) – Source". Eia.gov. Retrieved 2015-11-01.

- The Doomsday Machine, Cohen and McKillop (Palgrave 2012) page 199

- Indiviglio, Daniel (February 1, 2011). "Why Are New U.S. Nuclear Reactor Projects Fizzling?". The Atlantic.

- George S. Tolley; Donald W. Jones (August 2004). "The Economic Future of Nuclear Power" (PDF). University of Chicago: xi. Archived from the original (PDF) on 2007-04-15. Retrieved 2007-05-05. Cite journal requires

|journal=(help) - Malcolm Grimston (December 2005). "The Importance of Politics to Nuclear New Build" (PDF). Royal Institute of International Affairs: 34. Retrieved 5 February 2013. Cite journal requires

|journal=(help) - Yangbo Du; John E. Parsons (May 2009). "Update on the Cost of Nuclear Power" (PDF). Massachusetts Institute of Technology. Retrieved 2009-05-19. Cite journal requires

|journal=(help) - "UK study aims to identify nuclear cost reductions". World Nuclear News. 27 October 2017. Retrieved 29 October 2017.

- "The nuclear energy option in the UK" (PDF). Parliamentary Office of Science and Technology. December 2003. Archived from the original (PDF) on 2006-12-10. Retrieved 2007-04-29. Cite journal requires

|journal=(help) - Edward Kee (4 February 2015). "Can nuclear succeed in liberalized power markets?". World Nuclear News. Retrieved 9 February 2015.

- Fabien A. Roques; William J. Nuttall; David M. Newbery (July 2006). "Using Probabilistic Analysis to Value Power Generation Investments under Uncertainty" (PDF). University of Cambridge. Archived from the original (PDF) on 2007-09-29. Retrieved 2007-05-05. Cite journal requires

|journal=(help) - Till Stenzel (September 2003). "What does it mean to keep the nuclear option open in the UK?" (PDF). Imperial College: 16. Archived from the original (PDF) on 2006-10-17. Retrieved 2006-11-17. Cite journal requires

|journal=(help) - "Electricity Generation Technologies: Performance and Cost Characteristics" (PDF). Canadian Energy Research Institute. August 2005. Retrieved 2007-04-28. Cite journal requires

|journal=(help) - The Economic Modeling Working Group (2007-09-26). "Cost Estimating Guidelines for Generation IV Nuclear Energy Systems" (PDF). Generation IV International Forum. Archived from the original (PDF) on 2007-11-06. Retrieved 2008-04-19. Cite journal requires

|journal=(help) - "Nuclear banks? No thanks!". Nuclearbanks.org. Retrieved 2015-11-01.

- Lovering, Jessica R., Arthur Yip, and Ted Nordhaus. "Historical construction costs of global nuclear power reactors." Energy policy 91 (2016): 371-382.

- "Bruce Power New build Project Environmental Assessment – Round One Open House (Appendix B2)" (PDF). Bruce Power. 2006. Retrieved 2007-04-23.

- "NuStart Energy Picks Enercon for New Nuclear Power Plant License Applications for a GE ESBWR and a Westinghouse AP 1000". PRNewswire. 2006. Retrieved 2006-11-10.

- "Costs and Benefits". The Canadian Nuclear FAQ. 2011. Retrieved 2011-01-05.

- Christian Parenti (April 18, 2011). "Nuclear Dead End: It's the Economics, Stupid". The Nation.

- "NUREG-1350 Vol. 18: NRC Information Digest 2006–2007" (PDF). Nuclear Regulatory Commission. 2006. Retrieved 2007-01-22.

- What's behind the red-hot uranium boom, 2007-04-19, CNN Money, Retrieved 2008-07-2

- "UxC Nuclear Fuel Price Indicators (Delayed)". Ux Consulting Company, LLC. Retrieved 2008-07-02.

- "The Economics of Nuclear Power". World Nuclear Association. February 2014. Retrieved 2014-02-17.

- World Nuclear, Economics of nuclear power, Feb. 2014.

- Lightfoot, H. Douglas; Manheimer, Wallace; Meneley, Daniel A; Pendergast, Duane; Stanford, George S (2006). "Nuclear Fission Fuel is Inexhaustible". 2006 IEEE EIC Climate Change Conference. pp. 1–8. doi:10.1109/EICCCC.2006.277268. ISBN 978-1-4244-0218-2. S2CID 2731046.

- "Uranium resources sufficient to meet projected nuclear energy requirements long into the future". Nuclear Energy Agency (NEA). 3 June 2008. Archived from the original on 5 December 2008. Retrieved 2008-06-16.

- "Uranium Supplies: Supply of Uranium – World Nuclear Association". www.world-nuclear.org. World Nuclear Association. Retrieved 11 February 2017.

- "Processing of Used Nuclear Fuel – World Nuclear Association". www.world-nuclear.org. World Nuclear Association. Retrieved 11 February 2017.

- "Military Warheads as a Source of Nuclear Fuel | Megatons to MegaWatts – World Nuclear Association". www.world-nuclear.org. World Nuclear Association. Retrieved 11 February 2017.

- "Safe Transportation of Spent Nuclear Fuel". Sustainablenuclear.org. Archived from the original on 2016-06-10. Retrieved 2015-11-01.

- "Waste Management". Nuclearfaq.ca. Retrieved 2011-01-05.

- Archived April 4, 2008, at the Wayback Machine

- "Management of spent nuclear fuel and radioactive waste". Europa. SCADPlus. 2007-11-22. Archived from the original on 2008-05-15. Retrieved 2008-08-05.

- Nuclear Energy Data 2008, OECD, p. 48 (the Netherlands, Borssele nuclear power plant)

- Decommissioning a Nuclear Power Plant, 2007-4-20, U.S. Nuclear Regulatory Commission, Retrieved 2007-6-12

- "NRC: Three Mile Island – Unit 2". Nrc.gov. Retrieved 2015-11-01.

- Justin McCurry (6 March 2013). "Fukushima two years on: the largest nuclear decommissioning finally begins". The Guardian. London. Retrieved 23 April 2013.

- "Chernobyl nuclear plant to be decommissioned completely by 2013". Kyivpost.com. Retrieved 2015-11-01.

- "Decommissioning at Chernobyl". World-nuclear-news.org. 2007-04-26. Retrieved 2015-11-01.

- Koplow, Doug (February 2011). "Nuclear Power:Still Not Viable without Subsidies" (PDF). Union of Concerned Scientists. p. 10.

- https://www.cnn.com/2018/03/15/asia/north-korea-nuclear-reactors-activity/index.html%5B%5D

- Odette, G; Lucas (2001). "Embrittlement of Nuclear Reactor Pressure Vessels". JOM. 53 (7): 18–22. Bibcode:2001JOM....53g..18O. doi:10.1007/s11837-001-0081-0. S2CID 138790714. Retrieved 2 January 2014.

- Jacobson, Mark Z.; Delucchi, Mark A. (2010). "Providing all Global Energy with Wind, Water, and Solar Power, Part I: Technologies, Energy Resources, Quantities and Areas of Infrastructure, and Materials" (PDF). Energy Policy. p. 6.

- Hugh Gusterson (16 March 2011). "The lessons of Fukushima". Bulletin of the Atomic Scientists. Archived from the original on 6 June 2013.

- Diaz Maurin, François (26 March 2011). "Fukushima: Consequences of Systemic Problems in Nuclear Plant Design". Economic & Political Weekly. 46 (13): 10–12.

- James Paton (April 4, 2011). "Fukushima Crisis Worse for Atomic Power Than Chernobyl, UBS Says". Bloomberg Businessweek.

- Massachusetts Institute of Technology (2003). "The Future of Nuclear Power" (PDF). p. 48.

- Koplow, Doug (February 2011). "Nuclear Power:Still Not Viable without Subsidies" (PDF). Union of Concerned Scientists. p. 2.

- "Availability of Dam Insurance" (PDF). Damsafety.org. Archived from the original (PDF) on 2016-01-08. Retrieved 2015-11-01.

- Nancy Folbre (March 28, 2011). "Renewing Support for Renewables". The New York Times.

- Antony Froggatt (4 April 2011). "Viewpoint: Fukushima makes case for renewable energy". BBC News.

- Baurac, David (Winter 2002). "Passively safe reactors rely on nature to keep them cool". Argonne Logos. Argonne National Laboratory. 20 (1).

- Juergen Baetz (21 April 2011). "Nuclear Dilemma: Adequate Insurance Too Expensive". Associated Press. Retrieved 21 April 2011.

- Publications: Vienna Convention on Civil Liability for Nuclear Damage. International Atomic Energy Agency.

- Branch, Legislative Services. "Consolidated federal laws of canada, Nuclear Liability and Compensation Act". www.laws.justice.gc.ca. Retrieved 12 February 2017.

- Branch, Legislative Services. "Consolidated federal laws of canada, Nuclear Liability Act". www.laws.justice.gc.ca. Retrieved 12 February 2017.

- "Canadian Nuclear Association" (PDF). Cna.ca. 2013-01-24. Archived from the original (PDF) on 2012-03-12. Retrieved 2015-11-01.

- "Civil Liability for Nuclear Damage – Nuclear Insurance". world-nuclear.org. Retrieved 1 November 2015.

- "Increase in the Maximum Amount of Primary Nuclear Liability Insurance". Federal Register. 30 December 2016. Retrieved 12 February 2017.

- Archived July 2, 2013, at the Wayback Machine

- "Publications: International Conventions and Legal Agreements". iaea.org. Retrieved 1 November 2015.

- "Press Communiqué 6 June 2003 – Revised Nuclear Third Party Liability Conventions Improve Victims' Rights to Compensation". nea.fr. Archived from the original on 2007-06-22. Retrieved 1 November 2015.

- "(Florida) Nuclear Costs Explode". Archived from the original on May 9, 2008. Retrieved September 7, 2008.

- Platts: A utility's credit quality could be negatively impacted by building a new nuclear power plant, 2 June 2008, Moody's Investors Service

- John M. Deutch; et al. (2009). "Update of the MIT 2003 Future of Nuclear Power Study" (PDF). Massachusetts Institute of Technology. Retrieved 2009-05-18. Cite journal requires

|journal=(help) - Linares, Pedro; Conchado, Adela (2013). "The economics of new nuclear power plants in liberalized electricity markets". Energy Economics. 40: S119–S125. doi:10.1016/j.eneco.2013.09.007.

- "Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2015" (PDF). Eia.gov. Retrieved 2015-11-01.

- "Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2019" (PDF). February 2019.

- Lazard's Levelized Cost of Energy Analysis - Version 13.0 (PDF) (Report). Lazard. November 2019. Retrieved 22 April 2020.

- Henry Fountain (December 22, 2014). "Nuclear: Carbon Free, but Not Free of Unease". The New York Times. The Times Company. Retrieved December 23, 2014.

the plant had become unprofitable in recent years, a victim largely of lower energy prices resulting from a glut of natural gas used to fire electricity plants

- "German grid operator sees 70% wind + solar before storage needed". Renew Economy. 7 December 2015. Retrieved 20 January 2017.

Schucht says, in the region he is operating in, 42 percent of the power supply (in output, not capacity), came from wind and solar – about the same as South Australia. Schucht believes that integration of 60 to 70 percent variable renewable energy – just wind and solar – could be accommodated within the German market without the need for additional storage. Beyond that, storage will be needed.

- "New material promises 120-year reactor lives". www.world-nuclear-news.org. Retrieved 8 June 2017.

- "NRC: Backgrounder on Reactor License Renewal". www.nrc.gov. Retrieved 3 June 2017.

- "NRC: Subsequent License Renewal". www.nrc.gov. Retrieved 3 June 2017.

- https://www.lazard.com/media/438038/levelized-cost-of-energy-v100.pdf

- Koplow, Doug (February 2011). "Nuclear Power:Still Not Viable without Subsidies" (PDF). Union of Concerned Scientists. p. 1.

- Benjamin K. Sovacool (January 2011). "Second Thoughts About Nuclear Power" (PDF). National University of Singapore. p. 4. Archived from the original (PDF) on 2013-01-16. Retrieved 2011-04-09.

- "Sun, wind and drain". The Economist. Retrieved 1 November 2015.

- Charles Frank (May 2014). "THE NET BENEFITS OF LOW AND NO-CARBON ELECTRICITY TECHNOLOGIES" (PDF). Brookings.edu. Archived from the original (PDF) on 2015-08-14. Retrieved 2015-11-01.

- Paul Joskow (September 2011). "Comparing the Costs of Intermittent and Dispatchable Electricity-Generating Technologies". Massachusetts Institute of Technology. Retrieved 2015-11-01.

- Amory Lovins. "Fourteen alleged magical properties coal and nuclear plants don't have". Rocky Mountain Institute.

- Shrader-Frechette, Kristin (2009). "Climate Change, Nuclear Economics, and Conflicts of Interest". Science and Engineering Ethics. 17 (1): 75–107. doi:10.1007/s11948-009-9181-y. PMID 19898994. S2CID 17603922.

- Jon Palfreman. "Why the French Like Nuclear Power". Frontline. Public Broadcasting Service. Retrieved 2006-11-10.

- Grubler, Arnulf (2010). "The costs of the French nuclear scale-up: A case of negative learning by doing". Energy Policy. 38 (9): 5174–5188. doi:10.1016/j.enpol.2010.05.003.

- Steve Kidd (3 February 2016). "Can high nuclear construction costs be overcome?". Nuclear Engineering International. Retrieved 12 March 2016.

- Marcus Leroux (10 March 2016). "You cannot afford to build Hinkley Point, EDF is told". The Times. London. Retrieved 12 March 2016.

- "Costs for nuclear increase | Nuclear power in Europe". Climatesceptics.org. 2008-06-02. Retrieved 2015-11-01.

- Charles D. Ferguson (April 2007). "Nuclear Energy: Balancing Benefits and Risks" (PDF). Council on Foreign Relations. Retrieved 2008-05-08.

- Andrews, Dave (2009-04-29). ""Nuclear power stations can't load follow that much" – Official | Claverton Group". Claverton-energy.com. Retrieved 2015-11-01.

- Archived February 25, 2009, at the Wayback Machine

- "EPR™ reactor, one of the most powerful in the world". AREVA. Retrieved 2015-11-01.

- Steve Kidd (3 March 2009). "New nuclear build – sufficient supply capability?". Nuclear Engineering International. Archived from the original on 2011-06-13. Retrieved 2009-03-09.

- "** Welcome to Doosan Heavy Industries & Construction **". Archived from the original on February 28, 2009. Retrieved March 11, 2009.

- Steve Kidd (22 August 2008). "Escalating costs of new build: what does it mean?". Nuclear Engineering International. Archived from the original on 6 October 2008. Retrieved 2008-08-30.

- Watt, Holly (2017-10-12). "Electricity consumers 'to fund nuclear weapons through Hinkley Point C'". The Guardian. ISSN 0261-3077. Retrieved 2017-10-13.

- "Bruce Power's Unit 2 sends electricity to Ontario grid for first time in 17 years". Bruce Power. 2012-10-16. Archived from the original on 2013-01-02. Retrieved 2014-01-24.

- James Kanter (2009-05-28). "In Finland, Nuclear Renaissance Runs Into Trouble". The New York Times.

- James Kanter (2009-05-29). "Is the Nuclear Renaissance Fizzling?". Green.

- Rob Broomby (2009-07-08). "Nuclear dawn delayed in Finland". BBC News.

- Jeff McMahon (2013-11-10). "New-Build Nuclear Is Dead: Morningstar". Forbes.

- Ian Lowe (2011-03-20). "No nukes now, or ever". The Age. Melbourne.

- Hannah Northey (2011-03-18). "Former NRC Member Says Renaissance is Dead, for Now". The New York Times.

- Leo Hickman (2012-11-28). "Nuclear lobbyists wined and dined senior civil servants, documents show". The Guardian. London.

- Diane Farseta (2008-09-01). "The Campaign to Sell Nuclear". Bulletin of the Atomic Scientists. 64 (4): 38–56. doi:10.1080/00963402.2008.11461168. S2CID 218769014.

- Jonathan Leake (2005-05-23). "The Nuclear Charm Offensive". New Statesman.

- "Nuclear Industry Spent Hundreds of Millions of Dollars Over the Last Decade to Sell Public, Congress on New Reactors, New Investigation Finds". Union of Concerned Scientists. 2010-02-01. Archived from the original on 2013-11-27.

- "Nuclear group spent $460,000 lobbying in 4Q". Business Week. 2010-03-19. Archived from the original on 2012-10-23.

- "Nuclear Power in China". World Nuclear Association. 2010-12-10.

- "China is Building the World's Largest Nuclear Capacity". 21cbh.com. 2010-09-21. Archived from the original on 2012-03-06.

- "China Should Control Pace of Reactor Construction, Outlook Says". Bloomberg News. 2011-01-11.

- "European Commission, keep committed to energy system change towards renewables and efficiency!" (PDF). EREF. Retrieved 1 November 2015.

- "Unsupported database type". energyprobe.org. Retrieved 1 November 2015.

- Mycle Schneider, Steve Thomas, Antony Froggatt, Doug Koplow (August 2009). The World Nuclear Industry Status Report 2009 Archived April 24, 2011, at the Wayback Machine Commissioned by German Federal Ministry of Environment, Nature Conservation and Reactor Safety, p. 7.

- "Olkiluoto 3:n myöhästyminen tulee kalliiksi pohjoismaisille sähkönkäyttäjille – Suomen ElFi Oy" [Olkiluoto 3 delay comes at a cost to the Nordic electricity users – ElFi Finland Oy] (in Finnish). Archived from the original on November 3, 2009. Retrieved June 30, 2010.

- Tony Halpin (2007-04-17). "Floating nuclear power stations raise spectre of Chernobyl at sea". The Times Online. Retrieved 2011-03-07.

- http://www.rosenergoatom.ru/zhurnalistam/main-news/29791/

- "Gauging the pressure". The Economist. 28 April 2011. Retrieved 3 May 2011.

- Eileen O'Grady. Entergy says nuclear remains costly Reuters, May 25, 2010.

- Terry Ganey. AmerenUE pulls plug on project Columbia Daily Tribune, April 23, 2009.

- "NRC: Location of Projected New Nuclear Power Reactors". Nrc.gov. Retrieved 2015-11-01.

- "New Nuclear Energy Facilities – Nuclear Energy Institute". Nei.org. Retrieved 2015-11-01.

- Matthew L. Wald. (September 23, 2010). "Aid Sought for Nuclear Plants". Green. The New York Times.

- Mark Cooper (18 June 2013). "Nuclear aging: Not so graceful". Bulletin of the Atomic Scientists.

- Matthew Wald (June 14, 2013). "Nuclear Plants, Old and Uncompetitive, Are Closing Earlier Than Expected". The New York Times.

- Mark Cooper (July 18, 2013). "Renaissance in reverse" (PDF). Vermont Law School. Archived from the original (PDF) on January 14, 2016. Retrieved July 27, 2013.

- Polson, Jim (14 July 2017). "Why Nuclear Power, Once Cash Cow, Now Has Tin Cup". Bloomberg. Retrieved 15 July 2017.

External links

- Steve Kidd (11 November 2016). "Transforming nuclear economics – why and how?". Nuclear Engineering International.

- The Economics of Nuclear Power, World Nuclear Association, April 2010.

- Nuclear Power's Global Expansion: Weighing Its Costs and Risks, 2010.