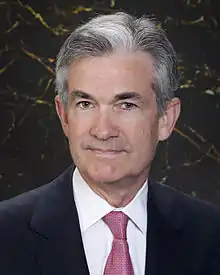

Jerome Powell

Jerome Hayden "Jay" Powell (born February 4, 1953) is the 16th chair of the Federal Reserve, serving in that office since February 2018. He was nominated to the Board of the Federal Reserve in 2012 by President Barack Obama, and subsequently nominated to the chair of the Fed by President Donald Trump, and confirmed in each case by the United States Senate.[4][5] During his chairmanship, he was both criticized and praised by Trump.[6]

Jerome Powell | |

|---|---|

Official portrait, 2012 | |

| 16th Chair of the Federal Reserve | |

| Assumed office February 5, 2018 | |

| President | Donald Trump Joe Biden |

| Deputy | Richard Clarida |

| Preceded by | Janet Yellen |

| Member of the Federal Reserve Board of Governors | |

| Assumed office May 25, 2012 | |

| President | Barack Obama Donald Trump Joe Biden |

| Preceded by | Frederic Mishkin |

| Under Secretary of the Treasury for Domestic Finance | |

| In office 1992–1993 | |

| President | George H. W. Bush |

| Preceded by | Robert R. Glauber |

| Succeeded by | Frank N. Newman |

| Personal details | |

| Born | Jerome Hayden Powell February 4, 1953 Washington, D.C., U.S. |

| Political party | Republican[1] |

| Spouse(s) | Elissa Leonard (m. 1985) |

| Children | 3 |

| Education | Princeton University (BA) Georgetown University (JD) |

| Net worth | $55 million[2][3] |

As Fed chair, rather than having strong monetary views, Powell was seen as a consensus-builder and problem-solver, who kept close contact with Capitol Hill.[7] Powell won bipartisan praise for the actions taken by the Fed in early 2020 to combat the financial effects of the COVID‑19 pandemic.[8] As Powell continued to apply high levels of monetary stimulus to further raise asset prices and support growth, the resulting disconnect between asset prices and the economy became controversial,[9][10][11] both for the simultaneous bubbles recorded in most asset classes,[12][13][14] and the historic widening of wealth inequality.[15][16][17] By the end of 2020, Powell had created the loosest monetary conditions ever recorded,[18][19][20] and the Financial Times warned that the resulting wealth inequality from Powell's K-shaped recovery could lead to political and social instability,[21] and that credit markets had a concerning "jenga-like structure".[22]

So dominant,[20][23] and distorting,[24][25] were Powell's actions on asset prices – despite a pandemic, divided Congress, weak economy, low buybacks, and trade wars – that by the end of 2020, Bloomberg called Powell, "Wall Street's Head of State",[26] and that his actions were "exuberantly asymmetric".[9] 2020 was one of the most profitable years in Wall Street history,[27][28] and earned Powell the title of Wall Street's Dr. Feelgood.[29][30] Time said the scale and manner of Powell's actions had "changed the Fed forever",[24] and shared concerns that he had conditioned Wall Street to unsustainable levels of monetary stimulus to artificially support extremely high asset prices,[10] likened to a stronger Greenspan put,[9][11] and also termed the Everything Bubble.[31][25][24] The Wall Street Journal called Powell's defence of the Fed model to justify valuations associated with the peaks of past bubbles,[32] as an attempt to "rewrite the laws of investing".[33]

Powell earned a degree in politics from Princeton University in 1975 and a Juris Doctor from Georgetown University Law Center in 1979.[7] He moved to investment banking in 1984, and worked for several financial institutions, including as a partner of The Carlyle Group.[7] In 1992, Powell briefly served as Under Secretary of the Treasury for Domestic Finance under President George H. W. Bush. He was a visiting scholar at the Bipartisan Policy Center from 2010 to 2012.[7]

Early life

Powell was born on February 4, 1953, in Washington, D.C., as one of six children to Patricia (née Hayden; 1926–2010)[34] and Jerome Powell (1921–2007),[35][36] a lawyer in private practice.[37] His maternal grandfather, James J. Hayden, was Dean of the Columbus School of Law at Catholic University of America and later a lecturer at Georgetown Law School.[38] He has five siblings: Susan, Matthew, Tia, Libby, and Monica.[39]

In 1972, Powell graduated from Georgetown Preparatory School, a Jesuit university-preparatory school. He received a Bachelor of Arts in politics from Princeton University in 1975, where his senior thesis was titled "South Africa: Forces for Change."[40] In 1975–76, he spent a year as a legislative assistant to Pennsylvania Senator Richard Schweiker (R).[41][42]

Powell earned a Juris Doctor degree from Georgetown University Law Center in 1979, where he was editor-in-chief of the Georgetown Law Journal.[43]

Career

Legal and investment banking (1979–2012)

In 1979, Powell moved to New York City and became a clerk to Judge Ellsworth Van Graafeiland of the United States Court of Appeals for the Second Circuit. From 1981 to 1983, Powell was a lawyer with Davis Polk & Wardwell, and from 1983 to 1984, he worked at the firm of Werbel & McMillen.[42]

From 1984 to 1990, Powell worked at Dillon, Read & Co., an investment bank, where he concentrated on financing, merchant banking, and mergers and acquisitions, rising to the position of vice president.[42][44]

Between 1990 and 1993, Powell worked in the United States Department of the Treasury, at which time Nicholas F. Brady, the former chairman of Dillon, Read & Co., was the United States Secretary of the Treasury. In 1992, Powell became the Under Secretary of the Treasury for Domestic Finance after being nominated by George H. W. Bush.[42][44][41] During his stint at the Treasury, Powell oversaw the investigation and sanctioning of Salomon Brothers after one of its traders submitted false bids for a United States Treasury security.[45] Powell was also involved in the negotiations that made Warren Buffett the chairman of Salomon.[46]

In 1993, Powell began working as a managing director for Bankers Trust, but he quit in 1995 after the bank got into trouble when several customers suffered large losses due to derivatives. He then went back to work for Dillon, Read & Co.[44] From 1997 to 2005, Powell was a partner at The Carlyle Group, where he founded and led the Industrial Group within the Carlyle U.S. Buyout Fund.[43][47] After leaving Carlyle, Powell founded Severn Capital Partners, a private investment firm focused on specialty finance and opportunistic investments in the industrial sector.[48] In 2008, Powell became a managing partner of the Global Environment Fund, a private equity and venture capital firm that invests in sustainable energy.[48]

Between 2010 and 2012, Powell was a visiting scholar at the Bipartisan Policy Center, a think tank in Washington, D.C., where he worked on getting Congress to raise the United States debt ceiling during the United States debt-ceiling crisis of 2011. Powell presented the implications to the economy and interest rates of a default or a delay in raising the debt ceiling.[47] He worked for a salary of $1 per year.[2]

Federal Reserve Board of Governors (2012–)

.jpg.webp)

In December 2011, along with Jeremy C. Stein, Powell was nominated to the Federal Reserve Board of Governors by President Barack Obama. The nomination included two people to help garner bipartisan support for both nominees since Stein's nomination had previously been filibustered. Powell's nomination was the first time that a president nominated a member of the opposition party for such a position since 1988.[1] He took office on May 25, 2012, to fill the unexpired term of Frederic Mishkin, who resigned. In January 2014, he was nominated for another term, and, in June 2014, he was confirmed by the United States Senate in a 67–24 vote for a 14-year term ending January 31, 2028.[49]

In 2013, Powell made a speech regarding financial regulation and ending "too big to fail".[50] In April 2017, he took over oversight of the "too big to fail" banks.[51]

2018–2019

.jpg.webp)

On 2 November 2017, President Trump nominated Powell to serve as the chair of the Federal Reserve.[52] On December 5 2017, the Senate Banking Committee approved Powell's nomination to be Chair in a 22–1 vote, with Senator Elizabeth Warren casting the lone dissenting vote.[53] His nomination was confirmed by the Senate on January 23, 2018 by an 84–13 vote.[54] Powell assumed office as chair on February 5, 2018.[55]

.jpg.webp)

In Q1 2018, one of Powells first actions was to continue to raise US interest rates, as a response to the increasing strength of the US economy.[55][56] Trump subsequently complained about the Fed raising interest rates,[57] and in 2018 said in an interview with The Wall Street Journal that he "maybe" regretted nominating Powell, complaining that the Fed chairman "almost looks like he's happy raising interest rates."[58] Powell has described the Fed's role as nonpartisan and apolitical.[59]

In 2018, for the first time since the 2008 financial crisis, Powell reduced the size of the Fed's balance in a process called quantitative tightening, planning to reduce it from US$4.5 trillion to US$2.5–3 trillion in 4 years.[60][61] Powell called the monthly reduction of US$50 billion as being "on automatic pilot", however, by end of 2018 global asset prices collapsed;[62] Powell abandoned quantitative tightening in Q1 2019, leading to a recovery in global asset prices.[62][63]

Powell's actions drew negative comments from Trump who said in June 2019: "Here's a guy, nobody ever heard of him before. And now, I made him and he wants to show how tough he is ... He's not doing a good job." Trump called the interest rate increase and quantitative tightening "insane".[64] In July 2019, Powell said he would not stand down if Trump attempted to remove him,[65] noting it was Congress that has oversight of the Fed.[66] In August 2019, Trump called Powell an "enemy",[67] "equivalent to or worse than" China's leader Xi Jinping,[68] and that he had "an horrendous lack of vision",[69] and "I disagree with him entirely".[70]

In Q3 2019, as asset prices waned, Powell announced the Fed would return to expanding its balance sheet, which led to a global rally in assets in Q4 2020, and pushed valuations to their highest levels since 1999–2000.[71] Powell said the Fed's actions were not quantitative easing, but some dubbed them as being QE4.[72] Powell's expansion utilized an indirect form of quantitative easing, which printed new funds (per direct quantitative easing), but then lent them to US investment banks who made the asset purchases (as opposed to the Fed purchasing assets); it is known as a "repo trade", and was associated with the "Greenspan put".[73][31][74][75]

2020-2021

In Q1 2020, Powell launched an unprecedented series of actions to counter the financial market impact of the COVID-19 pandemic, which included a dramatic expansion of the Fed's balance sheet and introduction of new tools, including the direct purchase of corporate bonds, and direct lending programs.[24][76] Powell emphasized monetary policy alone without an equivalent fiscal policy response from Congress would widen income inequality.[77] Powell's actions earned him bi-partisan praise,[78][8] including from Trump, who told Fox News that he was "very happy with his performance" and that "over the last period of six months, he's really stepped up to the plate".[6]

During Q2 and Q3 2020, Powell kept using tools to further amplify asset prices, despite concerns US asset prices were in a bubble,[79] and that Powell's actions had driven wealth inequality to historic levels.[80][17] Powell defended his actions saying: "I don't know that the connection between asset purchases and financial stability is a particularly tight one",[79] and that he wasn't worried that the Fed's actions were creating asset bubbles.[81] In July 2020, CNBC host Jim Cramer said, "I'm sick and tired of hearing that we're in a bubble, that Powell's overinflating the price of stocks by printing money to keep the economy moving".[82] The Washington Post called the Fed "addicted to propping up markets, even when there is no need".[10] In August 2020, investors Leon Cooperman and Seth Klarman warned of a dangerous "speculative bubble",[83] with market psychology "unhinged from market fundamentals".[84][85] In October, David Einhorn called the peak of a second dot-com bubble.[86]

In November 2020, as markets reached record valuations – despite a weak economy, divided Congress, and trade wars – Bloomberg called Powell "Wall Street's Head of State", as a reflection of how dominant Powell's actions were on asset prices, and how profitable his actions were for Wall Street.[26] On 19 November 2020, Treasury secretary Steve Mnuchin got into an "unprecedented spat" with Powell over the return of unused crisis funds, to which Powell relented.[87] In December 2020, Powell defended high asset prices by invoking the controversial Fed model, saying: "Admittedly P/Es are high but that's maybe not as relevant in a world where we think the 10-year Treasury is going to be lower than it's been historically from a return perspective".[32] The author of the Fed model, Dr. Edward Yardeni, said Powell's actions could form the greatest financial bubble in history,[88] while the Wall Street Journal described Powell's comparison as an attempt to "rewrite the laws of investing".[33]

In January 2021, investor Jeremy Grantham said markets were in an "epic bubble",[89] writing, "All three of Powell's predecessors claimed that the asset prices they helped inflate in turn aided the economy through the wealth effect", before eventually collapsing.[90][91] In reviewing 2020, BNN Bloomberg said Powell showed "complete dominance over financial markets", despite the challenges of the year.[23] Former IMF deputy director, Desmond Lachman, said that Powell's monetary policy created "the mother of all bubbles in the world's financial markets".[14] The Wall Street Journal wrote that Powell was comfortable maintaining quantitative easing, and did not see any risk from asset bubbles.[92] In a January 2021 interview with Neue Zürcher Zeitung, Mohamed El-Erian said, "you have such an enormous disconnect between fundamentals and valuations", and that the record highs in assets were due to the actions of the Fed and the ECB, clarifying "That is the reason why we’ve seen prices going from one record high to another despite completely changing narratives. Forget about the «great reopening», the «Trump trade» and all this other stuff".[20] The Financial Times capital markets editor described Powell's January 2021 decision to keep buying assets in spite of bubble valuations, as creating a "jenga-like structure" in credit markets.[22] On 24 January 2021, Bloomberg reported that "Pandemic-Era Central Banking Is Creating Bubbles Everywhere", and called it the "Everything Rally", noting that other major central bankers including Haruhiko Kuroda at the BOJ, had followed Powell's strategy.[93] Bloomberg noted that "Powell, Bank of Japan Governor Haruhiko Kuroda, and other leading central bankers, though taken to task about bubbles in markets in recent months, have played down the concerns.[93] In contrast, the Financial Times reported that the People's Bank of China issued a bubble warning on the 26 January 2021, for several asset classes including equities and housing, and started to process of withdrawing liquidity (i.e. the reverse of a Fed put).[94] Bloomberg wrote that Powell, in the last year of his term, was afraid of a repeat of what happened in Q4 2018 when he started quantitative tightening.[95]

Economic philosophy

Monetary policy

On joining the Fed, Powell was not considered a deep expert in macroeconomics or monetary policy; and rather than having strong economic views, Powell was seen as a consensus builder, and a rational fact-based problem solver, who was prepared to visit Capitol Hill frequently to communicate and listen to all views on the economy.[7] The Bloomberg Intelligence Fed Spectrometer rated Powell as neutral in terms of monetary views (i.e., neither a hawk nor a dove).[96] Powell was a skeptic of round 3 of quantitative easing (or QE3), initiated in 2012, although he eventually voted for it.[96]

Powell's first year as Fed chairman saw him raise rates and attempt to reduce the Fed's balance sheet (i.e. hawkish actions); in his second year, Powell restarted expanding the Fed's balance sheet (i.e. dovish actions), which led to an expansion of equity valuation multiples to levels not seen since 1999–2000.[31] Powell's actions to combat the financial effects of the pandemic saw him more overtly embrace asset bubbles as an acceptable consequence of his actions.[12][81][97] The simultaneous bubbles created by Powell in 2019–2020 in the bond markets, the equity markets, and laterally in the housing markets,[13] became known as the Everything Bubble;[14] Powell was criticised for using high levels of direct and indirect quantitative easing as valuations hit levels last seen at the peaks of previous bubbles.[31][25][79]

Powell's adoption of asset bubbles from 2019 onwards, resulted in levels of wealth inequality not seen in the United States since the 1920s.[16][15][17] Powell's use of asset bubbles was also attributed to the K-shaped recovery that emerged post the coronavirus pandemic, where the asset bubbles protected the wealthier segments of society from the financial effects of the pandemic,[98][99] at the expense of most other segments,[100][24] and particularly on the younger non-asset owning segments such as millennials.[101] In January 2021, Edward Luce of the Financial Times warned that Powell's use of asset bubbles, and their resultant widening of wealth inequality, could lead to political and social instability in the United States, saying: "The majority of people are suffering amid a Great Gatsby-style boom at the top".[21]

Powell's use of indirect quantitative easing (or "repo trades"), from the "Greenspan put",[73][101] created large profits for Wall Street investment banks.[29] In June 2020, Jim Grant called Powell's Wall Street Dr. Feelgood.[29][30] In a September 2020 testimony, Powell said: "Our actions were in no way an attempt to relieve pain on Wall Street".[102] By the end of 2020, Wall Street investment banks recorded their best year in history,[27][103] and Bloomberg called 2020, ".. a great year for Wall Street, but a bear market for Humans".[28] Mohamed A. El-Erian called Powell "a follower, not a leader", of markets.[11]

In August 2020, Bloomberg called Powell's policy "exuberantly asymmetric" (echoing Alan Greenspan's "irrational exuberance" quote from 1996),[9] and that the "Powell Put" had become more extreme than the "Greenspan Put".[9] Steven Pearlstein in the Washington Post said that Powell had "adopted a strategy that works like a one-way ratchet, providing a floor for stock and bond prices but never a ceiling", and that any attempt by Powell to abandon this strategy "will trigger a sharp sell-off by investors who have become addicted to monetary stimulus".[10]

By December 2020, Powell's monetary policy, measured by the Goldman Sachs US Financial Conditions Index (GSFCI), was the loosest in the history of the GSFCI (goes back to 1987), and had created simultaneous asset bubbles across most of the major asset classes in the United States:[18][19][14] For example, in equities,[104] in housing,[13][105] and in bonds.[106] Even asset classes such as cryptocurrencies saw dramatic increases in price during 2020, leading Powell to win the 2020, Forbes Person Of The Year In Crypto.[107]

"You can't lose in that market," he said, adding "it's like a slot machine" that always pays out. "I've not seen this in my career".

High up on his list, and sooner rather than later, will be dealing with the consequences of the biggest financial bubble in U.S. history. Why the biggest? Because it encompasses not just stocks but pretty much every other financial asset too. And for that, you may thank the Federal Reserve.

— Richard Cookson, Bloomberg (4 February 2021)[109]

Financial regulation

.jpg.webp)

Powell "appears to largely support" the Dodd–Frank Wall Street Reform and Consumer Protection Act, although he has stated that "we can do it more efficiently".[96] In an October 2017 speech, Powell stated that higher capital and liquidity requirements and stress tests have made the financial system safer and must be preserved. However, he also stated that the Volcker Rule should be re-written to exclude smaller banks.[96]

Housing finance reform

In a July 2017 speech, Powell said that in regard to Fannie Mae and Freddie Mac the status quo is "unacceptable" and that the current situation "may feel comfortable, but it is also unsustainable". He warned that "the next few years may present our last best chance" to "address the ultimate status of Fannie Mae and Freddie Mac" and avoid "repeating the mistakes of the past". Powell expressed concerns that, in the current situation, the government is responsible for mortgage defaults and that lending standards were too rigid, noting that these can be solved by encouraging "ample amounts of private capital to support housing finance activities".[110]

Financial Market Intervention

During the coronavirus pandemic in 2020, Powell tried to save the financial markets by ingesting trillions of dollars. On March 12th, the stock market sharply turned up as $1.5 trillion was used to rescue the 'free falling' stock indexes.[111]. Such unusual measures changed the role of federal reserve system from an independent central bank to a market operator.

Personal life

Powell married Elissa Leonard in 1985.[37] They have three children[43] and live in Chevy Chase Village, Maryland, where Elissa is chair of the board of managers of the village.[112] In 2010, Powell was on the board of governors of Chevy Chase Club, a country club.[113]

Based on public filings, Powell's net worth is estimated to be as little as $4.7 million and as much as $55 million.[2][3][114] He is the wealthiest member of the Federal Reserve Board of Governors.[115]

Powell has served on the boards of charitable and educational institutions including DC Prep, a public charter school, the Bendheim Center for Finance at Princeton University, and The Nature Conservancy. He was also a founder of the Center City Consortium, a group of 16 parochial schools in the poorest areas of Washington, D.C.[47]

Powell is a registered Republican.[1]

See also

| Wikimedia Commons has media related to Jerome Powell. |

References

- Applebaum, Binyamin (December 27, 2011). "Obama to Nominate Two for Vacancies on Fed Board". The New York Times.

- Long, Heather (October 31, 2017). "Jerome Powell, Trump's pick to lead Fed, would be the richest chair since the 1940s". The Washington Post.

- Gandel, Stephen (November 2, 2017). "Powell Is Trump's Kind of Rich". Bloomberg L.P.

- "Senate Confirms Jerome Powell As New Federal Reserve Chair". NPR. Retrieved January 31, 2018.

- The Hill. "Senate confirms Jerome Powell as Fed chairman". Retrieved January 31, 2018.The Federal Reserve. "Federal Open Market Committee unanimously selects Jerome H. Powell to serve as its Chairman, effective February 3, 2018". Retrieved February 2, 2018.

- Matthews, Steve; Jacobs, Jennifer (July 1, 2020). "Trump Says He's Very Happy With Fed Chief Powell's Performance". Bloomberg News. Retrieved November 9, 2020.

- Long, Heather (June 2, 2017). "Who is Jerome Powell, Trump's pick for the nation's most powerful economic position?". Washington Post. Retrieved November 9, 2020.

- Griffiths, Brent D. (November 6, 2020). "The Finance 202: The 2020 election has an early winner: Fed Chair Jay Powell". Washington Post. Retrieved November 9, 2020.

- Authers, John (August 4, 2020). "The Fed's Stocks Policy Is Exuberantly Asymmetric". Bloomberg News. Retrieved November 18, 2020.

- Steven Pearlstein (June 17, 2020). "The Fed is addicted to propping up the markets, even without a need". Washington Post. Retrieved November 23, 2020.

- Mohamed A. El-Erian (November 23, 2020). "Joe Biden needs to break the market's codependency with White House". Financial Times. Retrieved November 24, 2020.

- Authers, John (June 11, 2020). "Powell's Ready to Play the Fresh Prince of Bubbles". Bloomberg News. Retrieved November 9, 2020.

- Brown, Arron (November 13, 2020). "Home Prices Are In a Bubble. Full Stop". Bloomberg News. Retrieved November 16, 2020.

- Lachman, Desmond (January 7, 2021). "Georgia and the everything market bubble". The Hill. Retrieved January 7, 2021.

- Long, Heather (January 20, 2020). "The global economy is likely to rebound in 2020, but the IMF warns of eerie parallels to the 1920s". Washington Post. Retrieved November 11, 2020.

- Rabouin, Dion (October 13, 2020). "Jerome Powell's ironic legacy on economic inequality". Axios. Retrieved November 11, 2020.

- Gold, Howard (August 17, 2020). "Opinion: The Federal Reserve's policies have drastically increased inequality". MarketWatch. Retrieved November 19, 2020.

- Miller, Rich (December 14, 2020). "U.S. Financial Conditions Easiest on Record, Goldman Sachs Says". Bloomberg News. Retrieved December 25, 2020.

- Phillips, Matt (December 26, 2020). "Market Edges Toward Euphoria, Despite Pandemic's Toll". The New York Times. Retrieved January 3, 2021.

- Gisiger, Christoph (January 7, 2021). "Mohamed El-Erian: «This Is Starting to Get to Dangerous Levels»". Neue Zürcher Zeitung. Retrieved January 10, 2021.

- Luce, Edward (January 3, 2021). "America's dangerous reliance on the Fed". Financial Times. Retrieved January 4, 2021.

- Rennison, Joe (January 16, 2021). "Jenga-like structure builds in credit markets". Financial Times. Retrieved January 20, 2021.

- McCreath, Andrew. "Fed Chair Jay Powell's dominant influence on markets". BNN Bloomberg. Retrieved January 7, 2021.

- Leonard, Christopher (June 22, 2020). "How Jay Powell's Coronavirus Response Is Changing the Fed Forever". Time. Retrieved November 12, 2020.

- Lachman, Desmond (May 19, 2020). "The Federal Reserve's everything bubble". The Hill (newspaper). Retrieved November 9, 2020.

- Greifeld, Katherine; Wang, Lu; Hajric, Vildana (November 6, 2020). "Stocks Show Jerome Powell Is Still Wall Street's Head of State". Bloomberg News. Retrieved November 11, 2020.

- Noonan, Laura (January 20, 2021). "Morgan Stanley posts record profit as trading booms". Financial Times. Retrieved January 20, 2021.

- Regan, Michael P. (December 21, 2020). "2020 Has Been a Great Year for Stocks and a Bear Market for Humans". Bloomberg News. Retrieved January 21, 2021.

- Grant, Jim (June 28, 2020). "Powell Has Become the Fed's Dr. Feelgood". Wall Street Journal. Retrieved November 11, 2020.

- Kass, David L. (June 30, 2020). "'Feelgood' Fed Treating the Patient Correctly". The Wall Street Journal. Retrieved January 20, 2021.

- Howell, Mark (January 16, 2020). "The Federal Reserve is the cause of the bubble in everything". Financial Times. Retrieved November 9, 2020.

- Ponczek, Sarah; Wang, Lu (December 16, 2020). "Soaring Stock Valuations No Big Deal to Powell Next to Bonds". Bloomberg News. Retrieved December 16, 2020.

- Lahart, Justin (December 23, 2020). "Has the Fed Rewritten the Laws of Investing?". The Wall Street Journal. Retrieved December 25, 2020.

- "Patricia Powell". Geni.

- "Jerome Powell". Geni.

- "Obituary: Jerome Powell". The Washington Post. August 7, 2007. Retrieved November 10, 2020.

- "ELISSA LEONARD WED TO JEROME H. POWELL". The New York Times. September 15, 1985.

- "Patricia H. Powell's Obituary on The Washington Post". The Washington Post. October 1, 2010.

- "Jerome Powell Notice". Legacy.

- Princeton University Senior Thesis Database, http://arks.princeton.edu/ark:/88435/dsp01pg15bg641

- "Nomination of Jerome H. Powell To Be an Under Secretary of the Treasury". University of California, Santa Barbara (Press release). April 9, 1992.

- Greenhouse, Steven (April 14, 1992). "New Duties Familiar To Treasury Nominee". The New York Times.

- "Board Members: Jerome H. Powell". Federal Reserve Board of Governors.

- "Banker Joins Dillon, Read". The New York Times. February 17, 1995.

- Powell, Jerome (October 5, 2017). "Treasury Markets and the TMPG". Federal Reserve Board of Governors.

- Loomis, Carol J. (October 27, 1997). "Warren Buffett's Wild Ride at Salomon". Fortune.

- "Bipartisan Policy Center: Jerome Powell". Bipartisan Policy Center.

- "GEF Adds to Investment Team" (Press release). Business Wire. July 8, 2008.

- "PN1350 — Jerome H. Powell — Federal Reserve System". United States Senate.

- Robb, Greg (March 4, 2013). "Fed's Powell: Ending too big to fail to take years". MarketWatch.

- Borak, Donna (April 7, 2017). "Fed taps Jerome Powell to head oversight of 'too big to fail' banks". CNN.

- Gensler, Lauren (November 2, 2017). "Trump Taps Jerome Powell As Next Fed Chair In Call For Continuity". Forbes.

- "Senate panel OKs Trump's pick, Jerome Powell, for the next Federal Reserve chief". Los Angeles Times. December 5, 2017. Retrieved December 6, 2017.

- Lane, Sylvan (January 23, 2018). "Senate confirms Jerome Powell as Fed chairman". TheHill.

- Torres, Craig (November 28, 2017). "Powell Says Case 'Coming Together' for December Rate Hike". Bloomberg News. Retrieved November 9, 2020.

- Borak, Donna (March 21, 2017). "Fed raises interest rates in Powell's debut". CNN News. Retrieved November 9, 2020.

- Condon, Christopher (May 21, 2019). "Here's a Timeline of All Trump's Key Quotes on Powell and the Fed". Bloomberg News. Retrieved May 21, 2019.

- Bender, Michael C.; Ballhaus, Rebecca; Nicholas, Peter; Leary, Alex (October 24, 2018). "Trump Steps Up Attacks on Fed Chairman Jerome Powell". The Wall Street Journal. ISSN 0099-9660.

- DeBonis, Mike; Bade, Rachael (April 11, 2019). "Powell maintains his distance from Trump in speech to House Democrats". The Washington Post.

- Tett, Gillian (March 1, 2018). "Why Jay Powell's Fed taper is not causing tantrums". Financial Times. Retrieved November 13, 2020.

- Rennison, Joe (December 20, 2020). "Investors raise alarm over Fed's shrinking balance sheet". Financial Times. Retrieved November 9, 2020.

- Hunnicut, Trevor (March 20, 2019). "Fed announces plan to end balance sheet runoff in September". Reuters. Retrieved November 13, 2020.

- Phillips, Matt (January 30, 2019). "'Quantitative Tightening': the Hot Topic in Markets Right Now". New York Times. Retrieved November 9, 2020.

- Jolly, Jasper (June 26, 2019). "Trump criticises Fed chairman Powell for trying to be 'tough'". The Guardian. Retrieved June 27, 2019.

- Torres, Craig; Litvan, Laura (July 10, 2019). "Fed's Powell Says He Won't Leave If Trump Tries to Fire Him". Bloomberg News. Retrieved November 12, 2020.

- Mohsin, Saleha; Jacobs, Jennifer (June 18, 2019). "Trump Asked White House Lawyers for Options on Removing Powell". Bloomberg News. Retrieved November 12, 2020.

- Smialek, Jeanna (August 23, 2019). "Powell Highlights Fed's Limits. Trump Labels Him an 'Enemy'". New York Times. ISSN 0362-4331. Retrieved August 24, 2019.

- Crutsinger, Martin (August 23, 2019). "Trump attacks Fed chair he appointed, calling him an 'enemy' equivalent to China's president". Chicago Tribune. Retrieved August 24, 2019.

- Kiernan, Rebecca Ballhaus, Andrew Restuccia and Paul (August 23, 2019). "Trump Calls for a Big Fed Rate Cut, Again Criticizes Central Bank Chairman". Wall Street Journal. Retrieved August 24, 2019.

- Condon, Christopher (August 22, 2019). "Key Trump Quotes on Powell as Fed Remains in the Firing Line". Bloomberg. Retrieved August 24, 2019.

- Miller, Rich; Matthews, Steve (October 8, 2019). "Powell Sees Fed Resuming Balance-Sheet Growth, But It's Not QE". Bloomberg News. Retrieved November 9, 2020.

- Long, Heather (October 8, 2019). "Fed Chair Powell says central bank will buy more Treasury bonds soon, but this is 'not QE'". Washington Post. Retrieved November 9, 2020.

- Petrou, Karen (November 6, 2019). "Repo ructions highlight failure of post-crisis policymaking". Financial Times. Retrieved November 13, 2020.

The old ‘Greenspan put’ is now a Powell promise: fear not, the Fed is there for you

- Rennison, Joe; Smith, Colby; Greeley, Brendan (January 16, 2020). "QE or not QE? Why the Fed is struggling with its message". Financial Times. Retrieved November 9, 2020.

- Forsyth, Randall W. (January 3, 2020). "Is the Fed Building Another Stock Bubble?". Barron's. Retrieved November 12, 2020.

- Siegel, Rachel (September 13, 2020). "The recession is testing the limits and shortfalls of the Federal Reserve's toolkit". The Washington Post. Retrieved November 9, 2020.

- Smialek, Jeanna (June 16, 2020). "Fed Chair Powell Warns Pandemic Downturn Could Widen Inequalities". The New York Times. Retrieved November 9, 2020.

- Guida, Victoria (September 21, 2020). "Powell's pandemic response gets him bipartisan praise — and a possible second term". Politico. Retrieved September 9, 2020.

- Randall, David (September 11, 2020). "Fed defends 'pedal to the metal' policy and is not fearful of asset bubbles ahead". Reuters. Retrieved November 11, 2020.

- Chapatta, Brian (June 9, 2020). "Fed Needs Better Answers on Runaway Markets and Inequality". Bloomberg News. Retrieved November 11, 2020.

- "Quick Hits: Powell Isn't Worried Fed Actions Are Generating Asset Bubbles". The Wall Street Journal. September 16, 2020. Retrieved November 9, 2020.

- Clifford, Tim (July 29, 2020). "'I'm sick and tired' — Cramer bemoans talk of a Fed-induced stock market bubble". CNBC. Retrieved November 16, 2020.

- Graffeo, Emily (August 24, 2020). "Billionaire investor Leon Cooperman says Fed relief efforts have created a 'speculative bubble'". Business Insider. Retrieved November 17, 2020.

- McDonald, Michael (August 1, 2020). "Seth Klarman Says Fed Is Infantilizing Investors in 'Surreal' Market". Bloomberg News. Retrieved November 17, 2020.

- Wick, Ben (June 23, 2020). "The Fed's unprecedented relief measures could form the greatest financial bubble in history, Ed Yardeni says". Business Insider. Retrieved November 23, 2020.

- Fox, Matthew (October 27, 2020). "Greenlight Capital's David Einhorn just called the top in stocks and gave 10 reasons tech is in a bubble". Business Insider. Retrieved November 26, 2020.

- Chappata, Brian (November 20, 2020), "This Fed-Treasury Public Fight Has No Winners", Bloomberg News, retrieved November 23, 2020

- Winck, Ben (June 23, 2020). "The Fed's unprecedented relief measures could form the greatest financial bubble in history says Ed Yardeni". Business Insider. Retrieved December 16, 2020.

- Massa, Annie (January 5, 2021). "Grantham Renews 'Epic Bubble' Warning After Stocks' Record Year". Bloomberg News. Retrieved January 5, 2021.

- "WAITING FOR THE LAST DANCE". GMO Asset Management. January 5, 2021. Retrieved January 5, 2021.

- Graffeo, Emily (January 5, 2021). "Jeremy Grantham reiterates his warning that the stock market is in an epic bubble". Business Insider. Retrieved January 5, 2021.

- Timarios, Nick (January 6, 2021). "Fed Saw Bond-Buying Program Providing 'Very Significant' Support". Wall Street Journal. Retrieved January 7, 2021.

- Curran, Enda; Anstey, Chris (January 24, 2021). "Pandemic-Era Central Banking Is Creating Bubbles Everywhere". Bloomberg News. Retrieved January 24, 2021.

- Hale, Thomas; Lockett, Hudson (January 26, 2021). "Chinese stocks fall as central bank adviser warns of asset bubble". Financial Times. Retrieved January 26, 2021.

- Miller, Rich (January 26, 2021). "Powell, With Year to Run at Fed, Aims to Avoid Past QE Mistake". Bloomberg News. Retrieved January 27, 2021.

- Matthews, Steve (November 1, 2017). "Here's What You Need to Know About Powell's Fed Chair Selection". Bloomberg L.P.

- Mackenzie, Michael (June 13, 2020). "Investors reset for Fed's single-minded pursuit of policy goals". Financial Times. Retrieved November 16, 2020.

- Cox, Jeff (September 4, 2020). "Worries grow over a K-shaped economic recovery that favors the wealthy". CNBC. Retrieved November 11, 2020.

- FT Alphaville (August 19, 2020). "Yet another 'K-shaped' recovery data point". Financial Times. Retrieved November 11, 2020.

- Hillflower, Hillary (January 13, 2021). "The tools that rescued America's economy are mostly helping wealthy Americans". Business Insider. Retrieved January 23, 2021.

- Bair, Sheila (April 14, 2020). "Op-Ed: Overreliance on the Fed is compromising the future for millennials". CNBC. Retrieved November 12, 2020.

- Saraiva, Catarina; Matthews, Steve (September 23, 2020). "Powell Grilled by Congress on How Fed Is Helping Main Street". Bloomberg News. Retrieved November 12, 2020.

- King, Kate (October 22, 2020). "Wall Street Profits Soar During First Half of 2020". Wall Street Journal. Retrieved November 12, 2020.

- Hulbert, Mark (October 30, 2020). "Opinion: The stock market is overvalued, according to almost every measure dating to 1950". MarketWatch. Retrieved November 26, 2020.

- Shedlock, Mish (November 14, 2020). "The Housing Bubble is Even Bigger Than the Stock Market Bubble". Mish.com. Retrieved November 26, 2020.

- Segilson, Paula (November 9, 2020). "U.S. Junk Bond Yields Hit Record Low as Vaccine Hope Fuels Rally". Bloomberg News. Retrieved November 26, 2020.

- del Castillo, Michael (December 26, 2020). "Forbes Cryptocurrency Awards 2020: The $3 Trillion Bitcoin Marketing Campaign". Forbes. Retrieved January 4, 2021.

- Belvedere, Matthew (November 24, 2020). "Cramer calls this stock market environment 'the most speculative' he's ever seen". CNBC. Retrieved November 25, 2020.

- Cookson, Richard (February 4, 2021). "Rising Inflation Will Force the Fed's Hand". Bloomberg News. Retrieved February 4, 2021.

- Klein, Matthew C. (July 7, 2017). "Jerome Powell has some curious ideas about housing finance". Financial Times.

- Cox, Jexx (March 12, 2020). "Fed to pump in more than $1 trillion in dramatic ramping up of market intervention amid coronavirus meltdown". CNBC.

- "Chevy Chase Village: Staff Directory". Chevy Chase Village, Maryland.

- Chevy Chase Club: Directors

- Public Financial Disclosure Report (OGE Form 2783) Executive Branch Personnel, U.S. Office of Government Ethics. Annual Report 2017: Powell, Jerome. https://extapps2.oge.gov/201/Presiden.nsf/PAS+Index/E54DC5C9281668888525815A006BF4E1/%24FILE/Jerome-H-Powell-2017-278.pdf Accessed April 24, 2020.

- Peterson, Kristina; Portlock, Sarah (September 6, 2012). "Newest Fed Governor Is Board's Richest Member". The Wall Street Journal.

External links

Official

- Biography from the Federal Reserve

Other

- Statements and Speeches of Jerome H. Powell (Saint Louis Federal Reserve Database)

- Appearances on C-SPAN

| Political offices | ||

|---|---|---|

| Preceded by Robert R. Glauber |

Under Secretary of the Treasury for Domestic Finance 1992–1993 |

Succeeded by Frank N. Newman |

| Government offices | ||

| Preceded by Frederic Mishkin |

Member of the Federal Reserve Board of Governors 2012–present |

Incumbent |

| Preceded by Janet Yellen |

Chair of the Federal Reserve 2018–present | |

| U.S. order of precedence (ceremonial) | ||

| Preceded by Louis DeJoy as Postmaster General |

Order of Precedence of the United States Chairman of the Federal Reserve |

Succeeded by Vacant as Chair of the Council on Environmental Quality |