Economy of the United Arab Emirates

The economy of the United Arab Emirates (or UAE) is the second largest in the Middle East (after Saudi Arabia), with a gross domestic product (GDP) of US$354 billion (AED 1.3 trillion) in 2020.

.jpg.webp) Dubai, the financial center of the United Arab Emirates | |

| Currency | United Arab Emirates dirham (AED, د.إ) |

|---|---|

| calendar year | |

Trade organisations | OPEC and WTO |

Country group | |

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

| -1% (2020 est.)[4] | |

Population below poverty line | N/A |

| 32.5 medium (2014)[7] | |

Labour force | |

Labour force by occupation |

|

| Unemployment | |

Main industries | |

| External | |

| Exports | |

Export goods | Crude oil 45%, natural gas, reexports, dried fish, dates (2012 est.) |

Main export partners |

|

| Imports | |

Import goods | machinery and transport equipment, chemicals, food |

Main import partners |

|

FDI stock | |

Gross external debt | |

| Public finances | |

| −0.2% (of GDP) (2017 est.)[6] | |

| Revenues | 110.2 billion (2017 est.)[6] |

| Expenses | 111.1 billion (2017 est.)[6][note 1] |

| Standard & Poor's: AA[14] Outlook: Stable Moody's: Aa2 Outlook: Stable Fitch: AA Outlook: Stable | |

Foreign reserves | |

The UAE has been successfully diversifying its economy,[15] particularly in Dubai, but still remains heavily reliant on revenues from petroleum and natural gas, which continue to play a central role in its economy, especially in Abu Dhabi. More than 85% of the UAE's economy was based on the oil exports in 2009.[16][17] While Abu Dhabi and other UAE emirates have remained relatively conservative in their approach to diversification, Dubai, which has far smaller oil reserves, was bolder in its diversification policy.[18] In 2011, oil exports accounted for 77% of the UAE's state budget.[19]

Tourism is one of the bigger non-oil sources of revenue in the UAE, with some of the world's most luxurious hotels being based in the UAE. A massive construction boom, an expanding manufacturing base, and a thriving services sector are helping the UAE diversify its economy. Nationwide, there is currently $350 billion worth of active construction projects.[20]

The UAE is a member of the World Trade Organization and OPEC.

The UAE government has long been investing in the economy to diversify and reduce its dependence on oil revenue.

Historical background

Prior to independence from the UK and unification in 1971, each emirate was responsible for its own economy. At the time, pearl diving, seafaring and fishing were together the mainstay of the economy, until the development of Japanese cultured pearls and the discovery of commercial quantities of oil.[21] Previous UAE President Zayed Bin Sultan Al Nahyan is credited with bringing the country forward into the 20th century and using the revenue from oil exports to fund all the necessary development. Likewise, former UAE vice-president Rashid Bin Saeed Al Maktoum had a bold vision for the Emirate of Dubai and foresaw the future in not petroleum alone, but also other industries.[22]

In the 1980s Dubai's diversification centred around trade and the creation of shipping and logistics centres, notably Port Rashid and the port and Free Zone of Jebel Ali as well as Dubai International Airport,[23] leading to a number of major global plays in shipping, transportation and logistics (DP World, Emirates, DNATA). The emergence of Dubai's lively real estate market was briefly checked by the global financial crisis of 2007–8, when Dubai was bailed out by Abu Dhabi.[24] The recovery from the overheated market led to tighter regulation and oversight and a more realistic market for real estate throughout the UAE with many 'on hold' projects restarting. Although the market continues to expand, current market conditions for developers have been characterised as 'tough'.[25]

Overview

UAE has the second-largest economy in the Arab world (after Saudi Arabia),[26] with a gross domestic product (GDP) of US$414 billion (AED 1.52 trillion) in 2018.[27] A third of the GDP is from oil revenues.[26] The economy was expected to grow 4–4.5% in 2013, compared to 2.3–3.5% over the previous five years. Since independence in 1971, UAE's economy has grown by nearly 231 times to AED1.45 trillion in 2013. The non-oil trade has grown to AED1.2 trillion, a growth of around 28 times from 1981 to 2012.[26]

The UAE's economy is one of the most open worldwide, and its economic history goes back to the times when ships sailed to India, along the Swahili coast, as far south as Mozambique.[28]

International Monetary Fund (IMF) expected UAE's economic growth to increase to 4.5% in 2015, compared to 4.3% in 2014. The IMF ascribed UAE's potentially strong economic growth in World Economic Outlook Report to the increased contribution of non-petroleum sectors, which registered a growth average of more than 6% in 2014 and 2015. Such contribution includes banking, tourism, commerce and real estate. Increase of Emirati purchasing power and governmental expenditures in infrastructure projects have considerably increased.

Internationally, UAE is ranked among the top 20 for global service business, according to AT Kearney, the top 30 on the WEF "most-networked countries" and in the top quarter as a least corrupt country per the TI's corruption index.[29]

The government of the United Arab Emirates announced a broad restructuring and merger of more than 50% of its federal agencies, including ministries and departments, in an attempt to deal with and recover from the economic shocks following months-long coronavirus lockdown.[30]

Data

The following table shows the main economic indicators in 1980–2017. Inflation below 2% is in green.[31]

| Year | GDP (in Bil. US$PPP) |

GDP per capita (in US$ PPP) |

GDP growth (real) |

Inflation rate (in Percent) |

Government debt (in % of GDP) |

|---|---|---|---|---|---|

| 1980 | 75.1 | 74,759 | n/a | ||

| 1981 | n/a | ||||

| 1982 | n/a | ||||

| 1983 | n/a | ||||

| 1984 | n/a | ||||

| 1985 | n/a | ||||

| 1986 | n/a | ||||

| 1987 | n/a | ||||

| 1988 | n/a | ||||

| 1989 | n/a | ||||

| 1990 | n/a | ||||

| 1991 | n/a | ||||

| 1992 | n/a | ||||

| 1993 | n/a | ||||

| 1994 | n/a | ||||

| 1995 | n/a | ||||

| 1996 | n/a | ||||

| 1997 | n/a | ||||

| 1998 | n/a | ||||

| 1999 | 4.8 % | ||||

| 2000 | |||||

| 2001 | |||||

| 2002 | |||||

| 2003 | |||||

| 2004 | |||||

| 2005 | |||||

| 2006 | |||||

| 2007 | |||||

| 2008 | |||||

| 2009 | |||||

| 2010 | |||||

| 2011 | |||||

| 2012 | |||||

| 2013 | |||||

| 2014 | |||||

| 2015 | |||||

| 2016 | |||||

| 2017 |

External trade

With imports totaling $273.5 billion in 2012, UAE passed Saudi Arabia as the largest consumer market in the region. Exports totaled $314 billion, which makes UAE the second largest exporter in the region.[26]

UAE and India are each other's main trading partners, with the latter having many of its citizens working and living in the former. The trade totals over $75 billion (AED275.25 billion).[32]

The top five of the Main Partner Countries of the UAE in 2014 are Iran (3.0%), India (2.9%), Saudi Arabia (1.5%), Oman (1.4%) and Switzerland (1.2%). As for the top five of UAE suppliers are China (7.4%), United States (6.4%), India (5.8%), Germany (3.9%) and Japan (3.5%).

Diversification of UAE's economy

Although UAE has the most diversified economy in the GCC, the UAE's economy remains extremely reliant on oil. With the exception of Dubai, most of the UAE is dependent on oil revenues. Petroleum and natural gas continue to play a central role in the economy, especially in Abu Dhabi. More than 85% of the UAE's economy was based on the oil exports in 2009.[16][17] While Abu Dhabi and other UAE emirates have remained relatively conservative in their approach to diversification, Dubai, which has far smaller oil reserves, was bolder in its diversification policy.[18] In 2011, oil exports accounted for 77% of the UAE's state budget.[19]

Dubai suffered from a significant economic crisis in 2007-2010 and was bailed out by Abu Dhabi's oil wealth. Dubai's current prosperity has been attributed to Abu Dhabi's petrodollars.[33] In 2014, Dubai owed a total of $142 billion in debt.[34] The UAE government has worked towards reducing the economy's dependence on oil exports by 2030.[35] Various projects are underway to help achieve this, the most recent being the Khalifa Port, opened in the Emirate of Abu Dhabi at the end of 2012. The UAE has also won the right to host the World Expo 2020, which is believed to have a positive effect on future growth, although there are some skeptics which mention the opposite.[36]

Over the decades, the Emirate of Dubai has started to look for additional sources of revenue. High-class tourism and international finance continue to be developed. In line with this initiative, the Dubai International Financial Centre was announced, offering 55.5% foreign ownership, no withholding tax, freehold land and office space and a tailor-made financial regulatory system with laws taken from best practice in other leading financial centres like New York, London, Zürich and Singapore. A new stock market for regional companies and other initiatives were announced in DIFC. Dubai has also developed Internet and Media free zones, offering 100% foreign ownership, no tax office space for the world's leading ICT and media companies, with the latest communications infrastructure to service them. Many of the world's leading companies have now set up branch offices, and even changed headquarters to, there. Recent liberalisation in the property market allowing non citizens to buy freehold land has resulted in a major boom in the construction and real estate sectors, with several signature developments such as the 2 Palm Islands, the World (archipelago), Dubai Marina, Jumeirah Lake Towers, and a number of other developments, offering villas and high rise apartments and office space. Emirates (part of the Emirates Group) was formed by the Dubai Government in the 1980s and is presently one of the few airlines to witness strong levels of growth. Emirates is also the largest operator of the Airbus A380 aircraft. As of 2001, budgeted government revenues were about AED 29.7 billion, and expenditures were about AED 22.9 billion.In addition, to finding new ways of sustaining the national economy, the UAE has also made progress in installing new, sustainable methods of generating electricity. This is evidenced by various solar energy initiatives at Masdar City and by other renewable energy developments in parts of the country.[37][38]

In addition, the UAE is starting to see the emergence of local manufacturing as new source of economic development, examples of significant government-led investments such as Strata in aerospace industry, under Mubadala are successful, while there are also small scale entrepreneurial ventures picking up, such as Zarooq Motors in the automotive industry.[39]

Foreign trade

With reference to foreign trade, UAE's market is one of the world's most dynamic markets worldwide, placed among the 16 largest exporters and 20 largest importers of commodities.[40] The top five of the Main Partner Countries of the UAE in 2014 are Iran (3.0%), India (2.9%), Saudi Arabia (1.5%), Oman (1.4%) and Switzerland (1.2%). As for the top five of UAE suppliers are China (7.4%), United States (6.4%), India (5.8%), Germany (3.9%) and Japan (3.5%).

| Indicator | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|

| Imports of Goods (million USD) | 165,000 | 203,000 | 226,000 | 251,000 | 262,000 |

| Exports of Goods (million USD) | 214,000 | 302,000 | 349,000 | 379,000 | 360,000 |

| Imports of Services (million USD) | 41,337 | 55,702 | 62,301 | 66,413 | 70,279 |

| Exports of Services (million USD) | 11,028 | 12,063 | 15,276 | 17,345 | 19,769 |

| Imports of Goods and Services (Annual % Change) | 2.1 | 18.8 | 5.2 | 6.5 | 6.1 |

| Exports of Goods and Services (Annual % Change) | 2.5 | 20.7 | 17.0 | 4.5 | 8.2 |

| Imports of Goods and Services (in % of GDP) | 72.2 | 72.3 | 75.3 | 76.8 | 77.9 |

| Exports of Goods and Services (in % of GDP) | 78.8 | 90.3 | 100.6 | 101.3 | 98.0 |

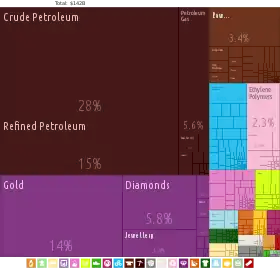

In 2014, the United Arab Emirates managed to export 380.4bn dominated by four products which are Petroleum oils and oils obtained from bituminous... (19.8%) Diamonds, whether or not worked, but not mounted... (3.4%) Gold in UAE(3.2%) incl. gold plated with platinum, unwrought...Articles of jewellery and parts thereof, of...(2.8%). In the same year, the United Arab Emirates imported 298.6 bn dominated by five countries which are China (7.4%), United States (6.4%), India (5.8%), Germany (3.9%), Japan (3.5%).

On one hand, the United Arab Emirates managed in 2013 to export 17 bn USD services exported in 2013 dominated by travel (67.13%), transportation (28.13%), Government services (4.74%). On the other hand, it imported 63.9 bn USD of services imported services dominated by transportation (70.68%), travel (27.70%) and government services (1.62%).

Human Resources and Employment

Emiratisation is an initiative by the government of the UAE to employ more UAE Nationals in a meaningful and efficient manner in the public and private sectors.[42][43] While the program has been in place for more than a decade and results can be seen in the public sector, the private sector is still lagging behind with citizens only representing 0.34% of the private sector workforce.[44]

While there is general agreement over the importance of Emiratisation for social, economic and political reasons, there is also some contention as to the impact of localization on organizational efficiency. It is yet unknown whether, and the extent to which, employment of nationals generates returns for MNEs operating in the Middle East. Recent research cautions that localization is not always advantageous for firms operating in the region, and its effectiveness depends on a number of contingent factors.[45][46]

In December 2009 however, a positive impact of UAE citizens in the workplace was identified in a newspaper article citing a yet unpublished study,[47] this advantage being the use of networks within the evolving power structures.

Overall, however, uptake in the private sector remains low regardless of significant investments in education, which have reached record levels with education now accounting for 22.5% – or $2.6 billion – of the overall budget planned for 2010.[48] Multiple governmental initiatives are actively promoting Emiratisation by training anyone from highschool dropouts to graduates in a multitude of skills needed for the - essentially Western - work environment of the UAE, these initiatives include Tawteen UAE,[49] ENDP[50] or the Abu Dhabi Tawteen Council.[51]

There are very few anti-discrimination laws in relation to labour issues, with Emiratis – and other GCC nationals – being given preference when it comes to employment.[52] Unions are generally banned and workers with any labour issues are advised to be in touch with the Ministry of Labour, instead of protesting or refusing to work. Migrant employees often complain of poor workplace safety and wages based on nationality, although this is being slowly addressed.[53]

Beyond directly sponsoring educational initiatives, the Emirates Foundation for Philanthropy[54] is funding major research initiatives into Emiratisation through competitive research grants, allowing universities such as United Arab Emirates University or Dubai School of Government to build and disseminate expertise on the topic.

Academics working on various aspects of Emiratisation include Paul Dyer[12] and Natasha Ridge from Dubai School of Government, Ingo Forstenlechner[13] from United Arab Emirates University, Kasim Randaree from the British University of Dubai and Paul Knoglinger from the FHWien.

In 2020, economy of the United Arab Emirates became vulnerable to the COVID-19 pandemic, witnessing an economic shutdown. Among the Emirates, Dubai was facing extreme situation, where the expat workers were left jobless. Thousands of the Britons working in the city started selling off their possessions to collect money, as the strict visa regulations forced them to return to the UK.[55]

Investment

The stock market capitalisation of listed companies in the UAE was valued at $109.9 billion in October 2012 by Bloomberg.[56]

Outward investment

A investment institutions were created by the government to promote manage investments made by the UAE abroad:

Abu Dhabi Investment Authority (ADIA)

Inward investment

The UAE is in the 17th position in term of the Global Competitiveness Index (GCI). The report says that the UAE competitiveness stems from "high quality [...] infrastructure" and "highly efficient good markets." [58]

Corporate Governance Code

The Securities and Commodities Authority (SCA) introduced a new corporate governance regulation (the Corporate Governance Code), which applies to all joint stock companies and institutions whose securities are listed on Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) in 2009.[59]

Banking

On 19 June 2020, rating agency Moody's changed its outlook regarding eight banks in the United Arab Emirates from stable to negative. The change was due to “the potential material weakening in their standalone credit profiles”, where the UAE's economy was facing additional challenges amidst the COVID-19 pandemic and low oil prices. The eight banks included Abu Dhabi Commercial Bank, Emirates NBD, HSBC Bank Middle East, Dubai Islamic Bank, Abu Dhabi Islamic Bank, National Bank of Fujairah, National Bank of Ras al-Khaimah and Mashreq Bank.[60]

The Fitch Ratings in its June 22, 2020 report predicted that the Standalone Credit Profiles of UAE-based banks are to possibly weaken in the following year owing to the financial crisis caused by the coronavirus pandemic and oil price collapse. As per the Fitch report, despite the implementation of timely measures for supporting the economy, the profitability of banks in the UAE are prone to get affected by a lower non-interest income worsened by a controlled business volume, lower interest rates, and higher loan recovery charges. In addition, the asset quality is expected to weaken, too, following the unbearable impact of the economic downturn that all borrowers may not be able to withstand.[61]

Real estate

The development in the real estate and infrastructure sectors during the recent year has contributed in making the country a global touristic destination. The contribution of tourism in the Emirati GDP increased from 3% in the mid-1990s to more than 16.5% by the end of 2010. This trend is supported by the huge public investments in touristic projects (47 Billion Dollars per annum) carried mainly to expend airports, increase their capacity, set up new airports and ports.

The real estate sector have a positive impact on development, job opportunities, investments and tourism as estate projects were launched to meet the needs of market and the increasing demand for housing and commercial units especially in Dubai and Abu Dhabi. The UAE has 18 tour hotels out of the 155 (150 meters high) that exist around the world. This makes the UAE the third destination with such tours after China and America in 2014. These buildings are among the UAE's attractions for tourists. Dubai has adopted dazzling ideas in construction and design of these tall tours.

The leap in real estate sector along and infrastructure development in the UAE during the recent year has contributed in making this country a global touristic destination par excellence. Therefore, the contribution of tourism in the Emirati GDP increased from 3% in the mid-1990s to more than 16.5% by the end of 2010. This trend is supported by the huge public investments in touristic projects (47 Billion Dollars per year) carried mainly to expend airports, increase their capacity, set up new airports and ports.

The UAE has about 37% of the region's petroleum and gas industries, chemical industries, energy and water and garbage projects. The UAE's government have been injecting huge funds in tourism and real estate projects, especially in Abu Dhabi and Dubai. Al Saadiyat Island in Abu Dhabi and Burj Khalifa in Dubai, the tallest tower in the world, world central near “Jebel Ali” are a point in case of the milestones that have given the UAE its high profile of a global tourist destination. According to 2013-2014 Global Competitiveness Report, the UAE ranked fourth worldwide in terms of infrastructure quality.

On 28 November 2020, the Abu Dhabi Media Office announced that the government of United Arab Emirates, ahead of the 49th National Day, granted house loans, land and homes worth $2 billion (7.2 billion dirhams) to their citizens. The package is said to comprise of 3,099 plots, 2,000 house loans and 601 homes and exempting some families of the deceased citizen(s) and retirees from the repayment of mortgage. The Director General of the Abu Dhabi Housing Society, Basheer Al Mehairbi said the initiative of providing sustainable housing aimed at ensuring a good standard of living for the citizens of the UAE.[62]

Real-estate projects

Some of the significant real-estate projects are:

- Burj Khalifa

- Creek Tower

- Arabian Ranches

- Mohammed bin Rashid City

- Falcon City of Wonders

- International City

- Dubai Marina

- Jumeirah Beach Residence

- Jumerah Lakes Towers (JLT)

- Al Barari Dubai

- Business Bay

- Dubai Hills

- Dubai South

- City Walk / The Walk

- Al Furjan

- Dubai Sports City

- Dubai Studio City

- Dubai Motor City

- Saadiyat Island

- The World, the Palms and the Palm (artificial islands)

- Dubai Miracle Garden, the world's largest natural flower garden.

- Masdar City, a zero carbon, zero waste city.

- Yas Island, in Abu Dhabi, featuring attractions such as Ferrari World,

- Yas Marina

- Falcon Island, in Ras Al Khaimah

- Al Dana Island, artificial Fujairah island[63]

Financial centers

Among the most prominent financial centers in the UAE are:

- Dubai International Financial Center (DIFC), a Dubai-based federal financial free zone

- Abu Dhabi Global Market (ADGM), an international financial centre located on Al Maryah Island

See also

References

- "World Economic Outlook Database, April 2019". IMF.org. International Monetary Fund. Retrieved 29 September 2019.

- "World Bank Country and Lending Groups". datahelpdesk.worldbank.org. World Bank. Retrieved 29 September 2019.

- "Population, total". data.worldbank.org. World Bank. Retrieved 24 August 2019.

- "World Economic Outlook Database, October 2019". IMF.org. International Monetary Fund. Retrieved 16 November 2019.

- "Global Economic Prospects, June 2020". openknowledge.worldbank.org. World Bank. p. 92. Retrieved 28 September 2020.

- "The World Factbook". CIA.gov. Central Intelligence Agency. Retrieved 13 June 2019.

- "GINI index (World Bank estimate) - United Arab Emirates". data.worldbank.org. World Bank. Retrieved 30 March 2020.

- "Human Development Index (HDI)". hdr.undp.org. HDRO (Human Development Report Office) United Nations Development Programme. Retrieved 11 December 2019.

- "Inequality-adjusted Human Development Index (IHDI)". hdr.undp.org. HDRO (Human Development Report Office) United Nations Development Programme. Retrieved 11 December 2019.

- "Labor force, total - United Arab Emirates". data.worldbank.org. World Bank. Retrieved 15 November 2019.

- "Employment to population ratio, 15+, total (%) (national estimate)". data.worldbank.org. World Bank. Retrieved 24 August 2019.

- "Unemployment, total (% of total labor force) (national estimate)". data.worldbank.org. World Bank. Retrieved 24 August 2019.

- "Ease of Doing Business in United Arab Emirates". Doingbusiness.org. Retrieved 24 November 2017.

- "Sovereigns rating list". Standard & Poor's. Retrieved 26 May 2011.

- "Diversification raises non-oil share of UAE's GDP to 71%".

- "The World Factbook". CIA.

- "WTO Trade Statistic 2009". Stat.wto.org. Archived from the original on 4 March 2016. Retrieved 1 December 2014.

- "United Arab Emirates profile". BBC News. 14 November 2012.

- "Economic diversification in the GCC countries" (PDF). p. 13.

- 3 Archived 2009-06-04 at the Wayback Machine

- "UAE History & Traditions: Pearls & pearling - UAEinteract". Archived from the original on 6 February 2016. Retrieved 3 March 2015.

- "The Hong Kong of the Middle East". Retrieved 3 March 2015.

- Cuthbert, Jon. "The 40 year history of UAE logistics: Part one - Ports | ArabianSupplyChain.com". www.arabiansupplychain.com. Archived from the original on 23 May 2015. Retrieved 10 May 2017.

- "Abu Dhabi helps Dubai with bank bailout". Arabian Business. Retrieved 10 May 2017.

- Editor, Babu Das Augustine, Banking (16 February 2017). "Tough year ahead for UAE real estate market". GulfNews. Retrieved 10 May 2017.CS1 maint: extra text: authors list (link)

- "UAE's economy growth momentum set to pick up". Khaleej Times. 27 December 2013. Archived from the original on 4 January 2014. Retrieved 5 January 2014.

- "GDP to hit $474.2b in 2018". Khaleej Times. 4 July 2013. Retrieved 5 January 2014.

- "UAE Economy". UAE Embassy in Washington, DC. Retrieved 30 June 2016.

- "UAE Economy". Retrieved 4 July 2016.

- "UAE merges ministries in ambitious government restructuring". Financial Times. Retrieved 5 July 2020.

- "Report for Selected Countries and Subjects". www.imf.org. Retrieved 11 September 2018.

- "UAE and India sign crucial investment protection pact". Gulf News. 13 December 2013. Retrieved 5 January 2014.

- "Speaking of Water". Archived from the original on 14 May 2011.

- "Dubai Drowning in Debt".

- "UAE Industry Builds Capability". Retrieved 3 March 2015.

- "Dubai world Expo bid stirs worry of second bubble". Retrieved 3 March 2015.

- "Renewable energy across the MENA region : Clyde & Co (en)". Archived from the original on 15 August 2016. Retrieved 3 March 2015.

- "Masdar City: A Rising Star". The Ecologist. 8 April 2013. Retrieved 3 March 2015.

- "Trio hope 'fastest snake in desert' is start of UAE car industry | The National". www.thenational.ae. Retrieved 1 June 2016.

- "UAE foreign trade in figures". Retrieved 4 July 2016.

- "WTO - Statistics - Trade and tariff indicators". Retrieved 30 June 2016.

- Gulf News - New emiratisation drive Archived 2009-02-03 at the Wayback Machine

- Gulf News - Call for cautious Emiratisation Archived 2009-03-16 at the Wayback Machine

- Kerr, S. and A. England (2009). UAE to safeguard jobs of nationals. Financial Times. London

- Mellahi, K. (2007). The effect of regulations on HRM: private sector firms in Saudi Arabia. International Journal of Human Resource Management, 18(1): 85-99.

- Forstenlechner, I. (2010). "Workforce localization in emerging Gulf economies: the need to fine-tune HRM." Personnel Review 39(1): 135-152.

- http://www.thenational.ae/apps/pbcs.dll/article?AID=/20091203/NATIONAL/712029856/1010 Archived 2014-01-06 at the Wayback Machine

- http://www.uaeinteract.com Archived 2010-09-18 at the Wayback Machine.

- "UAETAW TEEN". Archived from the original on 22 April 2017. Retrieved 3 March 2015.

- ":: Emirates Nationals Development Programme ::". Archived from the original on 24 February 2015. Retrieved 3 March 2015.

- http://www.tawteencouncil.ae Archived 2011-06-28 at the Wayback Machine

- Emiratisation won't work if people don't want to learn | The National. Thenational.ae (2013-03-18). Retrieved on 2014-01-26.

- "Indian workers jailed in Dubai over violent protest". Retrieved 3 March 2015.

- "Welcome to Emirates Foundation". Retrieved 3 March 2015.

- "Britons in Dubai sell possessions and return home as coronavirus ends expat dream". The Telegraph. Retrieved 21 June 2020.

- "Bloomberg". Retrieved 3 March 2015.

- "Financial Sector". Retrieved 4 July 2016.

- "Arab World Competitiveness Report 2013". World Economic Forum. Retrieved 4 July 2016.

- "Resolution No. (518) of 2009 Concerning Governance Rules and Corporate Discipline Standards" (PDF). Archived from the original (PDF) on 4 March 2016. Retrieved 10 November 2015.

- "Moody's revises outlook to negative on eight UAE banks". Reuters. Retrieved 19 June 2020.

- "UAE Banks' Asset Quality under Pressure". Fitch Ratings. Retrieved 22 June 2020.

- "UAE to grant citizens $2 billion in homes, loans to mark National Day". Live Mint. Retrieved 29 November 2020.

- http://www.uae-embassy.org/about-uae/economy/real-estate Article entitled: Real Estate Website: http://www.uae-embassy.org/

Notes

- the UAE federal budget does not account for emirate-level spending in Abu Dhabi and Dubai